Smart Meter Data Management Market Statistics, 2030

The global smart meter data management market size was valued at $1.1 billion in 2020, and is projected to reach $5.2 billion by 2030, growing at a CAGR of 17.23% from 2021 to 2030.

Increase in energy demand, government mandates, and legislative compliances toward smart metering, and rise in need for improved customer service level & utility efficiency boost the global smart meter data management market growth. In addition, rise in investments in smart grid projects and increase in upgradation of transmission and distribution infrastructure and government policies toward deployment of smart grids and smart meters in emerging countries positively impact the growth of the market. However, various data management issues, such as data distribution and replication, transactions models, query processing, and location-based services are some of the major factors that hamper the growth of the market.

On the contrary, significant increase in meter data volume, resulting from the collection of interval data, prompts utilities to employ next-generation meter data management applications, which is anticipated to provide numerous opportunities for the market expansion. In addition, rise in adoption of machine learning and AI in smart meter data management improves operational planning, reduces peak demand, increases energy saving, and delivers new revenue stream for organizations. Thus, all these factors collectively are expected to provide potential growth opportunities for the market during the forecast period.

Smart meter data management is a software, which is used to validate, store, and make pre-processed meter data available for upstreaming the business application. In addition, smart meter is used by various key vendors for different purposes, which include helping organizations to manage their revenue by improving the meter quality & billing quality, providing accurate bill to end users, and helping consumers to improve their energy efficiency. The smart meter management system offers various advantages over the traditional metering system, including detection of energy theft, estimate meter readings, and better overall energy efficiency.

Segment Review

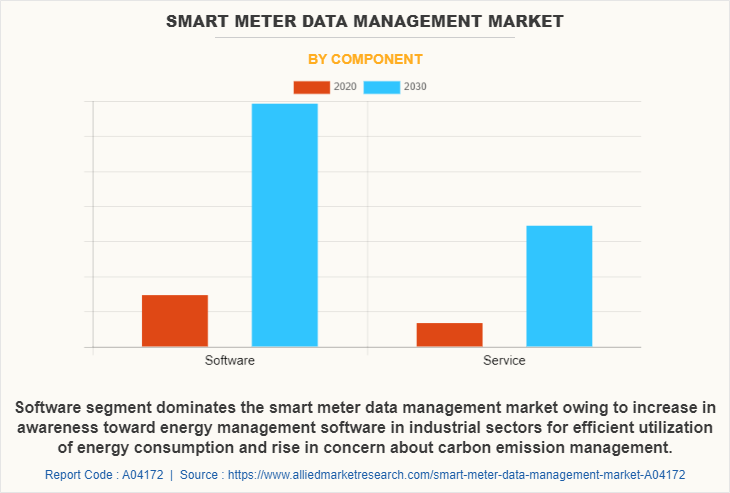

The smart meter data management market size is segmented into component, deployment model, application, and region. In terms of component, the market is fragmented into software and services. The software segment is further segmented into meter data management system (MDMS), meter data analytics (MDA), and communication software. Depending on deployment model, the market is bifurcated into on-premise and cloud. On the basis of application, the market is fragmented into electric meters, gas meters, and water meters. Region-wise, the market is analysed across North America, Europe, Asia-Pacific, and LAMEA.

The key players profiled in the smart meter data management market analysis are ABB Ltd., Aclara Technologies LLC, Arad Groul, Eaton Corporation, ElectSolve Technology Solutions & Services, Inc., Hansen Technologies Ltd. (Enoro Holding A/S), Honeywell International Inc. (Elster Group GmbH), Itron Inc., Landis+Gyr., Oracle Corporation, Siemens AG, and Trilliant Holdings, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the smart meter data management industry.

The report focuses on growth prospects, restraints, and trends of the smart meter data management market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the smart meter data management industry.

By component, the smart meter data management market share was led by the software segment in 2020, and is projected to maintain its dominance during the forecast period. This is attributed to increase in awareness toward energy management software in industrial sectors for efficient utilization of energy consumption and rise in alertness about carbon emission management. However, the service segment is expected to grow at the highest rate during the forecast period, owing to surge in adoption of consulting, integration, and implementation services in the utility & energy sector to reduce cost and improve productivity.

Top Impacting Factors

Rise in Adoption of Advanced Metering Infrastructure Technologies

Numerous benefits provided by the advanced metering technology, such as ability to detect outages and facilitation of real-time energy consumption patterns for end users fuel the adoption of advanced meter infrastructure (AMI) technology. Moreover, increase in energy demand, government mandates, and legislative compliances toward smart metering, and rise in need for improved customer service level and utility efficiency boost the market growth.

High Installation Costs of Smart Meters

Multiple components are associated with the deployment of smart meters, including a handheld device, communication network, MDMS, MDA, and other software. Furthermore, services related to smart meter deployments, such as consulting, maintenance, installation, integration, and upgradation incur additional costs, which considerably hampers the deployment of smart meter data management software. Moreover, challenges associated with traditional and advanced system integrations among many organizations have speculated the growth of the market, especially among SMEs. In addition, shun of cost factor required to implement big data initiatives and analytical models is a major factor expected to hinder the market growth to a certain extent.

Increase in Volume of Meter Data

Significant increase in meter data volume, resulting from the collection of interval data, prompts utilities to employ next-generation meter data management applications, which is anticipated to provide numerous opportunities for the market expansion. For instance, according to a report from the Edison Foundation published in 2018, the U.S. alone logs around one million of data points every day from more than 46 million installed smart meters. In addition, rise in deployment of smart meters at the residential customer’s level is expected to increase the generation of data volume, from monthly or annual frequency to daily and even intraday resolution, which generates the need for meter data management system.

COVID-19 Impact Analysis

Various countries across the globe halted the implementation of smart meters and smart cities projects due to alarming rise in COVID-positive patients, which, in turn, hampered the growth of the market. In addition, a number of governing bodies across the globe are taking initiatives to stop the spread of the COVID-19 virus by initiating various policies. However, surge in adoption of smart meters across the globe to provide smart billing systems and real-time updates on faulty meter drive the growth of the market in the pandemic situation. For instance, according to a research report published by SMS PLC in June 2020, during the COVID-19 lockdown period, around 21.5 million smart meters where deployed in the Great Britain by 2020. Thus, to manage large volume of data generated from these meters, the Government of Britain adopted smart meter data management software, which provides lucrative opportunity for the market.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the smart meter data management market analysis from 2020 to 2030 to identify the prevailing smart meter data management market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the smart meter data management market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global mart meter data management market forecast.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global smart meter data management market trends, key players, market segments, application areas, and market growth strategies.

Smart Meter Data Management Market Report Highlights

| Aspects | Details |

| By Component |

|

| By Application |

|

| By Deployment Mode |

|

| By Region |

|

| Key Market Players | Itron Inc., ABB Ltd., Eaton, Siemens AG, Oracle Corporation, ElectSolve Technology Solutions & Services, Inc., Aclara Technologies LLC, Honeywell International Inc., Hansen Technologies, Trilliant Holdings, Inc., Arad Group, Landis + Gyr |

Analyst Review

The adoption of smart meter data management software has increased over the time, to provide utility companies real-time consumer energy usage data for improving the management of grid networks. In addition, smart meter data management software helps utilities companies to improve their energy consumption, provide accurate billing to consumers, and improve their revenue collection methods. Furthermore, key vendors are launching products related to smart meter data management with increase in the demand for energy-efficient meters across the U.S. In addition, companies use smart grids or advanced metering infrastructure (AMI), a type of smart meter data management software, which plays a vital role to improve operation efficiency by reducing the need to manually operate the meter, improve grid reliability from better outage detection, and reduce peak demand time.

Furthermore, increase in economic strength of developing nations such as China, India, Indonesia, and Thailand is expected to provide lucrative opportunities for the market growth. North America is expected to dominate the market during the forecast period. Moreover, emerging countries in Asia-Pacific and Latin America are projected to offer significant growth opportunities during the forecast period. Global players are further focusing on product development and increasing their geographical presence, owing to increase in competition among local vendors in terms of features, quality, and price. In addition, these players adopt various business strategies to enhance their product offerings and strengthen their foothold in the market. For instance, in August 2020, Aclara introduced new meter series, which offers three variants that allow the UK utilities to further automate the management of their meter assets at a total lower cost of ownership.

Some of the key players profiled in the report include ABB Ltd., Aclara Technologies LLC, Arad Groul, Eaton Corporation, ElectSolve Technology Solutions & Services, Inc., Hansen Technologies Ltd. (Enoro Holding A/S), Honeywell International Inc. (Elster Group GmbH), Itron Inc., Landis+Gyr., Oracle Corporation, Siemens AG, and Trilliant Holdings, Inc. These players adopt various strategies to increase their market penetration and strengthen their position in the industry.

Surge in adoption of smart meters across the globe and increase in adoption of advanced metering infrastructure technologies significantly boosts the growth of the global smart meter data management market.

On the basis of application, the market is fragmented into electric meters, gas meters, and water meters.

Asia-Pacific is the largest regional market for Smart Meter Data Management

The global Smart Meter Data Management market was valued at $1,065.38 million in 2020, and is projected to reach $5,185.56 million by 2030, registering a CAGR of 17.23% from 2021 to 2030.

The key players profiled in the smart meter data management market analysis are ABB Ltd., Aclara Technologies LLC, Arad Groul, Eaton Corporation, ElectSolve Technology Solutions & Services, Inc., Hansen Technologies Ltd. (Enoro Holding A/S), Honeywell International Inc. (Elster Group GmbH), Itron Inc., Landis+Gyr., Oracle Corporation, Siemens AG, and Trilliant Holdings, Inc. These players adopt various strategies to increase their market penetration and strengthen their position in the industry.

Loading Table Of Content...