Smart Contracts Market Overview

The global smart contracts market was valued at $192.7 million in 2022, and is projected to reach $2.5 billion by 2032, growing at a CAGR of 29.6% from 2023 to 2032. Rising blockchain adoption, demand for smart contracts in educational institutions, and increasing emphasis on automation and digital transformation across sectors contribute to the growth of the market.

Market Dynamics & Insights

- The smart contracts industry in North America held the largest share of 39% in 2022.

- By contract type, the decentralized autonomous organizations (DAO)segment dominated the market, accounting for the revenue share of 33% in 2022.

- By end user, the BFSI segment dominated the market, accounting for the revenue share of 26% in 2022.

- By platform, the ethereum segment held the largest share in the market, accounting for the revenue share of 32% in 2022.

Market Size & Future Outlook

- 2022 Market Size: $192.7 Million

- 2032 Projected Market Size: $2,500 Million

- CAGR (2023-2032): 29.6%

- North America: dominated the market in 2022

- Asia-Pacific: Fastest growing market

What is Meant by Smart Contracts

Smart contracts are a use of blockchain technology that makes it clear for organizations, governments, corporations, and individuals to trade money, property, stocks, bonds, and contracts that have to do with money. You need a go-between. One thing that helps smart contracts grow is that they tend to set out the rules of the contract but automatically carry out their obligations. Smart contracts can be used for finance, insurance premiums, contract breach, property law, and many other things. Smart contracts have been going down, but they are expected to grow a lot in the next few years to serve end users in areas like banking, government, insurance, real estate, and the supply chain. Smart contracts can be the next step forward for voting and other legal forms and bids that the government gives out. This can be any agreement between the government and a public or private company.

Increase in adoption of blockchain technology and increase in demand for smart contracts in educational institutions is boosting the growth of the smart contracts market. In addition, increase in demand for automation and digital transformation technology is positively impacts growth of the market. However, lack of scalability and standardization and presence of legal and regulatory uncertainties is hampering the market growth. On the contrary, increasing adoption of various applications in industries is expected to offer remunerative opportunities for expansion of the smart contracts market during the forecast period.

Smart Contracts Market Segment Review

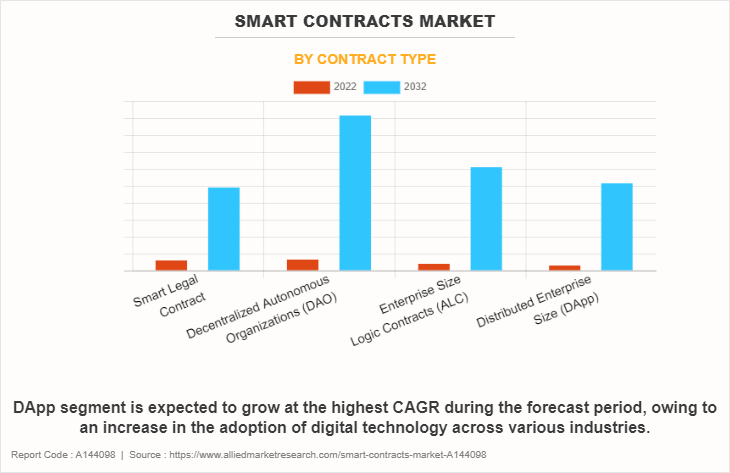

The smart contracts market is segmented on the basis of by contract type, platform, enterprise size, end-user, and region. On the basis of the contract type, the market is segmented into smart legal contracts, decentralized autonomous organizations (DAO), application logic contracts (ALC), and distributed application (DApp). On the basis of platform, the global smart contracts market is segmented into Ethereum, Cardano, BNB Chain, Polkadot, and others. On the basis of enterprise size, the market is bifurcated into large enterprises and SMEs. By end-user, it is classified into BFSI, retail, healthcare, real estate, logistics, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

In terms of contract type, the decentralized autonomous organization (DAO) segment holds the highest smart contracts market size, owing to an increase in the adoption of smart contracts application that provides enterprise-related services, such as automating and executing contract terms and reducing the need for intermediaries and manual processes with the help of codes. However, the DApp segment is expected to grow at the highest rate during the forecast period, owing to an increase in the adoption of digital technology across various industries.

Region-wise, the smart contracts market share was dominated by North America in 2022 and is expected to retain its position during the forecast period, owing to growing innovation and technological progression in this region. In addition, companies are paying attention to launching product platforms and forming partnerships to support their market position in this region. However, Asia-Pacific is expected to witness significant growth during the forecast period, owing to increasing mergers and acquisitions activities, and the growing adoption of digital platforms in this region.

The key players that operate in the smart contracts industry are ScienceSoft USA Corporation, innowise group, IBM Corporation, Tata Consultancy Services, BlockCypher, Blockstream Corporation Inc., Monax Industries Limited, BitPay, Inc., Chain, Inc., and Coinbase. These players have adopted various strategies to increase their market penetration and strengthen their position in the smart contracts industry.

Key Benefits

Smart contracts market are simple programs stored on a blockchain that run when predetermined conditions are met. With smart contracts, every transaction and movement of goods can be recorded and tracked on a shared ledger that is visible and verifiable by all participants, which can increase trust, accountability, and traceability in the supply chain. Moreover, the main benefit of a smart contract blockchain is that it deterministically executes unambiguous code when certain conditions are met. There is no need to wait for a human to interpret or negotiate the result. This removes the need for trusted intermediaries. Such benefits drives the smart contracts market.

What are the Top Impacting Factors in Smart Contracts Market

Increase in Adoption of Blockchain Technology

The increase in demand for advanced technology such as blockchain and other technology due to rising efficiency, cost reduction, and expanding acceptance of blockchain technology are the main factors driving the growth of the smart contracts market. Moreover, Blockchain technology is gaining popularity as companies look for safer, more effective, and transparent ways to manage data and carry out transactions, which powers smart contracts. In addition, the decentralized finance (DeFi) ecosystem, which has expanded quickly in recent years, depends heavily on smart contracts industry. DeFi adoption has resulted in a rise in demand for smart contracts market.

Moreover, with the increase in competition, major market players have started acquisition companies to expand their market penetration and reach. For instance, in May 2023, CertiK partnered with Alibaba Cloud, the digital technology and intelligence of Alibaba Group to provide blockchain security services to cloud-based Web3 projects. Web3 developers now accelerate their development process and secure their applications and smart contracts with CertiK’s Security Suite and Alibaba Cloud’s scalable, highly efficient, and secure infrastructure. Such demands are driving the growth of the smart contracts market.

Increase in Demand for Smart Contracts in Educational Institutions

The increasing demand for smart contract experts is creating an opportunity for educational institutions and training programs to offer courses and certifications focusing on smart contracts. Developing a skilled workforce that understands smart contract development, auditing and implementation of advanced technology is expected to drive the global smart contracts market growth during the forecast period.

The combination of smart contracts with Internet of Things (IoT) devices also offer new opportunities for the Smart Contracts Market growth. Smart contracts automate and facilitate transactions, agreements and data exchanges between interconnected devices. This enables autonomous and secure interactions within IoT ecosystems. This convergence creates various possibilities in areas such as logistics, supply chain management and smart cities.

Restraint

Lack of Scalability and Standardization

The scalability of smart contracts is a major challenge for smart contracts market growth. As blockchain networks are increasing in size and transaction volume, scalability issues are expected to arise, which leads to an increase in transaction costs and slower processing times. It is important to solve scalability challenges for the huge adoption of smart contracts in high-volume industries. Even though blockchain technology provides inherent security features, smart contracts are still vulnerable to coding errors, hacking and security breaches. Vulnerabilities in smart contracts lead to financial loss or exploitation. To mitigate risks, it is important to ensure security measures and auditing of smart contracts. The lack of standards that are widely adopted and best practices for the development of market is expected to hinder interoperability and increase the risk of inconsistent implementations in the future.

Opportunity

Increase in Adoption of Various Applications in Industries

Increasing adoption of various applications in industries such as supply chain, banking, government, insurance, and real estate drives the market growth. In addition, with rising complexity and competition in the smart contracts market, the demand for industry-specific solutions increased to meet the goals of the companies and technology-based solutions are helping industries to enhance their security and upsurge their revenue opportunity, which is driving the growth of the smart contracts market. Furthermore, IoT and blockchain technology assist industries at various stages of risk management process ranging from identifying risk exposure, measuring, estimating, to assessing its effects.

Moreover, increasing investments in smart contract application offer the potential to transform the area of automation for time-consuming, mundane processes, and offering a far more streamlined and personalized customer experience, which is enhancing the growth of the smart contracts market. For instance, in August 2023, SphereX bags launched security solution, SphereX Protect with the $8.2million seed funding was backed by investors such as Aleph, Pillar VC, Fabric Ventures, Mensch Capital Partners, along with other angel investors, such strategic developments are expected to provide lucrative opportunity for the growth of the smart contracts market.

What are the Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the smart contracts market analysis from 2023 to 2032 to identify the prevailing smart contracts market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- In-depth analysis of the smart contracts market segmentation assists to determine the prevailing smart contracts market outlook.

- Major countries in each region are mapped according to their revenue contribution to the global smart contracts market forecast.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the smart contracts market players.

- The report includes the analysis of the regional as well as global smart contracts market trends, key players, market segments, application areas, and market growth strategies.

Smart Contracts Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 2.5 billion |

| Growth Rate | CAGR of 29.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 294 |

| By Contract Type |

|

| By Platform |

|

| By Enterprise Size |

|

| By End User |

|

| By Region |

|

| Key Market Players | Monax Industries Limited, Tata Consultancy Services, Coinbase, IBM Corporation, Innowise Group, BitPay, Inc., Chain, Inc., ScienceSoft USA Corporation, Blockstream Corporation Inc., BlockCypher |

Analyst Review

An agreement between a buyer and a seller that is directly written into lines of code is called a smart contract, and it is a self-executing contract. A distributed and decentralized Blockchain network is where the code and agreement that it contains are stored. The execution can be controlled by written code, and transactions can be tracked and cannot be undone. The Blockchain processes the smart contract’s transactions, allowing for automatic transmission without the involvement of a third party.

The global smart contracts market is expected to register high growth, owing to growing use of blockchain technology, technological advancement, improved efficiency, and reduce costs are some of the factors driving the growth of the smart contracts market. Thus, the increase in adoption of smart contracts, owing to its high reliability and low latency networks is one of the most significant factors driving the growth of the market. With surge in demand for smart contracts, various companies have established alliances to increase their capabilities. For instance, in June 2020, PrairieDog Venture partnered Data Gumbo to transform capital projects into smart contracts. The partnership will deliver smart contracts designed to solve long-standing industry challenges around transaction and information friction across capital projects, transitions and maintenance for the industrial, commercial and infrastructure construction sectors.

In addition, with further growth in investment across the world and the rise in demand for smart contracts, various companies have expanded their current product portfolio with increased diversification among customers. For instance, in October 2022, Equinor launched Data Gumbo’s smart contracts platform to automate payment calculations and processes. By leveraging Data Gumbo’s smart contracts, end-users are able to streamline their payment systems with automation.

Moreover, with increase in competition, major market players have started acquisition companies to expand their market penetration and reach. For instance, May 2021, DocuSign acquired smart agreements’ startup Clause to deliver new opportunities and specific solutions for financial services, insurance, and healthcare companies complements the way the Agreement Cloud helps many of our customers

The smart contracts market is estimated to grow at a CAGR of 29.6% from 2023 to 2032.

The leading application of Smart Contracts Market is Supply chain management.

Largest regional market for Smart Contracts is Asia-Pacific.

The estimated industry size of Smart Contracts is $917.25 million by 2032

The top companies to hold the market share in Smart Contracts are ScienceSoft USA Corporation, innowise group, IBM Corporation, Tata Consultancy Services, BlockCypher, Blockstream Corporation Inc.

Loading Table Of Content...

Loading Research Methodology...