Single-use Bioprocessing Material Market Research, 2030

The global single-use bioprocessing material market was valued at $1,319.40 million in 2020, and is projected to reach $6,410.10 million by 2030, growing at a CAGR of 17.3% from 2021 to 2030. The impact of single-use or disposable equipment in the manufacturing of vaccines and therapeutic proteins has been indelible and wide-ranging. Single-use bioprocessing (SUB) refers to vessels, conduits, and active consumables that come into contact with process fluids once and are then discarded. In its purest sense, SUB replaces stainless steel or glass with plastic. In practice, the single-use philosophy has come to incorporate some products that come in fully-usable form or that bio processors employ for several runs instead of just one. Most of the progress in single-use bio manufacturing has been for upstream processes.

Advancements in the materials incorporated in the construction of single-use bioprocessing products has played a pivotal role in boosting the demand for single-use bioprocessing (SUB) products across the globe, thereby increasing the single-use bioprocessing material market size.

Increased preference for use of high-grade polymer materials in the construction of single-use bioprocessing products has fueled the market growth. In addition, development of advanced materials that can offer integral strength to the single-use bioprocessing products is expected to supplement the market growth. Conversely, existing concerns regarding the large-scale disposal of plastic derivatives used in the SUB products are anticipated to hamper the market growth. Moreover, surge in the incorporation of cost-effective materials in the development of single-use bioprocessing products is anticipated to offer lucrative opportunities for market expansion.

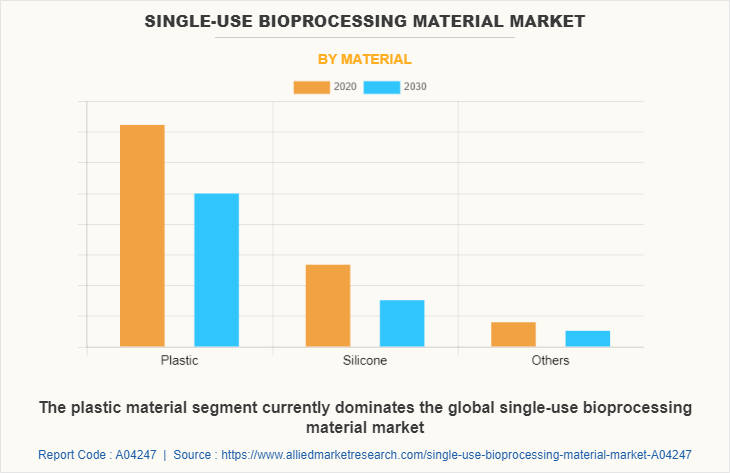

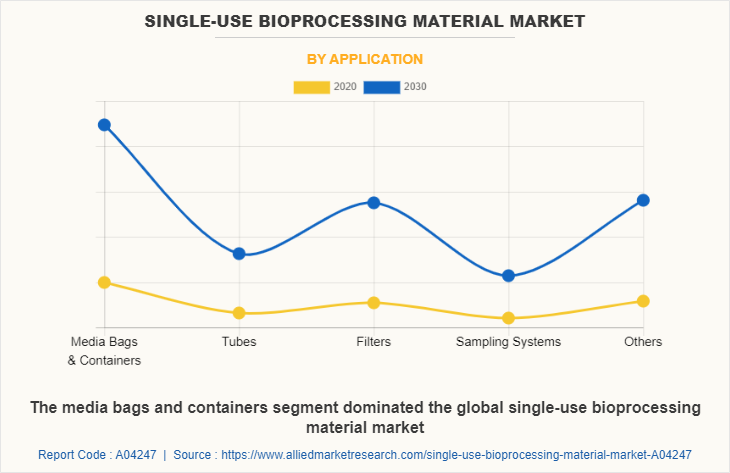

The single-use bioprocessing material market in this report is studied on the basis of material, application, and region. On the basis of material, the market is divided by plastic, silicone, and others. By plastic materials, the market is further divided into polyethylene, polyvinyl chloride, polyamide, polyvinylidene fluoride, and other plastic materials. By application, the market is classified into media bags & containers, tubes, filters, sampling systems, and others. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Segment review

On the basis of material, the plastic single-use bioprocessing material segment currently dominates the global single-use bioprocessing material market and is expected to continue this trend during the forecast period. This is due to features of plastics such as low cost, ease of manufacture, versatility, and resistant to the damage caused by water. The adoption toward use of plastic materials in single-use bioprocessing has gained traction considerably, in spite of the emerging biopharmaceutical production concerns pertaining to these materials. Such advantages of plastics will further help single-use bioprocessing material market growth during the analysis period.

On the basis of application, the media bags and containers segment dominated the global single-use bioprocessing material market share in 2020 and is anticipated to be dominant in the market as they provide a single-use disposable alternative to traditional glass and rigid plastic carboys in a large variety of bioprocess applications. They enhance process reliability as they reduce the risk of cross-contamination from batch to batch and from product to product. They also eliminate the time and expense of clean-in-place (CIP) & sterilization-in-place (SIP) operations, thus optimizing capacity utilization. The expanded application of single-use bags across biomanufacturing processes drives the market for single-use media bags and is expected to continue this trend during the single-use bioprocessing material market forecast.

Region Segment Review

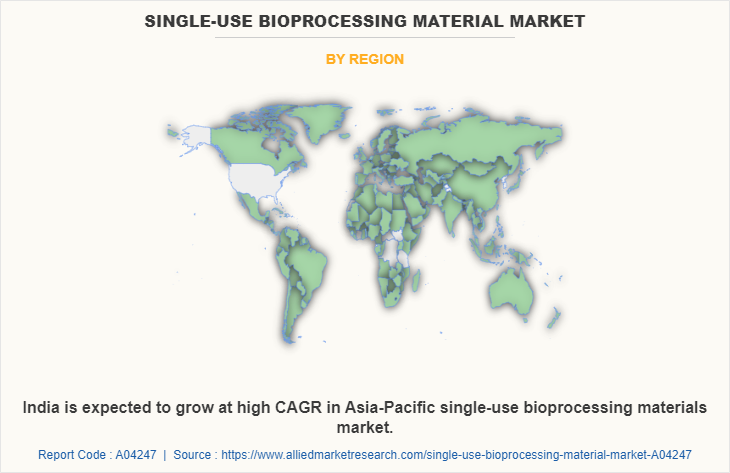

Region wise, North America dominated the market in 2020, owing to surge in demand for biopharmaceuticals owing to growth in geriatric population. The advantages of single-use bioprocessing (such as high energy efficiency, low water usage, less floor space requirement, reduced installation cost, decreased risk of product cross-contamination, and fast implementation) drive the adoption of the North America single-use bioprocessing material market share. However, Asia-Pacific is expected to witness considerable market growth during the forecast period due to presence of favorable government support, increase in private investments, surge in geriatric population, rise in trend of outsourcing to emerging Asian markets, and existence of skilled workforce in these countries. Moreover, India is expected to grow at high CAGR in Asia-Pacific single-use bioprocessing materials industry.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the single-use bioprocessing material market size analysis from 2020 to 2030 to identify the prevailing single-use bioprocessing material market opportunities.

- The single-use bioprocessing material industry research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the single-use bioprocessing material market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global single-use bioprocessing material market trends, key players, market segments, application areas, and market growth strategies.

Single-use Bioprocessing Material Market Report Highlights

| Aspects | Details |

| By Material |

|

| By Application |

|

| By Region |

|

| Key Market Players | LyondellBasell Industries Holdings B.V., SABIC, Celanese Corporation, saint gobain, Mitsubishi Chemical Advanced Materials, BASF, evonik industries ag, Exxon Mobil Corporation, Dow chemical company, Arkema, Inc. |

Analyst Review

According to the analyst’s perspective, globally, single-use bioprocessing (SUB) products are developed using disposable materials that generally constitute plastic polymers such as polyethylene (PE), polyamide (PA), and polyvinyl chloride (PVC) among other plastic polymers, silicone, and other materials. The product contact materials should comply with regulatory standards. Thus, pharmaceutical manufacturers need to choose the appropriate materials for single-use bioprocessing to avoid any further potential roadblock during the product launch in the market. Selection of an appropriate integral material plays a pivotal role in the construction of bioprocessing components such as bioreactors, tangential flow filtration devices, depth filters, media bags & containers, mixing systems, and tubing assemblies among others. Plastics are more commonly employed in the production of multiple single-use bioprocessing products, including media bags, bioprocess containers, tangential-flow filtration devices, mixing systems, and sampling systems.

Recent innovations and constant development in the field of single-use bioprocessing have further fueled the market growth. In addition, developing advanced materials in order to construct leak-free and fault-free SUB products is expected to supplement the market growth.

Arkema, Inc., Dow chemical company, Exxon Mobil, Saint Gobain and LyondellBasell Industries Holdings B.V.

Utilization of varied materials in the development of novel and cost efficient single use bioprocessing instruments/consumables

Largest regional market for single use bioprocessing material is North America

The global Single-use Bioprocessing Material market was valued at $1,319.4 million in 2020, and is projected to reach $6,410.1 million by 2030, registering a CAGR of 17.3% from 2021 to 2030.

research and development related to agriculture and food involve production of agricultural chemicals for control of animal and plant diseases, growth-stimulating agents for improved yield, and biological insecticides and herbicides; increasing bioprocess

Loading Table Of Content...