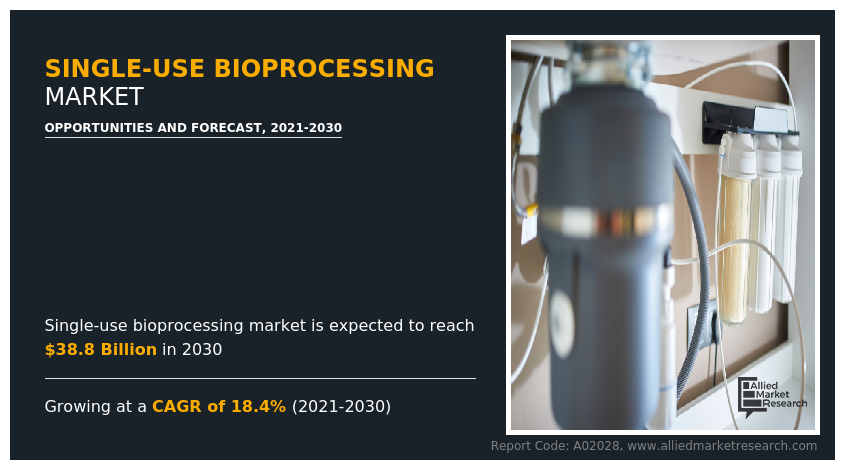

The global single-use bioprocessing market size was valued at $7.0 billion in 2020, and is projected to reach $38.8 billion by 2030, growing at a CAGR of 18.4% from 2021 to 2030.Single-use bioprocessing employs disposable technologies for the development and manufacturing of pharmaceutical products such as vaccines, monoclonal antibodies (mAbs), personalized medicine, and others. The adoption of single-use bioprocessing products has witnessed significant increase during the developmental stages of drugs and manufacturing of several biopharmaceuticals. This product has revolutionized the upstream as well as downstream processes of manufacturing drugs making it faster, simpler, and cheaper. Factors that boost the growth of single-use bioprocessing market include surge in demand for biopharmaceuticals, rise in adoption of disposable technologies, low risk of product cross-contamination attributed to SUB technologies, and less floor space requirement. However, certain aspects such as extractability & leachability issues and stringent regulations pertaining to use of disposable systems in biopharmaceutical industry hamper the market growth.

Single-use bioprocessing media bags & containers are used in various bioprocessing processes. In addition, single-use containers are widely used for critical liquid handling applications in the bio manufacturing and biopharmaceutical industries. Moreover, single-use bioprocessing technologies are used in the production of monoclonal antibodies (mAb); hence, this segment has a leading share in the global single-use bioprocessing market.

Single-use bioprocessing media bags & containers are used in various bioprocessing processes. In addition, single-use containers are widely used for critical liquid handling applications in the bio manufacturing and biopharmaceutical industries. Moreover, single-use bioprocessing technologies are used in the production of monoclonal antibodies (mAb); hence, this segment has a leading share in the global single-use bioprocessing market.

The Single-use bioprocessing market size in this report is studied on the basis of product, application, method, end user, and region. On the basis of product, the market is divided by bioreactors, tangential-flow filtration devices, depth filters, disposable filter cartridges, media bags & containers, mixing systems, tubing assemblies, sampling systems, and others. By application, the market is divided into monoclonal antibody production, vaccine production, plant cell cultivation, patient specific cell therapies, and others. By method, the market is classified into filtration, storage, cell culture, mixing, and purification. On the basis of end user, the market is divided into biopharmaceutical manufacturers, life science R&D companies & academic research institutes, and contract research organizations & manufacturers. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Segment review

By Product

On the basis of product, the media bags & containers segment currently dominates the global single-use bioprocessing market and is expected to continue this trend during the forecast period owing to single-use bioprocessing media bags & containers used in various bioprocessing processes. In addition, single-use containers are widely used for critical liquid handling applications in the bio manufacturing and biopharmaceutical industries. Moreover, single-use bioprocessing technologies are used in the production of monoclonal antibodies (mAb).

By Product

Bioreactors segment is projected as the most lucrative segment.

By Method

On the basis of method, the filtration segment dominated the global single-use bioprocessing market forecast in 2020 and is anticipated to be dominant in the market as it is a vital method to manufacture biological products such as vaccine, monoclonal antibodies, and others.

By Method

Purification segment would exhibit a CAGR of 20.3% during forecast period.

By Application

On the basis of application, the monoclonal antibody production segment dominated the global single-use bioprocessing market in 2020 and is anticipated to be dominant in the market as monoclonal antibodies are immensely useful to treat various immune disorders and are an integral part of vaccine development.

By Application

Others segment would exhibit a CAGR of 19.3% during forecast period.

By End User

On the basis of end user, the biopharmaceutical manufacturers segment dominated the global single-use bioprocessing market forecast in 2020 and is anticipated to be dominant in the market owing to increased adoption of these systems for enhanced production of vaccines, monoclonal antibodies, and personalized medicines.

By End User

Contract Research Organization & Manufacturers segment would witness the fastest growth, registering a CAGR of 19% during the forecast period.

Region Segment Review

Region wise, North America single-use bioprocessing market growth dominated the market in 2020, as there is an on-going trend of introducing novel single-use bioprocessing devices in developed economies such as the U.S. and Canada, and then unveiling it to the rest of the world. North America is known for its healthcare facilities and medical services. In addition, rise in the adoption of single-use bioprocessing technologies for various biopharmaceutical applications has propelled the growth of the market. However, Asia-Pacific single-use bioprocessing industry is expected to witness considerable market growth during the forecast period due to significant demand for bioprocess equipment including laboratory filtration systems and membrane-based microbial analysis among many others. In addition, Asia-Pacific witnessed strong growth in both the pharma and laboratory equipment market, which is expected to offer lucrative opportunities for single-use bioprocessing products in future. Moreover, India and China is expected to grow at high CAGR in Asia-Pacific single-use bioprocessing market.

By Region

India and China is expected to grow at high CAGR in Asia-Pacific single-use bioprocessing market

The major companies profiled in this report include 3M Company, Cesco Bioengineering Co. Ltd., Danaher Corporation, Eppendorf AG., Corning, Inc., Getinge Group, Merck KGaA, PBS Biotech, Sartorius Stedim Biotech, and Thermo Fisher Scientific, Inc.

Key Benefits For Stakeholders

- This global single-use bioprocessing market size report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the single-use bioprocessing market analysis from 2020 to 2030 to identify the prevailing single-use bioprocessing market opportunities.

- The global single-use bioprocessing market share research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the single-use bioprocessing market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global single-use bioprocessing market trends, key players, market segments, application areas, and market growth strategies.

Single-use Bioprocessing Market Report Highlights

| Aspects | Details |

| Market Size By 2030 | USD 38.8 billion |

| Growth Rate | CAGR of 18.4% |

| Forecast period | 2020 - 2030 |

| Report Pages | 200 |

| By End User |

|

| By Application |

|

| By Method |

|

| By Product |

|

| By Region |

|

| Key Market Players | Danaher Corporation, Cesco Bioengineering Co. Ltd., 3M Company, Getinge, Eppendorf AG, PBS Biotech, Inc. , Thermo Fisher Scienctific, Merck & Co. Inc., Corning Inc., Sartorius Stedim Biotech S.A |

Analyst Review

According to the analyst’s perspective, globally, single-use bioprocessing technology incorporates several disposable products for the development of several pharmaceutical products, such as vaccines, monoclonal antibodies, biologics, and others. The use of single-use products in the bioprocessing of drugs has increased over the recent years to cater to the demand for biopharmaceuticals globally. This technology offers several advantages over conventional bioprocessing methods such as increase in cost-effectiveness of the process, rise in productivity & flexibility, and improvement in the workflow. Single use bioprocessing products are widely used in relatively short span, owing to the remarkable features such as scalable implementation to both downstream and upstream operations in biopharmaceutical production and simplified design for rapid response. The other factors that supplement the market growth include faster installation of single-use products, lower water usage, lesser floor space requirement, and lower risk of product cross-contamination.

Single-use bioprocessing products use several disposable products such as bioreactors, tangential-flow filtration devices, depth filters, disposable filter cartridges, media bags & containers, and mixing systems for upstream as well as downstream processing. The media bags and containers segment dominate the global single-use bioprocessing market owing to its extensive use in transportation and storage of components essential for bioprocessing. In addition, biopharmaceutical manufacturers are the key end user of single-use bioprocessing technology. Furthermore, biopharmaceutical manufacturers use single-use technologies for manufacturing disposable products owing to their feasibility and low cost of bioprocessing.

Media culture for vaccine and pharmacetical products development

North America is the largest market for Single-use Bioprocessing Market

The global Single-use Bioprocessing market was valued at $6,953.0 million in 2020, and is projected to reach $38,843.8 million by 2030, registering a CAGR of 18.4% from 2021 to 2030

Thermo Fisher Scientific, Inc and Danaher Corporation

Loading Table Of Content...

Loading Research Methodology...