Sodium Sulphate Market Research, 2032

The global sodium sulphate market was valued at $0.7 billion in 2022, and is projected to reach $1.1 billion by 2032, growing at a CAGR of 4% from 2023 to 2032.

Report Key Highlighters

- The report provides competitive dynamics by evaluating business segments, product portfolios, target market revenue, geographical presence and key strategic developments by prominent manufacturers.

- The sodium sulphate market is fragmented in nature among prominent companies such as Aditya Birla Chemicals Limited., TCI Chemicals, Lenzing AG, Atul Ltd., Intersac, Nippon Chemical Industrial Co. Ltd., Merck KGaA, Ecobat Technologies Limited, GODAVARI BIOREFINERIES LTD., and Bordan and Remington Corp.

- The study contains qualitative information such as the market dynamics (drivers, restraints, challenges, and opportunities), key regulation analysis, pricing analysis, and Porter’s Five Force Analysis across North America, Europe, Asia-Pacific, LAMEA regions.

- Latest trends in global sodium sulphate market such as undergoing R&D activities, regulatory guidelines, and government initiatives are analyzed across 16 countries in 4 different regions.

- More than 2,200 sodium sulphate-related product literatures, industry releases, annual reports, and other such documents of key industry participants along with authentic industry journals and government websites have been reviewed for generating high-value industry insights for global sodium sulphate market.

Sodium sulphate (Na2SO4) is a chemical compound that belongs to the family of salts. It is composed of two sodium (Na) ions, one sulfur (S) ion, and four oxygen (O) ions. Sodium sulphate can exist in various forms, including anhydrous (without water) and hydrates (with water molecules attached). It is used in a wide range of sectors including detergent industry, textile, paper & pulp, glass, chemical manufacturing, construction, water treatment, and others. One of the major drivers for the market is the rise in demand from the detergent industry. Sodium sulphate is used as a processing aid and filler in the production of powdered detergents. Growth in the global population, urbanization, and increase in focus on cleanliness and hygiene contribute to the demand for detergents, thereby driving the sodium sulphate market.

Furthermore, the textile industry is a significant consumer of sodium sulphate, using it in dyeing and printing processes. As the global population continues to grow, there is increase in demand for textiles, including clothing and home textiles, which, in turn, boosts the demand for sodium sulphate. However, various substitutes for the product are available in the market, which are cheap and easily available. Thus, the demand for sodium sulphate is affected. Moreover, these substitutes offer similar properties and quality to sodium sulphate and are readily available, benefitting from product demand-supply gap in the sodium sulphate market, and thus restraining the market growth.

However, there is a growing trend toward sustainable and environmentally friendly products. Manufacturers have the opportunity to develop and market sodium sulphate as an eco-friendly option in industries such as detergents, textiles, and chemicals.

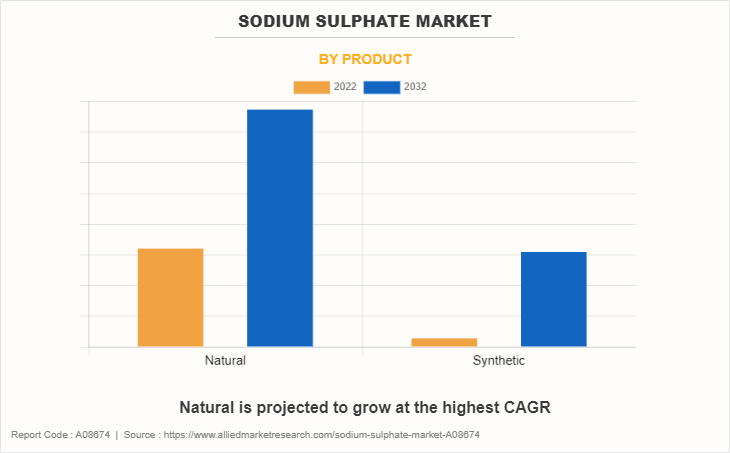

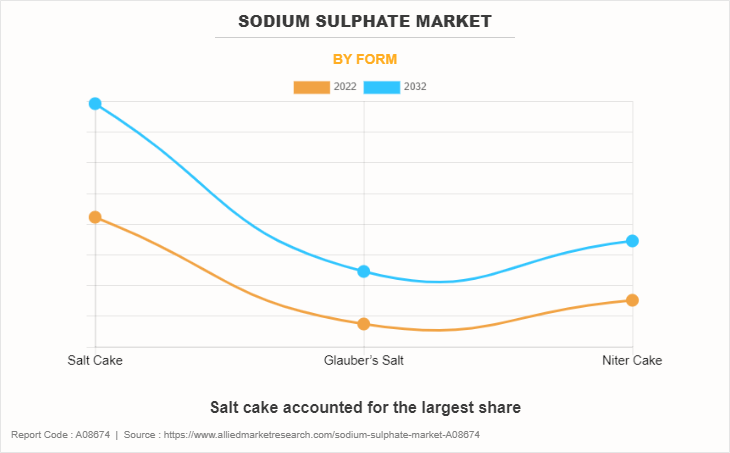

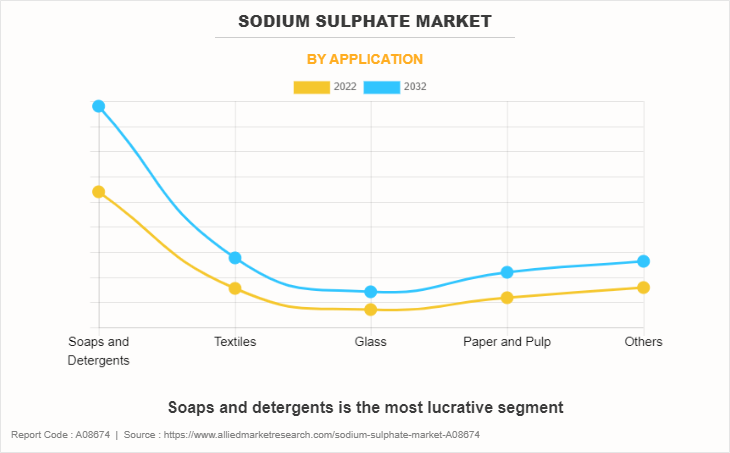

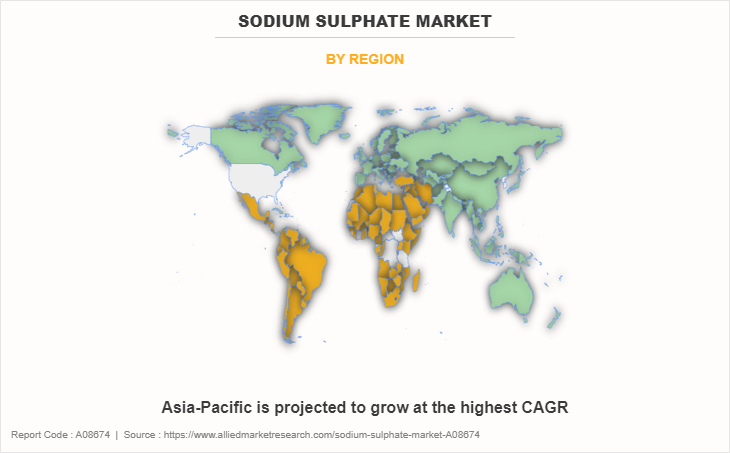

The sodium sulphate market is segmented on the basis of product, form, application, and region. By product, the market is divided into natural and synthetic. By form, the market is segmented into salt cake, Glauber’s salt, and niter cake. By application, the market is further divided into soaps & detergents, textile, glass, pulp & paper, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

In 2022, the natural segment was the largest revenue generator, and is anticipated to grow at a CAGR of 4.1% during the forecast period. As countries undergo industrialization and urbanization, the demand for products related to detergents, textiles, paper and pulp, and other industries that use natural sodium sulphate is expected to increase. Furthermore, the detergent industry is a significant consumer of sodium sulphate, using it as a key ingredient. As household and industrial cleaning product demands rise, so does the demand for natural sodium sulphate.

In addition, natural sodium sulphate is considered environmentally friendly, and as sustainability becomes a more critical factor in product choices, industries might prefer using sodium sulphate over other chemicals in certain applications. These factors are expected to surge the demand for natural sodium sulphate; thus, fueling the growth of the sodium sulphate market during the forecast period.

By form, the salt cake segment dominated the global market in 2022, and is anticipated to grow at a CAGR of 4.3% during forecast period. Salt cake, including sodium sulphate, is used as a raw material in the chemical industry. It may be utilized in the production of various sodium compounds, such as sodium sulfide and sodium carbonate, which have applications in different chemical processes. Furthermore, sodium sulphate, including that derived from salt cake, is commonly used in the textile industry for dyeing processes.

As the textile industry continues to grow, the demand for sodium sulphate in this application is anticipated to increase. In addition, sodium sulphate is used in the production of cleaning agents and detergents. The demand for household and industrial cleaning products could contribute to rise in demand for sodium sulphate. These factors are expected to boost the growth of the salt cake form of sodium sulphate; thus, fueling the growth of the sodium sulphate market.

By application, the soaps and detergents segment dominated the global market in 2022, and is anticipated to grow at a CAGR of 4.4% during forecast period. There has been an overall increase in the demand for detergents, either due to population growth, increase in consumer awareness about hygiene, or changes in lifestyle. This is expected to lead to a higher demand for various detergent ingredients, including sodium sulphate. Furthermore, sodium sulphate is often used as a cost-effective filler or processing aid in detergent formulations. If manufacturers are looking for ways to optimize production costs without compromising product quality, the demand for sodium sulphate may increase.

In addition, industry trends and consumer preferences may lead to changes in detergent formulations. Shift towards formulations that include sodium sulphate for specific benefits, such as controlling viscosity or improving product stability, it could contribute to increase in demand. These factors are expected to surge the demand for sodium sulphate for soaps and detergents application; thus, fueling the market growth.

The Asia-Pacific sodium sulphate market size is projected to grow at the highest CAGR of 4.5% during the forecast period and accounted for major share of sodium sulphate market share in 2022. The Asia-Pacific region, including countries such as China and India, is experiencing rapid industrialization and urbanization. This has led to increase in demand for products in sectors such as paper and pulp, detergents, textiles, and chemicals. Thereby driving the demand for sodium sulphate. Furthermore, the paper and pulp industry is a major consumer of sodium sulphate in the Asia-Pacific region. The growth of this industry, driven by packaging demand and economic development, contributes significantly to the sodium sulphate market.

The global sodium sulphate market profiles leading players that include Aditya Birla Chemicals Limited., TCI Chemicals, Lenzing AG, Atul Ltd., Intersac, Nippon Chemical Industrial Co. Ltd., Merck KGaA, Ecobat Technologies Limited, GODAVARI BIOREFINERIES LTD., and Bordan and Remington Corp. The global sodium sulphate market report provides in-depth competitive analysis as well as profiles of these major players.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the sodium sulphate market analysis from 2022 to 2032 to identify the prevailing sodium sulphate market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the sodium sulphate market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global sodium sulphate market trends, key players, market segments, application areas, and market growth strategies.

Sodium Sulphate Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 1.1 billion |

| Growth Rate | CAGR of 4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 334 |

| By Application |

|

| By PRODUCT |

|

| By FORM |

|

| By Region |

|

| Key Market Players | TCI Chemicals, Nippon Chemical Industrial Co. Ltd., Atul Ltd., Lenzing AG, Bordan and Remington Corp., Ecobat Technologies Limited, Intersac, Merck KGaA, Aditya Birla Chemicals Limited., GODAVARI BIOREFINERIES LTD. |

Analyst Review

CXOs are likely to closely monitor market dynamics, including supply and demand trends, pricing fluctuations, and the competitive landscape. Understanding how these factors impact the sodium sulphate market helps executives make informed strategic decisions. Furthermore, executives often consider the broader economic context, including factors such as GDP growth, inflation rates, and currency exchange rates. Global economic conditions can influence both, production and consumption of sodium sulphate.

Changes in regulations related to chemical production, environmental standards, and trade policies can significantly impact the sodium sulphate market. Furthermore, sustainability is a growing concern in the chemical industry. CXOs may prioritize sustainable practices, including resource efficiency, waste reduction, and environmentally friendly production methods, to meet market demands and regulatory expectations.

In addition, understanding customer requirements and market trends is crucial. CXOs focus on developing products that meet the evolving needs of end-users in sectors such as textiles, detergents, and paper.

Surge in use in soaps and detergents, and growing demand from various end-user industries are the upcoming trends of sodium sulphate market in the world.

Soaps and detergents is the leading application of sodium sulphate market.

Asia-Pacific is the largest regional market for sodium sulphate.

The sodium sulphate market was valued for $0.7 billion in 2022 and is estimated to reach $1.1 billion by 2032, exhibiting a CAGR of 4.0% from 2023 to 2032.

Aditya Birla Chemicals Limited., TCI Chemicals, Lenzing AG, Atul Ltd., Intersac, Nippon Chemical Industrial Co. Ltd., Merck KGaA, Ecobat Technologies Limited, GODAVARI BIOREFINERIES LTD., and Bordan and Remington Corp. are the top companies to hold the market share in the sodium sulphate market.

Loading Table Of Content...

Loading Research Methodology...