Smart Insulin Pens Market Research, 2030

The global smart insulin pens market share was valued at $94.76 million in 2020, and is projected to reach $298.87 million by 2030, growing at a CAGR of 12.1% from 2021 to 2030. Smart insulin pens are used for external insulin delivery, thus offering an easy to carry solution for diabetes management. This smart system calculates and tracks doses and provides helpful reminders, alerts, and reports. They can come in the form of an add-on to your current insulin pen or a reusable form, which uses prefilled cartridges instead of vials or disposable pens. A smart insulin pen can deliver accurate half-unit doses, help prevent skipped or missed doses, keep track of the time and amount of each dose, and remind when it is time for the next one, notify when the insulin has expired or exceeded its temperature range, so that patient can replace the cartridge, send diabetes data to health care team whenever needed and work with smart phone or smart watch and popular diabetes data tracking platforms.

The demand for the insulin pens has increased considerably in the smart insulin pens market forecast owing to surge in incidence of diabetic patients coupled with their cost-effective nature as compared to insulin pumps. In addition, simple functioning and accuracy related to insulin dosing further stimulates its demand. However, there are certain disadvantages associated with the use of insulin pen such as two types of insulin cannot be mixed in an insulin pen, thus increasing the frequency of injections needed. This in turn impedes the smart insulin pens industry growth.

The upsurge in demand for smart insulin pens, rise in disposable incomes, and growth prospects in emerging economies of Asia-Pacific and LAMEA are expected to provide numerous opportunities for smart insulin pens market size growth during the forecast period. According to International Diabetes Federation, in 2021 approximately 537 million adults (20-79 years) are living with diabetes. The total number of people living with diabetes is projected to rise to 643 million by 2030 and 783 million by 2045. About 3 in 4 adults with diabetes live in low and middle-income countries. Almost 1 in 2 (240 million) adults living with diabetes are undiagnosed. Diabetes caused 6.7 million deaths and more than 1.2 million children and adolescents (0-19 years) are living with type 1 diabetes whereas 1 in 6 live births (21 million) are affected by diabetes during pregnancy and around 541 million adults are at increased risk of developing type 2 diabetes.

Smart Insulin Pens Market Segmentation

The smart insulin pens market is segmented into By Type, Usability, End User and Region. By type, the market is categorized into first generation pens and second-generation pens. By usability, the market is categorized into pre-filled and reusable. By end user, the market is categorized into hospitals & clinics, ambulatory surgical centers, and home care settings.Regionwise, the market is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, UK, and Rest of Europe), Asia-Pacific (China, Japan, Australia, India, South Korea, and Rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and Rest of LAMEA).

Segment review

Depending on type, the first-generation pens segment dominated the market in 2020, and this trend is expected to continue during the forecast period, owing to advancements in R&D activities in the healthcare sector and increase in diabetic population. The global first-generation smart insulin pens market was valued at $60.2 million in 2020, and is projected to reach $174.8 million by 2030, growing at a CAGR of 11.2% from 2021 to 2030. In addition, rise in awareness among people regarding the new and advanced methods for insulin delivery is also expected to boost the market growth. Second generation pens segment is expected to exhibit the fastest growth rate during the forecast period owing to increase in geriatric population and rise in the number of new product launches.

By Type

The first-generation pens segment dominated the market in 2020 and this trend is expected to continue during the forecast period.

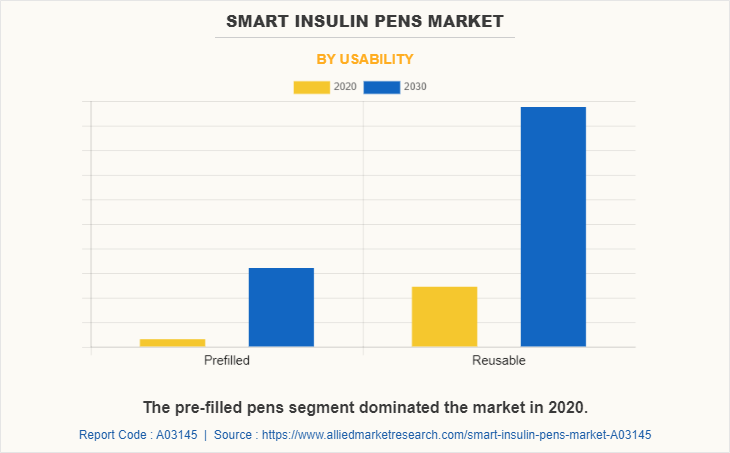

Depending on usability, the reusable pens segment dominated the market in 2020, reusable smart insulin pens are featured with memory and timing function that provides intelligent injection for patients and this trend is expected to continue during the forecast period. The global pre-filled smart insulin pens market was valued at $25.8 million in 2020, and is projected to reach $83.7 million by 2030, growing at a CAGR of 12.7% from 2021 to 2030. Prefilled segment is expected to exhibit the fastest growth rate during the forecast period owing to rise in awareness among people regarding the new and advanced methods for insulin delivery.

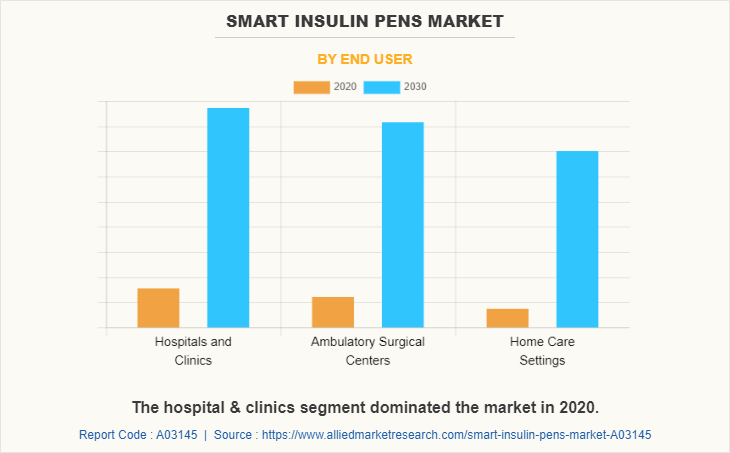

By end user, the hospital & clinics segment dominated the market in 2020. Generally, hospitals are well equipped with diabetes management products to accommodate to the various patients with type 1 and type 2 diabetes. Hospitals and clinics have skilled professionals and staff, which facilitates the delivery of insulin, enhance patient safety, increase patient comfort, and improve blood sugar. The global smart insulin pens market for hospital & clinics was valued at $35.5 million in 2020, and is projected to reach $107.3 million by 2030, growing at a CAGR of 11.7% from 2021 to 2030. Home care settings segment is expected to exhibit the fastest growth rate of CAGR 12.7% during the forecast period owing to increase in the number of home care settings that increase the demand for smart insulin pens.

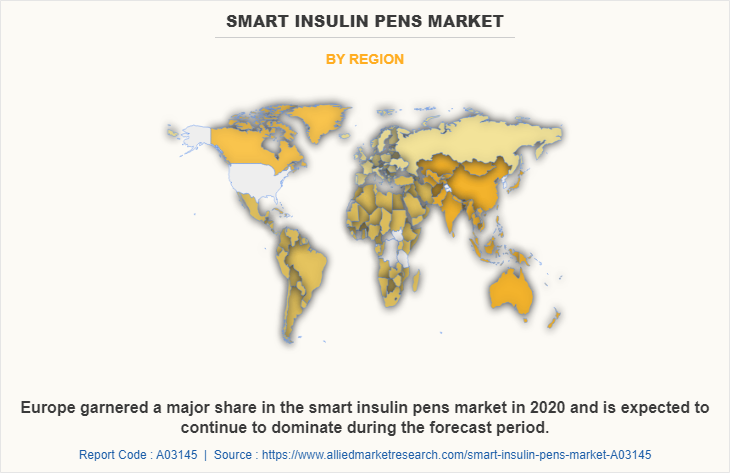

By region, Europe garnered a major share in the smart insulin pens market in 2020, and is expected to continue to dominate during the forecast period, due to increase in incidence of diabetic patients, presence of key players, and development in R&D activities in healthcare sector in the region. Europe was the highest contributor to the global market with $38.9 million in 2020, and is projected to reach $119.2 million by 2030, registering a CAGR of 11.8%. Asia-Pacific smart insulin pens market is estimated to reach $52 million by 2030 growing at a CAGR of 11.4%. However, LAMEA is expected to register fastest growth rate with CAGR of 13.4% from 2021 to 2030, owing to surge in demand for smart insulin delivery products, increase in the number of advanced healthcare facilities.

The key players that operate in the smart insulin pens market include Berlin-Chemie, Bigfoot Biomedical, Digital Medics Pty Ltd., Eli Lilly and Company, Emperra GmbH, Jiangsu Deflu Medical Device Co. Ltd., Medtronic PLC, Novo Nordisk, Pendiq, and Sanofi.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the smart insulin pens market analysis from 2020 to 2030 to identify the prevailing smart insulin pens market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the smart insulin pens market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global smart insulin pens market trends, key players, market segments, application areas, and market growth strategies.

Smart Insulin Pens Market Report Highlights

| Aspects | Details |

| By End User |

|

| By Type |

|

| By Usability |

|

| By Region |

|

| Key Market Players | Digital Medics Pty Ltd., Jiangsu Deflu Medical Device Co. Ltd., Berlin-Chemie, Medtronic plc, Pendiq, Eli Lilly and Company, Novo Nordisk, Bigfoot Biomedical, Sanofi, Emperra GmbH |

Analyst Review

According to the analyst perspectives, the adoption of needle free injection system is expected to increase in near future due to surge in the incidence of diabetics, low cost of insulin pens as compared to insulin pumps, and less injection pain caused than syringes. In addition, benefit of smart insulin pens is that it can be easily used by people with visual or motor skills impairments, which further fuels the market growth. However, dearth of trained personnel and limitation in usage for intravenous administration are expected to hamper the market growth. As per the analyst perspectives, the use of these devices is the highest in Europe, owing to heavy expenditure by the government on healthcare. It is followed by North America and Asia-Pacific, respectively.

The total market value of smart insulin pens market is $298.9 million in 2030.

The market value of smart insulin pens market in 2020 is $94.8 million.

The advancements in R&D activities in the healthcare sector, increase in diabetic population, advancements in the smart insulin pens products and the launch of new products are the key trends in the smart insulin pens market report.

Yes, the smart insulin pens market companies are profiled in the report.

Yes, the smart insulin pens market report provides PORTER Analysis

Loading Table Of Content...