Silicone Market Overview

The global silicone market size was valued at $18.8 billion in 2022, and is projected to reach $39.4 billion by 2032, growing at a CAGR of 7.7% from 2023 to 2032.

The renewable energy sector is witnessing significant growth worldwide, driven by increasing environmental concerns and government initiatives promoting clean energy. Silicone materials play a crucial role in this expansion, particularly in applications such as solar panels and wind turbines. In solar panels, silicone is used as an encapsulant and sealant to protect photovoltaic cells from moisture, dust, and mechanical damage. Its durability and flexibility help maintain the efficiency and longevity of solar panels even under harsh environmental conditions, such as extreme temperatures and UV exposure.

![]()

Introduction

Silicone is a synthetic polymer primarily composed of silicon, oxygen, carbon, and hydrogen atoms. It is renowned for its unique combination of properties that make it highly versatile and useful in a wide range of applications. One of silicone's defining characteristics is its exceptional temperature resistance. It withstands extreme heat & cold and remains stable & flexible over a broad temperature range, from as low as -40°C (-40°F) to as high as 230°C (446°F). This property makes silicone ideal for use in baking molds, kitchen utensils, and even aerospace applications.

Silicone exhibits excellent flexibility and elasticity. It has the ability to be stretched and compressed without losing its shape, making it valuable in products such as gaskets, seals, and medical devices. Its resistance to moisture, UV radiation, and chemicals makes it durable and long-lasting. Furthermore, silicone is biocompatible, meaning it is safe for use in medical implants and prosthetics. It is non-toxic and hypoallergenic, reducing the risk of adverse reactions in contact with the human body. Its low surface energy prevents substances from sticking to it, which is why it is commonly used in non-stick cookware.

Report Key Highlighters:

- The silicone market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($million) and volume (Kilotons) for the projected period 2023-2032.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The silicone market is highly fragmented, with several players including Dow Inc., Wacker Chemie AG, Momentive Performance Materials, Evonik Industries AG, KANEKA CORPORATION, Arkema, BASF SE, Shin-Etsu Chemical Co., Ltd., Elkem ASA, and KCC Silicone Corporation.

Market Dynamics

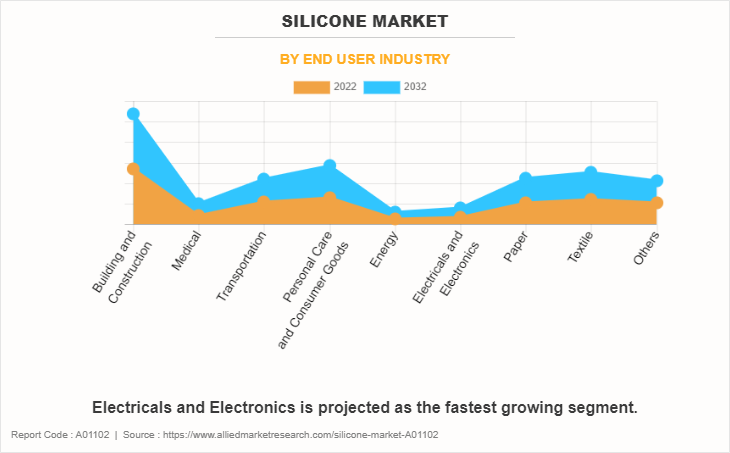

The growing demand for silicones in the electronics & electrical industry is expected to drive the growth of the silicone market. There is an increasing consumer demand for smart devices, wearable technology, and efficient electrical systems. Silicone plays a vital role in this sector due to its unique combination of properties, including excellent thermal stability, electrical insulation, and flexibility. These characteristics make silicone an ideal material for protecting sensitive electronic components and ensuring their reliable performance over time. In April 2025, the Indian Union Cabinet approved the Electronics Component Manufacturing Scheme with an investment of $2,761 million (₹22,919 crore). This initiative aims to develop a robust component ecosystem, attract global and domestic investments, and reduce import dependence.

Moreover, the rise of emerging technologies such as 5G networks, electric vehicles, and Internet of Things (IoT) devices further drives the demand for silicone in the electronics sector. These technologies require components that can operate reliably in diverse and often harsh environments, where temperature fluctuations and electrical interference are common. In January 2025, WACKER expanded its silicone production facility in China in 2022 to meet the growing demand for silicone thermal adhesives in the Asia-Pacific region, particularly for 5G infrastructure and consumer electronics.

However, the availability of alternative material is expected to hamper the growth of the silicone market. Lightweight materials like carbon fiber, aluminum, EPDM (ethylene propylene diene monomer), nitrile rubber, and neoprene are increasingly replacing silicone in automotive components to improve fuel efficiency and reduce emissions. For example, EPDM is widely used for automotive gaskets and seals due to its lower cost and good weather resistance, while nitrile rubber is preferred for its oil and fuel resistance in industrial and automotive sealing applications. Alternatives like MS polymers, polyurethanes, and specialized sealants (e.g., Sashco's Lexel, OSI Quad, and DAP's Ultra Clear) provide similar or superior performance characteristics for selling and bonding, often at a lower cost. For many uses, these alternatives provide adequate resistance to weather, chemicals, and aging, narrowing the performance gap with silicone and increasing their adoption in sectors like automotive, construction, and electronics.

Segment Overview

The silicone market is segmented on the basis of type, end-user industry, and region. By type, the market is divided into elastomers, fluids, resins, gels, and others. On the basis of the end-user industry, it is categorized into building & construction, medical, transportation, personal care & consumer goods, energy, electrical & electronics, paper, textile, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

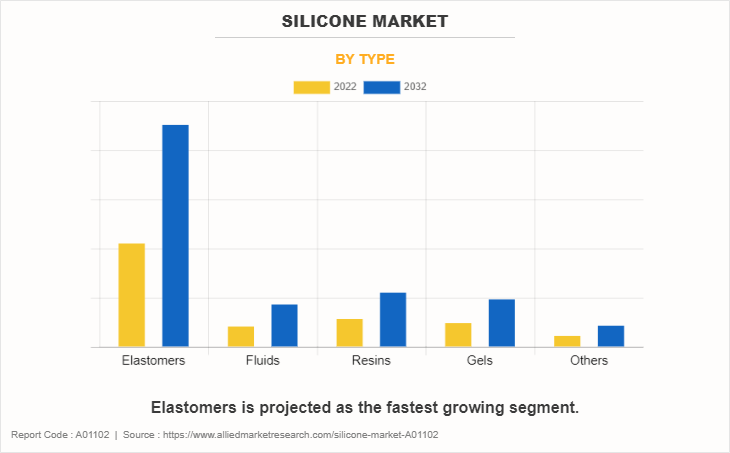

Silicone Market By Type

The elastomers segment accounted for the largest share accounting for more than half of the global silicone market revenue in 2022 and is expected to register the highest CAGR of 8.0%. Silicone elastomers are favored for their exceptional heat resistance, flexibility, and electrical insulation properties. These factors stem from the unique chemical structure of silicones, featuring silicon-oxygen (Si-O) bonds. Their high-temperature stability, low toxicity, and resistance to UV radiation make them ideal for various applications, including medical devices, automotive gaskets, and kitchenware. In addition, their ability to maintain flexibility over a wide temperature range and resist moisture and chemical exposure further enhances their suitability in diverse industries. In May 2024, Wacker Chemie AG invested approximately $50 million in a new research and development center in Ann Arbor, Michigan, and about $200 million in an HCR and fumed silica plant in Charleston, Tennessee, to enhance its silicone elastomer production capacity.

Silicone Market By End User Industry

The building and construction segment accounted for the largest share accounting for more than one-fourth of the global silicone market revenue in 2022. Silicone has become an essential material in the building and construction industry due to its unique properties that make it highly versatile and durable. One of the primary uses of silicone in construction is as a sealant. Silicone sealants are widely used for filling gaps and joints in buildings, such as around windows, doors, and curtain walls. The International Building Code (IBC) and ASTM E814/UL 1479 standards mandate that silicone firestop sealants withstand temperatures exceeding 1,000°C for up to 4 hours. In 2023, 72% of U.S. infrastructure projects specified ASTM/UL-compliant sealants.

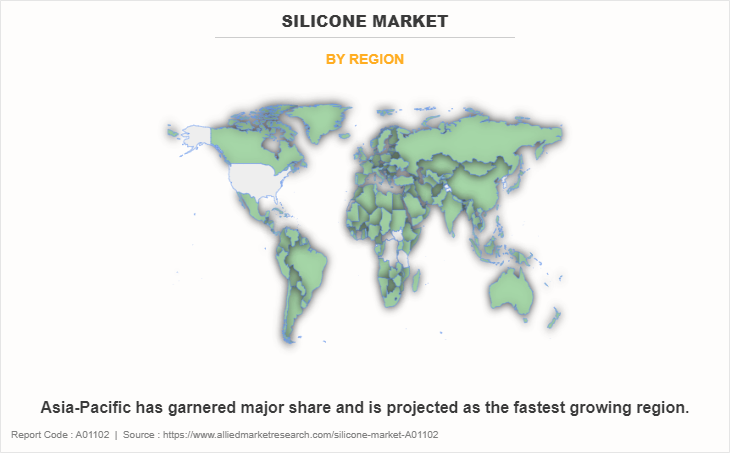

Silicone Market By Region

Asia-Pacific garnered the largest silicone market share, accounting for more than two-fifths of the global silicone industry revenue in 2022. Silicone demand in Asia-Pacific has been growing steadily, driven by rapid industrialization, urbanization, and expanding end-use sectors such as automotive, electronics, construction, and personal care. Countries like China, Japan, South Korea, and India dominate the region’s silicone consumption due to their strong manufacturing bases and large consumer markets. In September 2023, China launched a green manufacturing initiative focusing on reducing industrial emissions. This includes incentives for manufacturers adopting eco-friendly materials like silicones, particularly in the construction and automotive sectors. Moreover, in May 2024, Shin-Etsu Chemical announced plans to establish Shin-Etsu Silicone (Pinghu) Co., Ltd. in Zhejiang Province, China, to expand its silicone product line

Competitive Analysis:

The major players operating in the global silicone market are Dow Inc., Wacker Chemie AG, Momentive Performance Materials, Evonik Industries AG, KANEKA CORPORATION, Arkema, BASF SE, Shin-Etsu Chemical Co., Ltd., Elkem ASA, and KCC Silicone Corporation.

Other players include Avantor, Inc., Siltech Corporation, Gelest, Inc., Saint-Gobain Performance Plastics, 3M, Specialty Silicone Products, Inc., Applied Silicone Corporation, CHT Germany GmbH, ACC Silicones Ltd., Silicone Engineering Ltd., Momentive Performance Materials, Inc.

In June 2024, Shin-Etsu announced a global price revision of 10% or more for all silicone products, effective July 1, 2024, due to rising raw material and energy costs.

In May 2024, Shin-Etsu announced plans to build a new silicone products plant in Pinghu City, Zhejiang Province, China, with an investment of approximately $13.65 million (¥2.1 billion), aiming for completion in February 2026.

Recent Developments in the Silicone Market

In January 2024, Wacker revealed plans to build a new production site in Karlovy Vary, Czech Republic, to manufacture room-temperature-vulcanizing silicones, supporting the growing demand in electromobility and renewable energy sectors.

In March 2024, Shin-Etsu Chemical Co., Ltd. introduced the KRW-6000 Series, a water-based, fast-curing silicone resin that marks a breakthrough in the industry by eliminating the need for emulsifiers.

In September 2023, Wacker Chemie AG expanded its specialty silicone production capacities in China, allocating approximately USD 158.73 million for the expansion project.

In February 2023, Momentive Performance Materials, Inc. launched a new specialty silicone manufacturing facility in Rayong, Thailand. This facility will boost Momentive's production capacity to meet the rising demand for specialty silicones in Southeast Asia, catering to industries like beauty and personal care, automotive, energy, healthcare, and agriculture.

Key Regulations of Silicone Market

Canadian Environmental Protection Act (CEPA): Under CEPA, silicone materials are evaluated using a risk-based, weight-of-evidence methodology. This approach considers real-world exposure and all available scientific data to determine whether a substance poses a danger to human health or the environment. Canadian authorities have repeatedly concluded that key silicone materials (including L2, L4, L5, D3, D4, D5, D6, and L3) do not meet the criteria for restriction under CEPA, resulting in no regulatory restrictions on their use in Canada.

CLP (Classification, Labelling and Packaging Regulation): CLP works alongside REACH to ensure that chemicals, including silicones, are properly classified, labelled, and packaged to communicate hazards and protect human health and the environment

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the silicone market analysis from 2022 to 2032 to identify the prevailing silicone market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the silicone market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global silicone market trends, key players, market segments, application areas, and market growth strategies.

Silicone Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 39.4 billion |

| Growth Rate | CAGR of 7.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 563 |

| By Type |

|

| By End User Industry |

|

| By Region |

|

| Key Market Players | Momentive, KCC Silicone Corporation, Shin-Etsu Chemical Co., Ltd., KANEKA CORPORATION, Wacker Chemie AG, Dow Inc., Evonik Industries AG, BASF SE, Elkem ASA, Arkema |

Analyst Review

According to the insights of the CXOs of leading companies, the surge in demand for silicone-based products across various industries, including automotive, construction, healthcare, and electronics, continues to stimulate market growth. Silicone's exceptional properties, such as high-temperature resistance, flexibility, and biocompatibility, make it a preferred choice for a wide array of applications. In addition, the increasing emphasis on sustainability and environmental consciousness has led to the development of eco-friendly silicone materials, aligning with the global shift toward greener alternatives.

However, the volatility in raw material prices is primarily driven by fluctuations in crude oil prices, as silicone is derived from silicones, which are petroleum-based products. This volatility impacts production costs and, subsequently, product pricing and hampers the growth of the market.

The CXOs further added that the rapid growth of the electronics and electrical industry, driven by innovations such as 5G technology and electric vehicles, presents a substantial growth avenue for silicone, given its critical role in insulating and protecting sensitive electronic components. In addition, the healthcare sector offers promising opportunities, with silicone's biocompatibility and versatility making it indispensable for medical devices and pharmaceutical applications.

The global silicone market was valued at $18.8 billion in 2022, and is projected to reach $39.4 billion by 2032, growing at a CAGR of 7.7% from 2023 to 2032.

The Silicone Market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Increasing demand from food and beverage packaging is the upcoming trend of Silicone Market in the world.

Asia-Pacific is the largest regional market for Silicone.

Electrical and electronics is the leading end-user industry of Silicone Market.

Increase in adoption of waterborne coatings and increase in demand in construction and infrastructure are the driving factors of the Silicone Market.

Dow Inc., Wacker Chemie AG, Momentive Performance Materials, Evonik Industries AG, KANEKA CORPORATION, Arkema, BASF SE are the top companies to hold the market share in Silicone.

Loading Table Of Content...

Loading Research Methodology...