Smart Manufacturing Market Size & Insights:

The global smart manufacturing market size was valued at USD 249.5 billion in 2021, and is projected to reach USD 860 billion by 2031, growing at a CAGR of 13.7% from 2022 to 2031.

The increasing demand for automation is one of the key drivers of the smart manufacturing market growth. Automation refers to the use of technology to perform tasks that were previously done manually by humans. With the growing need for efficiency, productivity, and cost savings, there is a growing demand for automation in manufacturing. Automation also reduces the risk of human error, improves safety, and enables round-the-clock production. This can help manufacturers to reduce costs, increase productivity, and improve the quality of their products. Furthermore, automation is also driving the development of new business models, such as "lights out" manufacturing, where production runs with minimal human intervention. This enables manufacturers to reduce labor costs, increase efficiency, and improve flexibility, which is particularly important in industries with rapidly changing demand.

Smart manufacturing technologies such as robotics, artificial intelligence, and machine learning enable automation, reducing the need for manual labor and improving production efficiency. For example, robots can perform repetitive tasks with greater accuracy and speed, while artificial intelligence and machine learning can analyze data to optimize production processes and identify areas for improvement.

Smart manufacturing technologies frequently necessitate significant investments in hardware, software, and infrastructure. Smaller manufacturers cannot have the resources to invest in such technologies, which can be a barrier. Smart manufacturing technologies require skilled workers to design, implement, and maintain them. However, there is a shortage of workers with the necessary skills and experience to work with smart manufacturing technologies. This can make it difficult for manufacturers to adopt and fully leverage smart manufacturing solutions.

The information technology industry is at the forefront of the market's existence and development. As a result of the widespread standardization and the recent implementation of the internet of things, the smart manufacturing market has become more standardized. (IoT). The Internet of Things has standardized entry-level manufacturing, application, and implementation of market technology around the world. To meet modern challenges and demands, the information technology industry employs augmented reality, virtual reality, machine learning, artificial intelligence, and a variety of other modern solutions. The Industrial Internet of Things (IIoT) enables machines, equipment, and products to be connected to each other and to the internet, allowing for real-time monitoring and control. This provides manufacturers with unprecedented visibility and control over their production processes, improving efficiency, reducing downtime, and enhancing product quality.

The key players profiled in this report include ABB Ltd., Siemens, General Electric, Rockwell Automation Inc., Schneider Electric, Honeywell International Inc., Emerson Electric Co., Fanuc UK Limited, Fujitsu Global, and IBM.

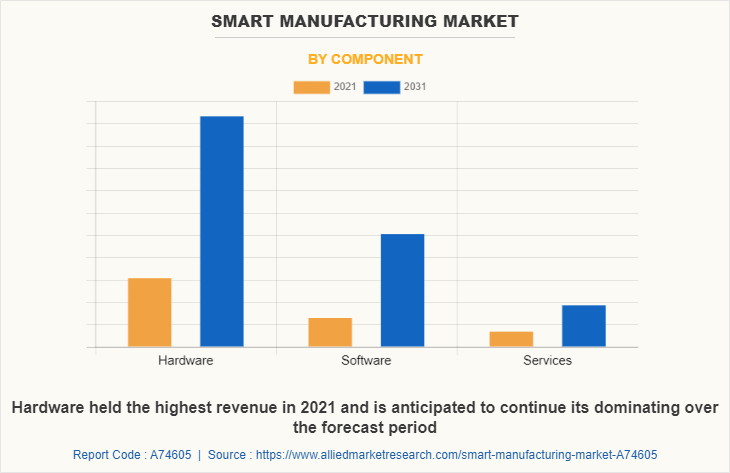

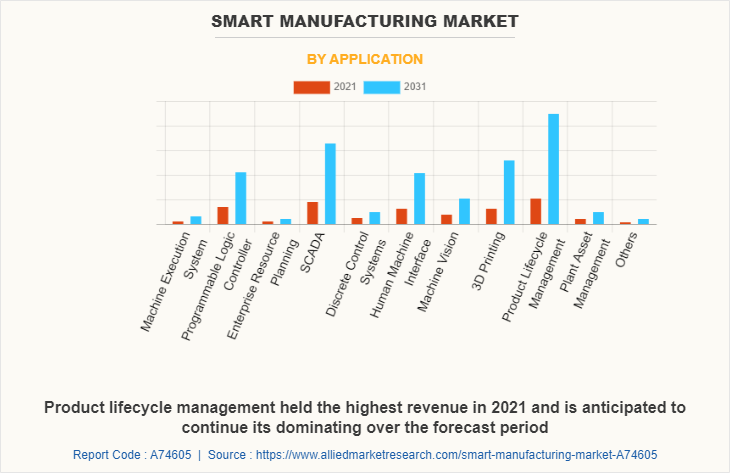

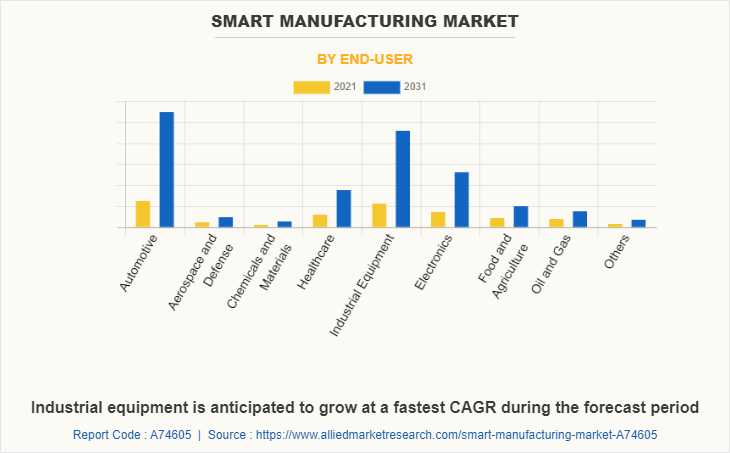

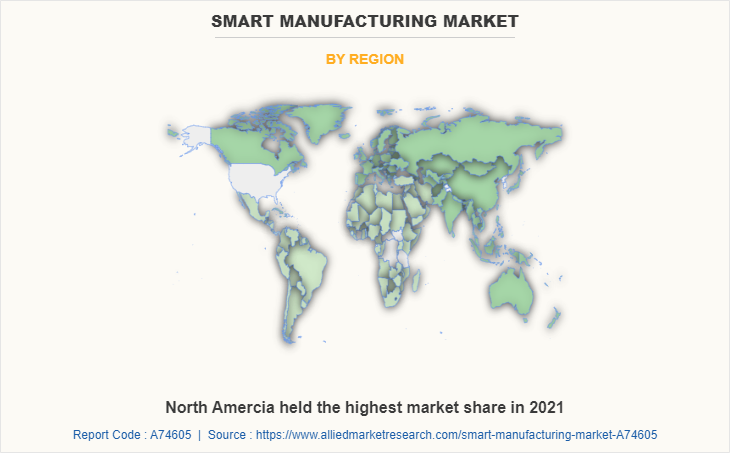

The global smart manufacturing market is segmented on the basis of component, application, end-user, and region. By component, the market is sub-segmented into hardware, software, and services. By application, the market is sub-segmented into machine execution system, programmable logic controller, enterprise resource planning, Scada, discrete control systems, human machine interface, machine vision, 3D printing, product lifecycle management, plant asset management, and others. By end-use, the market is classified into automotive, aerospace & defense, chemicals & materials, healthcare, industrial equipment, electronics, food & agriculture, oil & gas, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By component, the hardware sub-segment dominated the market in 2021. The hardware sub-segment of the smart manufacturing market includes a wide range of devices and equipment used in manufacturing operations, such as sensors, controllers, robots, and 3D printers. These hardware components form the backbone of the smart manufacturing ecosystem, providing the necessary data collection, automation, and control capabilities. Sensors are a key component of the hardware segment, providing real-time data on everything from temperature and pressure to motion and vibration. This data is used to monitor and optimize manufacturing processes, identify inefficiencies, and improve product quality. Controllers, such as programmable logic controllers (PLCs) and distributed control systems (DCS), are used to automate and control manufacturing processes, ensuring consistent and efficient operation. These are predicted to be the major factors affecting the smart manufacturing market size during the forecast period too.

By application, the product lifecycle management sub-segment dominated the global smart manufacturing market share in 2021. The product lifecycle management (PLM) segment of the market includes software solutions used to manage all aspects of a product's lifecycle, from design and engineering to manufacturing, service, and end-of-life disposal. PLM software enables collaboration between different departments and stakeholders involved in the product lifecycle, ensuring that all aspects of the product development process are seamlessly integrated and optimized. PLM is a growing category due to consumer demand for better product quality and faster time to market. Smart manufacturing technologies can aid in the more rapid and effective design and development of products while also guaranteeing that they adhere to high quality standards. Smart manufacturing can assist producers in remaining competitive in today's fast-paced business environment by streamlining the product development process and lowering the time needed to bring a product to market.

By end-user, the automotive sub-segment hold the largest market share in 2021. The automotive segment is one of the largest and most significant segments of the smart manufacturing market forecast period. The automotive industry is highly competitive and constantly evolving, with manufacturers seeking to improve efficiency, reduce costs, and enhance product quality. Robotics and automation are being used extensively in the automotive industry to improve efficiency, reduce labor costs, and enhance safety. Robots are being used to perform tasks such as welding, painting, and assembly, while automated guided vehicles (AGVs) are being used to transport materials and components around the factory floor.

By region, Asia-Pacific dominated the global smart manufacturing industry in 2021 and is projected to remain the fastest-growing sub-segment during the forecast period. Asia-Pacific is a hub for innovation and technological advancements, with many companies investing heavily in R&D. This has led to the development of cutting-edge smart manufacturing technologies, such as the Internet of Things (IoT), artificial intelligence (AI), and robotics, among others. As smart manufacturing systems become more connected and digital, there is a growing need for cybersecurity solutions to protect against cyber threats. There is an opportunity for companies to develop innovative solutions that can provide robust cybersecurity protection for smart manufacturing systems.

Key Benefits for Stakeholders:

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the smart manufacturing market analysis from 2021 to 2031 to identify the prevailing market opportunities.

- The smart manufacturing market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the market segmentation assists to determine the prevailing smart manufacturing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global smart manufacturing market trends, key players, market segments, application areas, and market growth strategies.

Smart Manufacturing Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 860 billion |

| Growth Rate | CAGR of 13.7% |

| Forecast period | 2021 - 2031 |

| Report Pages | 280 |

| By Component |

|

| By Application |

|

| By End-User |

|

| By Region |

|

| Key Market Players | Siemens, IBM, ABB Ltd., Faststream Technologies, fanuc uk, General Electric, HONEYWELL INTERNATIONAL, Emerson Electric, Rockwell Automation, Schneider Electric, Fujitsu Global |

Analyst Review

The major trend in the smart manufacturing market is the increasing adoption of Industry 4.0 technologies, such as the Internet of Things (IoT), artificial intelligence (AI), and big data analytics. These technologies are enabling manufacturers to improve efficiency, reduce costs, and enhance product quality by connecting and analyzing data from machines, sensors, and other devices.

However, the high initial investment needed to implement smart manufacturing technologies is one of the main barriers to adoption. IoT sensors, automation, and big data analytics are examples of smart manufacturing technologies that demand hefty infrastructure, software, and hardware investments.

The future of the smart manufacturing market looks promising, as businesses continue to invest in new technologies and processes to improve efficiency, reduce costs, and enhance product quality for key players to maintain the pace of the smart manufacturing market in the upcoming years.

Among the analyzed regions, North America is expected to account for the highest revenue in the market by the end of 2031, followed by Asia-Pacific, Europe, and LAMEA. Globally, governments are promoting the use of smart manufacturing technology through programs such as funding, tax incentives, and regulatory assistance for market players in North America and Asia-Pacific in the global smart manufacturing market.

The global smart manufacturing market is expected to grow at a compound annual growth rate (CAGR) of 13.7% from 2022-2031 to reach USD 860 billion by 2031

The global smart manufacturing market size was valued at USD 249.5 billion in 2021, and is projected to reach USD 860 billion by 2031

Major key players in the smart manufacturing market research report include ABB Ltd., Siemens, General Electric, Rockwell Automation Inc., Schneider Electric, Honeywell International Inc., Emerson Electric Co., Fanuc UK Limited, Fujitsu Global, and IBM.

The increasing demand for automation is one of the key drivers of the smart manufacturing market growth.

Asia-Pacific is expected to witness significant growth during the forecast period

Loading Table Of Content...

Loading Research Methodology...