Smart Polymers Market Research, 2033

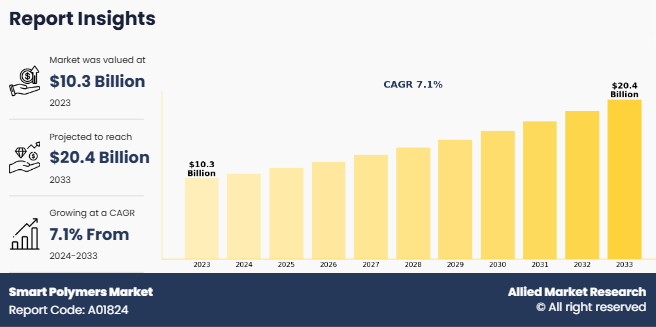

The global smart polymers market was valued at $10.3 billion in 2023, and is projected to reach $20.4 billion by 2033, growing at a CAGR of 7.1% from 2024 to 2033.

Introduction

Smart polymers, or stimuli-responsive polymers, are innovative materials that exhibit significant and reversible changes in their physical or chemical properties when exposed to specific external stimuli. These triggers can include variations in temperature, pH levels, light, magnetic or electric fields, and chemical agents. Their dynamic responsiveness to environmental changes makes smart polymers exceptionally versatile and suitable for diverse applications. Structurally, smart polymers are composed of macromolecules with functional groups that interact with stimuli, leading to transformations in their shape, solubility, conductivity, or other characteristics. These materials are designed with precision to harness predictable and repeatable responses, which makes them ideal for advanced technological, biomedical, and industrial applications.

Smart polymers have become integral to the biomedical field due to their biocompatibility, adaptability to stimuli, and ability to replicate biological functions. These advanced materials play a pivotal role in drug delivery systems, tissue engineering, and diagnostics. In controlled drug delivery, smart polymers respond to specific triggers like pH or temperature changes to release medication precisely where needed. For example, pH-sensitive polymers target the acidic environments of tumors or the stomach. Thermo-responsive polymers, such as poly(N-isopropylacrylamide) (PNIPAAm), are widely used in tissue engineering scaffolds. These scaffolds support cell adhesion and growth at body temperature but dissolve or detach at lower temperatures, enabling non-invasive removal.

Key Takeaways

- The smart polymers market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global smart polymers markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The key players in the smart polymers market are Arkema, BASF, Merck KGaA, Evonik, Solvay, The Lubrizol Corporation., Nouryon, Spintech Holdings Inc, SMP Technologies Inc, and Dow. They have adopted strategies such as acquisition, product launch, merger, and expansion to gain an edge in the market.

Market Dynamics

Increase in demand for biomedical applications is expected to drive the growth of the market. The growing demand for smart polymers in biomedical applications is driven by their exceptional ability to respond to specific stimuli, including temperature, pH, light, and biological signals. These polymers have found extensive use in drug delivery systems, where their stimuli-responsive nature enables the precise and controlled release of therapeutic agents. For instance, temperature-sensitive polymers can release drugs at a target site when the local temperature changes, ensuring maximum efficacy and minimizing side effects. This characteristic is particularly valuable in cancer treatments, where targeted delivery to tumor sites is critical.

In tissue engineering, smart polymers serve as essential scaffolding materials, replicating the structure and function of the extracellular matrix. Their adaptability allows them to support cell growth, proliferation, and differentiation in response to environmental cues. Furthermore, pH-responsive polymers can provide controlled degradation, releasing nutrients or bioactive molecules to support tissue regeneration. These features make them indispensable in developing advanced biomaterials for regenerative medicine and complex wound healing solutions. In September 2023, MIMEDX Group Inc. expanded its advanced wound care product portfolio with the launch of EPIEFFECT. This innovative product is a lyophilized allograft derived from human placental tissue, incorporating both amnion and chorion membranes.

However, high cost of smart polymers production is expected to hamper the growth of the market. The high cost of production is a significant barrier to the widespread adoption of smart polymers. Manufacturing these advanced materials typically involves intricate processes and the use of specialized raw materials, which increase their overall cost. Unlike traditional polymers, the synthesis of smart polymers often requires precision techniques such as controlled polymerization, functionalization, or incorporation of stimuli-responsive elements. These methods demand sophisticated equipment and expert knowledge, further increasing production expenses. Another factor contributing to the high cost is the scale of production. Many smart polymers are still in the research and development stage, with limited large-scale manufacturing capabilities. Small batch production results in higher unit costs, making these materials less accessible for industries that require cost-effective solutions. Scaling up the manufacturing process while ensuring consistent performance and high-quality polymers presents a significant challenge, which further increases the associated costs.

Segments Overview

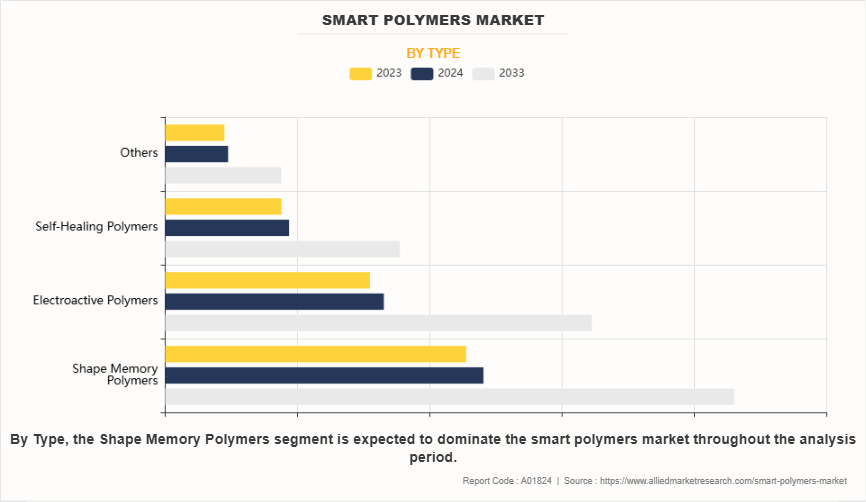

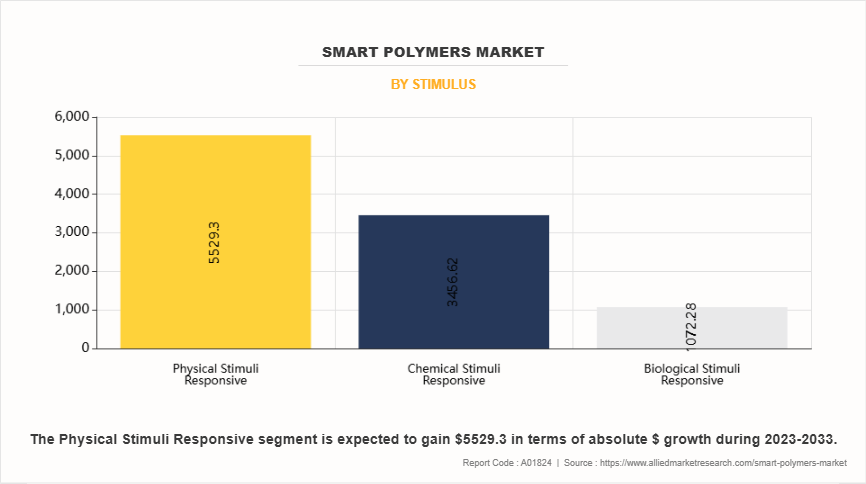

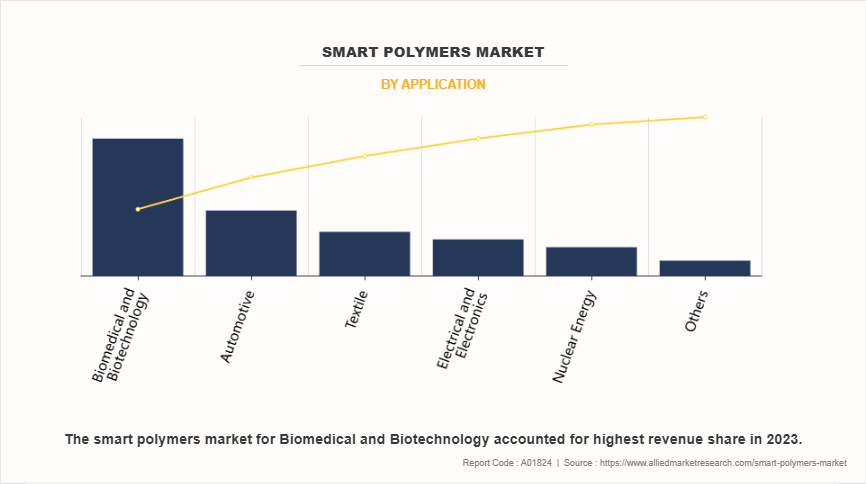

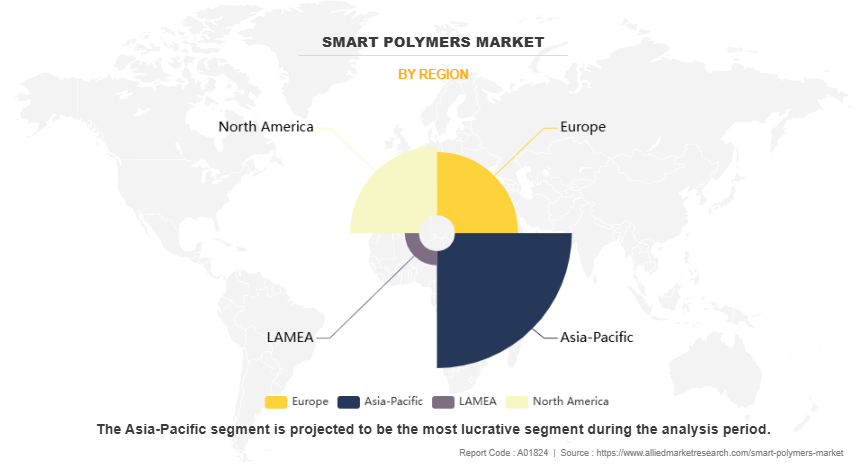

The smart polymers market is segmented into type, stimulus, application, and region. On the basis of type, the market is divided into shape memory polymers, electroactive polymers, self-healing polymers, and others. On the basis of stimulus, the market is categorized into physical stimuli responsive, chemical stimuli responsive, and biological stimuli responsive. On the basis of application, the market is classified into biomedical & biotechnology, textile, electrical & electronics, automotive, nuclear energy, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By type, the shape memory polymers segment dominated the smart polymers market growing with the CAGR of 6.7% during the forecast period. Shape Memory Polymers (SMPs) are a class of smart polymers capable of undergoing significant and reversible shape changes in response to external stimuli such as temperature, light, pH, or electric and magnetic fields. This unique property makes SMPs highly versatile and adaptable for a variety of applications. In the biomedical field, SMPs have garnered significant attention for applications such as self-expanding stents, sutures, and drug delivery systems. For instance, SMPs can be compressed into a compact shape for minimally invasive insertion into the body and then triggered to expand to their functional shape at body temperature. This feature minimizes surgical trauma and enhances patient recovery.

On the basis of stimulus, physical stimuli responsive segment was the highest revenue contributor in the smart polymers market in 2023. Smart polymers are advanced materials that exhibit a change in their physical or chemical properties in response to external stimuli. Temperature-Responsive Smart Polymers are among the most studied types in this category. These polymers undergo phase transitions at specific temperatures, typically characterized by their lower critical solution temperature (LCST) or upper critical solution temperature (UCST). For instance, poly(N-isopropylacrylamide) (PNIPAAm) exhibits a sharp transition from hydrophilic to hydrophobic around its LCST, making it useful in drug delivery systems, tissue engineering, and controlled-release applications.

By application, biomedical and biotechnology segment dominated the smart polymers market representing the CAGR of 6.5% in 2023. In the biomedical sector, smart polymers play a crucial role in drug delivery systems. Thermoresponsive polymers, for instance, enable controlled drug release by responding to temperature changes. These polymers remain stable at physiological temperatures but undergo phase transitions at higher temperatures, ensuring targeted delivery to diseased tissues while minimizing side effects. Additionally, pH-responsive polymers are utilized for site-specific drug release in acidic environments, such as tumors or inflamed tissues.

Region-wise, Asia-Pacific dominated the smart polymers market representing the CAGR of 7.4% during the forecast period. In Asia-Pacific countries, countries like Japan, China, and South Korea are leading in the development of healthcare technologies, leveraging smart polymers for drug delivery systems, tissue engineering, and biosensors. These polymers respond to specific stimuli, such as pH, temperature, or light, enabling precise drug release and enhanced patient outcomes. For instance, Japan’s robust pharmaceutical industry has adopted thermo-responsive polymers for controlled drug delivery, while South Korea is investing in research on biodegradable smart polymers for regenerative medicine.

Competitive Analysis

Key players in the smart polymers industry include Arkema, BASF, Merck KGaA, Evonik, Solvay, The Lubrizol Corporation., Nouryon, Spintech Holdings Inc., SMP Technologies Inc., and Dow. These players have adopted several strategies to make their market position strong.

BASF SE is a diversified global company offering innovative solutions across multiple industries. Its expansive portfolio includes chemicals, performance products, functional materials and solutions, agricultural solutions, and oil and gas. BASF's offerings range from petrochemicals, intermediates, and industrial gases to plastics, coatings, and crop protection products.

The Lubrizol Corporation, a Berkshire Hathaway subsidiary, is a global leader in specialty chemicals. It focuses on developing advanced additives, ingredients, and technologies that enhance product performance across transportation, industrial, and consumer markets.

Smart Polymers Industry News:

· In May 2024, Kydex, a thermoplastic brand originally developed for aircraft interiors and now produced by Sekisui Kydex, LLC, partnered with Kasiglas to develop a transparent aviation polymer. This advanced, scratch-resistant polymer technology is designed for specialized applications, such as decorative panels or accent features in aircraft cabins.

· In November 2022, DuPont successfully finalized the sale of most of its former mobility & materials segment to Celanese, securing a cash deal valued at $11 billion.

· In August 2022, Nouryon obtained a U.S. patent for its innovative LumaTreat product line. These smart-tagged polymers feature fluorescent monomers that attach to deposit control agents, enhancing their functionality.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the smart polymers market analysis from 2023 to 2033 to identify the prevailing smart polymers market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the smart polymers market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global smart polymers market trends, key players, market segments, application areas, and market growth strategies.

Smart Polymers Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 20.4 billion |

| Growth Rate | CAGR of 7.1% |

| Forecast period | 2023 - 2033 |

| Report Pages | 300 |

| By Application |

|

| By Type |

|

| By Stimulus |

|

| By Region |

|

| Key Market Players | Merck KGaA, Basf, Dow, Arkema, Nouryon, The Lubrizol Corporation., Spintech Holdings Inc, Evonik, Solvay, SMP Technologies Inc |

Analyst Review

Increase in demand for personalized medicine is expected to drive the growth of the smart polymers market during the forecast period. Rise in demand for personalized medicine has significantly boosted the adoption of smart polymers, especially in the field of drug delivery systems. Personalized medicine focuses on tailoring medical treatments to individual patients based on their unique genetic, environmental, and lifestyle factors. This approach requires advanced materials capable of delivering drugs precisely and effectively, minimizing side effects while maximizing therapeutic outcomes. Smart polymers, with their ability to respond to external stimuli such as pH, temperature, and specific biomolecules, are ideally suited for this purpose.

One of the key applications of smart polymers in personalized medicine is their use in controlled drug release. These polymers can be engineered to release medication at specific rates, locations, or in response to certain conditions in the body. For instance, pH-sensitive smart polymers can deliver drugs in targeted areas of the gastrointestinal tract, while temperature-responsive polymers can release therapeutic agents in response to localized changes in body heat, such as inflammation or infection. This level of precision ensures that patients receive the right dosage at the right time, enhancing the effectiveness of treatment while reducing risks of overdose or underdose.

However, complexity in processing of smart polymers is expected to drive the growth of smart polymers market during the forecast period. The complexity in processing smart polymers is a significant challenge that limits their widespread adoption across industries. Smart polymers, due to their unique ability to respond to specific stimuli such as temperature, pH, light, or pressure, possess specialized molecular structures and behaviors. These characteristics, while beneficial for their functionality, demand precise and controlled processing conditions to maintain their desired properties. One major aspect of this complexity is the sensitivity of smart polymers to external factors during manufacturing. Minor variations in temperature, humidity, or chemical environment can alter their responsiveness or degrade their functionality. For instance, shape-memory polymers must be carefully processed to ensure they retain their programmed configurations, while pH-sensitive polymers require stringent pH control during synthesis to maintain their sensitivity.

Key players in the smart polymers industry include Arkema, BASF, Merck KGaA, Evonik, Solvay, The Lubrizol Corporation., Nouryon, Spintech Holdings Inc., SMP Technologies Inc., and Dow. These players have adopted several strategies to make their market position strong.

The global smart polymers market was valued at $10.3 billion in 2023, and is projected to reach $20.4 billion by 2033, growing at a CAGR of 7.1% from 2024 to 2033.

Asia-Pacific is the largest regional market for smart polymers.

Biomedical and biotechnology is the leading application of smart polymers market.

Advances in smart packaging are the upcoming trends of smart polymers market.

Loading Table Of Content...

Loading Research Methodology...