Singapore Bunker Fuel Market Outlook - 2030

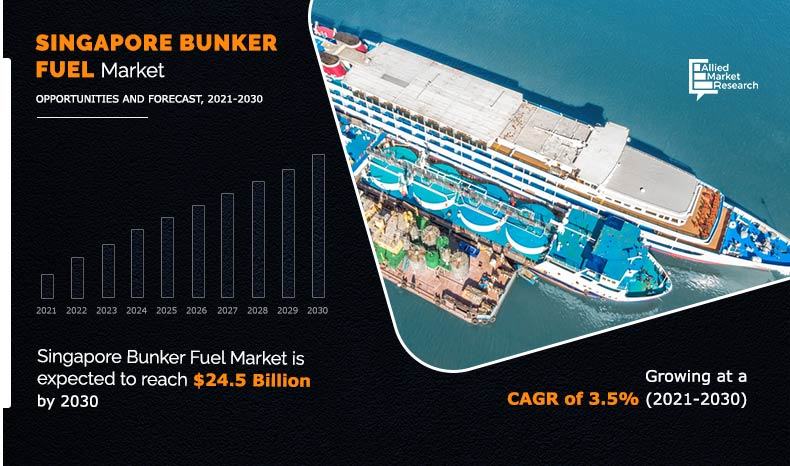

The Singapore bunker fuel market size was valued at $17.6 billion in 2020, and is projected to reach $24.5 billion by 2030, growing at a CAGR of 3.5% from 2021 to 2030. Bunker fuel is a fuel oil used in marine vessels. It is poured into the ship bunkers to power its engines. Ships use mainly three types of marine fuels, which include high sulfur fuel oil, low sulfur fuel oil, and diesel oil. Nowadays, growth in awareness toward reducing environmental pollution and stringent government regulations are expected to create opportunities for the fuels, including LNG, gasoil, LPG, and others, as a substitute to the above-mentioned bunker fuels.

Rise in maritime trade has increased the demand for bunker fuel and bunkering services. Increase in oil & gas exploration activities in emerging oil regions drives the growth of the bunker fuel market, as many bunker fuel suppliers changed their focus of operation to these offshore resource sites. In addition, fuel reduction initiatives by shipping industries are expected to hamper the market growth. Therefore, due to stringent environmental regulations regarding marine environment, the shipping industry has decided to reduce the use of residual fuel oil that contains contaminants such as nitrogen and sulfur. The shipping industry is focusing toward new alternative such as LNG, which is less harmful to the marine environment. Hence, rise in investment toward LNG bunkering infrastructure is anticipated to provide lucrative opportunity for key players operating in the market.

For the purpose of analysis, the Singapore bunker fuel market is segmented on the basis of type, commercial distributor, and application. Depending on type, the market is categorized into high sulfur fuel oil (HSFO), low sulfur fuel oil (LSFO), marine gasoil, and others. On the basis of commercial distributor, it is classified into oil major, large independent, and small independent. The applications covered in the study include container, bulk carrier, oil tanker, general cargo, chemical tanker, fishing vessels, gas tankers, and others.

The key players operating in the Singapore bunker fuel market are BP Plc, Exxon Mobil Corporation, Equatorial Marine Fuel Management Services Pte. Ltd., Glencore Singapore Pte. Ltd., PetroChina International (Singapore) Pte. Ltd., Royal Dutch Shell Plc, Sentek Marine & Trading Pte. Ltd., SK Energy International Singapore Pte. Ltd., Total Energies, and Vitol Marine Fuels Pte. Ltd.

These key players are adopting various strategies, such as acquisition, agreement, collaboration, business expansion, and product launch to stay competitive in the bunker fuel market.

For instance, in September 2021, BP plc. collaborated with NYK Line (a part of NYK Group). This collaboration aimed at working together on marine fuels such as biofuels, LNG, hydrogen and ammonia, and explore participation in supply chains for ammonia and hydrogen for heavy industry and power generation.

In addition, in March 2021, Total Energies received a bunker supplier license from the Maritime and Port Authority of Singapore (MPA) to develop Singapore into a major LNG maritime hub for Asia. Through this achievement followed by the agreement between Total Energies and MPA, Singapore, the company is expected to develop a LNG bunker supply chain in the port of Singapore.

Other players operating in the value chain of the Singapore bunker fuel market are Global Energy Trading Pte. Ltd., Chevron Singapore Pte. Ltd., Eng Hua Company Pte Ltd., Maersk Oil Trading Singapore Pte Ltd., and others.

The Singapore bunker fuel market is analyzed and estimated in accordance with impacts of the drivers, restraints, and opportunities. The period studied in this report is 2020–2030. The report includes the study of the Singapore bunker fuel market with respect to the growth prospects and restraints based on the product analysis. The study includes Porter’s five forces analysis of the industry to determine the impact of suppliers, competitors, new entrants, substitutes, and buyers on the market growth.

Singapore bunker fuel market, by type

By type, the LSFO segment held the largest market share in 2020. This is attributed to rise in demand for marine fuel from shipping companies and implementation of IMO 2020 i.e., the use of low sulfur fuel oil (<0.5% S content) across the globe. In addition, rise in maritime trade activities between Asia-Pacific, Europe, North America, and LAMEA region is further projected to increase the demand for LSFO from 2021 to 2030.

By Type

LSFO is projected as the most lucrative segment.

Singapore bunker fuel market, by commercial distributor

On the basis of commercial distributor, the oil majors segment dominated the Singapore bunker fuel market in 2020, in terms of share, owing to dominance of oil majors in the crude oil tanker chartering business across the globe. In addition, developments adopted by oil majors in the bunker fuel industry such as product launch, agreement, and others, are further anticipated to drive the growth of the market during the analyzed timeframe.

By Commercial Distributor

Oil majors is projected as the most lucrative segment.

Singapore bunker fuel market, by application

By application, the container segment dominated the highest Singapore bunker fuel market share in 2020, and is expected to maintain the same during the forecast period. This is attributed to increase in demand for cargo transportation through ships and rise in trade-related agreements. In addition, rise in number of manufacturing units and factories in the region such as Asia-Pacific, is anticipated to drive the growth of the Singapore bunker fuel market for container shipping in the coming years.

By Application

Container holds a dominant position in 2020 and would continue to maintain the lead over the forecast period.

COVID-19 impact on the market

Lockdown imposed due to the outbreak of the COVID-19 pandemic resulted in temporary ban on the import and export, thereby disrupting the supply chain and hampering the Singapore bunker fuel market growth in the second, third, and fourth quarter of 2020. In addition, there will be some impact on the growth of the market in 2021, owing to the second wave of COVID-19 pandemic across the globe. However, the market is expected to recover by the end of 2021, as the production in various industries restarts with rapid vaccination across the globe. In addition, rise in maritime trade activities after the ease of ban on import and export is anticipated to fuel the market growth in the coming years.

Key Benefits For Stakeholders

- The report includes in-depth Singapore bunker fuel market analysis of different segments and provides market estimations between 2021 and 2030.

- A comprehensive analysis of the factors that drive and restrict the Singapore bunker fuel market growth is provided.

- Porter’s five forces model illustrates the potency of buyers & sellers, which is estimated to assist the market players to adopt effective strategies.

- Estimations and Singapore bunker fuel market forecast are based on factors impacting the growth in terms of value.

- Key market players are profiled to gain an understanding of the strategies adopted by them.

- This report provides a detailed analysis of the current Singapore bunker fuel market trends and future estimations from 2021 to 2030, which helps identify the prevailing market Singapore bunker fuel market opportunities.

Singapore Bunker Fuel Market Report Highlights

| Aspects | Details |

| By Type |

|

| By COMMERCIAL DISTRIBUTOR |

|

| By APPLICATION |

|

| Key Market Players | SK Energy International Pte. Ltd. (Parent: SK INNOVATION, CO. LTD.), PetroChina International (Singapore) Pte. Ltd. (Parent: PetroChina Company Limited), SENTEK MARINE & TRADING PTE LTD, EQUATORIAL MARINE FUEL MANAGEMENT SERVICES PTE LTD, ROYAL DUTCH SHELL PLC, Vitol Marine Fuels Pte. Ltd. (Parent: Vitol Group), BP P.L.C, Glencore Singapore Pte. Ltd. (Parent: Glencore International AG), TOTAL ENERGIES, EXXON MOBIL CORPORATION |

Analyst Review

Singapore bunker fuel market has registered the dynamic growth over the past few years and still acquired the position as leading bunkering hub across the globe owing to the low cost of bunkers and high level of service providing than other ports across the globe. In addition, the International Maritime Organization (IMO) regulations over reduction of sulfur cap from 3.5% to 0.5% to reduce the marine pollution are expected to drive the growth of the bunker fuel market. As these stringent environmental regulations might enhance the reduction of marine pollution. The lower sulfur cap regulation in bunker fuel is anticipated to reduce the marine pollution, which led to increase in demand for bunker fuel among the shipping companies. According to some CXOs, with increase in oil and gas exploration activities, the bunker fuel market is expected to witness growth in emerging oil-producing regions, especially in the Indo-Pacific region.

New oil-producing regions have vast unexplored reserves, which are enough to meet the growing energy demand in future. Exploration of these untapped reserves will affect the demand for shipping vessels, as increase in exploration, drilling, and production of oil & gas will require more shipping vessels to transport oil & gas to desired destinations, which will boost the growth of the bunker fuel market.

The previously predicted HSFO surplus amid carriage ban introduction and high refining runs will not materialized during initial quarter of 2020. In addition, the sharp drop in topline refinery throughput due to COVID-19 has meant a sharp decrease in sour residue supply and therefore, absolute HSFO production. But the refining industry has done better than expected job minimizing its HSFO fraction - and increasing its VLSFO yield.

Regardless, the narrower VLSFO-HSFO differential and overall lack of a supply crunch for low-sulfur bunker fuel is not likely to change anytime soon. Refinery throughput and global demand are negatively affected by COVID-19.

- The impact of IMO specification change on reduction of sulfur cap will depend on the different strategies adopted by the ship owners. There are three main options for ship owners:

- Purchasing compliant bunker fuel without making any changes in the vessel.

- Installation of exhaust cleaning systems on board, known as scrubbers. These scrubbers will remove sulfur dioxide emissions from the exhaust and allow the ship owners to continue burning high sulfur bunker.

- Switching to alternative fuel such as liquefied natural gas (LNG) by making modifications in the vessel.

The first option will increase the demand for low sulfur content fuel. The second option would be less disruptive for refining industry but comes up with the high initial investment for vessel owner. Third option will reduce the demand for both fuel oil and gas oil. Overall IMO specification changes eroded high sulfur fuel consumption and is expected to increase for various types of low sulfur bunker fuels.

In addition, increase in hydrocarbon exploration activities in Asia-Pacific and rise in sea borne trade are expected to drive the growth of the Singapore bunker fuel market in the near future. However, regional players such as China made available surplus reserve of marine compliant fuels is expected to attract key shipping players from Singapore to Chinese ports, which in turn is anticipated to restrain the growth of the Singapore bunker fuel market in the coming years.

Furthermore, due to stringent government regulations, shipping companies has decided to reduce usage of bunker fuel such as residual fuel oil (RFO). They are focusing toward the adoption of alternative fuels such as LNG (Liquified Natural Gas), biodiesel, kerosene, and others. LNG is expected to be put in newly build vessels particularly to those that operate within a geographic area, particularly emission control area (ECA). It is expected that with the rise in investment toward building & construction of LNG bunkering infrastructure there will be rise in lucrative opportunities for key players in the Singapore bunker fuel market from 2021 to 2030.

The potential customers of the Singapore bunker fuel are shipping applications such as container, bulk carrier, general cargo, gas tanker, chemical tanker and others.

The key growth strategies of Singapore bunker fuel market players are acquisition, agreement, collaboration, partnership and product launch.

To get latest version of Singapore bunker fuel market report can be obtained on demand from the website.

The key benefits of the Singapore bunker fuel market are information on key trends, market size & forecast, top players and their development strategies, and others.

IMO regulation on sulfur content, increase in oil & gas exploration activities, and rise in international maritime trade are expected to be the driving factors and opportunities in the Singapore bunker fuel market.

The top ten market players are selected based on two key attributes - competitive strength and market positioning

On the basis of type, LSFO segment will drive the Singapore bunker fuel growth during the forecast period. By commercial distributor, oil majors will fuel the Singapore bunker fuel growth. On the basis of application, container segment will fuel the Singapore bunker fuel growth.

Top players in the Singapore bunker fuel are BP Plc, Exxon Mobil Corporation, Equatorial Marine Fuel Management Services Pte. Ltd., Glencore Singapore Pte. Ltd., PetroChina International (Singapore) Pte. Ltd., Royal Dutch Shell Plc, Sentek Marine & Trading Pte. Ltd., SK Energy International Singapore Pte. Ltd., Total Energies, and Vitol Marine Fuels Pte. Ltd.

In terms of revenue, the market size of the Singapore bunker fuel is anticipated to reach $24.6 billion by 2030, growing at CAGR of 3.5% from 2021 to 2030.

Development and adoption of low sulfur bunker fuels and rapid growth of LNG bunkering is expected to influence the Singapore bunker fuel market in the next few years.

Loading Table Of Content...