Smart Grid Market Statistics, 2025

The smart grid provides technologies that improve fault detection and enables self-healing of the network automatically after the power disturbances. The smart grid thus provides the extraordinary opportunity for the economy as well as the environment by providing reliable and efficient power supply through various smart grid applications and technologies. The smart grid market size was valued at $66.96 billion in 2017, and is projected to reach $169.18 billion by 2025, growing at a CAGR of 12.4% from 2018 to 2025.

The smart grid market drivers such as rise in concerns pertaining to environment protection and growth in adoption of smart grid technology to improve efficiency in energy conservation and consumption are fueling the growth of the market. In addition, supportive government policies & regulations to use smart meters and rise in investments in digital electricity infrastructure are also some of the crucial factors that drive the market growth. However, lack of standardization and rise in privacy & security concerns are expected to hinder the smart grid market growth. Furthermore, increase in the number of electric vehicles on the road and upcoming smart cities projects in developing regions are expected to provide lucrative opportunities for the market growth in the coming years.

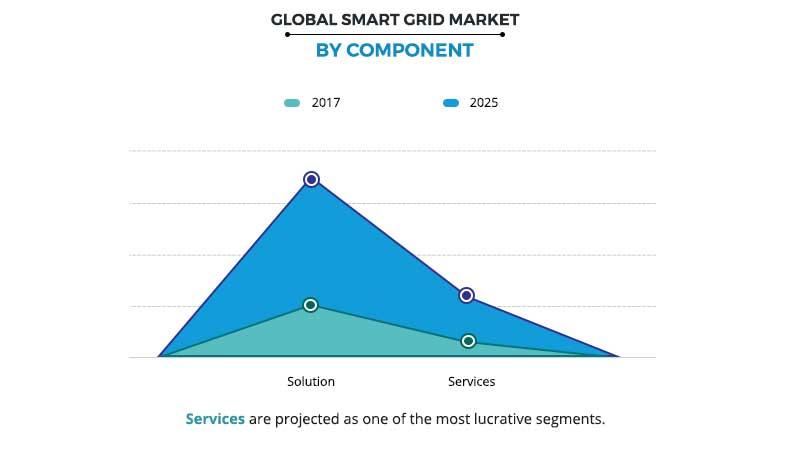

Based on component, the solution segment dominated the overall market share in 2017 and is expected to remain dominant during the smart grid market forecast period. The growth of this segment is mainly attributed to cost savings on overall electricity bills and increase in need to shift from conventional energy sources to sustainable and renewable energy resources. In addition, the growing concerns regarding security and data privacy is also the major factor that drives the growth of this segment.

The commercial segment generated the highest revenue for smart grid market share in 2017, the growing demand for the uninterrupted, efficient, and reliable electricity source is the major factor that drives the market growth in this segment.

The report focuses on the growth prospects, restraints, and trends of the smart grid market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the global market.

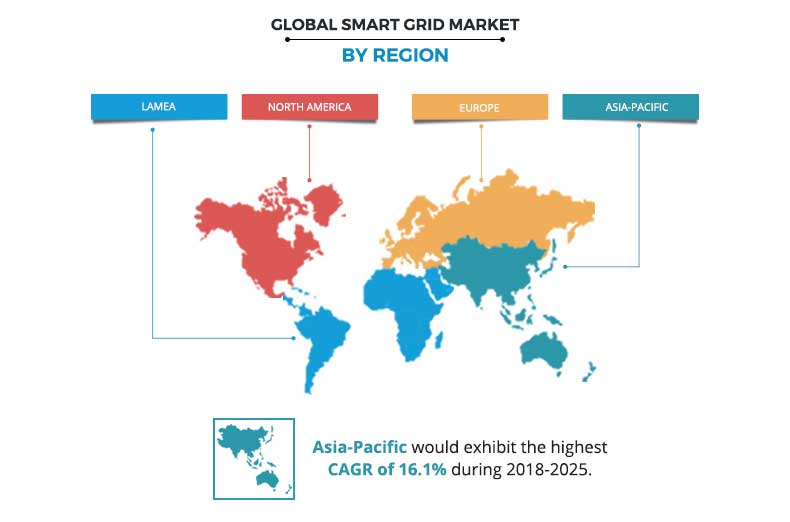

North America dominated the overall smart grid market share in 2017 and is expected to remain dominant during the forecast period due to emergence of electric vehicles and major investments done by private and public as well as government entities in this region. Furthermore, Asia-Pacific is expected to exhibit highest growth rate throughout the smart grid forecast period. The growth in demand to link up the remote and rural communities to national grid and increase in need to overcome the electricity outage is expected to drive the smart grid market growth in this region.

Segment Review

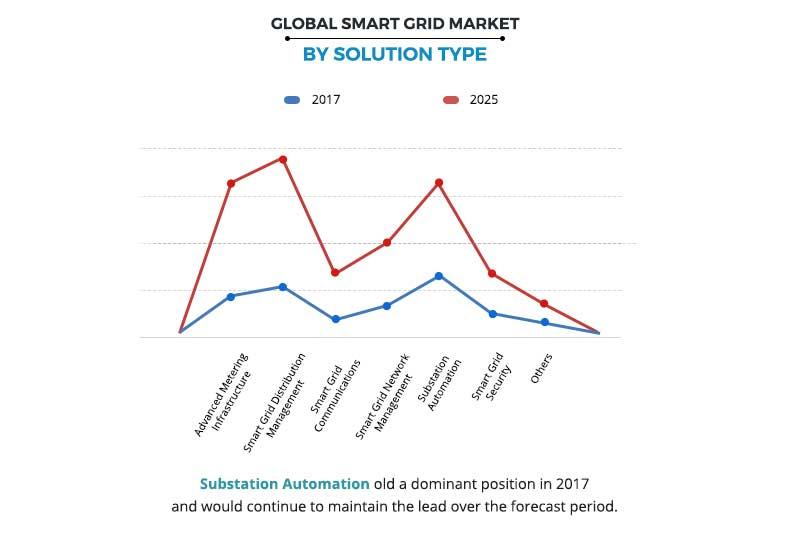

The global smart grid market is segmented on the basis of component, application, solutions, end user, and region. Based on component, the market is categorized into solutions and services. On the basis of application, it is classified into generation, transmission, distribution, and consumption/end use. By solutions, the market is categorized into advanced metering infrastructure (AMI), smart grid distribution management, smart grid communications, smart grid network management, substation automation, smart grid security, and others. On the basis of end user, it is divided into residential, commercial, and industrial. Based on region, the smart grid market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The smart grid market is dominated by the players such as Cisco Systems, Inc., General Electric, Honeywell International Inc, International Business Machines Corporation (IBM), Itron Inc., Oracle, Schneider Electric, Siemens, Tech Mahindra Limited, Wipro Limited, and others.

Top Impacting Factors

Current and future smart grid market trends are outlined to determine the overall attractiveness of the market. Top impacting factors highlight the opportunities during the smart grid market forecast period. Factors such as rise in concerns pertaining to environment protection and growth in adoption of smart grid technology to improve efficiency in energy conservation and consumption are the major factors that fuel the growth of the market. In addition, supportive government policies & regulations to use smart meters is also one of the crucial factors driving the market growth. However, rise in privacy & security concerns is expected to hinder the smart grid market growth. Furthermore, increase in the number of electric vehicles on the road and upcoming smart cities projects in developing regions are expected to provide major opportunities for the growth of market in the coming years.

Growth in adoption of smart grid technology to improve reliability and efficiency in energy conservation & consumption

Increase in dependence on the electronic devices and constant need for electricity in households as well as commercial sector drive the growth of the smart grid industry. As it delivers electricity to consumers when they need it and satisfies their requirements. The households, factories, cities, and offices need reliable and efficient power source that can reduce the frequency and duration of blackouts or can completely eliminate power disturbances. The smart grid market thus provides technologies that improve fault detection and enables self-healing of the network automatically.

In addition, with constant detection of disturbances, smart grid also offers the real-time assistance to energy management systems, which further increases situational awareness of the distribution system. Moreover, smart grid will involve the usage of sensors and other technologies, which is also anticipated to decrease the amount of electricity consumed when not in use. For instance, sensors will detect the occupied areas and they will allow fans to cool in that particular area only. Furthermore, integrated information and communication system provided by smart grid is also expected to enable utilities to better integrate and act on the massive amount of data in order to enhance system reliability which is expected to provide lucrative opportunities for the smart grid market.

Supportive Governments Policies and Regulations

The growing need to alleviate climate change for renewable energy expansion is expected to drive the smart grid initiatives worldwide. In addition, a number of governments are progressively investing in smart grid technology as it is expected to help them in achieving their carbon emission reduction targets and enable long-term economic prosperity. Moreover, numerous countries already have net energy metering protocols and equipment, and some countries are still exploring the technology and its mechanism which is expected to provide lucrative opportunities for the smart grid market. For instance, in 2017 under AMI (Advanced Metering Infrastructure), the U.S. installed around 76 smart meters and is anticipated to install approximately 90 million meters by the year 2020.

Furthermore, in December 2017, the Indian government made it obligatory to install the smart meters for consumers who have monthly electricity consumption of 500 units or more. In addition, under Smart City Initiative Indian government has a target of installing 130 million smart meters by the year 2021, which is expected to drive the growth for the smart grid markets.

Increase in the number of electric vehicles on the road

Increase in number of vehicles across the globe is becoming a major concern for the environment, as air pollution is growing at an alarming rate. The growth in deployment of vehicles for passenger and freight transportation is the major factor that fuel the pollution worldwide. In such critical scenario, electric vehicles can be seen as key solution as EVs do not produce any sort of carbon emission, thus provides major opportunity for the market growth in this sector. Moreover, electric engines are more efficient than internal-combustion engine (ICE), which is also one of the major factors expected to drive the demand for electric vehicles thus providing the major opportunities for the smart grid market outlook in the coming years.

Furthermore, increase in production of electric vehicles is also expected to be opportunistic for the market growth as several countries such as Europe, India, China, the USA, and others are already deploying electric vehicles and encouraging their production. For instance, according to USA Today 2018, the U.S. government has pledged $2.4 billion in federal grants to support the development of next-generation electric cars and batteries, and $115 million for the installation of electric vehicle charging infrastructure.

Upcoming smart cities projects in developing regions

The smart city initiatives are being adopted by many developing and developed nations, and India is one of the major adopters of this project. The smart city initiative thus involves the adoption of digital technologies for smart retail, Internet of Things (IoT), smart mobility, smart grid, and others to create a sustainable city. Moreover, smart grid is one of the crucial factors of smart city initiatives as it majorly depends on smart grid systems to ensure flexible distribution of electricity to supply its numerous functions. In addition, smart grid in smart city allows integration of renewables and enables clean energy production close to where it is needed, which further provides an opportunity for the smart grid industry.

Furthermore, several countries such the USA, India, China, and others are investing heavily in smart city initiatives, which is expected to provide lucrative opportunities for the smart grid market in the near future. For instance, Japan is assisting India in developing its smart cities initiatives by investing $4.5 billion in the first phase of the DMIC (Delhi-Mumbai Industrial Corrido) project. Under which, India is projected to install 130 million smart meters by the year 2021. In addition, the Power Grid Corporation of India has also planned to invest $26 billion in the upcoming five years.

Covid-19 Impacts on Smart Grid Market-

- Several smart grid manufacturers across the globe have halted their production activities due to disrupted supply of equipment and components from suppliers located in Southeast Asian countries and China amid lockdown due to Covid-19 pandemic.

- Amid lockdown due to COVID-19 drives the demand for smart systems is expected to surge to manage grid operations in order to reduce the human intervention.

Key Benefits for Smart Grid Market:

- This study presents the analytical depiction of the global smart grid market trends and future estimations to determine the imminent investment pockets.

- A detailed analysis of the smart grid market segments measures the potential of the market. These segments outline the favorable conditions for the market.

- The report presents information related to key drivers, restraints, and opportunities.

- The current smart grid market size is quantitatively analyzed from 2017 to 2025 to highlight the financial competency of the industry.

- Porter’s five forces analysis illustrates the potency of buyers & suppliers in the smart grid industry.

Smart Grid Market Report Highlights

| Aspects | Details |

| By Component |

|

| By SOLUTION |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | ORACLE CORPORATION, HONEYWELL INTERNATIONAL INC., ABB, SIEMENS AG, ITRON, GENERAL ELECTRIC, CISCO SYSTEMS INC., WIPRO LIMITED, IBM CORPORATION, SCHNEIDER ELECTRIC |

Analyst Review

Smart grid is a self-monitoring electricity network system that combines smart digital communication technology with existing electrical network. In addition, it uses two-way communication and control capabilities that allow bidirectional flow of energy, which creates efficiency within the supply chain and grids. Moreover, rise in concerns pertaining to environment protection and growth in adoption of smart grid technology to improve efficiency in energy conservation and consumption are some of the factors that fuel the growth of the smart grid market. In addition, supportive government policies & regulations to use smart meters and rise in investments in digital electricity infrastructure are also some of the crucial factors that drive the market growth. However, lack of standardization and rise in privacy & security concerns are expected to hinder the market growth. Furthermore, increase in number of electric vehicles on the road and upcoming smart cities projects in developing regions are expected to provide major opportunities for the market growth in the coming years. Moreover, many government organizations across the globe are already investing in smart grid technology to develop smart city solutions and building more data centers to cope with the 5G technology in the coming years.

The key players operating in the global smart grid market include Cisco Systems, Inc., General Electric, Honeywell International Inc, International Business Machines Corporation (IBM), Itron Inc., Oracle, Schneider Electric, Siemens, Tech Mahindra Limited, Wipro Limited, and others. The key players have adopted various growth strategies to enhance and develop their product portfolio, strengthen their smart grid market share, and to increase their market penetration. For instance, in May 2019, Schneider Electric and Gasunie, the leading European gas infrastructure company launched the gas grid management technology called Advanced Gas Management System (AGMS) for natural gas grid management software replacement project.

Loading Table Of Content...