Snared Devices Market Research, 2031

The global snared devices market was valued at $950.2 million in 2021, and is projected to reach $1,616.7 million by 2031, growing at a CAGR of 5.2% from 2022 to 2031. Snared device is surgical instruments with a wire loop controlled by a mechanism in the handle used to remove growths, such as tumors and polyps. It is designed with three interlaced loops to retrieve and manipulate foreign objects in the body. It can be used to retrieve inferior vena cava filters, reposition indwelling venous catheters, fibrin sheath stripping, or to assist in central venal access venipuncture. It is mostly used to remove the unwanted cell growth and tumor from the body.

Growth of the global snared devices market size is majorly driven by rise in prevalence of chronic disease, rise in geriatric population, surge in demand for minimal invasive surgical procedure, and increase in number of ambulatory surgical centers. According to the World Health Organization (WHO), an increasing number of deaths and disability caused by heart diseases & stroke are triggering the demand for snared devices. From the total number of deaths worldwide, over three quarters of cardiovascular disease (CVD) deaths occur in low- and middle-income countries. Such findings are contributing toward the growth of the snared devices market. High prevalence of recurrent pulmonary embolism & venous thromboembolism diseases fuels the demand for snared devices.

In addition, increase in the number of colonoscopy procedures, and rise in number of snared devices industry is driving the medical devices and pharmaceutical industries which is expected to boost the snared devices market growth. For instance, in April 2021, Argon Medical Devices rolled out its Halo single-loop snared kits in the U.S. The kits have been designed for providing reliability and accuracy when manipulating and retrieving foreign objects from the hollow viscus or cardiovascular system. The increase in prevalence of endoscopy procedures, surge the need for reusable snared device and drive the growth of the market. Reusable snared are conventional devices used in endoscopy procedures and are majorly adopted in medical settings of various emerging countries as they help in reducing the cost of endoscopy procedures.

Moreover, increase in prevalence of colon cancer and rise in awareness of screening, diagnosis, and treatment procedures, drive the growth of the market. The high incidence of colorectal cancer (CRC) in the U.S. has resulted in the provision of reimbursements to increase the affordability of CRC screening procedures in the country. This has increased the affordability of CRC screening procedures, which in turn is driving the number of endoscopic procedures using the snaring technique performed in the U.S. In addition, rise in urinary tract infections, urinary bladder injuries, and renal calculi are the major factors that are positively influencing the growth of the market during the snared devices market forecast period. The presence of major snared devices industry in the region such as Boston Scientific Corporation, CONMED Corporation, Cook Medical Inc., Hill-Rom Holdings Inc., Medline Industries Inc., Merit Medical Systems, Inc., and Stryker Corporation is one of the major factors that contributes toward the growth of the snared devices market.

Favorable government policies regarding the development of health care infrastructure are the key factors for the growth of the market. Expansion of research and development units and clinical labs in Europe is another key factor expected to propel the surgical snared device market. Furthermore issues of product recalls are affecting the growth of the snared devices market share.

Snared Devices Market Segmentation

The snared devices market size is segmented into Usability, Application and by End User. and region. On the basis of usability, the market is segmented into single-use, and reusable. By application, the market is bifurcated into GI endoscopy, urology endoscopy gynecology endoscopy, laparoscopy, arthroscopy, bronchoscopy, mediastinoscopy, laryngoscopy and others. By end user, the market is classified into hospitals, and ambulatory surgical centers. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Segment Review

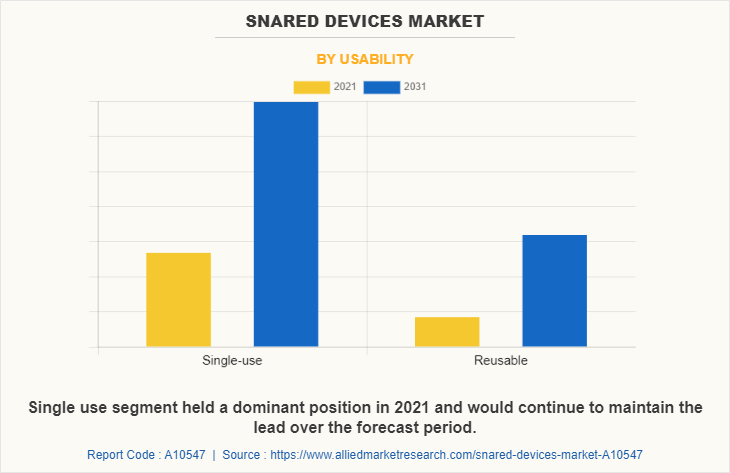

Snared Devices Market by Usability

By usability, the single use segment generated the highest revenue in the snared devices market in 2021 owing to extensive product applicability across various surgeries. Increasing adoption of single-use instruments in medical settings owing to various advantages, such as safety and convenience, is expected to accelerate the segment growth during the forecast period.

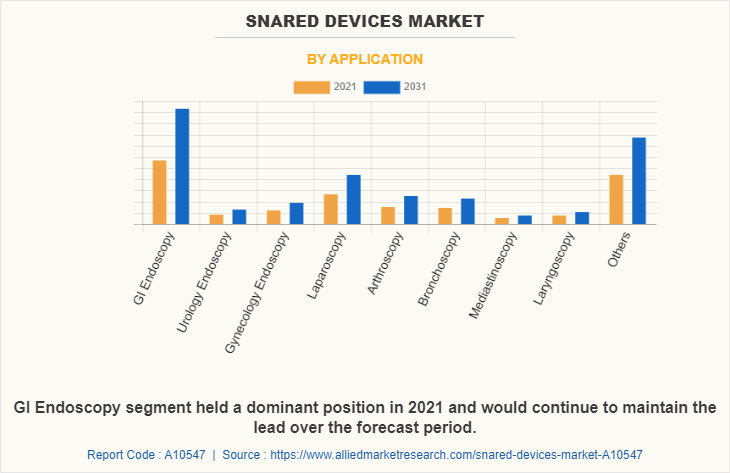

Snared Devices Market by Application

By application, the GI endoscopy segment generated the highest revenue in the snared devices market in 2021, owing to increased burden of functional gastrointestinal diseases and rise in geriatric population across the globe. In addition, increase in number of upper gastrointestinal procedures performed and the growth in the adoption of endoscopes for the treatment and diagnosis of gastrointestinal diseases drive the segment growth.

Snared Devices Market by End User

By end user, the hospitals segment generated the highest revenue in the snared devices market in 2021, owing to factors such as well-resourced diagnostic rooms, well equipped operation theatre, higher buying power, availability of highly qualified healthcare practitioners, and increase in health coverage for hospital-based healthcare services from several private & group insurance programs. Ambulatory surgical centers is expected to register fastest CAGR during the forecast period, owing rise in number of minimal invasive surgical procedure, and increase in number of ambulatory surgical centers.

By End User

Hospitals segment is projected as one of the most lucrative segment.

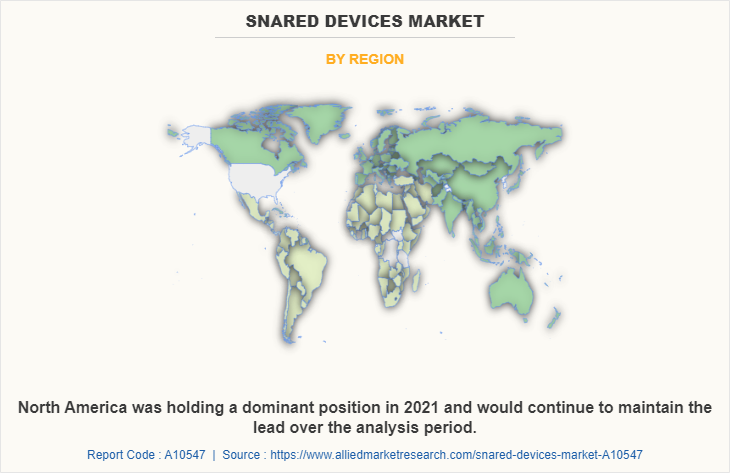

Snared Devices Market by Region

North America accounted for the largest snared devices market share in the snared devices market in 2021 and is expected to retain its dominance throughout the forecast period. This is primarily attributed to increase in product developments by regional industry players, and rise in adoption of advanced technology to improve clinical outcomes in the region.

Asia-Pacific is anticipated to grow at the fastest CAGR during the forecast period. High population base, rapidly developments in healthcare infrastructure, establishment of research organizations, and increase in investments in medical devices industry fuel the growth of the market in this region.

Some of the major companies that operate in the global snared devices market include Boston Scientific Corporation, CONMED Corporation, Cook Medical Inc., Hill-Rom Holdings Inc., Johnson and Johnson, Medline Industries, Inc., Medtronic Plc., Merit Medical Systems, Inc., Olympus Corporation, Sklar Corporation, and Steris Plc.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the snared devices market analysis from 2021 to 2031 to identify the prevailing snared devices market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the snared devices market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global snared devices market trends, key players, market segments, application areas, and market growth strategies.

Snared Devices Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 1.6 billion |

| Growth Rate | CAGR of 5.2% |

| Forecast period | 2021 - 2031 |

| Report Pages | 248 |

| By Usability |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Boston Scientific Corporation, Hill-Rom Holdings Inc., Cook Medical Inc., Medtronic Plc., Medline Industries, Inc., CONMED Corporation, Olympus Corporation, Sklar Corporation, Steris Plc. |

Analyst Review

This section provides opinions of the CXOs of key companies operating in the snared devices market. According to the CXOs, the adoption of increase in treatment options for cancer. The rise in adoption of vascular snared and their requirements for removing foreign particles, and high use in minimal invasive procedures in cardiac surgeries accelerate the market growth. Increase in inclination toward permanent surgical solutions over long term management with prescription drugs and surge in the preference for surgeries and technological advancements in the field of surgery further influence the growth of the market.

By region, North America is expected to remain dominant during the forecast period, due to local presence of large in-house manufacturers like Boston Scientific Corporation, CONMED Corporation, Cook Medical Inc., Hill-Rom Holdings Inc., Johnson and Johnson, Medline Industries Inc., Merit Medical Systems, Inc., and Sklar Corporation. Moreover, Asia-Pacific registered highest CAGR and is expected to remain dominant throughout the forecast period, owing to improvement in healthcare facilities, rise in disposable income, rise in awareness programs, and rapid improvement in economic conditions.

The top companies that hold the market share in snared devices market are Boston Scientific Corporation, CONMED Corporation, Cook Medical Inc., Hill-Rom Holdings Inc., Johnson and Johnson, Medline Industries, Inc., Medtronic Plc., Merit Medical Systems, Inc., Olympus Corporation, Sklar Corporation, and Steris Plc

Asia-Pacific is expected to register highest CAGR of 5.9% from 2022 to 2031, owing to high population base, rapidly developments in healthcare infrastructure, establishment of research organizations, and increase in investments in medical devices industry

The key trends in the snared devices market are rise in prevalence of chronic disease, rise in geriatric population, surge in demand for minimal invasive surgical procedure, and increase in number of ambulatory surgical centers

The base year for the report is 2021.

Yes, snared devices market market companies are profiled in the report

The total market value of snared devices market market is $950.2 million in 2021.

The forecast period in the report is from 2022 to 2031

The market value of snared devices market in 2022 was $1021.47 million

Loading Table Of Content...