Simulation Software Market Insights:

The global simulation software market was valued at USD 16.9 billion in 2022, and is projected to reach USD 57.5 billion by 2032, growing at a CAGR of 13.4% from 2023 to 2032.

Increase in demand for ecofriendly work environment, rise in use of simulation software in the automotive and healthcare industries, and significant adoption of simulation across the aerospace & defense sector are some of the major factors that are driving the growth of this market. Further, surge in number of small and medium enterprises is anticipated to drive the growth of global simulation software market forecast.

However, security concerns associated with the simulation software is restraining the growth of this market. On the contrary, emerging trends such as digital twins in the industry 4.0 and use of simulation software to develop IoT supporting devices are expected to create lucrative opportunities for the global market during the forecast period.

Simulation is a representation of the functioning of a system or process. Through simulation, a model can be implanted with unlimited variations and produce complex scenarios. Simulation software is based on the process of modeling a real phenomenon with a set of mathematical formulas. It helps to predict the behavior of the system. These capabilities allow analysis and understanding of how individual elements interact and affect the simulated environment. It is used to evaluate a new design, analyze problems with present design, and test a system in conditions that are difficult to reproduce.

Key Takeaways:

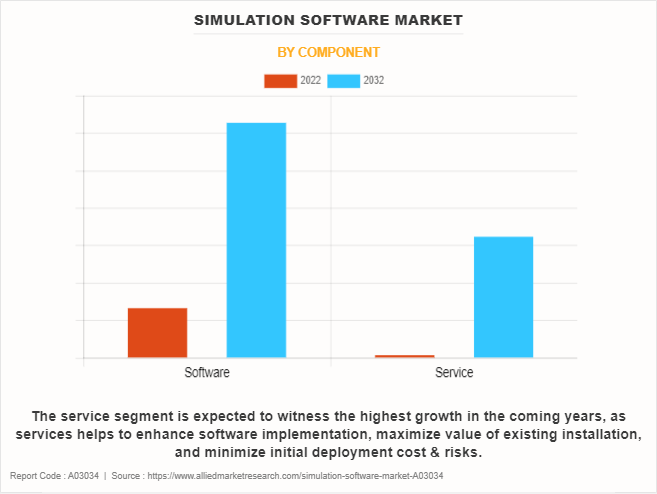

- Depending on component, the software segment accounted for the largest simulation software market share in 2022.

- By deployment mode, the on-premise segment accounted for the largest simulation software market share in 2022.

- On the basis of end-use, the automotive segment accounted for the largest share in 2022.

- Region wise, North America generated the highest revenue in 2022.

Top Impacting Factors:

Rise in demand for ecofriendly work environment

Simulations are now considered a crucial part in workplace as it helps in replicating the real-life situations, problems, and processes. These features offer a risk-free environment in which a learner gets an opportunity to explore various options and take informed decisions. Simultaneously, simulations allow to make mistakes and learn from them without any real consequences. These learners are placed into a workplace environment that helps them to observe and analyze the specific circumstances displayed in different scenarios. Through these, employees can analyze their actions and decisions within the online training simulation. Moreover, simulations reduce risks and help employees build skills and expand their knowledge. Furthermore, training simulations reduce online training expenses and time as employees acquire more information in a rapid manner by applying the concepts and interacting directly with the subject matter. All these significant benefits offered by simulation are promoting its adoption among workplaces and plays a significant role in market growth.

Surge in adoption of simulation software in the industry:

Surge of simulation software in various industries can be attributed to numerous factors enhancing its adoption and proliferation. Advancements in computing power and generation have made it extra feasible to develop complex simulation models that correctly represent real-world phenomena. This enables industries to simulate numerous eventualities and are expecting outcomes with better precision, leading to progressed selection-making and risk management. In addition, the increasing complexity and interconnectedness of systems within industries consisting of manufacturing, healthcare, automotive, and transportation have created a growing need for simulation software to model and optimize these systems. By simulating tactics, workflows, and environments, businesses can identify inefficiencies, streamline operations, and optimize aid allocation, ultimately leading to financial savings and better performance.

Moreover, the upward push of Industry 4.0 and the Internet of Things (IoT) has generated big extent of information that may be applied to inform simulation models and enhance their accuracy. Integration with IoT gadgets and sensors permits real-time information series, which may be fed into simulation software program to create dynamic models that replicate current working conditions and aid predictive analytics. Furthermore, the increasing emphasis on sustainability and environmental effect has spurred the adoption of simulation software for evaluating and optimizing methods to minimize resource consumption, waste generation, and carbon emissions. In essence, adoption of simulation software program contributes to superior efficiency, productiveness, and competitiveness for industries throughout diverse sectors.

Segment Review:

The simulation software market is segmented into component, deployment mode, industry vertical, and region. On the basis of component, the market is bifurcated into software and service. Depending on deployment mode, it is divided into on-premise and cloud. By end use, it is segregated into automotive, aerospace & defense, semiconductor & electronics, healthcare, AEC (architecture, engineering, & construction), and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa (MEA).

Depending on component, the global simulation software market size was dominated by the software segment in 2022 and is expected to maintain its dominance in the upcoming years. Simulation software provides multiple benefits to the enterprises of various industries. With the availability of relatively inexpensive, high-speed microcomputers, and engineering workstations, simulation software is becoming more popular for modeling complex systems. However, the service segment is expected to witness the highest growth in the coming years. Adoption of services helps to enhance software implementation, maximize value of existing installation by optimizing it, and minimizes initial deployment cost & risks.

By region, North America dominated the market simulation software market size in 2022. Rise in adoption of simulation software by aerospace & defense companies is anticipated to fuel the growth of the simulation software market. In addition, North America exhibits an increase in investments in the market, and several vendors have evolved to cater to the rapidly growing market. This is expected to boost the growth of the market in the region during the forecast period. However, Asia-Pacific is expected to exhibit the highest growth during the forecast period. The region has a robust IT infrastructure and solid software and service offerings. In addition, increase in adoption of advanced technologies and higher adoption of digitalization initiative propel the simulation software market growth of the market in this region.

Competition Analysis:

The market players operating in the simulation software market are Altair Engineering, Inc., Autodesk Inc., Ansys, Inc., Bentley Systems, Incorporated, Dassault System, The MathWorks, Inc., Rockwell Automation, Inc., Simulations Plus, ESI Group, and GSE Systems. These players have adopted various key development strategies such as business expansion, new product launches, and partnerships, which help to drive the growth of the simulation software industry globally.

Key Developments in the Industry:

- In January 2023, Altair, a global leader in computational science and artificial intelligence (AI), announced the latest updates to its simulation portfolio. These updated portfolio will improve Altair’s cloud elasticity and scalability, electrification, and product development capabilities.

- In October 2022, Ansys Inc. launched the availability of Ansys Gateway powered, which allows customers to use popular Ansys products in one unique workspace on AWS, that will help simplify access to faster, more flexible, and highly scalable engineering solutions. Ansys Gateway makes it possible for customers to easily access, subscribe, and configure Ansys applications from a single location. Customers will also benefit from the accelerated performance of Ansys applications enhanced on AWS.

- In June 2022, Keysight Technologies, Inc., a leading technology company that delivers advanced design and validation solutions to help accelerate innovation to connect and secure the world, launched the new PathWave Advanced Design System (ADS) 2023, an integrated design and simulation software that rapidly addresses increasing design complexity and higher frequencies in the radio frequency (RF) and microwave industry.

Key Benefits for Stakeholders:

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the simulation software market analysis from 2022 to 2032 to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the simulation software market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global simulation software market trends, key players, market segments, application areas, and market growth strategies.

Simulation Software Market Report Highlights

| Aspects | Details |

| Forecast period | 2022 - 2032 |

| Report Pages | 214 |

| By Component |

|

| By Deployment Mode |

|

| By End-Use |

|

| By Region |

|

| Key Market Players | Simulations Plus, Altair Engineering, Inc., Dassault System, ESI Group, GSE Systems, Ansys, Inc, Rockwell Automation, Inc., Autodesk Inc., The MathWorks, Inc.,, Bentley Systems Incorporated |

Analyst Review

The growth of the global simulation software market is driven by various factors such as surge in adoption of simulation for emerging trends such as digital twin, increase in product complexity, increase in use of big data with agent-based modeling, rise in need for cost effective ways to test innovative designs in manufacturing processes as well as reduce the product development timeline.

Furthermore, vendors are responding to the demand for cloud-based offerings of simulation software as model execution is shifting from desktop computer to the cloud, which allows faster execution of complex multi-run experiments. In addition, vendors are trying to introduce specialized software tools for vertical markets such as supply chains, healthcare, and mining. For instance, Ansys and PTC have partnered to accelerate product innovation by providing customers with best-in-class simulation-driven design solutions. PTC has integrated Ansys technology into Creo to create two products. Creo Simulation Live provides design engineers instantaneous static structural, thermal, modal and fluid flow design guidance, disrupting the traditional, time-intensive design process with instant feedback through real-time simulation. The second product, Creo Ansys Simulation is an easy-to-use, fully featured, high-fidelity simulation tool which leverages Ansys’ capabilities for thermal, structural, and modal analyses directly within Creo.

Furthermore, the global simulation software market is witnessing the trend of democratization of simulation software. Rise in adoption of artificial intelligence (AI) is expected to allow simulation models to be used along with neural networks. AI components can be directly embedded in a simulation model to allow testing and forecasting, and simulation models can be used to train the neural networks. Furthermore, a simulation model is an integral part of any digital twin. The digital twin can be utilized for monitoring prescriptive analytics and test predictive maintenance to optimize asset performance. With its mass adoption, the simulation software market is anticipated to witness rapid growth. Moreover, the demand for simulation software in aerospace and defense as well as automotive sector is projected to escalate during the forecast period.

The global simulation software market was valued at $16.9 billion in 2022, and is projected to reach $57.5 billion by 2032

The simulation software market is projected to grow at a compound annual growth rate of 13.4% from 2023 to 2032.

The key players that operate in the cloud gaming market such as Altair Engineering, Inc., Autodesk Inc., Ansys, Inc., Bentley Systems, Incorporated, Dassault System, The MathWorks, Inc., Rockwell Automation, Inc., and others

The North America is the largest market for the Simulation Software.

Increase in demand for ecofriendly work environment and rise in use of simulation software in automotive and healthcare and other industries are major factors that drive the growth of the simulation software market.

Loading Table Of Content...

Loading Research Methodology...