Single Crystal Diamond Market Research, 2033

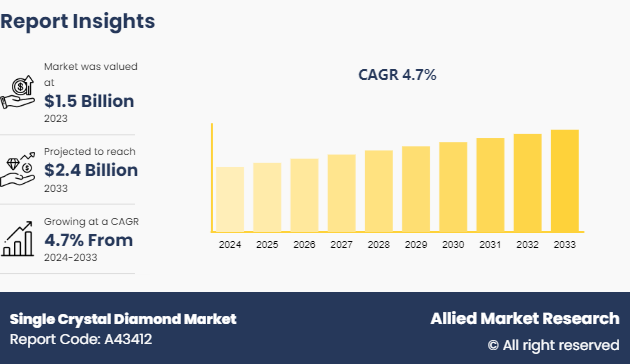

The global single crystal diamond market was valued at $1.5 billion in 2023, and is projected to reach $2.4 billion by 2033, growing at a CAGR of 4.7% from 2024 to 2033.

Market Introduction and definition

Single crystal diamond refers to a synthetic diamond grown as a continuous crystal lattice with uniform properties, making it superior to natural or other synthetic diamonds that may have defects. It is produced under controlled conditions using methods such as high-pressure high temperature (HPHT) or chemical vapor deposition (CVD) . Single crystal diamonds are prized for their exceptional hardness, thermal conductivity, and optical transparency. Such properties make them indispensable in various high-tech applications, including precision cutting, optical and electronic devices, and high-power lasers.

In addition, single crystal diamonds are emerging as a promising substrate in semiconductor technology for creating high-performance electronics. The market for single crystal diamonds exists primarily because of their unparalleled material properties, allowing for advancements in industrial, technological, and scientific fields, where maximizing performance and durability is crucial.

Key Takeaways

- The single crystal diamond market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected period 2024-2033.

- More than 1, 500 product literature, industry releases, annual reports, and other documents of major single crystal diamond industry participants, authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve the most ambitious growth objectives.

Key Market Dynamics

The single crystal diamond market is significantly driven by its growing demand for diamond powder within the electronics and semiconductor industries. According to the Electronic Components Industry Association (ECIA) , “global semiconductor sales change for 2023-2024 is around +16.5%”. Furthermore, increase in the miniaturization of electronic gadgets led to investment in higher-efficiency semiconductor chips in the semiconductor sectors and has had a positive impact on the market.

However, according to the Semiconductor Industry Association (SIA) , “design costs have risen over 18X from 65nm in 2006 to 5nm in 2020 for conventional chips”. The increase in costs is expected to hinder the development of conventional chips based on single crystal diamonds. Despite their advantages, the widespread adoption of single crystal diamonds in commercial applications is hindered by high production costs. The methods used to synthesize these diamonds, primarily HPHT, and CVD require substantial energy inputs and sophisticated equipment to precisely control the purity and quality of the diamonds, which in turn elevates the manufacturing costs.

Furthermore, the development of quantum computing and advanced optical materials presents a major opportunity for the single crystal diamond market. Diamond-based detectors are utilized in the identification of beams from K500 and K150 cyclotrons at the Tamu Cyclotron Institute. The presence of many advantages over traditional silicon detectors such as resilience to radiation, low voice, and intrinsically low leakage current.

Patent Analysis for Single Crystal Diamond Market

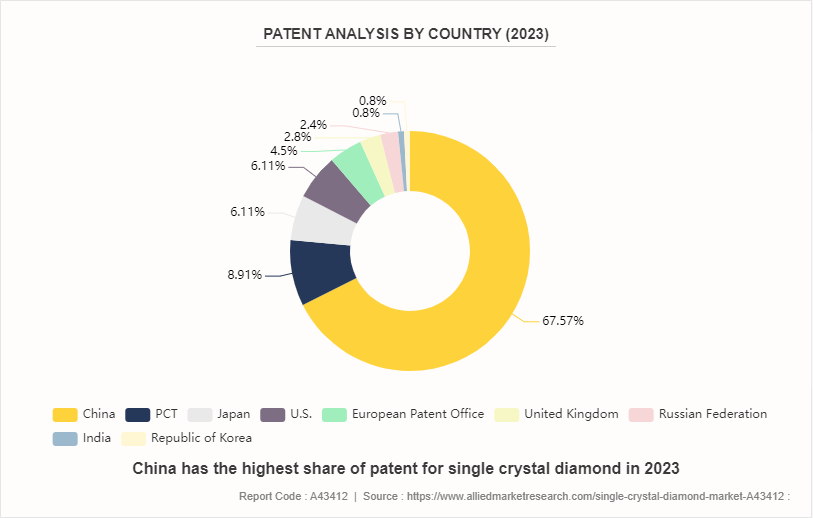

China increased its dominance related to patent filing with respect to single crystal diamond technologies by 25% in 2023, highlighting its focused expansion in advanced materials. Patent Cooperation Treaty filings saw a slight increase, indicating ongoing global interest. The U.S. and Japan closely competed with 15 filings each, showing a minor realignment from the previous year. The European Patent Office also experienced a modest rise in filings. Notably, India and Russia saw reduced filings, suggesting fluctuating innovation trends in these regions, possibly driven by economic or strategic challenges. These shifts reflect evolving dynamics in the single crystal diamond market.

Market Segmentation

The single crystal diamond market is segmented into type, application, and region. On the basis of type, the market is divided into high pressure, high temperature (HPHT) and chemical vapor deposition (CVD) . On the basis of application, the market is segregated into mechanical devices, optical materials, electronic devices, jewelry, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Asia-Pacific Market Outlook

The Asia-Pacific region, including countries such as China, Japan, India, South Korea, and Australia, is witnessing significant advancements and developments in the single crystal and synthetic diamond industry. China stands out with its advancements in single-crystal diamond production using Microwave Plasma Chemical Vapor Deposition (MPCVD) technology. Major producers such as Zhengzhou Sino-Crystal Diamond Co., Ltd. are aiming to penetrate the jewelry market with lab-created diamonds, indicating a shift towards synthetic alternatives. Japan is focusing on innovative applications of synthetic diamonds, such as developing power semiconductors and sub-micron single-crystal diamond tools. These advancements signify Japan's commitment to utilizing diamond's unique properties in various cutting-edge technologies.

India emerges as a major player in lab-grown diamond production, showcasing millions of carats annually. The unveiling of the "Pride of India, " a notable lab-grown diamond, symbolizes the country's growing prominence in the global diamond industry. South Korea demonstrates rapid progress in synthetic diamond manufacturing, with researchers developing novel techniques for quick and efficient production. Companies like KDT Diamonds are expanding their operations, indicating the region's potential as a hub for lab-grown diamond manufacturing. Australia is leveraging synthetic diamonds for cutting-edge technologies like quantum computing, establishing research and development hubs to harness their unique properties. In addition, the production of lab-grown diamonds in Australia offers an ethical and cost-effective alternative to traditional mined diamonds.

The Asia-Pacific region presents a promising landscape for the single crystal and synthetic diamond industry. However, challenges such as the complexity of the manufacturing process may pose obstacles to the market's growth. Nonetheless, with continued innovation and investment, the region is poised to play a significant role in shaping the future of the global diamond industry.

Competitive Landscape

The major players operating in the single crystal diamond market include Element Six Holdings Limited, Diamond Foundry Inc, New Diamond Technology LLC, ILJIN Diamond, Hera Jewelry & Diamonds, Xinren Superabrasives Co., LTD, Grim Diamonds LLC, Henan Huanghe Whirlwind Co., LTD, Venus Gems Group Inc., and IIa Technologies (Pte) Ltd. Other players in the single crystal diamond market include Zhongnan Diamond, Zhengzhou Sino-Crystal, Sumitomo Electric, Jamnejad Group, CR GEMS Diamond, and others.

Recent Key Strategies and Developments

Element Six:

Element Six is at the forefront of the single crystal diamond market, harnessing Microwave Plasma Chemical Vapor Deposition (MPCVD) technology to produce high-quality single crystal diamonds. It has developed a range of CVD diamond grades catering to diverse applications like quantum optics and electrochemistry. In 2022, Element Six's technology licensing to II-VI Incorporated demonstrated its intent to foster innovative applications in new markets, further solidifying its impact on the single crystal diamond industry.

Diamond Foundry:

Diamond Foundry is making significant development in the market with the creation of the world's first 100mm single-crystal diamond wafer, and its development of diamond GPUs using heteroepitaxy for scalable substrates. Its ambitious plan to begin production of single-crystal diamond chips with a total volume of 10 million carats by 2025 positions them as key innovators in expanding the practical applications and scalability of single crystal diamonds. The impact of these companies on the single crystal diamond market is profound, driving technological innovation, expanding applications, and enhancing the scalability of this remarkable material, thus shaping the future dynamics of the industry.

Upcoming Industry Trends:

- The creation of shallow color centers with high precision and stability is critical for advancing quantum technologies. Methods such as low-energy ion implantation and delta-doping, combined with optimized surface termination techniques (e.g., oxygen or fluorine termination) , are being explored to improve the spectral stability and coherence time of color centers in diamond nanostructures.

- Nanomechanical components, such as cantilevers and nanowires, are gaining traction for their applications in sensitive force detection and scanning probe microscopy. Diamond's exceptional mechanical properties make it an ideal candidate for such components, with efforts focused on reducing mass and increasing sensitivity while maintaining high mechanical quality factors.

- Hybrid systems combining quantum elements like qubits with mechanical oscillators are garnering attention for their potential in quantum information processing and communication. Diamond-based optomechanical crystals embedded with NV centers offer avenues for exploring quantum-optomechanical interactions, paving the way for novel quantum technologies.

- Advanced diamond nanostructures, including mirrors and nanogratings, are being developed to address specific challenges in various applications. Monolithic diamond mirrors, fabricated via etching nanostructures into diamond surfaces, offer high reflectivity and thermal conductivity, overcoming the limitations of conventional multilayer coatings. Similarly, diamond nano gratings with dense high-aspect-ratio structures are enhancing sensitivity in NV center-based sensors for NMR spectroscopy.

Key Sources Referred

- doi.org

- Quantum Economic Development Consortium (QED-C)

- Quantum Industry Coalition (QuIC)

- Semiconductor Industry Association (SIA)

- Institute of Electrical and Electronics Engineers (IEEE)

- Electronic Components Industry Association (ECIA)

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the single crystal diamond market analysis from 2024 to 2033 to identify the prevailing single crystal diamond market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the single crystal diamond market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global single crystal diamond market trends, key players, market segments, application areas, and market growth strategies.

Single Crystal Diamond Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 2.4 Billion |

| Growth Rate | CAGR of 4.7% |

| Forecast period | 2024 - 2033 |

| Report Pages | 310 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Xinren Superabrasives Co., LTD, Grim Diamonds LLC, Henan Huanghe Whirlwind CO.,Ltd., Diamond Foundry Inc, Venus Gems Group Inc., Hera Jewelry & Diamonds, Element Six Holdings Limited, ILJIN Diamond CO., LTD., iia technologies pte. ltd., New Diamond Technology LLC |

Loading Table Of Content...