Software Defined Data Center Market Overview

The global software defined data center market size was valued at USD 39.45 billion in 2020 and is projected to reach USD 320.59 billion by 2030, growing at a CAGR of 23.7% from 2021 to 2030.

SDDCs grain traction among businesses, due to their unique advantages, including simplified and automated data center operations. They are provided on a lease basis to end users to store their crucial information that can be remotely accessed. In addition, it avoids the requirement for a large upfront investment in a datacenter. As a result, the usage of SDDC increases across industries, such as BFSI, retail, telecom & IT, and healthcare, owing to, cost-effective solution for automating data center operations while improving security which, in turn, fuels software defined data center market growth. On the other hand, issue of data security restraints to market growth. Furthermore, enormous demand for dynamic connectivity, particularly in emerging nations, is projected to generate development prospects in the future.

Introduction

A software defined data center (SDDC) is a data storage facility in which all infrastructure elements, such as storage, CPU, networking, and security, are virtualized and delivered as a service. SDDC uses virtualization and cloud technologies to give end users software-based access to all data center resources. Furthermore, its main goal is to provide smarter services, better management solutions, and standardized hardware platforms.

The report focuses on growth prospects, restraints, and trends of the software-defined data center market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the software defined data center market outlook.

Segment Overview

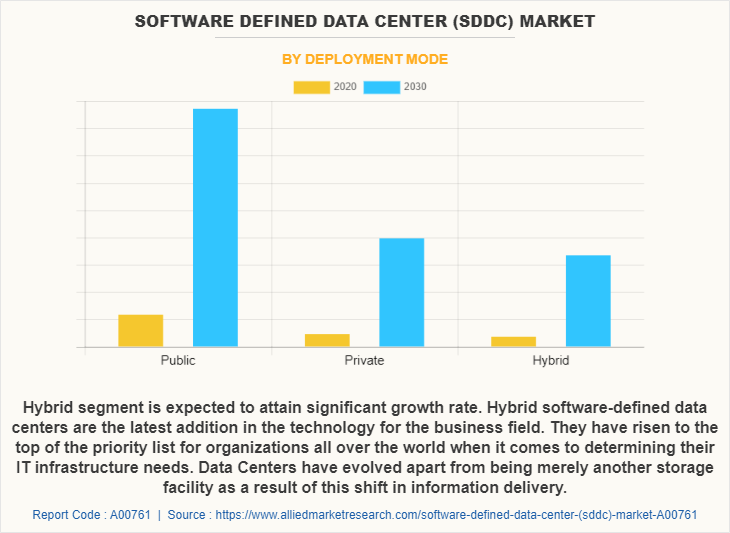

The software defined data center market is segmented on the basis of component, deployment mode, enterprise size, type, industry vertical, and region. By component, it is bifurcated into software and services. Depending on deployment mode, it is fragmented into public, private, and hybrid. According to enterprise size, it is bifurcated into large enterprises and small & medium-sized enterprises. Based on type, it is differentiated into software-defined compute (SDC), software-defined networking (SDN), software defined storage (SDS), and others. As per industry vertical, it is segregated into IT enabled services (ITeS), BFSI, government, healthcare, manufacturing, retail and e-commerce, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

In terms of component, software segment acquired the major share in the software defined data center (SDDC) market size. SDDC software consist of all the support and facilities that assist the operation and project of a data center. These services can be broadly classified in three types, integration service & deployment service, consulting & assessment service, and managed service.

Public segment acquired the major share of SDDC market. SDDC allows for the elimination of proprietary hardware dependency; this is one of the benefits that the cloud provides. In addition, this new approach will liberate the IT department so that it can focus on innovative projects that add value to the organization and its bottom line.

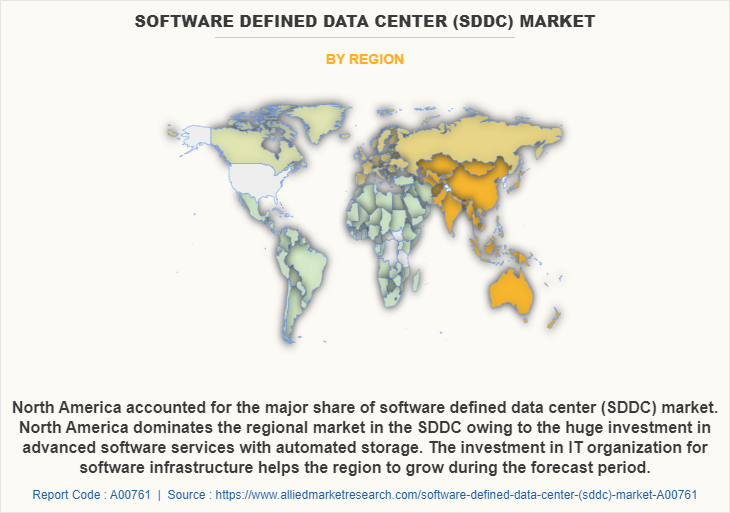

North America accounted for the major software defined data center market share. North America dominates the regional market in the SDDC owing to the huge investment in advanced software services with automated storage. The investment in IT organization for software infrastructure helps the region to grow.

Key Market Players

The key players operating in the global software defined data center market include Citrix Systems, Inc., Cisco Systems, Inc., IBM Corporation, Microsoft, Hewlett Packard Enterprise Development LP, SAP SE, Oracle Corporation, Dell Inc., VMware, Inc., and Datacore Software. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Top Impacting Factors

Rise in Demand for Data Storage

Rise in the number of online shoppers led to the emergence of e-commerce businesses. Attractive offers, ease of payment, myriad options, and convenience of shopping are some of the driving factors for the online shopping platforms. Online shopping generates enormous amount of data, which is processed and stored in data centers. In addition, e-commerce sites need to be continuously functional. Hence, data centers require proper setup with advanced systems that lead to huge infrastructure cost. Moreover, demand for storage and high-performance computing increases from oil & gas firms. This has increased the demand for software defined data center solutions, owing to cost-effectiveness and the ability to deliver streamlined storage services. Thus, rapid increase in demand for data storage is boosting the software defined data center industry growth.

Scalability and Cost-effective Solution

Presently, companies are expected to grow rapidly and their data processing and storage system must be scalable to fulfil the requirement. SDDC market is capable to perform as per the increase in work load. The major advantages in the market include cost-effectiveness and less capital expenditure (CAPEX) As the number of hardware components required is less, these systems are easy to install and requires less human interference, thus boosting the demand for SDDC technology during the forecast period.

Streamlined and Automated Data Center Operations

SDDC delivers streamlined and automated data center operations solution, which reduces the operational expenses (OPEX) through intelligent IT approach. It reduces the mean time to resolve any issue, which makes the system more efficient and also provides an open and extendable platform with third party integration. Thus, it improves the overall performance of the system and increases SDDC market demand, which results in market growth.

Key Benefits for Stakeholders:

The study provides in-depth analysis of the global software defined data center market share along with current trends and future estimations to illustrate the imminent investment pockets.

Information about key drivers, restrains, and opportunities and their impact analysis on the global software defined data center market size are provided in the report.

The Porter’s five forces analysis illustrates the potency of buyers and suppliers operating in the software defined data center market.

An extensive analysis of the key segments of the industry helps to understand the software defined data center market trends.

The quantitative analysis of the global software defined data center market forecast from 2021 to 2030 is provided to determine the market potential.

Software Defined Data Center (SDDC) Market Report Highlights

| Aspects | Details |

| By Component |

|

| By Deployment Mode |

|

| By Enterprise Size |

|

| By Type |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Microsoft Corporation, EMC Corporation, Cisco Systems Inc., Hewlett Packard (HP), Citrix Systems, Inc., International Business Machines Corporation (IBM), SAP SE, Oracle Corporation, Dell Software Inc., VMware, Inc. |

Analyst Review

Software-defined data center (SDDC) is important in the software business because it makes it easier to store and process data. Effective service delivery, increased performance, and standardized hardware platforms are some of the primary advantages of SDDC centers. SDDC is also prevalent in the industrialized countries, including North America and Europe (the U.K., Germany, and Russia). However, it is rapidly gaining popularity in emerging nations, including Asia-Pacific, Latin America, and the Caribbean. Few nations, such as Australia, Japan, and India, produce the majority of demand for SDDC in emerging regions.

Moreover, during this global health crisis, the adoption of software-defined data centers technology increased among large & small businesses. This, as a result increased the demand for software-defined data center, thereby accelerating the revenue growth.

The software-defined data center market is fragmented with the presence of regional vendors, such as Citrix Systems, Inc., Cisco Systems, Inc., IBM Corporation, Microsoft, Hewlett Packard Enterprise Development LP, SAP SE, Oracle Corporation, Dell Inc., VMware, Inc., and Datacore Software. Major players operating in this market have witnessed significant adoption of strategies that include business expansion and partnership to reduce supply and demand gap. With increase in awareness & demand for software-defined data center across the globe, major players are collaborating their product portfolio to provide differentiated and innovative products.

The major trends in the market are SDDCs grain traction among businesses, due to their unique advantages, including simplified and automated data center operations. They are provided on a lease basis to end users to store their crucial information that can be remotely accessed.

Software-defined compute (SDC) segment accounted for the highest revenue in software defined data center (SDDC) market. SDC is a popular network solution as it provides a software infrastructure, which is flexible and can serve many enterprises simultaneously. SDC is driven by the increase in complexity of the network solutions with rapid technology evolution.

North America accounted for the major share of software defined data center (SDDC) market. North America dominates the regional market in the SDDC owing to the huge investment in advanced software services with automated storage. The investment in IT organization for software infrastructure helps the region to grow.

The global software defined data center market size was valued at $39.45 billion in 2020, and is projected to reach $320.59 billion by 2030, growing at a CAGR of 23.7% from 2021 to 2030.

Cisco Systems, Inc., IBM Corporation, Microsoft, and Datacore Software hold the market share in software defined data center market.

Loading Table Of Content...