Sharps Containers Market Research, 2031

The global sharps containers market size was valued at $430.8 million in 2021, and is projected to reach $632.8 million by 2031, growing at a CAGR of 3.9% from 2022 to 2031. Sharps containers, also called as sharps bins, which are used for safely dispose medical waste such as hypodermic needles, syringes, catheters and other sharps waste. The medical waste produced by healthcare organizations, research institutions, and hospital chains includes needles, syringes, damaged glass, blood samples and infectious pathogens are disposed by using sharps containers. There are two main types of sharps containers include, single use which are disposed of with the waste inside, and reusable which are robotically emptied and sterilized before being returned for re-use.

Sharps containers industry is anticipated to increase globally during the forecast period, owing to rise in diagnostic and clinical tests. In addition, an increase in strict government regulations for disposal of medical waste further drive sharps containers market growth during forecast period. However, lack of awareness about disposal of medical waste and inadequate training to hospital staff about disposal of sharps containers are some limitations which may hamper growth of the market. Conversely, increase in number of surgeries worldwide and increase in demand for sharps containers is expected to offer sharps containers market opportunity for the key player.

The sharps containers market size is segmented on the basis of type, container size, usage and region. On the basis of type, the market is classified into patient room containers, phlebotomy containers and multipurpose containers. On the basis of container size, it is segmented into 1-2 gallons, 2-4 gallons and 4-8 gallons. On the basis of usage, it is segmented into single use containers and reusable containers. Furthermore, on the basis of region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

COVID-19 Impact Analysis

The COVID-19 pandemic positively impacted the sharps containers industry in 2020 due to the COVID-19 vaccination. The outbreak of COVID-19 has disrupted workflows in the health care sector across the world. The disease has forced a number of industries to shut their doors temporarily, including several sub-domains of health care. However, there has also been a positive effect and surge in demand for various medical services such as syringe, needles and others sharps which generates sharps waste leads to increase in demand for sharps containers. Medical disposables such as syringes and needles are a key to corona vaccine delivery, the pandemic is expected to have a positive impact on growth of the sharps containers. In addition, during pandemic the COVID-19 vaccination generates high amount of sharps waste which required the sharps containers to dispose these wastes.

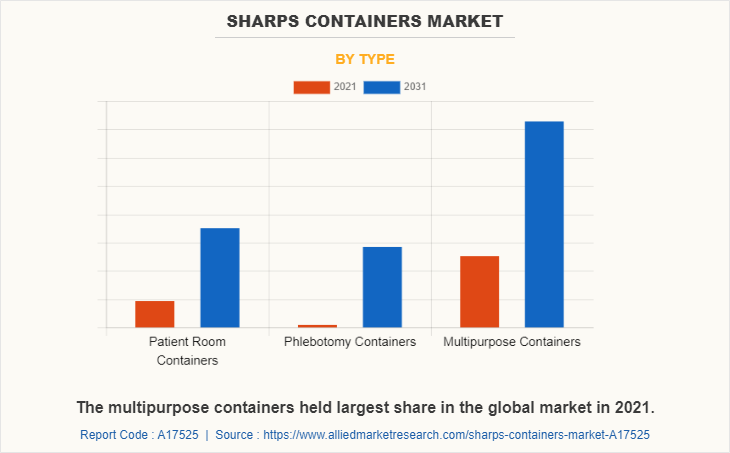

Global Sharps Containers Market by Type

By type, the sharps containers market are divided into patient room containers, phlebotomy containers and multipurpose containers. The multipurpose containers segment was the major revenue contributor in 2021, and is anticipated to continue this trend during the forecast period, owing to the advantages associated with multipurpose containers such as easy and simple structure of sharps containers, leaf proof property and availability of various sizes of container. Furthermore, rise in number of surgeries which generated high amount of medical waste are estimated to boost the growth of the multipurpose containers.

On the other side, phlebotomy containers is projected to exhibit second fastest CAGR during sharps containers market forecast, owing to rise in demand for sharps containers and rise in awareness about disposal of medical waste during the forecast period. In addition, rise in innovative designs for sharps containers further fuel the market growth.

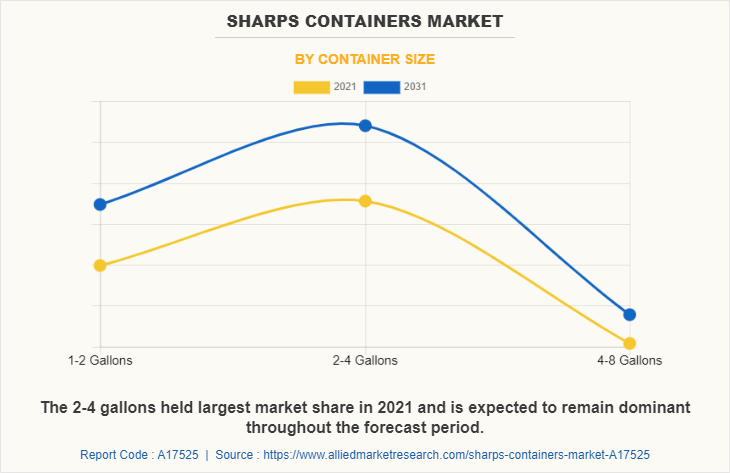

Global Sharps Containers Market by Container Size

By container size, the market is divided into 1-2 gallons, 2-4 gallons and 4-8 gallons. The 2-4 gallons was the major revenue contributor in 2021, and is anticipated to exhibit the fastest growth during forecast period, owing to more adoption of 2-4 gallons size container in hospitals and clinics for disposal of injections, cotton swabs, needles, etc. In addition, high favorable and variability of sharps containers boost the market growth. However, the 4-8 gallons segment is projected to exhibit the fastest growth during forecast period owing to high variability and convenience to use.

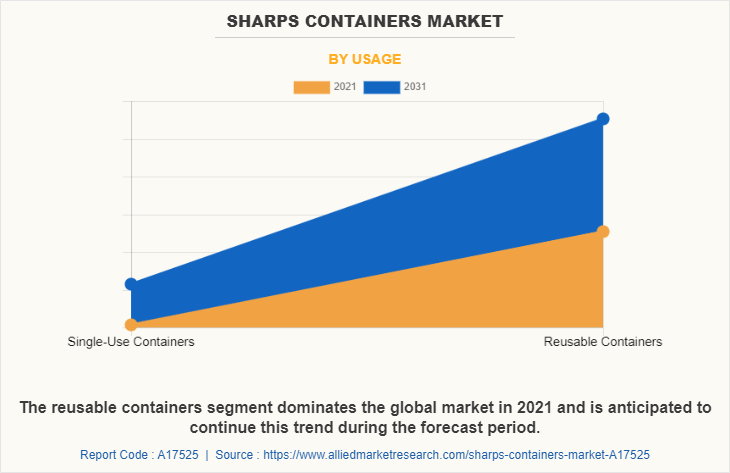

Global Sharps Containers Market by Usage

By usage, the market is divided into single use containers and reusable containers. The reusable containers segment was the major sharps containers market share contributor in 2021, and is anticipated to continue this trend during the forecast period, owing to effective distribution network of reusable sharps containers and easy to use are expected to boost the reusable containers market.

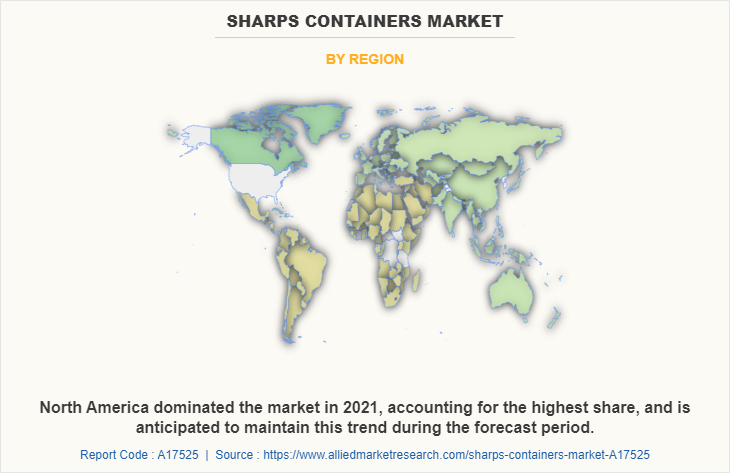

Global Sharps Containers Market by Region

By region, the sharps containers market are analyzed across North America, Asia-Pacific, Europe, and LAMEA. North America dominated the market in 2021, accounting for the highest sharps containers market Share, and is anticipated to maintain this trend during the forecast period. Owing to factors such as availability of various diagnostic and clinical tests, well-established regulations for disposal of medical waste, and presence of key players such as Becton, Dickinson and Company in the region. Furthermore, increase in adoption of sharps containers in the U.S. is anticipated to boost the growth of the North America market.

On the other side, Asia pacific is projected to register the highest CAGR during the forecast period. This is attributed to effective distribution network of sharps containers in the region is the key driving factor that boost the growth of the market in the region.

The major companies profiled in the report include Becton, Dickinson and Company, Bemis Health Care, Bondtech Corporation, Cardinal Health, EnviroTain, GPC Medical Ltd., Harloff, Henery Schiens, Stericycle and Thermo Fisher Scientific.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the sharps containers market analysis from 2021 to 2031 to identify the prevailing sharps containers market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the sharps containers market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global sharps containers market trends, key players, market segments, application areas, and market growth strategies.

Sharps Containers Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 632.8 million |

| Growth Rate | CAGR of 3.9% |

| Forecast period | 2021 - 2031 |

| Report Pages | 258 |

| By Type |

|

| By Container Size |

|

| By Usage |

|

| By Region |

|

| Key Market Players | Stericycle, Cardinal Health, GPC Medical, Becton, Dickinsons and Company, EnviroTain, BemishHealthcare, Harloff, Thermo Fischer Scientific, BondTech Corporation, HenrySchein |

Analyst Review

Sharps containers are used for collection of sharp waste. There are several advantages associated with sharps containers such as it prevents the spreading of infections in hospitals and clinics. In addition, it can be reusable and are ecofriendly therefore, are widely used. Sharps containers are provided by standard pharmacies, healthcare organizations, medical supply businesses, and other online sources.

Global sharps containers market is expected to exhibit high growth potential attributable to factors such as increase in demand for sharps containers and strict regulations for disposal of biomedical waste. Moreover, rise in number of surgeries which generates high amount of sharps waste fuel the growth of the market. The sharps containers market is being driven by rise in requirement for catheters, saline needles, syringes, and reagents in hospitals and other laboratory research activities, which require sharps containers for disposal.

North America is expected to remain dominant during the forecast period, owing to rise in strict government regulations for disposal of waste, rise in awareness associated with waste management, and strong presence of key players. However, Asia-Pacific is anticipated to witness notable growth, owing to rise in distribution network of sharps containers and increase in investments for manufacturing sharps containers during the forecast period.

The total market value of sharps containers market is $430.75 million in 2021.

The market value of sharps containers market in 2031 is $632.78 million.

The forecast period for sharps containers market is 2022 to 2031

The base year is 2021 in sharps containers market

Top companies such as Becton, Dickinson and Company,Cardinal Health,Thermo Fisher Scientific held a high market position in 2021.

The multipurpose containers segment is the most influencing segment owing to advantages associated with multipurpose containers such as easy and simple structure of sharps containers, leaf proof property and various sizes of container are available these factors influencing the growth of multipurpose containers segment.

Increase in demand for sharps containers, increase in need for diagnostic and clinical tests, high generation of medical waste and rise in need for effective medical waste management which is expected to propel growth of the sharps containers market during the forecast period.

Loading Table Of Content...