Smart Space Market Insights:

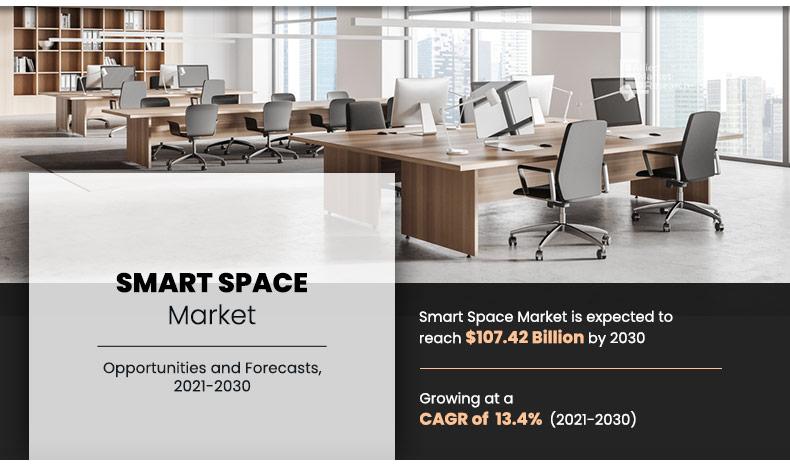

The global smart space market size was valued at USD 30.53 billion in 2020 and is projected to reach USD 107.42 billion by 2030, registering a CAGR of 13.4%.

The global smart space market is influenced by several factors such as proliferation of advanced technologies such as Internet of Things (IoT) and artificial intelligence (AI) drives the growth of the market. In addition, rise in Greenfield projects and increase in environmental concerns across the globe are also expected to boost the market growth. However, high initial capital expenditure required for connected devices & other hardware, and rise in privacy concerns pertaining to information manipulation are expected to impede the market growth during the forecast period. Furthermore, increase in smart city initiatives across all the regions and emergence of 5G technology are expected to provide major growth opportunities for market in upcoming years.

Digital technologies such as Internet of Things (IoT), cloud computing, connected devices, and Artificial Intelligence (AI) are transforming every sector and part of the world. These have changed work life of people in offices, process of production in factories and industries, and daily operations in cities. Smart space is also one of these key technologies, which is bringing innovation and changes across various sectors by creating smart and connected environment. Proliferation of advanced technologies such as internet of things (IoT) and artificial intelligence (AI) drives the growth of the smart space market.

On the basis of component, the hardware segment dominated the smart space market share in 2020, and is expected to maintain its dominance in the upcoming years. This is due to the increased adoption of smart devices in smart homes and buildings, which is the major factor that drives the demand for various hardware in the smart space industry. However, the services segment is expected to witness highest growth rate during the forecast period.

By Component

Services segment is projected as one of the most lucrative segments.

By space type, the smart indoor spaces segment dominated the growth of the smart space market size in 2020, and is expected to maintain its dominance in the upcoming years. Increase in trend of making homes, buildings, and other indoor spaces smarter is the major factor that drives the adoption of smart space platform in this segment. Moreover, a recent report published by the British Council for Offices (BCO) on “Improving Productivity in the Workplace” stated that indoor environments have a significant effect on an actual workplace productivity, which indicates that workplaces need to be smart and modern.

North America dominates the market. Smart space market growth in this region is attributed to several factors such as huge government funding on innovative as well as smart technologies, increased number of IoT devices, and a strong technical base. However, Asia-Pacific is expected to witness highest growth rate during the forecast period, owing to the proliferation of connected systems fueled by the ongoing trend of smart offices and homes in the region along with the government-driven infrastructural projects.

By Region

North America is projected as one of the most significant region.

The report focuses on the growth prospects, restraints, and global smart space market analysis. The study provides Porter’s five forces analysis of the global market forecast to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, the threat of new entrants, threat of substitutes, and bargaining power of buyers on the global smart space market trends.

Segment Review:

The global smart space market is segmented based on component, space type, application, end user, industry vertical, and region. Based on component, the market is divided into hardware, software, and services. Based on space type, it is bifurcated into smart indoor spaces and smart outdoor spaces.

Based on application, it is classified into energy management and optimization, layout & space management, emergency & disaster management, and security management, and others. Depending on end user, smart space market share is segmented into residential and commercial. The commercial segment is further categorized into energy & utility, transportation & logistic, healthcare, education, retail, manufacturing, government, and others. Based on region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Applications

Emergency And Disaster Management segment is projected as one of the most lucrative segments.

Top Impacting Factors:

Rise in the Number of Greenfield Projects

Several developing countries are shifting toward Greenfield strategies to reduce the pressure on more developed cities, as these cities face issues such as increased population and infrastructural constraints. Moreover, Greenfield projects bring integrated smart infrastructure for new buildings, factories, airports, and power plants, which drives the market growth for smart space. The Greenfield project mainly focuses on new infrastructures and buildings; thus, eliminating the need of integrating with any legacy systems, which is also one of the major factors that drives the market growth for smart space.

For instance, South Korea’s Songdo development is one of the Greenfield projects that have highly energy efficient and digital infrastructure. In addition, it also has household waste management system that collects waste directly from homes and takes it to processing centers through network of tunnels for sorting and treatment, which further eliminates the need for garbage trucks.

Rise in Smart Cities Initiatives

Smart space is a digital or physical environment where humans interact with technology enabled systems in connected as well as coordinated and smart ecosystems. The smart spaces environment is a part of other relative concepts such as smart/connected homes, connected factories, and smart cities. The smart cities initiative thus involves the adoption of digital technologies for smart retail, Internet of Things (IoT), smart mobility, smart grid, and others to create a sustainable city.

In addition, it also enhances city operations, businesses, and lifestyle of people, which in turn provides major opportunities to the smart space market. For instance, smart cities initiatives include enhanced connectivity, better security, increased awareness toward infrastructure issues, and other benefits, which thus provide major opportunities for the market growth. Moreover, rise in investment by various governments in smart cities projects is also creating the opportunity for the market. In addition, countries such as India, the U.S., China, Europe, and others, are investing heavily in smart city projects to tackle urban issues.

For instance, the U.S. government is expected to invest approximately $160 million in smart city initiatives in upcoming five years. Also, the Indian government has announced to invest $30 billion in smart city initiatives, out of which 80% of the funds would be expended on area-based development (ABD) and remaining 20% on ICT solutions.

Regional Insights:

North America:

North America leads the smart space market due to high technology adoption and the presence of major smart space solution providers. The region is driven by strong demand for smart offices, smart homes, and intelligent urban infrastructure in the U.S. and Canada. Rapid advancements in IoT, AI, and connected devices are transforming workplaces, cities, and residential spaces. In addition, government initiatives to support smart city projects and the increasing focus on energy-efficient solutions are further propelling the market’s growth in the region.

Europe:

Europe is a prominent market for smart space technologies, largely due to stringent environmental regulations and a growing emphasis on sustainability. Countries like Germany, the UK, and France are investing heavily in smart city projects, smart buildings, and green spaces that utilize intelligent systems for energy management and optimization. The region’s focus on reducing carbon emissions and improving energy efficiency is driving the adoption of smart technologies in both commercial and residential spaces. The integration of AI, IoT, and data analytics into building management systems is a key trend in this region.

Asia-Pacific:

The Asia-Pacific region is experiencing rapid growth in the smart space market, driven by increasing urbanization, the rise of smart city initiatives, and widespread adoption of IoT technologies. Countries like China, Japan, and South Korea are at the forefront, with large-scale investments in smart buildings, intelligent transportation systems, and smart homes. The region’s expanding middle class and growing demand for energy-efficient and sustainable solutions further support market growth. In addition, the rise of 5G networks and the growing reliance on connected devices are boosting the development of smart spaces across the region.

Latin America:

Latin America is an emerging market for smart space solutions, with growing interest in smart city initiatives, particularly in Brazil and Mexico. The region’s push towards urban modernization and the need to improve infrastructure resilience are driving the adoption of smart technologies. However, economic constraints and limited access to advanced technologies pose challenges to widespread implementation. Nonetheless, the increasing demand for smart homes and energy-efficient buildings is gradually contributing to the growth of the smart space market in the region.

Middle East and Africa:

The Middle East and Africa (MEA) region is seeing increasing investments in smart space technologies, particularly in the Gulf Cooperation Council (GCC) countries such as the UAE, Saudi Arabia, and Qatar. These countries are focusing on developing smart cities and intelligent infrastructure as part of their vision to modernize and diversify their economies. The region's adoption of smart building technologies and AI-driven urban solutions is gaining momentum. However, in Africa, the smart space market is still in the early stages of development, with growth opportunities hindered by infrastructure and economic challenges.

Competition Analysis:

Competitive analysis and profiles of the major players in the smart space market such as Cisco Systems, Inc., Eutech Cybernetic Pte. Ltd., Hitachi Vantara Corporation, Huawei Technologies Co., Ltd., International Business Machines Corporation (IBM), Schneider Electric SE, Siemens AG, SmartSpace Software Plc, Spacewell, and others.

Key Benefits for Stakeholders:

- This study includes the global smart space market analysis, trends, and future estimations to determine the imminent investment pockets.

- The report presents information related to key drivers, restraints, and global smart space market opportunity.

- The global smart space market size is quantitatively analyzed from 2020 to 2030 to highlight the financial competency of the industry.

- Porter’s five forces analysis illustrates the potency of buyers & suppliers in global smart space industry.

Smart Space Market Report Highlights

| Aspects | Details |

| By COMPONENT |

|

| By SPACE TYPE |

|

| By APPLICATION |

|

| By END USER |

|

| By Region |

|

| By Key Market Players |

|

Analyst Review

In accordance with the insights by the CXOs of leading companies, the global smart space market is projected to witness prominent growth, especially in Asia-Pacific and Europe regions. Smart space market in Asia-Pacific is growing at a rapid rate and has immense scope for enhancement. Also, there is positive return on investment in the smart space market, as there is a strong opportunity for the improvement of existing infrastructure/buildings. In addition, rise in demand for space management across several industries also offers major opportunities for the market growth. Moreover, the increase in usage of smart connected devices in homes and buildings also drives the growth of the market for smart space. Further, the European region is also expected to exhibit significant growth in the upcoming years as the European cities are set to become SMART. For instance, the European smart space project aims at increasing the innovation capabilities of industrial SMEs by exploiting the potential of intelligent and digital technologies.

Digital technologies such as Internet of Things (IoT), cloud computing, connected devices, and Artificial Intelligence (AI) are transforming every sector globally. They are changing work life of people in offices, manufacturing in factories and industries, daily operations in cities, and several other things. Smart space is also one of these key technologies, which is bringing innovation and changes across various sectors by creating smart and connected environment. The increase in demand for IoT coupled with the rise in environmental concerns are some of the factors contributing toward the growth of the smart space market. For instance, in September 2018, Microsoft announced Azure Digital Twins, which allows the user with the help of the cloud, AI and IoT to create digital replicas of spaces and infrastructure.

Moreover, IBM's cognitive building solutions provides the real estate and facilities management professionals with required tools necessary to reduce operating costs, optimize space, manage usage of energy, and simplify the real estate planning & management.

The global smart space market is consolidated, owing to the presence of several large international and regional vendors. The local vendors find it difficult to compete in terms of quality, safety, features, and price, as the global players are expanding in many regions. Many international players are expected to experience growth during the forecast period by acquiring domestic players who will help increase their market shares by expanding their product portfolios. Majority of the market share is occupied by key players profiled in the report. These include such as Cisco Systems, Inc., Hitachi Vantara Corporation, Huawei Technologies Co., Ltd., International Business Machines Corporation (IBM), Schneider Electric SE, and Siemens AG. However, small players in the market are adopting various strategies to enhance their service offerings, increase their market penetration, and gain competitive advantage over the other players. For instance, in May 2019, Spacewell launched a new service app, “Work Assistant for cleaning”, which is a mobile touchpoint of its Cobundu smart building platform. It supports service providers to deliver activity-based services, based on live IoT-data. Work orders can be created in a variety of ways, for example, through sensor triggers, user feedback, help desk tickets, and service scheduling.

The global smart space market size was valued at USD 30.53 billion in 2020 and is projected to reach USD 107.42 billion by 2030.

The global smart space market is expected to grow at a compound annual growth rate (CAGR) of 13.4% from 2021 to 2030 to reach USD 107.42 billion by 2030.

Major key players operating in the market are Cisco Systems, Inc., Eutech Cybernetic Pte. Ltd., Hitachi Vantara Corporation, Huawei Technologies Co., Ltd., International Business Machines Corporation (IBM), Schneider Electric SE, Siemens AG, SmartSpace Software Plc, Spacewell, and others.

Asia-Pacific is expected to witness the highest growth rate during the forecast period.

Top impacting factors in the market such as the rise in number of greenfield projects & rise in smart cities initiatives.

Loading Table Of Content...