Social Media Analytics-Based Insurance Market Research, 2031

The global social media analytics-based insurance market size was valued at $3.5 billion in 2021, and is projected to reach $33 billion by 2031, growing at a CAGR of 25.5% from 2022 to 2031.

In the insurance industry, significance of social media analytics for insurance are frequently used to reduce risk in underwriting, pricing, rating, claims, marketing, and reserving. This social media based analytical solution also aids insurance providers in risk management and the provision of better insurance policies in sectors like health, life, and property or casualty. In addition, the social media data for insurance analytics is to optimize customer interaction processes, cut expenses, and apply predictive analytics in insurance models to generate accurate reports for a variety of product lines.

Social media analytics based insurance helps insurance providers to find target audience for their insurance based services. Furthermore, social media analytics primarily offers, insights into customer behavior by letting providers know about their preferences, dislikes, issues, worries, and peer pressure. In addition, social media analytics offers customers personalized insurance services, based on their social media presence and preferences. Thus, these factors propel the social media analytics-based insurance market growth. However, privacy and security issues have emerged as key industry problems due to the extensive flow of customer data. Moreover, because insurance businesses rely largely on the quality of the data supplied, obtaining duplicated or erroneous data from customers might provide output that is inaccurate and of little value. Therefore, these factors are hampering the growth of the market. On the contrary, increase in adoption of cloud and artificial intelligence in the social media analytics is expected to boost demand for social media analytics-based insurance in the upcoming years.

The report focuses on growth prospects, restraints, and trends of the social media analytics based insurance market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the social media analytics-based insurance market overview.

Segment review

The social media analytics-based insurance market is segmented on the basis of component, deployment mode, enterprise size, platforms, end user, and region. By component, it is segmented into software and services. By deployment mode, it is bifurcated into on-premises and cloud. Based on enterprise size, it is segregated into large enterprises, and small and medium-sized enterprises (SMEs). By platforms, this is segmented into Facebook, LinkedIn, Twitter, Instagram, and YouTube. The Facebook segment is further sub-segmented into customer relationship management (CRM), predictive analytics, and credit scoring. Customer relationship management (CRM) is further divided into customer profiling & risk analysis, underwriting, and policy servicing. Based on end users, the social media analytics-based insurance market is segmented into insurance companies, government agencies and third-party administrators, brokers, and consultancies. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

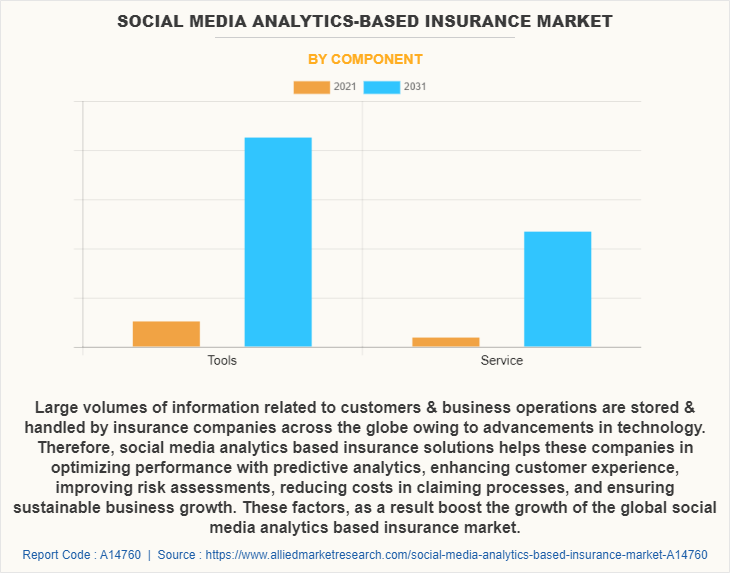

Based on the component, the tools segment attained the highest growth in 2021. This is owing to advancements in technology, large volumes of information related to customers & business operations are stored & handled by insurance companies across the globe. Therefore, social media analytics-based insurance solutions help these companies in optimizing performance with predictive analytics, enhancing customer experience, improve risk assessments, reducing costs in claiming processes, and ensuring sustainable business growth. These factors, as a result, boost the growth of the global social media analytics-based insurance market size.

Based on region, North America attained the highest growth in 2021. This is attributed to the rapid advancements in the insurance industry, owing to modern technologies such as machine learning, blockchain, big data, and artificial intelligence has contributed toward growth of the social media analytics-based insurance market in this region. In addition, increase in awareness of insurance analytical tools among insurance companies, government agencies, and third-party administrators, brokers, and consultancies surge in partnership for adopting & implementing insurance analytical tools are the major factors that influence growth of the social media analytics-based insurance market share in this region.

The report profiles of key players operating in the social media analytics-based insurance market analysis such as Adobe, Brandwatch, Cision U.S. Inc., Clarabridge, Digimind, GoodData Corporation, Hootsuite Inc. International Business Machines Corporation, Meltwater, Netbase Quid, Inc., Oracle, Salesforce, Inc., SAS Institute Inc., Sprout Social Inc., Talkwalker Inc., Kazee Indonesia and ViralStat.com. These players have adopted various strategies to increase their market penetration and strengthen their position in the social media analytics-based insurance industry.

COVID-19 impact analysis

The COVID-19 pandemic had a significant positive impact on the social media analytics-based insurance market. Since, the increasing number of cloud adoption and Artificial Intelligence (AI) among the insurance providers, during the pandemic was the important factor for growth of the market. However, pandemic had a negative impact on the most of the businesses all over the globe, but the social media analytics-based insurance market grew significantly as a result by staying connected with customers and learning about their preferences. Furthermore, due to the lockdown, most individuals stayed at home at that period, which caused social media sites to become crowded. Therefore, due to the widespread use of social media platforms for communication, many banking organizations, financial institutions, and insurance businesses have started using these channels to interact with their clients and the general public. In addition, these organizations took advantage of social media sites like Instagram, Facebook and YouTube, to influence users through their ad campaigns, which resulted in increasing demand for insurance services amongst the users. Therefore, these are the major factors impacting the growth of social media analytics-based insurance industry during the COVID-19 pandemic.

Top impacting factors

Increase in social media presence/traffic

The rise of social media over the past several years is driving the sharp rise in demand for digital insurance services. The use of mobile, laptops, and computers with access to the internet has increased over the years. Moreover, with the growth of digital technologies, people have started using social media for communication, online shopping, and other social connectivity activities. These have encouraged enterprises to adopt social media analytics solutions to understand the needs and demands of users and the salability of their products. Furthermore, most people are addicted to social media as social media has been a great medium for entertainment and news. Therefore, the demand for social media is increasing, and with it, the social media analytics market is also growing, and it is expected to grow more. Thus, this is one of the major driving factor of the social media analytics-based insurance market.

Complexities in the analytical workflow

Every analytical process includes a variety of crucial phases, including data identification, parameter setup, business rule definition, data preparation, execution, data modelling, and visualisation. In addition, insurance services providers are using various analytical methodologies, such as predictive, prescriptive, and descriptive analytics, to create maximum value out of social media data. However, the data obtained from various social media sites is unstructured and requires additional functionalities to structure and improve the insights. Therefore, analysts must integrate huge amounts of social media data from various social platforms and create efficient models to generate expected outcomes. As a result, it is time-consuming and highly complex. Thus, this is a major factor hampering the growth of social media analytics-based insurance market.

Increase in adoption of cloud and AI based technology

There has been a steep rise in the adoption of social media analytics-based insurance all around the world. The use of software-as-a-service (SaaS) to deliver cloud computing solutions is said to have increased cloud adoption in recent years by the social media analytics-based insurance. In addition, cloud computing allows firms to outsource their operational IT work to another company and all of the risks and responsibilities are assumed by cloud service providers. Furthermore, due to its range of features, such as flexibility, reliability, scalability and low costs, cloud computing is expected to grow at an even faster rate in the coming years. Therefore, technological advancement in the field of social media analytics will provide major lucrative opportunities in the growth of the social media analytics-based insurance market forecast.

Key benefits for stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the social media analytics-based insurance market analysis from 2021 to 2031 to identify the prevailing social media analytics-based insurance market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the social media analytics-based insurance market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global social media analytics-based insurance market trends, key players, market segments, application areas, and market growth strategies.

Social Media Analytics-Based Insurance Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 33 billion |

| Growth Rate | CAGR of 25.5% |

| Forecast period | 2021 - 2031 |

| Report Pages | 444 |

| By Component |

|

| By Deployment Mode |

|

| By Enterprise Size |

|

| By Platforms |

|

| By End User |

|

| By Region |

|

| Key Market Players | GoodData Corporation, International Business Machines Corporation, Cision U.S. Inc., Digimind, Brandwatch, Adobe, SAS Institute Inc., Talkwalker Inc., Oracle, Netbase Quid, Inc., Kazee Indonesia, Meltwater, Hootsuite Inc., Clarabridge, Sprout Social, Inc., ViralStat.com, Salesforce, Inc. |

Analyst Review

People have started using social media for communication, online shopping, and other social connectivity activities with the growth of digital technologies. These have encouraged enterprises to adopt social media analytics solutions to understand the needs and demands of users and the salability of their products. However, lack of awareness about digital insurance services may hamper the market growth. Moreover, social media analytics aids in the analysis of unstructured social data to respond to changing market conditions and increase sales and operational profitability. Moreover, insurance firms can use social media analytics to improve their market presence and gain a competitive advantage, by effectively analyzing the competition and customer behavior from social media platform.

Furthermore, market players are adopting partnership strategies for enhancing their services in the market and improving customer satisfaction. For instance, on January 2021, Clarabridge, a global leader in Customer Experience Management, launched a product called ‘Clarabridge CX Analytics’. This product offers organizations to easily add machine learning (ML)-driven speech and text analytics to existing contact center technologies driving measurable improvement to customer service quality, comprehensive risk/compliance management, and cost reduction in the contact center. These strategies are projected to provide major lucrative opportunities for the growth of the market. Some of the major players in the market include Adobe, Brandwatch, Cision U.S. Inc., Clarabridge, Digimind, GoodData Corporation, Hootsuite Inc. International Business Machines Corporation, Meltwater, Netbase Quid, Inc., Oracle, Salesforce, Inc., SAS Institute Inc., Sprout Social Inc., Talkwalker Inc., Kazee Indonesia and ViralStat.com. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Social media analytics based insurance helps insurance providers to find target audience for their insurance based services. Furthermore, social media analytics primarily offers, insights into customer behavior by letting providers know about their preferences, dislikes, issues, worries, and peer pressure.

Based on component, the tools segment attained the highest growth in 2021. This is owing to advancements in technology, large volumes of information related to customers & business operations are stored & handled by insurance companies across the globe.

Based on region, North America attained the highest growth in 2021. This is attributed to the rapid advancements in the insurance industry, owing to modern technologies such as machine learning, blockchain, big data, and artificial intelligence has contributed toward growth of the social media analytics based insurance market in this region.

The global social media analytics based insurance market size was valued at $3,450.66 million in 2021, and is projected to reach $33,006.17 million by 2031, growing at a CAGR of 25.5% from 2022 to 2031.

International Business Machines Corporation, Oracle, Salesforce, Inc., and SAS Institute Inc. hold the market share in social media analytics-based insurance market.

Loading Table Of Content...