The global short range air defense systems market size was valued at $12.4 billion in 2021, and is projected to reach $21.1 billion by 2031, growing at a CAGR of 5.6% from 2022 to 2031.

Short range air defense systems refer to a group of defense equipment that deals with defense against low-altitude aerial threats, particularly that from helicopters, unmanned aerial vehicles (UAVs), and low-flying aircraft. Amid a rise in conflicts and war-like situations across different parts of the world, the demand for short range air defense systems has grown at a significant rate. Short range air defense systems ensure the safety of national assets and citizens against threats such as drones and missile attacks. With the introduction of more lethal, covert, and nimble enemies, the characteristics of modern warfare have evolved. As the nature of warfare has changed, countries have started to invest in defensive spending, which has resulted in numerous developments across the short-range air defense systems. Currently, large defense corporations globally are substantially investing in the development of short range air defense systems to counter the new growing threats in the modern battlefield.

Over the past decade, the world has witnessed a tremendous rise in conflicts globally. The rise in tensions among several countries, such as India-China, India-Pakistan, Israel, China-Taiwan, China-Japan, Russia-Ukraine, and many Arab nations, have resulted in the development and procurement of aerial defense systems. Countries across the world are investing in various procurement contracts in order to modernize their defense portfolio. For instance, in May 2022, Thales was awarded a contract by PT Len, a communications equipment manufacturing company, to offer air surveillance radars and C2 systems to boost Indonesia’s air defense capabilities. This contract improved Indonesia's capabilities to defend from jets, missiles, rotorcraft and UAS. Similarly, in august 2022, Northrop Grumman was awarded a contract for the U.S. Army Maneuver Short Range Air Defense (M-SHORAD) directed energy prototyping initiative. The company worked on integrating a directed energy weapon system on a Stryker vehicle to provide comprehensive protection solutions to the combat units.

Factors such as increase in usage of new age weapons such as drone across cross border conflicts, technological advancement in weapon system, and increase in defense budget expenditure are primary factors supporting the market growth. The global defense expenditure has seen exponential growth in recent years. According to Stockholm International Peace Research Institute (SIPRI), global defense spending reached $1,981 billion in 2020 with a 2.6% year-on-year increase. The military expenditure accounted for 2.4% of the global gross domestic product (GDP) in 2020. Furthermore, the high costs associated with the development of short range air defense systems are expected to hinder the market growth in the future. Despite this, the ever-growing threats of slow-moving drones across the battlefield should continue to favor the growth of the market in the future.

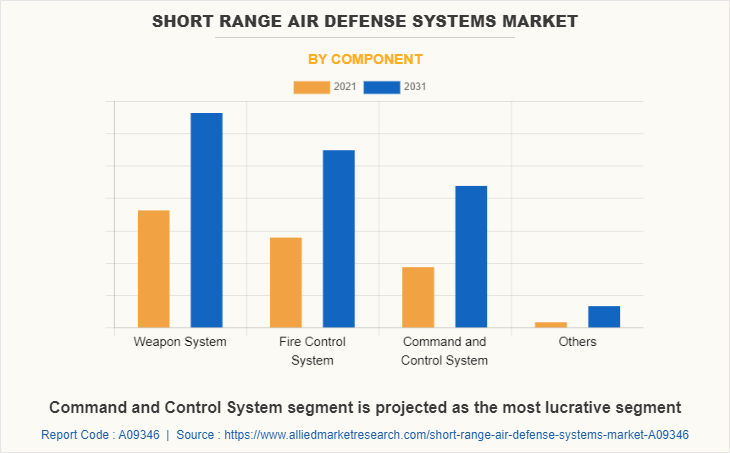

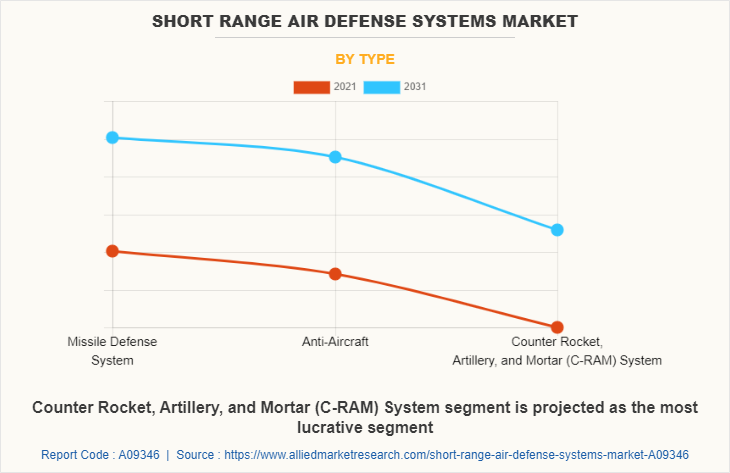

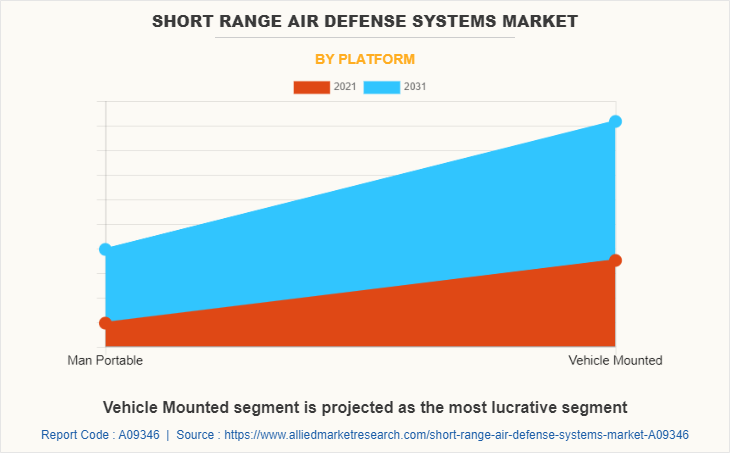

The short range air defense system market is segmented on the basis of component, platform, type, and region. The component segment is divided into the weapon system, fire control system, command, and control system, and others. The platform segment is divided into man portable and vehicle mounted. The market within the type segment is divided into missile defense system, anti-aircraft, counter rocket, artillery, and mortar (C-RAM) System. By region, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

North America comprises the U.S., Canada, and Mexico has one of the most advanced defense sectors across the globe. Countries such as U.S., Canada, and others in the region are highly developed in terms of short range air defense systems. The government’s improving defense expenditure to support the development of defense systems and associated equipment is anticipated to boost the growth of the market across the region. For instance, in financial year 2021, the U.S. Defense Budget request of $740.5 billion was a 6.85% increase over the sanctioned spending for the financial year 2020. The budget ropes the permanent implementation of the National Defense Strategy (NDS), which drives the Department of Defense's decision-making in reprioritizing resources and shifting investments to prepare for a potential future technology-intensive conflict. Such systems are well-equipped with the latest technologies and are continuously upgraded to meet the latest trends. Advancements in the defense infrastructure are the leading factors that boost demand for short range air defense systems across North America. In addition, the increase in the deployment of air defense systems for protection from air attacks is expected to create lucrative growth opportunities for the short range air defense system market in the region.

Some leading companies profiled in the report comprises Airbus, BAE Systems, Boeing, Elbit Systems Ltd., General Dynamics, L3Harris Technologies, Inc., Lockheed Martin Corporation., Northrop Grumman, Raytheon Technologies Corporation, and Thales Group.

The leading companies are adopting strategies such as product launch and contract to strengthen their market position. In September 2022, Thales launched its advanced technological solutions, including its Short-Range Air Defense capabilities STARStreak at the International Defense Industry Exhibition (MSPO), in Kielce, Poland. It was one of the fastest short-range surface-to-air missiles, reaching speeds of Mach 3,5 (roughly 3,000 mph), and was highly effective against armored fighter jets and helicopters. In July 2020, Northrop Grumman was awarded a contract by the U.S. Department of Defense (DOD) to supply its Forward Area Air Defense Command and Control (FAAD C2) system as the interim command and control system for future Counter-Small Unmanned Aerial System (C-sUAS) procurements. This allowed the U.S. to better equip themselves with capabilities to defend against aerial threats.

Rising threat of Unmanned Aerial Systems (UASs) across the battlefield

The field of unmanned aerial vehicles (UAVs) is witnessing unprecedented growth. Newer and better-unmanned vehicles are being developed across the globe owing to their versatility across various military applications across surveillance as well as attacking activities. Stealth drones are in development which is difficult to be detected by radar systems. For instance, in July 2022, the Defense Research and Development Organization (DRDO), a premier agency under the Department of Defense Research and Development under the Ministry of Defense of the Government of India, successfully completed the test flight of India’s first stealth combat aerial vehicle – the Ghatak drone. It can launch missiles and precision-guided munitions. Similarly, General Dynamics’s MQ-1 Predator and Northrop Grumman RQ-4 Global Hawk drones have become prime threats across the modern battlefield. Furthermore, the rising popularity of slow moving and low altitude drones for surveillance purposes, coupled by the fact that these drones can slip under the range of conventional radar and air defense systems is an issue from a defense point of view. In order to counter such threats, the development as well as the growth of short range air defense systems market is on an upward trend.

Rise in defense activities of nations to protect against various threats

The capacity to protect a nation's air space has grown more crucial as air combat technologies have developed, coupled with increased terrorism and cross border conflicts. The force is shielded from enemy air and missile attacks by the air defense system. The effectiveness of the U.S. weapon systems aids the nation in guaranteeing that the U.S. military has a tactical fighting edge over any foe. For instance, the U.S, Department of Defense (DoD) requested $247.3 billion for acquisition (Procurement and Research, Development, Test, and Evaluation (RDT&E)) funding for 2020. This amount includes funding from the base budget and the overseas contingency operations (OCO) fund, which totals $143.1 billion for Procurement and $104.3 billion for RDT&E.

For the National Defense Strategy's military force objective to be implemented, the spending in the budget proposal represents a balanced portfolio approach. The Major Defense Acquisition Programs (MDAPs), which are acquisition programs that exceed a cost cap set by the Under Secretary of Defense for Acquisition and Sustainment, are funded with $83.9 billion of the $247.3 billion requested within past five years. There have been over 1,200 more ballistic missiles, according to the missile defense organization. Over 5,900 ballistic missiles are deployed as of 2021, outside of the U.S. The U.S. defense system can now intercept hundreds of launchers and missiles simultaneously. Furthermore, in August 2022, the U.S. Missile Defense Agency (MDA) awarded Boeing a contract for the Integration, Test and Readiness (SITR) of its Ground-based Midcourse Defense (GMD) System.

In addition, India and Russia agreed to a $5.5 billion purchase agreement for five S-400 missile systems in 2018, and by the end of 2023, Russia is expected to deliver all five regiments of the S-400 air defense system to India. The Turkish armed forces were scheduled to acquire a second regiment of Russian S-400 surface-to-air missile systems in August 2022, according to a Turkish government announcement. Some components of the S-400 missile system are to be produced locally. In addition, the Russian military utilized at least one S-350 Vityaz air defense system for the battle in Ukraine on August 20, 2022. All these factors are supplementing the growth of the short range air defense market.

High costs associated with the development of short range air defense systems

One of the major hurdles igniting the defense program was the expenses associated with short range air defense system. Short range air defense systems are extensively used to defend against the threats of unmanned aerial vehicles (UAVs) and low-velocity small drones which can break through normal air defense systems. This is due to the inability of normal radar systems to detect slow moving targets, thereby allowing low, slow speed drones with a small radar cross-section to slip right across conventional air defense systems. Furthermore, short range air defense systems need to be portable and need to be deployed quickly should the threat assessment change and can be put in places where radar coverage is degraded or non-existent. High cost associated with the integration and implementation of air defense systems is limiting several nations to undergo long-term acquisition and operation contracts. However, these nations practice the acquisition and operation of second-hand air defense system, which are scrapped by first-world nations. Such factors greatly increase the costs associated with the development of t range air defense systems, which is expected to hamper the growth of the market.

Increase in defense expenditure towards the procurement of air defense systems

The defense expenditure of countries across the globe is on the rise. For instance, in financial year 2021, the U.S. Defense Budget request of $740.5 billion was 6.85% increase over the sanctioned spending for the financial year 2020. Furthermore, according to Stockholm International Peace Research Institute (SIPRI), the defense expenditure reached around US$1,981 billion in 2020 across the globe and it is growing by 2.6% year on year. The significantly rising defense budgets in the developing nations of India, China, and Vietnam is presenting a lucrative growth opportunity for the market players. For instance, according to SIPRI, in 2021, India's military expenditure increased to $76.6 billion, marking a 0.9% hike over the 2020 figures.

Due to the rise in regional conflicts between countries & for fulfilling their defense requirements, several countries are procuring advanced short-range air defense systems for their defense forces. For instance, in July 2019, Turkey started receiving parts of the air defense system, named S-400 from Russia. Moreover, India was expected to start receiving S-400 systems from the end of 2021, which is part of India’s $5.43 billion deal with Russia for the 5 S-400 regiments. Hence, such an increase in procurement of air defense systems by several countries is expected to drive the growth of the global air defense systems market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the short range air defense systems market analysis from 2021 to 2031 to identify the prevailing short range air defense systems market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the short range air defense systems market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global short range air defense systems market trends, key players, market segments, application areas, and market growth strategies.

Short Range Air Defense Systems Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 21.1 billion |

| Growth Rate | CAGR of 5.6% |

| Forecast period | 2021 - 2031 |

| Report Pages | 220 |

| By Component |

|

| By Type |

|

| By Platform |

|

| By Region |

|

| Key Market Players | Northrop Grumman Corporation, Thales, Airbus, BAE Systems plc, Raytheon Technologies Corporation, Elbit Systems Ltd., L3Harris Technologies, Inc., Lockheed Martin Corporation, Boeing Company, General Dynamics Corporation |

Analyst Review

The short range air defense system market is expected to witness a significant growth rate owning to increase in defense budgets of nations across the globe and rising concerns of nations to protect themselves from conventional and modern threats such as that from unmanned aerial vehicles (UAVs). While the short range air defense systems are very specific in their effectiveness against aerial threats within short distances, their effectiveness in countering modern threats such as stealth and slow moving drones which are difficult to be detected by conventional systems makes them worth the time and cost investment. Furthermore, the ever-growing advancements in weapon technologies and attacking capabilities across the globe have created the demand for modernization and installation of sophisticated defense technologies by governments to prevent threats and offensive attacks from foreign countries. Hence, increase in defense expenditure is expected to open new avenues for the growth of the short range air defense system market during the forecast period.

Also, adoption of internet of things (IoT) within the air defense system market is expected to change the business dynamics during the forecast period. One of the popular short range air defense systems is the Iron Dome. It is an artificial intelligence (AI)-powered anti-missile system that is reportedly 90% effective. The Iron Dome employs artificial intelligence to decide if the approaching wave of short-range rockets and missiles will strike the common people or the state's important assets. Unmanned Aerial Vehicles (UAVs), guided missiles, and cruise missiles are among the threats that the AI system identifies, analyses, and ultimately obstructs. In addition, AI and machine learning (ML) can also be useful in analyzing a vast amount of missile testing-data. A typical testing of ground-based midcourse defense generates terabytes of data. Using AI can ease the processing of data and provide vital insights to improve the functioning of the missile defense system.

In order to fulfil the ever-changing markets demands and scenarios, market participants are continuously engaged in product development in order to adapt their offerings to counter the growing threats across the battlefield and meet new business opportunities. In addition, market participants are continuously focusing on contracts and partnership efforts to match changing end-user requirements and improve the growth of the short range air defense system market.

Some leading companies profiled in the report comprises Airbus, BAE Systems, Boeing, Elbit Systems Ltd., General Dynamics, L3Harris Technologies, Inc., Lockheed Martin Corporation., Northrop Grumman, Raytheon Technologies Corporation, and Thales Group

The global short range air defense systems market was valued at $12.4 billion in 2021, and is projected to reach $21.1 billion by 2031, registering a CAGR of 5.6% from 2022 to 2031.

North America is the largest regional market for short range air defense systems.

Missile Defense System is the leading application of short range air defense systems market

Increase in defense expenditure towards the procurement of air defense systems and rise in technological innovations across aerial threats

Loading Table Of Content...