Sharing Accommodation Market Research, 2032

The global sharing accommodation market size was valued at $120.8 billion in 2022, and is projected to reach $235.7 billion by 2032, growing at a CAGR of 6.4% from 2023 to 2032.

Sharing accommodation is the practice of individuals renting out their own residences, spare rooms, or living spaces to travelers in need of temporary housing. This notion has grown in popularity because of online services such as Airbnb, Vrbo, and HomeAway. Sharing housing provides a wide range of alternatives, from complete flats and homes to one-of-a-kind experiences like treehouses and houseboats. It encourages a feeling of community and personalization in the travel experience by allowing travelers to stay in local neighborhoods and communicate with hosts for insider insights and recommendations. It has altered the traditional hotel sector by providing less expensive yet frequently more immersive options for travelers, while also letting property owners monetize their spaces. Sharing accommodations corresponds to modern travelers' growing expectations, emphasizing adaptability, reliability, and a sense of connection in the locations they visit.

Market Overview

The increase in the millennial population is a major driver in the sharing accommodation market growth of the sharing accommodation market and has led to several changes in the way people live around the world. There has been a significant rise in co-living spaces that have made sharing accommodation more attractive to millennials. In addition, co-living spaces offer a variety of amenities and services such as fully furnished spaces, utilities and maintenance, internet connectivity, and housekeeping, among others, that make shared living convenient and enjoyable for the consumers. Millennials are drawn to urban centers for job opportunities, however, these areas often come with high rental costs. Sharing accommodations enables them to affordably access city living without compromising on location. Millennials often face financial challenges such as student loans, higher living costs, and unstable job markets, thus they search for economic alternatives to reduce housing expenses. Sharing accommodation offers a cost-effective solution, which enables them to split expenses while still staying in a desirable living space. Millennials value experiences and connections with their peers, and sharing accommodation environments provide opportunities to interact with diverse individuals, which fosters a sense of community and helps expand their social circles.

The boom in the global tourism sector has significantly impacted the sharing accommodation industry, reshaping its landscape, and has helped drive substantial market growth. The rise in tourist numbers results in a heightened requirement for lodging options such as apartments and houses, thereby fueling the need for affordable and flexible accommodations. In addition, shared lodging aids in the mitigation of the environmental effects caused by tourism as it presents an alternative to conventional hotels, which are renowned for their larger carbon footprint. Moreover, sharing accommodation fosters cultural interaction, which allows tourists to reside with residents and gain insights into their culture. The increased demand from tourists for budget-conscious and authentic stay experiences has driven the prominence of platforms such as Airbnb, which offers distinct accommodation selections. Sharing accommodation has instigated hospitality innovation, leading traditional establishments to enhance offerings to achieve competitive parity. According to the United Nations World Tourism Organization (UNWTO), around 700 million tourists engaged in international travel from January to September in 2022, marking a significant increase (+133%) compared to the corresponding period in 2021. This accounts for 63% of the figures seen in 2019, indicating the sector's trajectory toward achieving 65% of its pre-pandemic benchmarks for the year 2022. Furthermore, global tourism was boosted owing to robust pent-up demand, elevated confidence levels, and the relaxation of restrictions in different destinations all around the globe.

The sharing accommodation sector is facing a pervasive issue of fraud attacks, which have grown in sophistication as fraudulent methods continue to evolve. Despite the convenience and flexibility of digital channels for booking accommodations online, there has been a substantial rise in online booking scams. The growing popularity of sharing accommodations and the shift toward digital booking platforms have provided fraudsters with new opportunities. These frauds have become more sophisticated, exploiting vulnerabilities in the online booking process. Scammers make use of various tactics, such as making fake listings, using stolen payment information, or posing as legitimate hosts. In addition, the lack of in-person interactions and the anonymity of online transactions makes it difficult for consumers to verify the authenticity of listings, which thus contributes to the rise in fraudulent incidents. As a result, sharing accommodation platforms and consumers both face the challenge of implementing robust security measures to combat these increasingly intricate fraud attempts. This poses a significant challenge for both e-commerce merchants and the sharing accommodation market.

The surge in the number of people traveling in a group has significantly driven the growth of the sharing accommodation market. Group travelers typically require multiple rooms or larger accommodations to accommodate their entire group. This leads to higher occupancy rates for sharing accommodation, making it more financially viable for hosts. Group tours often involve longer stays, which can provide hosts with a consistent source of income over an extended period, reducing the need for frequent turnover. When group travelers share a single accommodation, the cost per person can be reduced, making sharing accommodation an attractive option compared to booking multiple hotel rooms. Hosts can tailor their amenities and services to cater to group needs, such as offering communal kitchens, larger dining spaces, and facilities for group activities.

Over the past several years, a growing number of active industry players have pushed toward sustainability in response to alarming scientific data and opinions regarding the unsustainable state of the environment. Despite high short-term development costs and an unreliable return on investments (ROI), major industry players have invested a lot of effort and money in developing eco-friendly lodging. Leading companies in the tourism sector are effectively identifying new opportunities in social and environmental challenges to develop new business models, corporate strategies, and collaborative partnerships.

This shifting landscape is accompanied by shifting customer behavior. Almost three-fourths of travelers prefer sustainable accommodations, and over 80% aim to stay at least once in an eco-friendly or green hotel; yet, travelers frequently confront typical barriers such as additional expenditure and a lack of information, to name a few. In the long run, mutually beneficial cooperation between travel agencies and involved stakeholders is projected to be critical in providing a seamless consumer experience in the coming years.

Segmental Overview

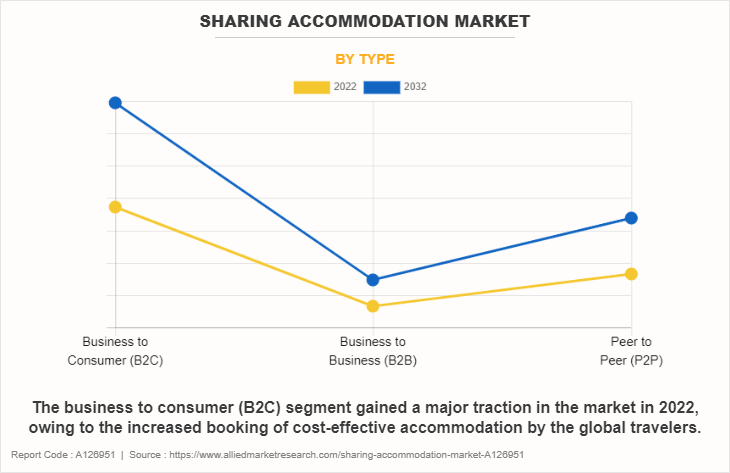

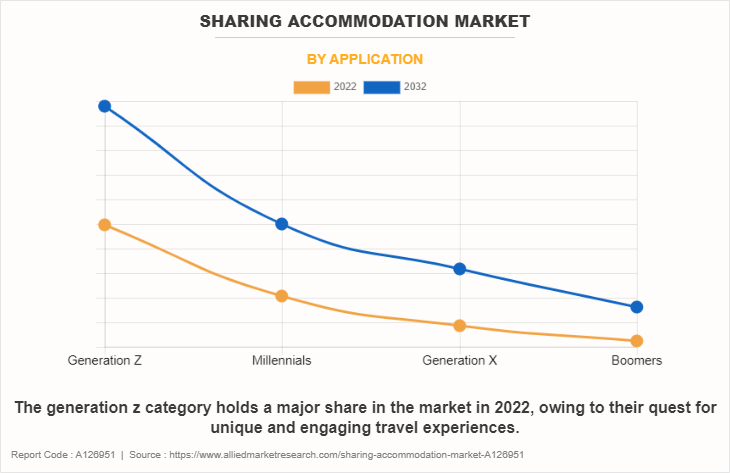

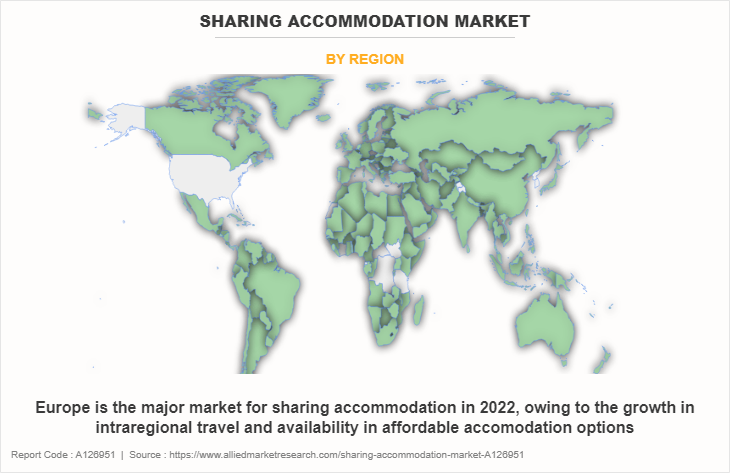

The sharing accommodation market is segmented into type, application, and region. On the basis of type, the market is classified into business to consumer (B2C), business to business (B2B), and peer to peer (P2P). Depending on application, it is segregated into Generation Z, millennials, Generation X, and boomer. Region wise, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, the UK, France, Italy, Spain, and the rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, and the rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, UAE, Argentina, and Rest of LAMEA).

By Type

According to type, the business to consumer (B2C) segment dominated the market in 2022 and is expected to maintain this trend during the forecast period. The increasing trend of personalized and immersive travel drives demand for one-of-a-kind lodgings, which benefits B2C platforms. The ease of reserving directly with specific hosts appeals to travelers looking for a more personalized touch, while the growing emphasis on cost-effectiveness attracts budget-conscious consumers to consider B2C sharing lodgings.

By Application

According to the sharing accommodation market demand, on the basis of application, the Generation Z segment dominated the market in 2022 and is expected to sustain its market share during the sharing accommodation market forecast period. Cost-effectiveness is important to Generation Z since they frequently seek cost-effective alternatives to conventional hotels. Additionally, their quest for unique and engaging travel experiences drives them to choose shared lodgings such as Airbnb, where they may stay in special locally owned apartments.

By Region

According to the region, Europe dominated the sharing accommodation market in 2022 and is expected to be dominant during the forecast period. Increase in air connectivity, growth in intraregional travel, surge in affordable travel options, and rise in implementation of digital platforms have led to robust travel and tourism growth in European countries.

Competition Landscape

Players operating in the global sharing accommodation industry have adopted various developmental strategies to expand their sharing accommodation market share, increase profitability, and remain competitive in the market. Key players profiled in this report include Airbnb, Inc., HomeExchange.com Inc., Homestay Technologies Limited, Bedycasa, Findroommate.dk ApS, InnoPeople Company Ltd., Expedia Group, Inc., Booking Holdings, Inc., HomeToGo GmbH, and Accor SA.

Examples of Partnership in the Global Sharing Accommodation Market

- In May 2023, Accor SA, subsidiary Onefinestay has partnered with London-based private theater group Revels in Hand to bring bespoke theatrical performances to their guests during their homes-stay.

- In December 2021, HomeToGo GmbH announced partnership with BookingPal to integrate BookingPal’s channel API to reach more property managers.

Examples of Service Launch in the Global Sharing Accommodation Market

- In May 2023, Accor SA through its subsidiary namely, Onefinestay, has launched a new collection of high-end luxury villas in Provence, France to expand its portfolio.

- In January 2023, Accor SA through its subsidiary namely, Onefinestay, has announced the launch of monthly stays in New York City, to expand its accommodation services in U.S.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the sharing accommodation market analysis from 2022 to 2032 to identify the prevailing sharing accommodation market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the sharing accommodation market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global sharing accommodation market trends, key players, market segments, application areas, and market growth strategies.

Sharing Accommodation Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 235.7 billion |

| Growth Rate | CAGR of 6.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 212 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | HomeExchange.com Inc., Homestay Technologies Limited, Findroommate.dk ApS, HomeToGo GmbH, Bedycasa, Booking Holdings, Inc., Airbnb, Inc., Accor SA, Expedia Group, Inc., InnoPeople Company Ltd. |

Analyst Review

Rapid development in the tourist sector, a shift in spending by consumers from product to experience, an increase in professional/business travel, and an increase in the number of individuals travelling for pleasure all contribute to the worldwide sharing accommodation market's expansion. Furthermore, visiting niche tourist sites has become a new trend among travelers, resulting in lucrative market development potential in nations such as Indonesia, Greece, Africa, and others.

According to the operational stakeholders, one of the primary causes contributing to the rise of the sharing accommodation sector is the thriving tourist industry, particularly in rural and specialized areas. In recent years, the trend of discovering unexplored locations and engaging in recreational activities has captured the interest of travelers and transformed vacation rentals. To stay ahead of the competition in the sharing accommodation industry, the industry players are focused heavily on corporate expansion through investment and acquisition. The leading companies intend to establish a solid foothold in the marketplace and grow their reach by purchasing existing lodging chains. However, the surge in online scams and fraud, such as fraudulent calls, credit card frauds, and fake travel booking sites, are important hurdles for sharing accommodation firms, impeding worldwide market growth.

The sharing accommodation market was valued at $120,838.6 million in 2022 and is projected to reach $235,726.4 million by 2032, growing at a CAGR of 6.4% from 2023 to 2032.

The global sharing accommodation market registered a CAGR of 6.4% from 2023 to 2032.

Raise the query and paste the link of the specific report and our sales executive will revert with the sample.

The forecast period in the sharing accommodation market report is from 2023 to 2032.

The top companies that hold the market share in the sharing accommodation market include Airbnb, Inc., HomeExchange.com Inc., Homestay Technologies Limited., Expedia Group, Inc., and Booking Holdings, Inc.

The sharing accommodation market report has 2 segments. The segments are type and application.

The emerging countries in the sharing accommodation market are likely to grow at a CAGR of more than 9.5% from 2023 to 2032.

Post-COVID-19, global industry is expected to grow at a high rate as market leaders adopt new partnerships for promoting safe accommodation and offer unique experience to the travelers.

Europe will dominate the sharing accommodation market by the end of 2032.

Loading Table Of Content...

Loading Research Methodology...