Small Caliber Ammunition Market Overview, 2031

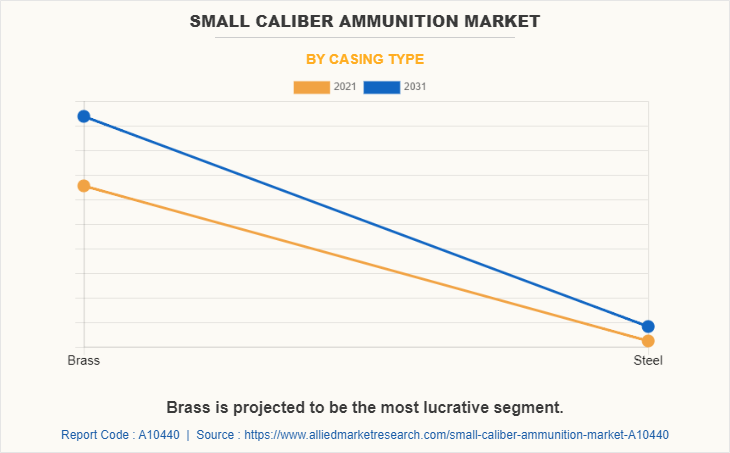

The global small caliber ammunition market size was valued at $10.8 billion in 2021, and is projected to reach $14.2 billion by 2031, growing at a CAGR of 2.8% from 2022 to 2031.Cartridges used in firearms with a barrel diameter of less than 20mm are referred to as small caliber ammunition. The small-caliber ammunition is used in the military, law enforcement, hunting, and sports. Small-caliber ammunition, which can be used in a variety of guns, including pistols, rifles, and machine guns, is typically produced in enormous quantities. Automatic weapons, which need to fire at a rapid rate and with pinpoint accuracy, also use it. Small-caliber ammunition manufacturing necessitates precise engineering and premium materials. The bullets are normally made of lead, copper, or a mix of lead & copper and the cartridges are typically constructed of steel or brass. The cartridges' excellent precision and velocity delivery features are expected to drive the market growth during the forecast period.

During the forecast period, factors such as growing terrorist threats, increased gun use for safety reasons, and expansion in military modernization programs are anticipated to propel market expansion. However, during the forecast period, market expansion is anticipated to be constrained by regulatory constraints related to production and distribution in the ammunition industry as well as ammunition diversion and smuggling. In addition, it is projected that throughout the forecast period, the development of small caliber ammunition and the rising demand for light weight ammunition would present profitable prospects for market expansion.

Rise in threats from terrorist activities are expected to boost small caliber ammunition market growth.

The rising threats from terrorist activities have indeed contributed to the growth of small caliber ammunition market. Small caliber ammunition refers to bullets and cartridges that are designed for use with firearms that have a bore diameter of less than 20mm. One recent instance that illustrates this trend is the increased demand for small caliber ammunition among military and law enforcement agencies in various parts of the world, particularly in regions that are prone to terrorist activities. For instance, the ongoing conflicts in the Middle East and Afghanistan have led to increased demand for small caliber ammunition among various military and terrorist groups operating in these regions.

Another instance is the rise of terrorist attacks in Europe and other parts of the world in recent years. These attacks have led to a surge in demand for small caliber ammunition among law enforcement agencies and private security firms, as well as among civilian gun owners who are concerned about their personal safety. People have become more concerned about their personal safety and security, hence, there has been an increase in gun sales and ammunition purchases. This has led to a surge in demand for small caliber ammunition, particularly among civilian gun owners. Thus, the small caliber ammunition market is expected to continue growing during the forecast period due to ongoing threats from terrorist activities and the increasing demand for personal security.

Increase in adoption of small caliber guns for safety purposes.

The increasing adoption of small caliber guns for safety purposes has been observed in recent years, particularly in regions with high crime rates or perceived security threats. Small caliber guns, which typically include handguns chambered for ammunition such as .22LR, .380ACP, and 9mm, are often preferred by civilians for self-defense due to their ease of use, portability, and relatively low recoil. One recent instance that illustrates this trend is the surge in gun sales in the U.S. in 2020 amid the COVID-19 pandemic and social unrest. According to data from the National Shooting Sports Foundation, gun sales in the U.S. reached record levels in 2020, with a significant portion of the sales attributed to first-time gun buyers. Many of these buyers opted for small caliber handguns for personal safety purposes.

Another instance is the increasing popularity of concealed carry permits in the U.S. and other countries. A concealed carry permit allows an individual to carry a concealed firearm in public places for personal protection. Small caliber handguns are often favored by individuals seeking a concealed carry permit due to their ease of concealment and relative lightweight. In addition, the perception of increasing crime rates in certain regions has led to an upward in the adoption of small caliber guns for safety purposes. For instance, in some Latin American countries, where violent crime is a major concern, the adoption of small caliber guns by civilians has increased significantly in recent years.

However, a number of variables, such as demand from the military & law enforcement, consumer demand for hunting & sports activities, and the necessity for personal security, all contribute to the need for small caliber ammunition.

The Regulatory Restrictions in Small Caliber Ammunition Industry is expected to hamper the market growth

Regulatory restrictions in the small caliber ammunition industry have the potential to hamper market growth, particularly in regions where there are strict regulations on production and distribution of firearms and ammunition. These restrictions can take many forms, including limits on the sale and possession of certain types of ammunition, restrictions on ammunition imports and exports, and requirements for licenses or permits to purchase or possess ammunition. One recent instance that illustrates this trend is the regulatory restrictions on ammunition sales and possession in California, one of the largest ammunition markets in the U.S. In 2019, California implemented a series of new regulations on ammunition sales, including requirements for background checks and restrictions on the sale of certain types of ammunition. These regulations have made it more difficult for ammunition manufacturers and retailers to do business in the state and have led to increased costs and administrative burdens for industry players.

Similarly, the European Union has implemented a series of regulations on small caliber ammunition in recent years, including restrictions on the sale of certain types of ammunition and requirements for licenses or permits to purchase or possess ammunition. These regulations have had a significant impact on the small caliber ammunition in Europe, particularly for manufacturers and retailers who operate across multiple EU member states. Regulatory restrictions can also impact the small caliber ammunition market in developing countries, where there may be limited infrastructure and resources to support regulatory compliance. For example, in some African countries, there are limited regulations on firearms and ammunition, which can lead to a proliferation of unregulated small arms and ammunition.

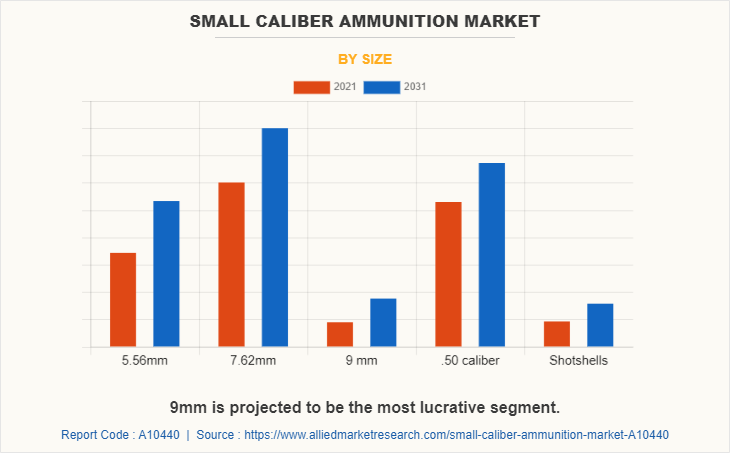

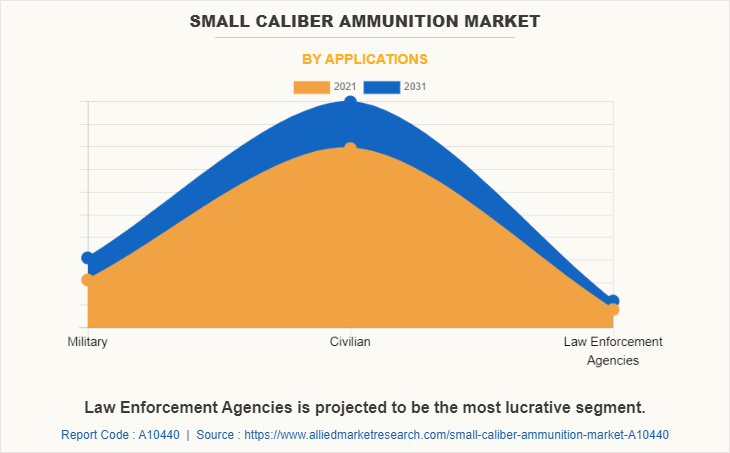

The small caliber ammunition market is segmented on the basis of size, application, casing, and region. By size, the market is divided into 5.56mm, 7.62mm, 9mm, .50 caliber, and shotshells. By application, it is fragmented into military, civilians, and law enforcement agencies. By casing, it is categorized into brass, and steel. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The leading players operating in the small caliber ammunition market are Northrop Grumman Corporation, General Dynamics Corporation, Nammo AS, CBC Global Ammunition, Olin Corporation, BAE Systems Plc, FN Herstal, Vista Outdoor Inc., Poongsan Corporation, and DSG Technology AS.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the small caliber ammunition market share analysis from 2021 to 2031 to identify the prevailing small caliber ammunition market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the small caliber ammunition market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global small caliber ammunition market trends, key players, market segments, application areas, and market growth strategies.

Small Caliber Ammunition Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 14.2 billion |

| Growth Rate | CAGR of 2.8% |

| Forecast period | 2021 - 2031 |

| Report Pages | 340 |

| By Size |

|

| By Applications |

|

| By Casing Type |

|

| By Region |

|

| Key Market Players | General Dynamics Corporation, Olin Corporation, Vista Outdoor Inc., DSG Technology AS, FN Herstal, Nammo AS, Northrop Grumman Corporation, Poongsan Corporation, CBC Global Ammunition, BAE Systems plc |

Analyst Review

The rise in threats from terrorist activities, increase in adoption of guns for safety purposes, and surge in military modernization programs are anticipated to drive the market growth during the forecast period. However, the regulatory restrictions in ammunition industry related to production and purchase are much stricter as compared to previous regulations that were much stricter , and diversion & smuggling of ammunition are expected to hamper the market growth during the forecast period. Moreover, the surge in demand for light weight ammunition and development in small caliber ammunitions are anticipated to offer lucrative opportunities for the market growth during the forecast period.

Terrorist activities continue to pose a significant threat to global security. According to the Global Terrorism Index 2021 report by the Institute for Economics and Peace (IEP), the number of deaths from terrorism declined for the fifth consecutive year in 2020, however the threat remains high with over 13,000 deaths from terrorism globally. Here are some statistical data on the rising threats from terrorist activities such as in 2020, Iraq and Afghanistan were the two countries with the highest number of deaths from terrorism, with over 10,000 deaths combined. The Middle East and North Africa region continued to be the most impacted by terrorism, accounting for 61% of all deaths from terrorism in 2020. While deaths from terrorism decreased globally, some countries saw a significant increase in the number of deaths. For instance, in Mozambique, the number of deaths from terrorism increased by 1,328% from 2019 to 2020. In 2020, the most active terrorist group was the Taliban, responsible for 21% of all deaths from terrorism globally. Terrorist groups were responsible for 97% of all deaths from terrorism in 2020, with state-sponsored terrorism accounting for the remaining 3%. The use of improvised explosive devices (IEDs) remains the most common tactic used by terrorists, accounting for 60% of all deaths from terrorism in 2020.

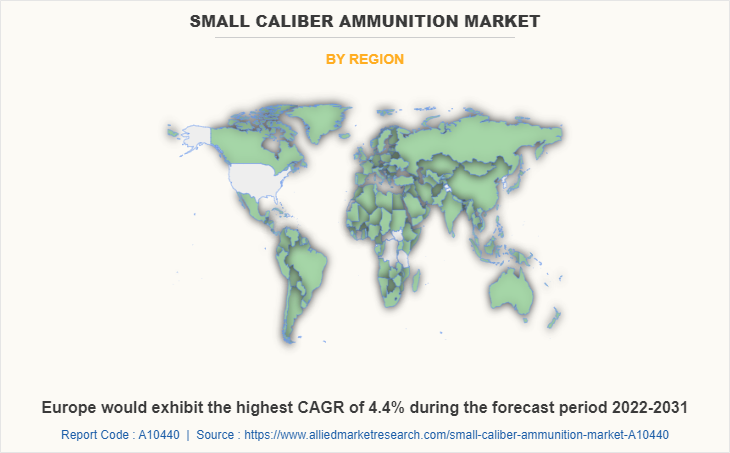

Among the analyzed regions, North America is the highest revenue contributor, followed by Asia-Pacific, Europe, and LAMEA. On the basis of forecast analysis, Europe is expected to lead during the forecast period due to growing technological advancements and the rising adoption of small arms in countries such as Germany, France, Russia, and the UK.

The Small Caliber Ammunition Market valued for $10,779.20 million in 2021 and is estimated to reach $14,190.60 million by 2031.

The leading players operating in the small caliber ammunition market are Northrop Grumman Corporation, General Dynamics Corporation, Nammo AS, CBC Global Ammunition, Olin Corporation, BAE Systems Plc, FN Herstal, Vista Outdoor Inc., Poongsan Corporation, and DSG Technology AS.

Civilians is the leading application of small caliber ammunition market.

North America is the largest regional market for small caliber ammunition market.

Rise of threat activities, and increasing adoption of small weapons by individuals for personal safety are the upcoming trends of small caliber ammunition market.

Loading Table Of Content...