Smart Water Management Market Insights, 2031

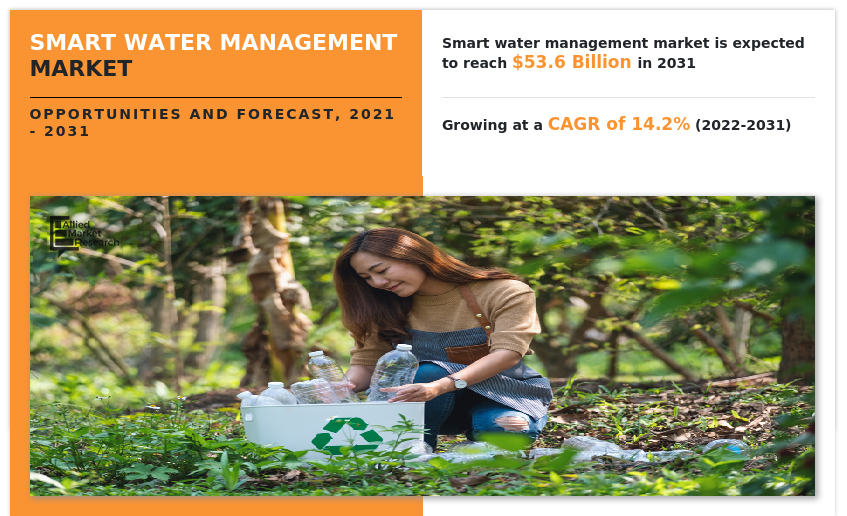

The global smart water management market was valued at USD 14.3 billion in 2021, and is projected to reach USD 53.6 billion by 2031, growing at a CAGR of 14.2% from 2022 to 2031.

Increase in usage of supervisory control and data acquisition drives the growth of the smart water management market. In addition, rise in number of smart cities and increase in use of digital transformation technology is boosting the smart water management market size. However, lack of capital investments to install infrastructure and lack of digitally skilled workforce are expected to impede the smart water management market growth. Furthermore, surge in government initiatives to implement smart water management is expected to provide lucrative opportunities for the smart water management market.

The use of the most recent technologies to replace conventional water conveyance is referred to as smart water management. In addition, number of assembling firms and synthetic-based companies are implementing smart water management to reduce the wastage of water and to use their energy efficiently. Moreover, management solutions suggest the utilization of data and corresponding innovations to tackle different challenges in water management.

Segment Review

The global smart water management market is segmented based on offering, application, end user, and geography. By offering, it is divided into solution and service. On the basis of application, it is fragmented into, water pipeline monitoring & leak detection, water level monitoring & dam management, water consumption & distribution, irrigation management, waste water monitoring, and others. In terms of end user, the market is classified into commercial, public sector, and residential. By geography, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players profiled in the smart water management market analysis are ABB Ltd., Badger Meter, Honeywell International Inc., Hydropoint, IBM Corporation, Itron, Landis+Gyr, Neptune Technology, Oracle Corporation, Schneider Electric SE, Siemens AG, Suez, Takadu, Trimble Inc., Xenius, Ayyeka, Ketos. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

In terms of offering, the solution segment holds the largest smart water management market share in the forecast period, owing to its ability to increase the operational efficiency of the entire water network even with low infrastructure investment. However, the service segment is expected to grow at the highest rate during the forecast period owing to rapid urbanization and rapid adoption of advanced technologies for innovating smart services. These are the major factors that influence solutions in the smart water management market.

Region-wise, the smart water management market share was dominated by North America in 2021 and is expected to retain its position during the forecast period, owing to increase in demand for sustainable energy solutions and strong government guidelines in various countries in the region. However, Asia-Pacific is expected to witness significant growth during the forecast period, due to rise in use of smart grid solutions, a surge in urbanization, agricultural production, technological adoption in the utility sector, and the deployment of smart solutions for better water management.

Top Impacting Factors

Increase in usage of supervisory control and data acquisition solution

Increase in usage of supervisory control and data acquisition across the globe owing to better operation management and correct investments. Moreover, it improves decision-making and lowers energy costs associated with pumping water through distribution systems. Furthermore, smart water management implements advanced analytic solutions for improvement of infrastructure and operations.

For instance, in July 2021, Ecolab launched an enhanced version of its smart water navigator to help businesses develop comprehensive, context-based plans and to better engage and support the teams responsible for driving smart water management. In addition, this project includes use of a supervisory control and data acquisition system for water supply operations and geographic information system-based asset management. Such initiatives are driving the growth of the smart water management industry.

Rise in number of smart cities

Rise in number of smart cities is an ever-evolving industry, and opportunities emerge regularly. In addition, governments across the globe are aiming to integrate smart technologies to drive economic growth as a major part of their urban planning strategy. Smart city initiatives, which began in 2013, comprise several aspects, such as smart mobility, smart energy, smart buildings, smart infrastructure, smart technology, and smart healthcare. Moreover, smart water management is one of the crucial components of a smart city. Additionally, the smart city initiatives open lucrative business avenues for the vendors of smart water management with the drastic rise in population, surge in demand for food, fast-paced urbanization, and overutilization of resources, which are successively driving the growth of the smart water management market.

COVID-19 Impact Analysis

The smart water management industry has witnessed stable growth during the COVID-19 pandemic, owing to the commercial segment that includes private companies and industries that limited their water usage and postponed their investments for the development of smart water management projects. In addition, governments across the world prioritized the water needs of households over industries, which triggered the share of the non-commercial segment to some extent.

Furthermore, with rapid digital transformation, various governments have introduced stringent regulations to protect end-user data, such as General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA). Thus, governments in various countries have taken strict actions toward the defaulters of COVID-19 regulations, and natural language processing technology is helping financial institutions to scan their internal policies as well as claims documents to check their compliance with different regulatory policies. However, the COVID-19 pandemic is making it even harder for larger industries to keep pace, and even more difficult for midsize and smaller companies to adopt technologies, owing to long development timelines and high investment requirements.

Key Benefits for Stakeholders

- The study provides an in-depth analysis of the global smart water management market forecast along with current & future trends to explain the imminent investment pockets.

- Information about key drivers, restraints, & opportunities and their impact analysis on Smart Water Management Market Trends is provided in the report.

- The Porter’s five forces analysis illustrates the potency of the buyers and suppliers operating in the industry.

- The smart water management market analysis from 2022 to 2031 is provided to determine the market potential.

Smart Water Management Market Report Highlights

| Aspects | Details |

| By Offering |

|

| By Application |

|

| By Application |

|

| By Region |

|

| Key Market Players | Siemens AG, Ayyeka, Suez, Badger Meter, IBM Corporation, Neptune Technology, ABB Ltd, Hydropoint, Oracle Corporation, Landis+Gyr, Itron, Ketos, Honeywell International Inc., Takadu, Trimble Inc., Schneider Electric SE, Xenius |

Analyst Review

Smart Water Management is a method of gathering, sharing, and analyzing data from water equipment and networks. In addition, it creates a more dependable and efficient water supply system, lowering costs and increasing sustainability. Furthermore, due to water shortages and rise in demand for water conservation, smart water management is gaining popularity around the globe. Smart water management solution vendors are providing smart water technology to assist consumers in coping with the persistent water shortage. Moreover, chemical and manufacturing industries have mostly implemented smart water management to reduce water waste and make better use of their resources.

The global smart water management market is expected to register high growth due to various organizations and governments across the globe executing smart water management (SMW) to manage water wastage and efficiently manage their energy utilization. Thus, increase in adoption of smart water managements, owing to their benefits, is one of the most significant factors expected to drive the growth of the market. With surge in demand for smart water management, various companies have established alliances to increase their capabilities. For instance, in June 2021, Itron partnered with United Utilities, the largest publicly traded water utility in the UK, to implement Temetra, Itron's innovative cloud-based meter management technology, and to enhance water distribution and administration.

In addition, with further growth in investment across the world and the rise in demand for smart water management, various companies have expanded their current product portfolio with increased diversification among customers. For instance, in March 2021, SUEZ and Schneider Electric announced a joint venture to boost their leadership in building new digital water solutions. For instance, in February 2022, ABB launched an innovative digital solution to reduce energy use and optimize operations in wastewater plants. These factors are set to accelerate the market growth toward smart water management in the future.

Moreover, with increase in competition, major market players have started collaboration companies to expand their market penetration and reach. For instance, Schneider Electric collaborated with SUEZ SA, an industrial water and process treatment technology company, to help water operators and industrial players globally accelerate their digital transformation by providing an innovative variety of software solutions for the operation, planning, maintenance, and optimization of water treatment infrastructure.

The global smart water management market was valued at $14.25 billion in 2021, and is projected to reach $53.61 billion by 2031

The smart water management market is projected to grow at a compound annual growth rate of 14.2% from 2022 to 2031.

The key players profiled in the smart water management market analysis are ABB Ltd., Badger Meter, Honeywell International Inc., Hydropoint, IBM Corporation, Itron, Landis+Gyr, Neptune Technology, Oracle Corporation, Schneider Electric SE, Siemens AG, Suez, Takadu, Trimble Inc., Xenius, Ayyeka, Ketos. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Region-wise, the smart water management market share was dominated by North America in 2021 and is expected to retain its position during the forecast period

Increase in usage of supervisory control and data acquisition drives the growth of the smart water management market. In addition, rise in number of smart cities and increase in use of digital transformation technology is boosting the smart water management market size.

Loading Table Of Content...