Small Arms Market Outlook, 2032

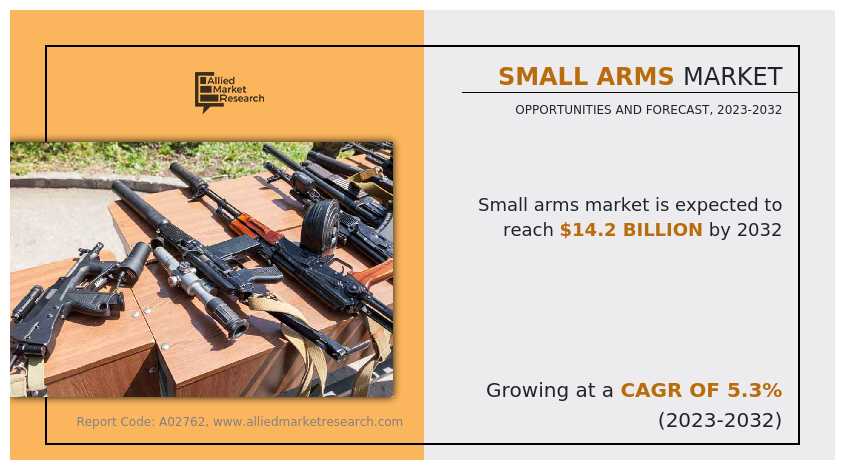

The global small arms market size was valued at $8,426.0 million in 2022, and is anticipated to reach $14,153.1 million by 2032, registering a CAGR of 5.3% from 2023 to 2032. Small arms are designed for individual use, typically by a single person. These arms are exemplified by their relatively small size and portability, making them easy for an individual to carry and operate. Small arms are generally used by military personnel, law enforcement officers, and civilians for self-defense, sport shooting, hunting, and various other purposes. Furthermore, military and law administration personnel also make use of small arms for carrying out their respective operations.

Report Key Highlighters:

- The small arms market study covers 14 countries. The research includes regional and segment analysis of each country in terms of value ($million) for the projected period 2023-2032.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The small arms market share is highly fragmented, into several players including CZG - Ceská zbrojovka Group SE, Fabbrica D'Armi Pietro Beretta S.P.A., FN Herstal, Heckler & Koch, Israel Weapon Industries (I.W.I) Ltd, Smith & Wesson Brands, Inc., Sturm, Ruger & Co., Inc., Taurus International Manufacturing, Inc., Webley & Scott and Weihrauch & Weihrauch Sport GmbH & Co. KG. The companies have adopted strategies such as product launch, contract, expansion, agreement, and others to improve their market positioning.

Small arms consist of various firearms such as pistol, shotgun, revolver, rifle, and other related systems. Sports events, hunting activities, and self-defense are the prominent application areas of firearms, and it is expected to be lucrative opportunity during the forecast year. Governments across the globe have introduced regulations and rules for small arms solution acquisition and usage activities. Growth in adoption of small arm solutions in sport events and increase in requirements of small arms for self-defense applications are crucial factors that support growth for small arms across the globe.

Factors such as a rise in demand for small arms for competitive sporting events and growth in a number of territorial conflicts across the globe are expected to drive growth of the small arms market. However, strict small arms ownership regulations restrain market growth. On the contrary, an increase in military expenditure globally and agreements & contracts with law enforcement and military agencies are projected to offer lucrative growth opportunities for the small arms market players.

Small arms industry in developed countries set up jobs, generates tax revenue, and supports related businesses, such as suppliers of firearm components and accessories. For instance, in U.S., after the tragic Sandy Hook Elementary School shooting in 2012, there was a rise in demand for small arms as individuals sought to purchase guns before potential changes in gun laws. This led to increased sales and revenue for small arms manufacturers and retailers. The presence of a strong domestic firearms industry can boost the overall economy. Some countries with robust small arms manufacturing capabilities export firearms to international markets. This can have a positive impact on the economy by expanding exports and trade revenue. However, the export of small arms is often subject to strict regulations and international agreements to prevent the production of weapons in dispute zones and criminal organizations.

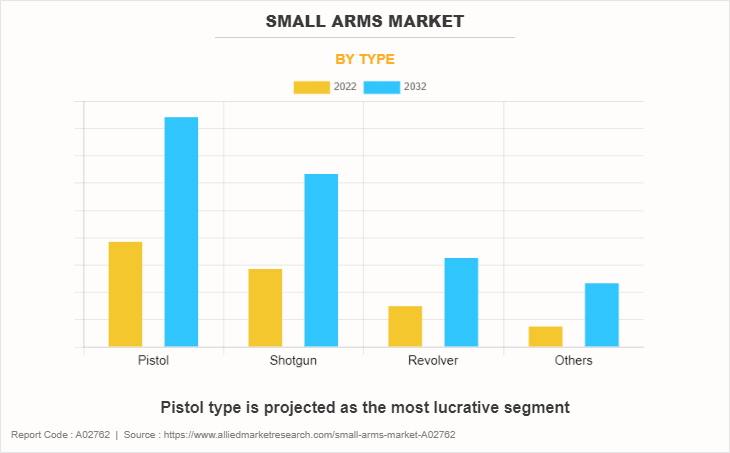

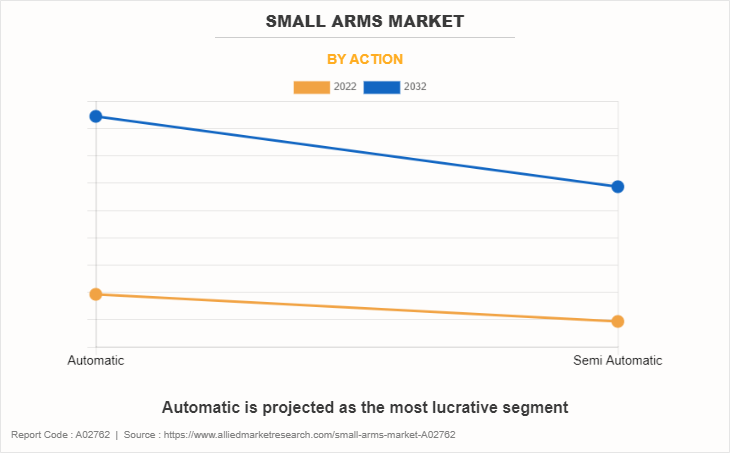

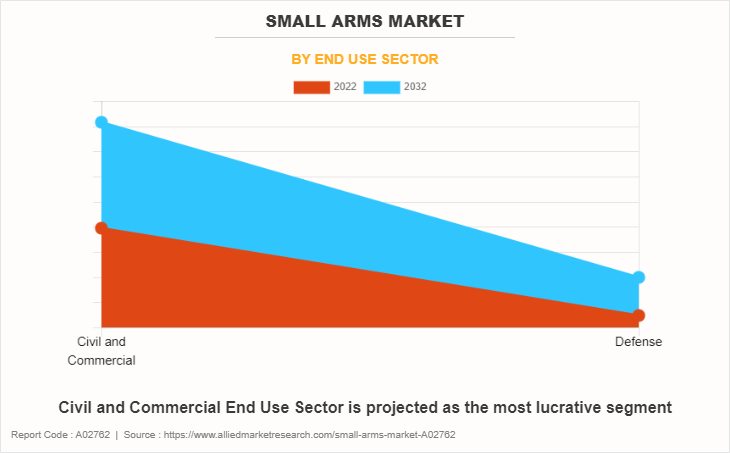

The global small arms market is segmented on the basis of type, action, end-use sector and region. By type, it is categorized into pistol, shotgun, revolver, and others. Depending on action, it is fragmented into automatic and semi-automatic. Depending on end-use sector, the small arms market is segregated into civil & commercial and defense. Region-wise, the small arms market is segmented into North America, Europe, Asia-Pacific, Latin America, Middle East & Africa (LAMEA) including country-level analysis for each region.

The small arms market in North America has observed significant growth and is hovering to offer compelling opportunities during the forecast year. The strong tradition of firearms ownership in North America, particularly in the U.S., has created a consistent and substantial domestic demand for small arms. This demand is driven by including personal defense, sport shooting, hunting, and recreational shooting sports. The culture of firearms ownership in the region has led to a robust civilian market for handguns, rifles, and shotguns.

Furthermore, changes in political and regulatory environments can significantly impact the small arms market in North America. Ongoing debates about gun control legislation and Second Amendment rights have at times led to increased consumer demand as individuals seek to acquire firearms before potential regulatory changes. The perceived need for self-defense and personal security can also drive market growth.

Key Developments

The leading companies are adopting strategies such as acquisition, agreement, expansion, partnership, contracts, and product launches to strengthen their market position.

- In May 2023, Sturm, Ruger & Company, Inc., launched the Ruger® LC Charger™ chambered in 5.7x28mm. This the Ruger LC Charger is ideal for the range, home defense or small game.

- In June 2023, Colt CZ Group SE ("Colt CZ", "Group" or "Company") is acquired a 100% stake in Swiss AA Holding AG ("swissAA"), Swiss is a manufacturer of ammunition and technology for the armed forces, acquisition is part of our long-term growth strategy but also in related industries.

- In August 2022, SMITH & WESSON BRANDS, INC. a leader in firearm is introduces the new Model 350, our first production revolver chambered in the powerful straight walled 350 Legend caliber. The Smith & Wesson Model 350TM is an X-Frame size, double action/single action revolver.

- In June 2022, ISRAEL WEAPON INDUSTRIES (I.W.I) LTD. launched GAL Versatile Protective Suit (VPS) at Eurosatory, with improved design reducing and provides protection from trauma injuries.

- In March 2022, SMITH & WESSON BRANDS, INC. released the next evolution of the Smith & Wesson M&P Shield pistol – the M&P Shield Plus.

- In March 2021, SMITH & WESSON BRANDS, INC. leader in firearms unveiled the latest expansion in its M&P M2.0 line of handguns. This handgun is designed to carry an impressive 15 + 1 capacity, with two magazines, and, reflecting the needs of the consumer, features Smith & Wesson’s brand new M2.0 flat face trigger design, which is designed to optimize trigger finger placement to allow for more consistent and accurate shooting.

Rise in demand for small arms for competitive sporting events

Sports weapons are referred to as non-lethal weapons that includes rifle, pistol, and shotgun. These are intended for competitive shooting and recreational purposes. These guns differ from one lethal counterpart according to their technology, projectile, caliber, and others. Sports guns are lighter and more comfortable to use as compared to lethal guns such as AK 47, Rheinmetall MG 3, Uzi, and M4 Carbine. Rise in participation in various shooting sports acts as a key factor for the small arms market growth. Shooting sports include target shooting, high power rifle, popinjay, sporting clays, skeet shooting, and cowboy action shooting. In addition, people are increasingly participating in shooting sports globally, owing to various benefits such as they enhance physical health, focus, and sharpen eyesight. Furthermore, growth in participation of school and college kids/students in national level shooting sports is expected to promote growth of the small arms market. Rise in participation for shooting competitions across the world is expected to fuel growth of the global small arms market during the forecast period.

Growth in the number of territorial conflicts across the globe

In recent years, the world has witnessed a rising trend in wars and conflicts across many nations. For instance, in August 2021, Afghanistan faced a political upheaval that brought the country into a permanent state of chaos. The rise in terrorist attacks and violent conflicts in the country are expected to lead to more unfavorable instances across neighboring nations in the future. Currently, there are numerous ongoing wars and minor conflicts in several countries globally, most of which are in the Middle East, North-West Asia, and Sub-Saharan Africa, and a major drug war in countries like Mexico. Nations across the world are buying arms and ammunition to counterterrorism, block the entry of enemy soldiers, and curb anti-national activities. Moreover, poor events that happened in last few years in countries such as the U.S. and France have resulted in a large number of citizens carrying guns for self-defense purposes. Such factors are anticipated to propel growth of the global small arms market during the forecast period.

Strict small arms ownership regulations

Numerous countries across the world have strict rules for ownership of guns. In past years, owing to various misfortunate events involving firearms, many nations have banned sales or tightened ownership processes for owning guns for ordinary citizen. In the UK, only police officers, members of the armed forces, or people with written permission from the home secretary legally own a handgun. Firearm owners have to obtain either a Shotgun Certificate or a Firearm Certificate. In China, civilians are not permitted to have weapons and face life imprisonment for trafficking firearms. They obtain a firearm for hunting only after a strict licensing process. Conviction for illegal possession or sale of firearms is punishable by up to 10 years in prison and up to life for arms trafficking, according to the Supreme People's Court. Such factors are anticipated to limit growth of the global small arms market during the forecast period.

Increase in military expenditure globally

According to the Stockholm International Peace Research Institute (SIPRI), the global military expenditure reached $1,981 billion in 2020, with a 2.6% year-on-year increase. Moreover, to modernize defense forces to undertake the rise in threats of wars and other internal conflicts, many nations are continuously increasing their defense spending to purchase and manufacture firearms, ammunition, and accessories. The military expenditure accounted for 2.4% of the global gross domestic product in 2020. Thus, an increase in global military expenditure has augmented the adoption of modern small arms solution. Procurement of modern firearms is costly and requires large capital spending for its integration in a variety of platforms. However, an increase in law enforcement and defense expenditure globally facilitates procurement of expensive but necessary weapon systems. Furthermore, advancements of weapons and attacking capabilities worldwide have created demand for modernization and installation of sophisticated defense infrastructure by governments to be prepared for any unprecedented threats and offensive attacks from foreign countries. Hence, increase in defense expenditure is expected to open new avenues for growth of the small arms market during the forecast period.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the small arms market analysis from 2022 to 2032 to identify the prevailing small arms market opportunities.

- The small arms market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the small arms market segmentation assists to determine the prevailing small arms market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global small arms market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the small arms market players.

- The report includes the analysis of the regional as well as global small arms market trends, key players, market segments, application areas, and market growth strategies.

Small Arms Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 14.2 billion |

| Growth Rate | CAGR of 5.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 374 |

| By Type |

|

| By Action |

|

| By End Use Sector |

|

| By Region |

|

| Key Market Players | FN Herstal, ISRAEL WEAPON INDUSTRIES (I.W.I) LTD., STURM, RUGER & CO., INC., Colt CZ Group SE, SMITH & WESSON BRANDS, INC., WEIHRAUCH & WEIHRAUCH SPORT GMBH & CO. KG, Fabbrica d'Armi Pietro Beretta S.p.A., Taurus International Manufacturing, Inc., WEBLEY & SCOTT, Heckler & Koch |

The global small arms market was valued at $8,426.0 million in 2022, and is projected to reach $14,153.1 million by 2032, registering a CAGR of 5.3% from 2023 to 2032.

Rise in demand for small arms for competitive sporting events, growth in a number of territorial conflicts across the globe, and rising modernized weapon innovations

Pistol type is the leading application of the small arms market

North America is the largest regional market for small arms.

CZG - Ceská zbrojovka Group SE, Fabbrica d'Armi Pietro Beretta S.P.A., FN Herstal, Heckler & Koch, ISRAEL WEAPON INDUSTRIES (I.W.I) LTD, Smith & Wesson Brands, Inc., Sturm, Ruger & Co., Inc., Taurus International Manufacturing, Inc., Webley & Scott, and Weihrauch & Weihrauch Sport GmbH & Co. KG.

Loading Table Of Content...

Loading Research Methodology...