Smart Well Market Research, 2031

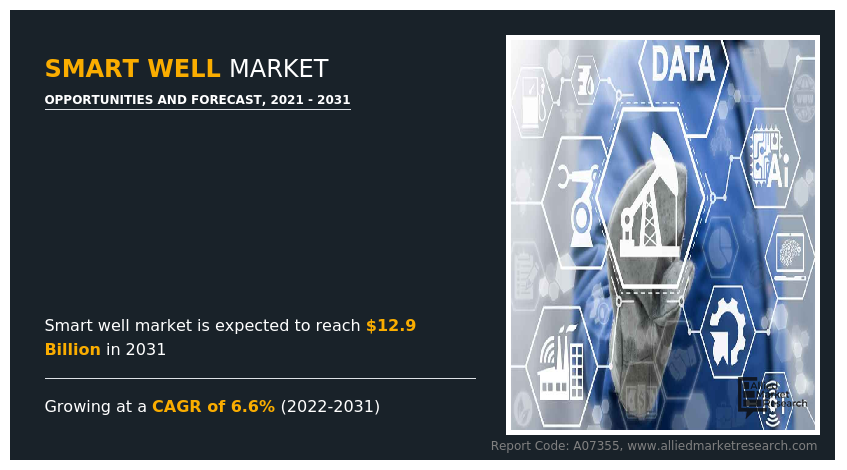

The global smart well market was valued at $7.0 billion in 2021, and is projected to reach $12.9 billion by 2031, growing at a CAGR of 6.6% from 2022 to 2031.

A smart well is a particular type of well that has equipment/hardware which can be managed remotely by an operator or automatically. In addition to the standard completion equipment, smart well systems also contain valves, chokes, sensors, and actuators that are remotely monitored by both software and humans. The smart well technology gathers the completion, production, reservoir data, and do the analysis on data which is enabling remote selectable zonal control and maximizing reservoir efficiency.

The field performance of each installation of a smart well system is tracked by smart well software, which keeps a thorough database. The data which is collected by smart well is employed to calibrate design forecasts and improve the design & production process. According to smart well market forecast, smart well is made to satisfy the needs of intelligent completions everywhere and in the most difficult conditions which boosts its demand in all regions.

Smart well can easily manage the production & injection zones and delay the breakthrough of gas & water, which helps to maximize overall productivity. Smart well can postpone or prevent the creation of sand and water/gas coning, which gradually pushes the well's production and boost the smart well industry growth. In addition, by using smart drilling techniques, operators can expand the drainage area and production zones with fewer wells. The ability to collect data while the well is still producing without having to shut it down for an intervention or data collection campaign is another crucial smart feature of the smart well, which is increasing smart well market share.

Oil and natural gas reserves are found in separate layers under the earth's surface, producers have the option to branch from the main well to access deposits at various depths. Multilateral wells, which are single wells having one or more wellbore branches, are being drilled by manufacturers. As per the smart well market analysis, smart well reduces the need for surface drilling while increasing the output from a single well. Multilateral wells are being used to increase the output from the well. The data related to the multilateral well can be maintained by the smart well technology and can be analyzed easily. The expansion of multilateral drilling, extended reach drilling, and horizontal drilling in mature wells in diverse places with the new technology of smart well is expected to drive the smart well market growth in near future.

Companies in the oil and gas industries are catch up with the trend which is improving the smart well market size. All the advantages of digitization have a price; for example, building a well with sensors and other hardware with software loaded on it increase the cost of the manufacturing. Construction and maintenance of smart wells are expensive. However, due to the cost factor, manufacturers are unable to switch to smart oil wells and continue using conventional oil wells. As a smart well system completion consists of a combination of zonal isolation devices, interval control devices, downhole control systems, , the implementation of converting the conventional well to a smart well can include additional expense.

The advancement of the oilfield's digitalization is expected to aid in the wells' proper upkeep and creating the smart well market opportunity. The adoption of routine inspections and reporting of well production is being done by manufacturers in the oil production sector. The future planning and execution are aided by maintaining the appropriate data producing wells and reservoirs. Regular reservoir monitoring and reporting are made simple by smart wells which is boosting the smart well market growth. Maintaining accurate data sheets and product quality while meeting deadlines is possible. With the use of smart well technology, the likelihood of well failure can be decreased.

Using cutting-edge technology and filtered data, smart well technology speeds up the decision-making process. The efficient use of both human and mechanical resources, as well as increased operational cost effectiveness, are all benefits of oilfield digitization. Smart well improves overall safety, protects the environment, and optimizes the rate of hydrocarbon production while reducing resource waste. One of the main factors driving the market for smart wells trend is the rising adoption of digitalization across several industries, including oil and gas. The demand for smart wells has grown dramatically as a result of the surge in demand for oil and oil derivatives across many industries, as well as the potentially hazardous working conditions present in the oil & gas sector.

Furthermore, as many oilfields are saturated, smart well technology are being deployed to boost oil recovery. End-user industries have adopted cutting-edge technology including reservoir optimization and well testing facilities. A surge in exploration activities that are finding new oilfields is another factor driving the sector growth.

In addition, the market is anticipated to develop as a result of the rising usage of real-time operation monitoring to cut out inefficient processes and losses. Smart wells offer more effective plant management with precise and reliable administration than manually overseen fields and related activities. Other reasons such as improvements in wireless technology, data collection & analysis services, and higher spending on offshore oil exploration activities are projected to fuel the expansion of the smart well market.

Apart from the pandemic time, a boom in exploration has tripled over the last five years. Owing to a global boom in oil and energy sector, Indian capital goods companies are getting into the smart well sector. Smart well equipment manufacturers and software companies are contracting with exploration companies for the expansion of smart well market. The smart well market is segmented on the basis of component, technology, application, and region.

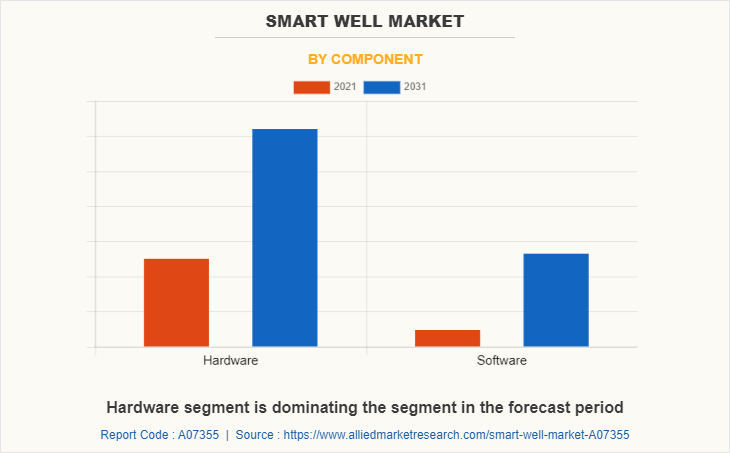

On the basis of component, the market is classified into hardware and software. Hardware is further divided on the basis of type in inflow control valve or interval control valve (ICVS), electric submersible pump (ESP), plugs and packers and sensors. Sensors are further segmented on the basis of type in wellbore internal sensors and casing external sensors. Software is further fragmented on the basis of type in data acquisition system (DAS), distributed temperature system (DTS and intelligent panel view) and distributed acoustic sensing (DAS) technology.

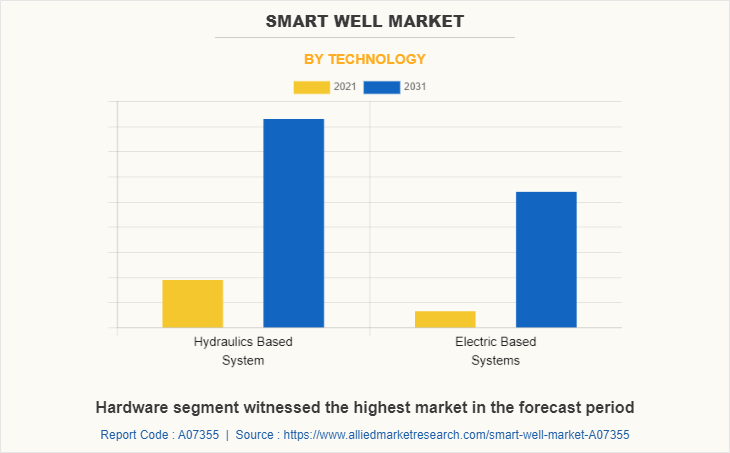

On the basis of technology, the market is segmented into electric systems and hydraulics based system. hydraulics based system is dominating the market as the technology is cost effective. However, electric based system is growing with the highest CAGR as optimization in the technology is easy and can be used for different wells

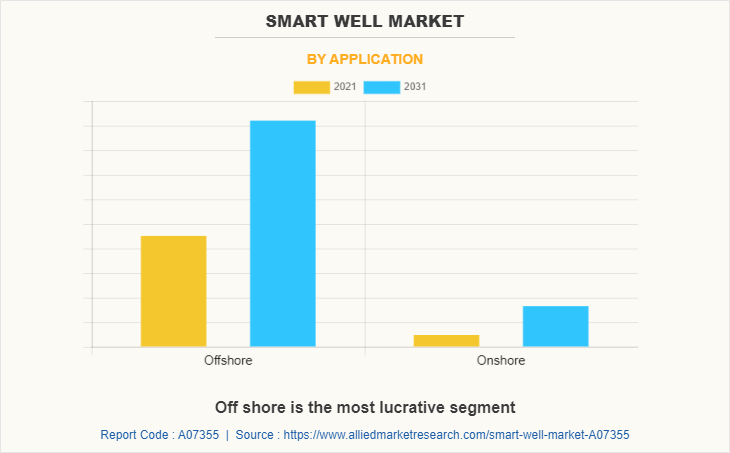

On the basis of application, the market is segmented into offshore and onshore. In 2021, offshore is dominating in the market as due to increasing oil exploration activities due to which the usage of smart well technologies are increasing in the offshore application.

The exponential population expansion and expanding Asia-Pacific economy have resulted in high demand for oil and gas, which is becoming increasingly challenging to meet. Oil and other commonly utilized energy sources are depleting. In the region, several businesses are investing in business growth, agreements to expand globally, and relationships to increase production through reserves.

The state-owned oil company PetroVietnam has cautioned that Russia's protracted assault against Ukraine could have an impact on oil drilling operations in the Southeast Asian country, despite the fact that Vietnam depends on Russia for the supply of energy and drilling equipment. The statement also highlighted the problems caused by rising costs and declining demand, which may hinder cooperation in the future of smart well sector. Russian players are actively pursuing all upstream projects in Africa, from exploration acreage to development and production assets. War has hampered the economy, which has reduced demand for smart well equipment and services in Africa.

The report further outlines the details about the revenue generated through the sale of smart well across North America, Europe, Asia-Pacific, and LAMEA. Major players operating in the smart well industry include Schlumberger Limited., ABB, Baker Hughes Company, Halliburton., Equinor ASA, Weatherford, Siemens, NOV Inc., Emerson Electric Co. , General Electric, and INTECH.

Competitors Key Strategies

- In 2022 June, ABB decided to enter the partnership with Think Gas. Think Gas company is engaged in gas distribution. ABB has created a system to integrate, monitor, and control day-to-day operations across the company, automating workflows to support operators in improving safety. This development will help the company to increase revenue in coming years

- In 2022 January, Halliburton. Company decided to enter the joint venture with Shell company to expand tubulars and intelligent completions. This development will help the company to increase revenue in near future

- In 2021 September, Schlumberger Limited. and AVEVA announce agreement to Advance Digital Solutions for Oil & Gas Production Operations. This development help to integrate edge, AI, and cloud digital solutions to help operators optimize oil and gas production

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the smart well market analysis from 2021 to 2031 to identify the prevailing smart well market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the smart well market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global smart well market trends, key players, market segments, application areas, and market growth strategies.

Smart Well Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 12.9 billion |

| Growth Rate | CAGR of 6.6% |

| Forecast period | 2021 - 2031 |

| Report Pages | 341 |

| By Component |

|

| By Technology |

|

| By Application |

|

| By Region |

|

| Key Market Players | General Electric, Equinor, Siemens Ltd, ABB, Weatherford International Ltd., Halliburton Company, NOV INC., Baker Hughes Inc., Emerson Electric Co., intech, Schlumberger Limited |

Analyst Review

The CXOs of major corporations claim that the spread of COVID-19 caused a considerable and quick reduction in global economic activity. This therefore has an impact on the demand for oil as well as for other goods and services like smart well and solutions. Pandemic had a detrimental effect on the market. Other pandemic consequences include decreased client spending, negative net income and revenue, operations interruptions The demand for digital products and services has decreased during this moment of severe economic disruption and low oil prices, which is anticipated to last for some time. Post the pandemic the demand for the smart well will increase as to optimize the resources. Government is also helping the companies to set up the smart well for the data collection and decision making which can help to earn more revenue.

Offshore is the leading application of smart well market

Schlumberger Limited., ABB, Baker Hughes Company, Halliburton. And Equinor ASA are the top players of smart well market

In 2021 September, Schlumberger Limited. and AVEVA announce agreement to Advance Digital Solutions for Oil & Gas Production Operations. This development help to integrate edge, AI, and cloud digital solutions to help operators optimize oil and gas production In 2022 January, Halliburton. Company decided to enter the joint venture with Shell company to expand tubulars and intelligent completions. This development will help the company to increase revenue in near future

Asia-Pacific is the largest region in the smart well market

The global smart well market was valued at $7.0 billion in 2021, and is projected to reach $12.9 billion by 2031, growing at a CAGR of 6.6% from 2022 to 2031.

Loading Table Of Content...