Ship Loader and Unloader Market Research - 2030

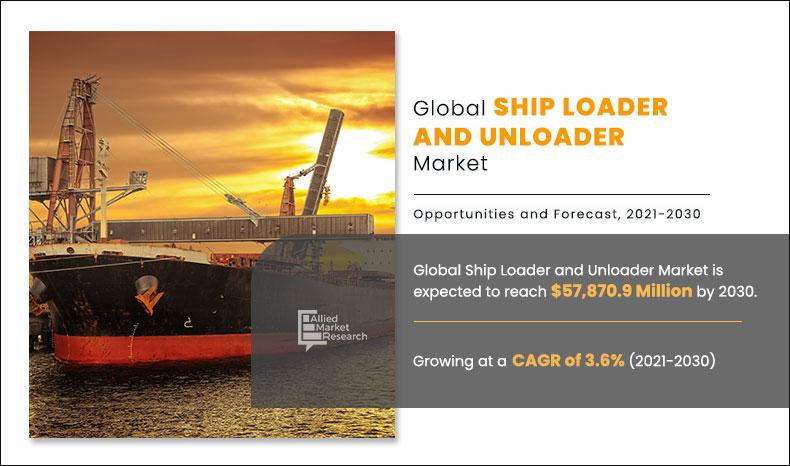

The global ship loader and unloader market size was valued at $39,770.2 million in 2020, and is expected to reach $57,870.9 million by 2030, with a CAGR of 3.6% from 2021 to 2030.

Market Introduction and Definition

Ship loader and unloader machine is a robust machine used to load and unload bulk material such as grains, coal, composites, and metals. Ship loader and unloader is available with tonnage capacity of 200 tons per hour to 8,000 tons per hour. Ship loader and unloader machines are best suitable for applications such as mining, construction, packaging, manufacturing, sea ports, and cargo terminals. In addition, it offers extremely high lifting capability and peak efficiency, stability, and precision.

Surge in urbanization is a major factor influencing demand for ship loaders and unloaders in developing nations such as India, Vietnam, and Brazil. Surge in necessity for housing, especially in urban areas has influenced construction of high-rise structures, which require ship loaders and unloaders to transport cement and composites from one port to another port, which, in turn, fuels growth of the ship loader and unloader market.

Rise in government spending on construction related activities is expected to increase demand for cement and composites required for construction. This is expected to increase demand for ship loaders for moving from one cargo terminal to another cargo terminal, which fuels growth of the ship loader and unloader market. For instance, in 2018, the government of Italy spent around $6.2 billion on building construction activities.

However, high cost of ship loaders and unloaders and fluctuation in raw material prices, limits growth of the ship loader and unloader market. On the contrary, adoption of ship loaders and unloaders for remote operations is anticipated to create growth opportunities for the market. Rise in adoption of ship loaders and unloaders in prefabricated construction is anticipated to provide lucrative opportunities for growth of the market.

By Product Type

Mobile segment is projected to grow at a significant CAGR

In addition, the COVID-19 pandemic has shut-down production and sales of various products in the ship loader and unloader market, mainly owing to prolonged lockdown in major global countries including the U.S., Italy, and the UK. This has hampered growth of the ship loader and unloader market significantly in last few months, and is expected to continue during the pandemic. Moreover, lockdowns have also led to a halt in construction activities, thereby hampering demand for the ship loader and unloader market during 2020.

By Technology

Mechanial segment generated the highest revenue.

Market Segmentation

The global ship loader and unloader market is segmented on the basis of product type, bulk type, technology, application, and region.

On the basis of product type, the market is divided into stationary and mobile. The stationary segment generated the highest revenue in 2020. By bulk type, the market is divided into dry and liquid. The dry segment generated highest revenue in 2020.

By technology, the market is divided into mechanical and pneumatic. The mechanical segment dominated the market in 2020.

On the basis of application, the market is categorized into mining, machinery, construction, sea ports and cargo terminals, and others. The mining segment generated the highest revenue in 2020.

By Bulk Type

Dry segment holds dominant position in 2020

Region wise, the global ship loader and unloader market analysis is conducted across North America (the U.S., Canada, and Mexico), Europe (the UK, France, Germany, Italy, and rest of Europe), Asia-Pacific (China, Japan, India, Australia, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa). In 2020, Asia-Pacific was the highest contributor to the global ship loader and unloader market, and is anticipated to secure a leading position during the forecast period.

By Region

Asia-Pacific holds a dominant position in 2020, with a highest CAGR of 4.3% during the forecast period.

Competition Analysis

Key market players profiled in the report include FLSmidth A/S, Fluor Corporation (American Equipment Company Inc), Buhler Group, Sandvik AB, Vigan Engineering S/A, NEUERO Industrietechnik fur Forderanlagen GmbH, SMB International GmbH, Aumund Group, EMS-Tech Inc., and Liebherr-International AG.

Many competitors in the ship loader and unloader market adopted product launch as their key developmental strategy to improve product portfolio of ship loader and unloader machines. For instance, in January 2019, Siwertell AB based in Sweden, launched a new ship loader Siwertell high- capacity loader. This machine is capable of loading bulk amount of coal around 8000 metric tons per hour. It is highly-efficient and low maintenance machine. It is best suitable for construction and mining applications.

Similarly, players in the global ship loader and unloader market are also adopting business expansion as their key development strategies to improve geographical presence of ship loader and unloader products. For instance, in July 2020, Liebherr formally moved to its expanded new campus located in Newport News, Virginia, in the U.S. The expansion project added 251,000 sq. ft. to its existing campus in the region. Liebherr invested $60 million for the expansion, which includes warehouse and equipment repair, state of the art office building, and a maintenance workshop for ship loader and related products.

Key Benefits For Stakeholders

- The report provides an extensive analysis of the current and emerging global ship loader and unloader market trends and dynamics.

- In-depth analysis of the market is conducted by constructing market estimations for the key market segments between 2020 and 2030.

- Extensive analysis of the market is conducted by following key product positioning and monitoring of the top competitors within the market framework.

- A comprehensive global ship loader and unloader market opportunity analysis of all the countries is also provided in the report.

- The global ship loader and unloader market forecast analysis from 2021 to 2030 is included in the report.

- The key players within the market are profiled in this report and their strategies are analyzed thoroughly, which help understand the competitive outlook of the industry.

Ship Loader and Unloader Market Report Highlights

| Aspects | Details |

| By Product Type |

|

| By TECHNOLOGY |

|

| By BULK TYPE |

|

| By APPLICATION |

|

| By Region |

|

| Key Market Players | SMB INTERNATIONAL GMBH, FLUOR CORPORATION (AMERICAN EQUIPMENT COMPANY INC), VIGAN ENGINEERING S/A, EMS-TECH INC., BUHLER GROUP, FLSMIDTH A/S, SANDVIK AB, AUMUND GROUP, NEUERO INDUSTRIETECHNIK FUR FORDERANLAGEN GMBH, LIEBHERR- INTERNATIONAL AG |

Analyst Review

The global ship loader and unloader market has witnessed huge demand in Asia-Pacific followed by Europe and North America. The highest share of the Asia-Pacific market is attributed to increase in demand for ship loaders and unloaders in mining and manufacturing sectors.

Ship loaders and unloaders are equipment used for bulk material handling. Ship loaders and unloaders are used for handling material such as iron core, coal, grains, fertilizers, and other materials in barges or ships. Ship loaders and unloaders are essential part of the shipping industry. Benefits associated with ship loaders and unloaders include high efficiency, huge material handling capacity, robust, and available in both mechanical and pneumatic technology.

Rise in demand for ship loaders and unloaders in industrial and manufacturing sectors globally fuels growth of the ship loader and unloader market. In addition, rise in seaborn trade in the ship industry globally has led to rise in demand for ship loaders and unloaders, owing to shipment of goods from one port to other port, which drives growth of the ship loader and unloader market.

Moreover, major players such as Metso Corporation and SMB International GmbH are engaged in offering ship loaders. For instance, Metso Corporation offered ship loaders for various applications such as loading bulk materials such as iron core, grains, and fertilizers. It has features such as durable, rugged construction, stationary, operates in cold weather, and operated by both way mechanical as well as pneumatically. All such instances drive growth of the ship loader and unloader market.

The global ship loader and unloader market size was $39,770.2 million in 2020 and is projected to reach $57,870.9 million in 2030, growing at a CAGR of 3.6% from 2021 to 2030.

The forecast period considered for the global ship loader and unloader market is 2021 to 2030, wherein, 2020 is the base year, 2021 is the estimated year, and 2030 is the forecast year.

The base year considered in the global ship loader and unloader market is 2020.

No, the report does not provide Value Chain Analysis for the global ship loader and unloader market. However, it provides market share analysis for the top players in the ship loader and unloader market.

On the basis of product type, the stationary segment is expected to be the most influencing segment growing in the global ship loader and unloader market report.

Based on the bulk type, in 2020, the dry segment generated the highest revenue, accounting for 75.4% of the market and is projected to grow at a CAGR of 3.8% from 2021 to 2030.

The report contains an exclusive company profile section, where leading 10 companies in the market are profiled. These profiles typically covers company overview, geographical presence, and market dominance (in terms of revenue and volume sales).

The market value of global ship loader and unloader market is $41,957.6 million in 2021.

Loading Table Of Content...