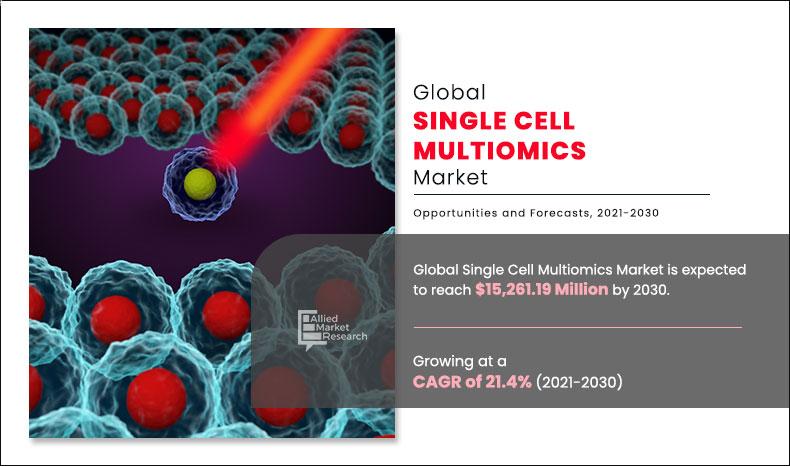

Single Cell Multiomics Market Statistics

The global single cell multiomics market size was valued at $2,175 million in 2020, and is projected to reach $15,261.19 million by 2030, registering a CAGR of 21.4% from 2021 to 2030. Single cell multiomics technologies typically measure multiple types of molecules from the same individual cell, allowing for more in-depth biological insight than can be gained by analyzing each molecular layer from separate cells. Single-cell multimodal omics (scMulti-omics) technologies allow for the measurement of multiple modalities from the same cell, including DNA methylation, chromatin accessibility, RNA expression, protein abundance, gene perturbation, and spatial information, unlike live-cell fluorescence imaging, which involves the destruction of cells for analysis.

Integrated techniques combine individual omics data in a sequential or simultaneous manner to understand the interplay of molecules. The single cell sequencing technology is classified as genotypic and phenotypic, which aid in determining the mechanisms that govern diseases and health. Furthermore, single cell multiomics market applications primarily include oncology, cell biology, neurology, stem cell, and immunology. Single cell omics has enormous potential for deciphering virus biology and virus-host cell interactions, making it a powerful tool in virology that should be used more frequently in the future.

The growth of the single cell multiomics market is majorly driven by technological advancements in single-cell analysis products and rise in number of large-scale genomics studies leveraging single-cell RNA Sequencing (sc-RNA). Furthermore, rising disposable income in emerging nations as well as increasing adoption of personalized medicine for screening and diagnostics of genetic disorders, are driving the growth of the single cell multiomics market. Personalized medicine can bring more clarity to the clinical and biological complexity of these types of disorders associated with high mortality and enormous health care costs. Furthermore, this might provide valuable tools for preventive strategies as well as possible clues on the disease's evolution, and it could aid in predicting morbidity, mortality, and detecting chronic disease indicators much earlier in the disease's course.

In addition, new single-cell platforms facilitate separation and analysis, and in some cases, both the potential development and limitations of these technologies are rapidly being developed, resulting in increased interest among researchers, particularly in the field of single cell genomics. As a result, technological advancements in single-cell analysis products is expected to drive the single cell multiomics market growth even further.

Furthermore, increase in various initiatives, collaborations among pharmaceutical and biotechnological companies and research institutes play a pivotal role and thus, further boost the market growth. However, the high cost of single cell analysis and the scarcity of large online data storage and analysis platforms are expected to limit the market growth. Expansion into new research applications, such as single-cell metabolomics, and increased collaborations and funding in single cell multiomics research, on the other hand, are expected to provide lucrative growth opportunities for single cell multiomics market players.

Moreover, considerable rise in healthcare expenditure worldwide has further fueled the market. The major factors that are responsible for increase in healthcare expenditure are rise in population, especially geriatric and increased medical service utilization for early diagnosis of genetic disorders.

Impact of COVID-19 Pandemic on Single Cell Multiomics Market (Pre & Post Analysis)

In addition, the COVID-19 outbreak is anticipated to have a positive impact on the single cell multiomics market. A huge number of clinics and hospitals across the globe were restructured to increase the hospital capacity for patients diagnosed with COVID-19. The non-essential procedures took a potential backlog due to rapidly rising COVID-19 cases. The lockdown led to the disruption of manufacturing and transportation of healthcare essentials. Moreover, other factors responsible for the impact on the market include limited availability of medical care, shortage of healthcare staff and rise in burden of COVID-19 related hospitalization.

Furthermore, there has been a positive impact on a variety of healthcare services, including single cell multiomics. According to healthcare experts, the single cell multiomics market is one of the most rapidly evolving markets. Furthermore, rising chronic diseases such as cancer and infectious diseases caused by viruses are driving the global market. The study of single cell multiomics for COVID-19 may pave the way for the target market to expand.

Accordingly, untapped, emerging markets are expected to offer potential growth opportunities, due to improved healthcare infrastructure, surge in personalization of medicines, increase in unmet healthcare needs, and rise in R&D activities. In addition, various technological advancements for early diagnosis of diseases is an emerging opportunity for key players to invest in the single cell multiomics market.

Single Cell Multiomics Market Segmentation

The global single cell multiomics market is segmented on the basis of type, application, technique, end user, and region. On the basis of type, the market is categorized into single cell genomics, single cell proteomics, single cell transcriptomics, and single cell metabolomics. By application, it is classified into oncology, cell biology, neurology, immunology and stem cell research. By technique, it is divided into single cell isolation & dispensing and single cell analysis. By end user, it is segmented into academic institutes, contract research organizations and pharmaceutical & biotech companies.

Region wise, the single cell multiomics market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (Japan, China, India, Australia, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, Saudi Arabia and rest of LAMEA).

Segment review

Based on type, the single cell genomics segment held the largest share in the global single cell multiomics market in 2020 owing to advanced method of classifying individual cells that can define unique traits and identify rare cell types.

On the basis of application, the oncology segment held the largest market share in 2020 and is expected to remain dominant during the forecast period owing to rise in cancer cases globally, demand for personalization of treatments, surge in early diagnosis and screening among the population.

By Type

Single Cell Genomics holds a dominant position in 2020 and would continue to maintain the lead over the forecast period.

On the basis of technique, the single-cell analysis held the largest market share in 2020 and is expected to remain dominant during the forecast period owing to its fast, effective, and gentle to maintain the native expression profiles advantage.

On the basis of end user, the academic institutes segment held the largest single cell multiomics market share in 2020 and is expected to remain dominant during the forecast period, owing to surge in number of ongoing research projects at academia and research laboratories.

By Application

Oncology segment is projected as one of the most lucrative segment.

North America is projected to account for a major share of the global single cell multiomics market during the forecast period. The market in the region is anticipated witness growth in future, owing to availability of developed healthcare infrastructure and continuous research activities for the development of advanced technologies in the region. Europe holds the second largest share and is expected to witness highest CAGR during the forecast period. Moreover, Germany and UK are expected to grow at high CAGR in Europe single cell multiomics market.

The major players profiled in the report are 10x Genomics, Inc., Becton, Dickinson and Company, Berkeley Lights Inc., BGI Genomics Co. Ltd, Bio Rad Laboratories, Inc., Danaher Corporation (Cytiva Life Sciences), Dolomite Bio, Epicypher Inc., Fluidigm Corporation, Illimina, Inc, Miltenyi Biotec B.V. & CO., Mission Bio, Inc., Nanostring Technologies, Inc., Olink Holding AB (Olink Proteomics), Parse Bioscience, Qiagen N.V., Takara Holdings Inc. (Takara Bio Group) and Thermo Fischer Scientific Inc.

By Region

Asia-Pacific is expected to experience growth at the highest rate, registering a CAGR of 21.4% during the forecast period.

Key Benefits for Stakeholders

- The study provides an in-depth analysis of the single cell multiomics market, and the current trends and future estimations to elucidate the imminent investment pockets.

- It presents a quantitative analysis of the market from 2021 to 2030 to enable stakeholders to capitalize on the prevailing market opportunities.

- Extensive analysis of the market based on procedures and services assists to understand the trends in the industry.

- Key players and their strategies are thoroughly analyzed to understand the competitive outlook of the market.

Single Cell Multiomics Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Application |

|

| By Technique |

|

| By End User |

|

| By Region |

|

| By Key Market Players |

|

Analyst Review

This section provides the opinions of top level CXOs in the single cell multiomics market. According to the CXOs, new advances of single-cell technologies provide the opportunity to separate biological insights within individual cells. Single-cell sequencing technology is divided into genotypic and phenotypic, which help to determine the mechanisms to govern diseases and health. Furthermore, applications of single cell multiomics primarily include oncology, cell biology, neurology, stem cell, and immunology.

Furthermore, rise in technological advancements in single-cell analysis products and increase in number of large-scale genomics studies leveraging single-cell RNA Sequencing (sc-RNA) are expected to drive the market growth. Furthermore, increasing adoption of personalized medicine for screening and diagnostics of genetic disorders and rising disposable income in emerging economies drive the growth of the single cell multiomics market.

Moreover, North America is projected to account for a major share of the global single cell multiomics market during the forecast period. The market in the region is anticipated grow in the near future, owing to availability of developed healthcare infrastructure and continuous research activities for the development of advanced technologies. North America is expected to be followed by Europe during the forecast period. Moreover, Germany and UK are expected to grow at high CAGR in Europe single cell multiomics market.

The total market value of single cell multiomics market is $2,175.0 million in 2020.

The forecast period for single cell multiomics market is 2021 to 2030

The market value of single cell multiomics market in 2021 is $2,655.89 million.

The base year is 2020 in single cell multiomics market

Top companies such as are 10X Genomics, Inc., Becton, Dickinson and Company, Berkeley Lights Inc., BGI Genomics Co. Ltd, Bio Rad Laboratories, Inc., Danaher Corporation (Cytiva Life Sciences), Dolomite Bio, Epicypher Inc., Fluidigm Corporation, Illimina, Inc, Miltenyi Biotec B.V. & CO., Mission Bio, Inc., Nanostring Technologies, Inc., Olink Holding AB (Olink Proteomics), Parse Bioscience, Qiagen N.V., Takara Holdings Inc. (Takara Bio Group) and Thermo Fischer Scientific Inc., held a high market position in 2020.

Single cell genomics segment dominated the global market in 2020, and expected to continue this trend throughout the forecast period due to advanced method of classifying individual cells that can define unique traits and identify rare cell typesand is thus expected to drive the segment

Increase in technological advancements in single-cell analysis products, surge in adoption of personalized medicine for screening and diagnostics of genetic disorders is anticipated to drive the market in the forecast period.

North America is projected to account for a major share of the global single cell multiomics market during the forecast period. U.S. dominated the North America single cell multiomics market owing to availability of developed healthcare infrastructure, presence of key players and continuous research activities for the development of advanced technologies across the country.

Loading Table Of Content...