Sodium Nitrate Market Overview

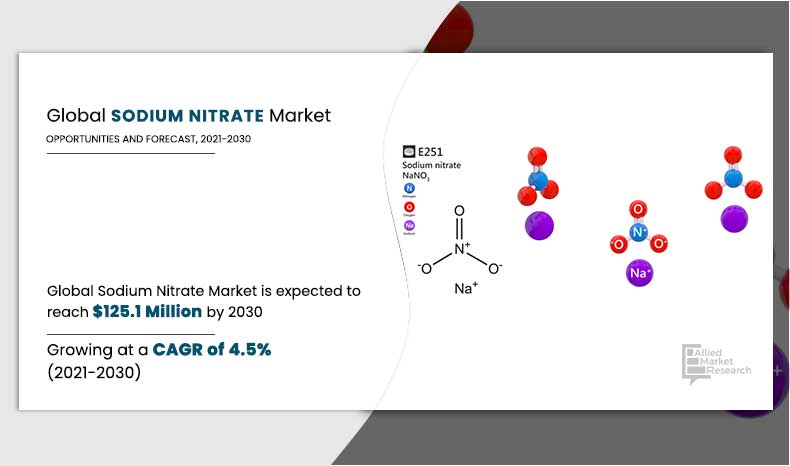

The global sodium nitrate market was valued at $80.6 million in 2020, and is projected to reach $125.1 million by 2030, growing at a CAGR of 4.5% from 2021 to 2030. Sodium nitrate is a chemical compound that is used in applications such as fertilizers and explosives. It is a type of alkali metal nitrate used as preservative in cured meat products.

Black powder is used in pyrotechnics and smoke bombs. This powder requires additional additives that help to slow down the burning rate. Sodium nitrate is widely used as active additive in black powder owing to its cost effectiveness and stability. In addition, it is capable of accelerating the burning capability of combustible materials. Thus, making it ideal to be used as a solid rocket propellant and other explosives. In addition, rise in demand of industrial grade sodium nitrate and glass production. Sodium nitrate is used in two-stage production of chemical stable and high strength glasses. In order to increase the strength of finished glass, it can be immersed in sodium nitrate bath. All these factors collectively surge demand for sodium nitrate, thereby augmenting the global market growth.

However, prolonged used of processed meat containing sodium nitrate preservative may increase the risk of heart diseases. In addition, it leads to blood vessel damage which in turn narrows arteries leading to risk of cardiac arrest is anticipated to hamper the market growth.

On the contrary, food grade sodium nitrate is used during curing process of packaged food and to avoid botulism exterminating for long aged meats. However, commercial use of food grade sodium nitrate is prohibited by FDA in food products such as smoked meat, cooked meat, sausages, and bacon. Industrial grade sodium nitrate is used in applications such as production of fertilizers, heat transfer component, and as an intermediate chemical compound. In addition, it can also be used for production of explosives, construction chemicals, degreasing products, and adhesives. Use of food grade sodium nitrate as a color fixative in cured meats and poultry meat products is key market trend. Growing legislator food regulations to ensure food safety has augmented the demand for food additives and preservatives. This factor is anticipated to offer new opportunities in the global market.

The sodium nitrate market analysis is done on the basis of grade, end use, and region. Depending on grade, the market is divided into food and industrial. On the basis of end use, it is fragmented into food, pharmaceuticals, chemicals & agrochemicals, explosives, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Sodium Nitrate Market, By Region

The Asia-Pacific sodium nitrate market accounted for 37.3% of the market share in 2020, and is projected to grow at the highest CAGR of 5.5% during the forecast period. Sodium nitrate creates distinct flavor, enables to control oxidation process, and imparts antimicrobial property in food products is the key market trend. Addition of sodium nitrate in processed meat such as ham and salami impart pink color to the meat. In addition, processed meat containing red hue requires preservative in order to extend the shelf life. These factors are driving the adoption of sodium nitrate in food industry and thereby augmenting the demand of the global market in Asia-Pacific.

By Region

Asia-Pacific would exhibit highest CAGR of 5.5% during 2021-2030.

Sodium Nitrate Market, By Grade

In 2020, the industrial grade was the largest revenue generator, and is anticipated to grow at a CAGR of 4.6% during the forecast period. Use of food grade sodium nitrate as a color fixative in cured meats and poultry meat products is a key market trend. Sodium nitrate is the most commonly used food preservative in processed meat products. It is used and added during curing process in order to inhibit the growth of bacteria. Moreover, sodium nitrate is capable of removing bacteria that grow in presence of moisture and inhibits the bacterial growth through dehydration.

By Grade

Industrial grade is the most lucrative segment

Sodium Nitrate Market, By End Use

By end use, the chemicals and agrochemicals segment dominated the global market in 2020, and is anticipated to grow at a CAGR of 4.7% during forecast period. Sodium nitrate is used in production of fertilizers as it acts as storage vessel for nitrogen. Nitrogen is important as it helps to stimulate plant growth, stems, and leaves. Moreover, lack of nitrogen reduces plant growth while on the other hand excess nitrogen content can deter flower and fruit growth. Use of sodium nitrate as a fertilizer helps to supply proper amount of nitrogen to plant roots and other vascular system.

By End Use

Chemicals and agrpchemicals end use is projected as the fastest growing segment

Key Benefits For Stakeholders

- Porter’s five forces analysis helps analyze the potential of buyers & suppliers and the competitive scenario of the industry for strategy building.

- It outlines the current market trends and future estimations of global sodium nitrate market from 2020 to 2030 to understand the prevailing opportunities and potential investment pockets.

- The major countries in the region have been mapped according to their individual revenue contribution to the regional market.

- The key drivers, restraints, and opportunities and their detailed impact analysis are explained in the study.

- The profiles of key players and their key strategic developments are enlisted in the report.

Sodium Nitrate Market Report Highlights

| Aspects | Details |

| By GRADE |

|

| By END USE |

|

| By Region |

|

| Key Market Players | Alfa Aesar, Santa Cruz Biotechnology, Inc., Aldebaran Sistemas, AG CHEMI GROUP s.r.o, Sumitomo Chemical Co. Ltd., American Elements, UBE Industries Ltd., BASF SE, Hach, .Pon Pure Chemicals Group |

Analyst Review

The global patient warmer market is expected to exhibit high growth potential attributed to growth in the number of surgeries, increase in cases of cardiovascular diseases and cancer as well as the surge in geriatric and preterm infant population which are more prone to hypothermia.

North America is expected to witness the highest growth, in terms of revenue, owing to rise in awareness about patient warmer and the availability of advanced patient warmers. In addition, increased prevalence of cardiovascular diseases and cancer as well as an increase in the number of surgeries. In addition, growth in the geriatric population, as well as the high incidence of preterm birth in the region, further drive the growth of the patient warmer market.

Europe was the second largest contributor to the market in 2020, and is expected to register the fastest CAGR during the forecast period, owing to presence of well-established healthcare facilities coupled with technological innovations in patient warmer devices. However, Asia-Pacific is expected to emerge as a lucrative market with maximum growth potential, owing to the increase in healthcare spending, advancements in patient warmer technology, increase in the number of cardiovascular disease and cancer cases.

Patient warmers are devices that assist to maintain an adequate amount of temperature in patients.

Patient warmers are medical equipment that provides a simple solution used in maintaining the normothermia during the surgical procedure

The total market value of patient warmer market is $1,664.45 million in 2020.

The forcast period for patient warmer market is 2021 to 2030

The market value of patient warmer market in 2021 is $1,812.59 million.

The surface warming system segment is the most influencing segment owing torise in adoption rate of surface warming systems in surgical procedures such as orthopedic surgeries, gynecology, and obstetrics procedures, gastrointestinal procedures, and general surgeries.

Growth in the number of surgeries, increase in cases of cardiovascular diseases and cancer as well as the surge in geriatric and preterm infant population which are more prone to hypothermia are some factors, which is expected to propel growth of the patient warmer market during the forecast period.

Asia-Pacific is expected to experience the highest growth rate during the forecast period, owing to growth in infrastructure of industries, rise in disposable incomes, and well-established presence of domestic companies in the region.

The base year is 2020 in patient warmer market

Top companies such as GE Healthcare, 3M Company, Geratherm Medical, Stryker Corporation, Baxter International, and Smiths Group Plc held a high market position in 2020.

Loading Table Of Content...