Shotcrete Market Research, 2030

The global shotcrete market was valued at $5.6 billion in 2020, and is projected to reach $10.9 billion by 2030, growing at a CAGR of 6.91% from 2021 to 2030. The shotcrete market has experienced increased demand due surge in infrastructure development across various regions, driven by the need for efficient construction techniques. As urbanization accelerates and government investments in infrastructure projects such as roads, bridges, tunnels, and water management systems rise, shotcrete offers a versatile and cost-effective solution.

Introduction

Shotcrete is a construction technique that involves applying concrete or mortar through a high-pressure hose onto a surface. This method is particularly effective for shaping and reinforcing structures where conventional concrete placement methods are impractical or inefficient. The process is performed using two primary techniques: dry-mix and wet-mix. In the dry-mix method, dry ingredients are mixed with water at the nozzle, allowing for precise control over the water-cement ratio, while in the wet-mix method, the mixture is pre-mixed with water before being pumped to the nozzle for application.

Market Dynamics

Increase in awareness about technical efficiency of shotcrete is expected to boost market growth. Some of the other factors, including advancement in shotcrete technology & raw materials; sustainability of shotcrete materials; increase in demand for shotcrete from construction & infrastructure industry; and surge in usage of sprayed concrete in manufacturing of domes, barrel vaulting, & bank vaults are expected to drive the growth of shotcrete market during the forecast period. Shotcrete repairs are completed easily and economically if proper materials, machinery, and procedures are used. Increase in consumer preferences and change in lifestyle of people resulted in construction of dams, subways, highways, bridges, tunnels, and other infrastructure, driving the shotcrete market growth.

Shotcrete application requires specialized machinery, such as high-pressure concrete pumps and nozzles, along with skilled operators to manage the equipment effectively. These machines are expensive to purchase and require regular maintenance to ensure optimal performance. For many small to mid-sized construction companies, the upfront investment in shotcrete equipment is prohibitive, limiting their ability to adopt this technique on a wide scale. As a result, these companies continue using traditional construction methods that involve lower capital costs, despite the efficiency benefits that Shotcrete offers. All these factors hamper the growth of shotcrete market during the forecast period.

The lack of skilled & trained professionals and challenges associated with transportation of concrete mix are projected to hamper market growth during the forecast period. Increase in the construction of free-form structures, including sculptures, theme park elements, climbing walls, and water-retaining structures, including river and seawalls, dams, storage reservoirs, swimming pools, canal lines, and water towers, are expected to provide lucrative growth opportunities for the shotcrete market.

Market Segmentation

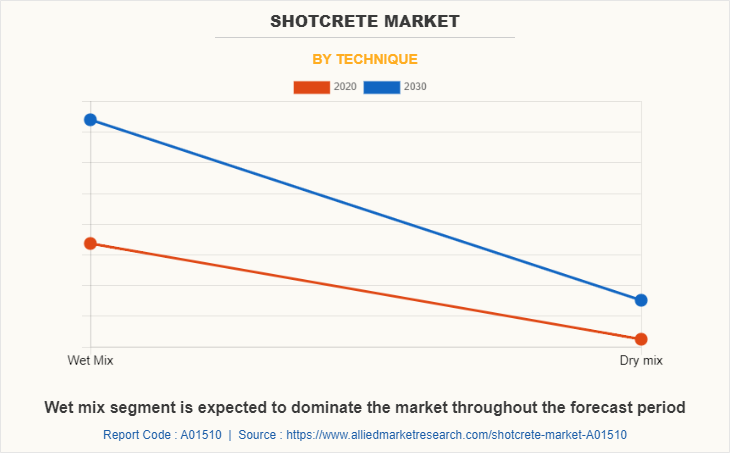

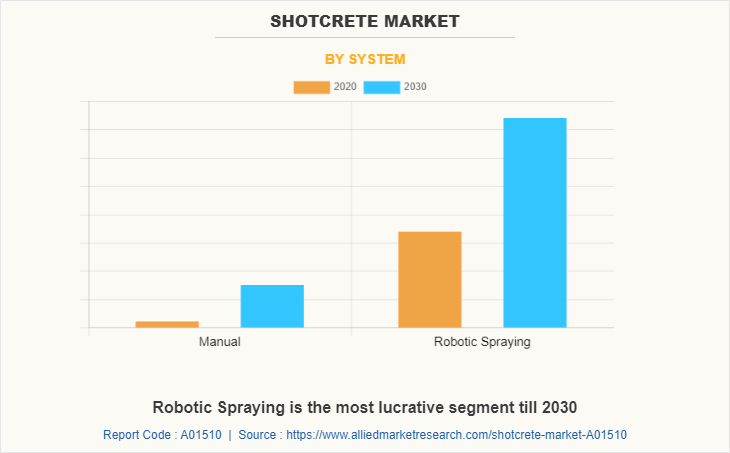

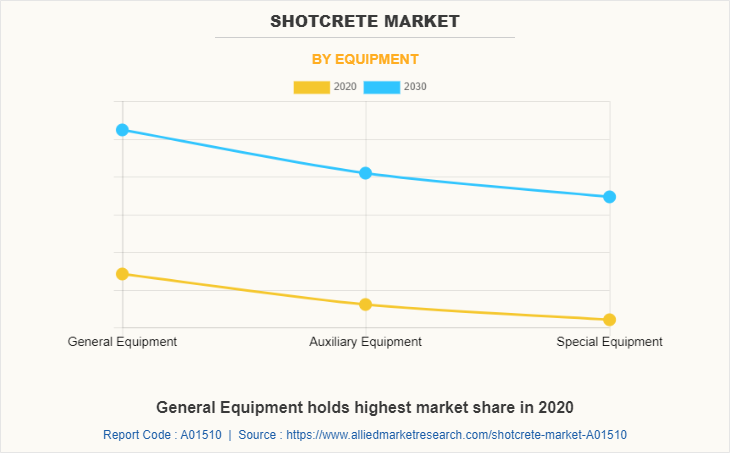

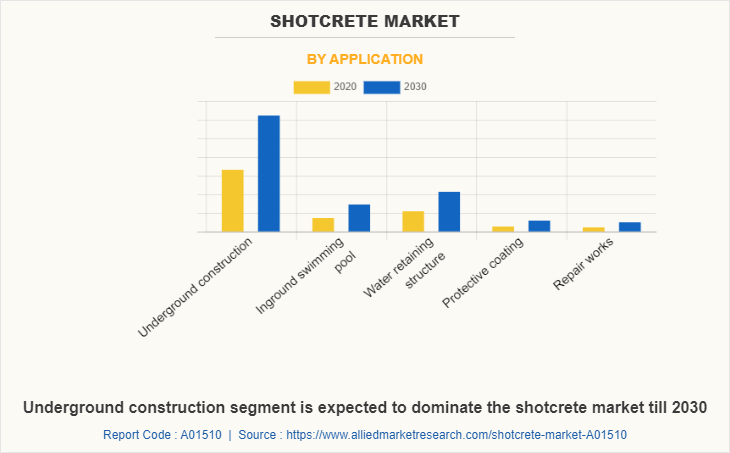

The shotcrete market is segmented into technique, system, application, equipment, and region. Depending on the technique, it is divided into wet mix and dry mix. By system, it is categorized into manual and robotic spraying. By application, it is classified into underground construction, inground swimming pool, water retaining structures, protective coatings, and repair works. By equipment, it is fragmented into general equipment, auxiliary equipment, and special equipment. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA. Europe is the leading region in terms of demand for shotcrete and is expected to maintain its dominance during the forecast period. High adoption of shotcrete as a protective coating and presence of huge infrastructural activities in the region are expected to bolster the shotcrete market size, due to presence of investment in the construction activities and repair works.

Competitive Landscape

The key players profiled in the shotcrete market report include BASF SE, Heidelberg Cement, Grupo ACS, Lafargeholcim, Cemex, Sika AG, GCP Applied Technologies, U.S. Concrete, Mapei, and Normet.

The other key players (not profiled in report) in the value chain include, Lkab Berg and Betong Quikrete cement and concrete products, Tutor Perini Corporation, Thiessen Team, and SAN are competing for the share of the market through product launch, joint venture, partnership, and expanding the production capabilities to meet the future demand for the shotcrete market in the forecast period.

Europe occupies the largest part of shotcrete market share in 2020. The global growth in demand for underground drilling, shipping, hard rock extraction, concrete repair, and technical advances in the shotcrete concrete market will be expected to continue during the forecast period. Shotcrete concrete is expected to dominate the market in the forecast period, owing to widespread demand for retaining structures, repair works, and protective coatings in Europe. In Europe, Attiko Metro Company is going to construct four new lines, the project worth over $3.61 billion, the ongoing ‘Elizabeth Line’ project which connects more than 40 stations through 26 mile of tunnel, the project worth over $23 billion. In addition, construction in this region of the metro project, which links east north and west south fuel the demand for shotcrete concrete in this region.

The wet mix segment dominated the global shotcrete market share in 2020. In wet mix process, the water content is controlled more precisely as the process involves mixing all ingredients with required water content. Wet mix shotcrete process is highly preferred in the shotcrete concrete market. For the wet mix, the combination of cement, mortar, and sprayed concrete admixture is applied with water. Spraying operation is easy, due to the fact that mix is prepared before. In this process, the admixtures can be added as per the design requirement and air consumed is less. Wet mix process offers high strength, owing to less water to cement ratio compared to the poured concrete. Wet mix process has high compressive strength and dense compaction is achieved by high velocity of application, owing to this. The bond strength provided by wet mix process is high as the aggregate mixture is properly prepared and improved adhesion is achieved.

The robotic spraying segment dominated the global shotcrete market share in 2020. The demand for robotic shotcrete technique, including use of mechanized equipment with robotic arm offers various advantages, including high-quality mixture with homogenous support. This is because in robotic or mechanized wet mix, spraying the water to cement ratio is automatically controlled by robotic arm that provides high strength. It offers energy savings as one robotic arm of sprayed concrete offers same performance as that of three machines. In addition, it requires’ less manpower, due to the fact that robotic technique can be operated by two workers compared to manual concrete spraying.

The general equipment segment dominated the global shotcrete market share in 2020. There are two basic types of shotcrete delivery equipment known as guns: dry-mix guns and wet mix guns. Furthermore, either type can be used for most shotcrete work however, each has its limitations. Dry-mix guns are divided into two classifications, double chamber gun and continuous feed gun. Double chamber gun is used only for mortar mixtures with low production rate , however larger, high-production units which will handle coarse aggregate up to about 3/4 inch are now available. Continuous feed guns handle mortar or concrete mixtures with aggregate up to about 3/4-inch and will produce shotcrete at production rates up to 2 cubic yards per hour. In wet mix the general equipment utilized are pneumatic feed and positive displacement equipment. In the pneumatic-feed equipment, premixed mortar or concrete is conveyed from gun through the delivery hose to the nozzle by slugs of compressed air. This equipment can handle mixtures of a consistency suitable for general shotcrete construction, using mixtures containing up to 3/4-inch aggregate. Guns with a dual mixing chamber and a two-way valve allow mixing of materials and a continuous flow operation. In the positive displacement equipment, the concrete is pumped or otherwise forced through the delivery hose without use of compressed air. Positive displacement delivery equipment requires a wetter mixture than pneumatic feed equipment and the velocity of the shotcrete being applied is lower. It is difficult to apply shotcrete to vertical and overhead surfaces by this method unless a suitable accelerator is used. This equipment can also satisfactorily shoot material containing 3/4-inch aggregate.

The underground construction segment dominated the global shotcrete market share in 2020. Shotcrete is widely used to process the underground construction as concrete spraying can be done from a safe distance. The underground space development is susceptible to extreme geological conditions, harmful gas outbursts, high ground stress, and rock bursts. Shotcrete is popular method for installation of permanent structural lining for non-uniform surfaces in underground construction. In addition, shotcrete excels in tunnel applications ,due to the fact that conventional methods require use of heavy structures ,including steel that has limited flexibility. Increase in underground construction activities, rise in economic development, urbanization, surge in underground transport, rise in shotcrete technological efficiency, and increase in mining and tunneling activities drive the growth of the market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the shotcrete market analysis from 2020 to 2030 to identify the prevailing shotcrete market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the shotcrete market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global shotcrete market trends, key players, market segments, application areas, and market growth strategies.

Shotcrete Market Report Highlights

| Aspects | Details |

| By Technique |

|

| By System |

|

| By Application |

|

| By Equipment |

|

| By Region |

|

| Key Market Players | Cemex S.A.B. De C.V., U.S. Concrete Inc, Lafargeholcim Ltd., Mapei S.P.A., Grupo ACS, Heidelbergcement, Normet Group, BASF SE, Sika AG, GCP Applied Technologies |

| | Quikrete Companies, Inc., KPM Industries Ltd., The Euclid Chemical Company, Lkab Berg & Betong AB, Cemex S.A.B. De C.V. |

Analyst Review

Shotcrete is used in various applications, which include underground construction, water retaining structure, protective coating, and repair works. It is used globally for its time and formwork reducing advantages. It is a suitable method when strengthening and relining work is required. In addition, shotcrete is used to make various architectural and landscape designs and is beneficial to use in slope stabilization works.

The global underground construction application is expected to significantly grow during the forecast period. Underground construction includes construction of tunnels, mines, subways, and water drainage. Tunnels, mining, and concrete lining are the main sectors under underground construction works. In tunnelling and mining industries, rock stabilization, arch linings, large cavity filling are the main areas of shotcrete utilization. Shotcrete is mainly used to strengthen the substrate by using sprayed concrete linings as a temporary or permanent lining considering time and cost required. Upcoming underground construction mega-projects like south –north water transfer project in china where 600 mile long canal will funnel water from China’s three largest rivers into the nation’s northern regions; London cross rail project, where 26 miles of tunnel is under construction for connecting 40 stations through the existing network the ‘Elizabeth Line’. Chuo Shinkansen, a high speed rail line to transport passengers 286 kilometers from Tokyo to Nagoya in mere 40 minutes. This project will require extensive tunnel construction, which is approximately 86% compared to entire project. The project is scheduled for completion by 2027 before work continues to extend the line onwards to Osaka. Great Man Made River project is classed as the largest irrigation project in the world and upon completion it will supply water to more than 0.35 million acres of arable land and also increase the availability of clean drinking water in the majority of Libya’s urban centers. The above mentioned projects are expected to increase the shotcrete requirement significantly in the upcoming years.

The protective coatings is one of the most widely used application across the globe in various sectors, as it is used to protect structural steelwork from fires, refractory linings, pipelines, rock, and soil. For preventing steelwork catching fire, micro monofilament polypropylene fibers are reinforced in shotcrete along with steel. Shotcrete for refractory lining is currently a flourishing application, which is expected to maintain the trend as demand for refractory materials by industries is increasing. Use of shotcrete as a protective coating for pipelines is increasing, owing to its efficiency to prevent leakage.

Rapid development of shotcrete technology and raw materials and Economic and technical efficiency of shotcrete are the key factors boosting the Shotcrete Market growth

The market value of Shotcrete in 2030 is expected to be US$ 10.9 Billion

BASF SE, Heidelberg Cement, Grupo ACS, Lafargeholcim, Cemex, Sika AG, GCP Applied Technologies, U.S. Concrete, Mapei, and Normet

Building and Construction industry is projected to increase the demand for Shotcrete Market

The global shotcrete market is segmented on the basis of technique, system, application, equipment, and region. Depending on the technique, the market is segmented into wet mix and dry mix. According to system, it is categorized into manual and robotic spraying. As per the application, it is segregated into underground construction, water retaining structures, protective coatings, and repair works. On the basis of equipment, it is classified into general equipment, auxiliary equipment, and special equipment. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Sustainability of shotcrete process is the Main Driver of Shotcrete Market

Underground construction, water retaining structures, protective coatings are expected to drive the adoption of Shotcrete

Emergence of COVID-19 minimally impacted the growth of the global shotcrete market during this period. This impact is mostly attributed to the significant disruptions in raw material transportation and unavailability of labor, which, in turn, ceased many manufacturing industries, declining demand for shotcrete during this period. The decrease in demand for many non-essential products and ceased construction created a negative impact on the growth of global shotcrete market.

Loading Table Of Content...