Solar Cell Paste Market Research, 2033

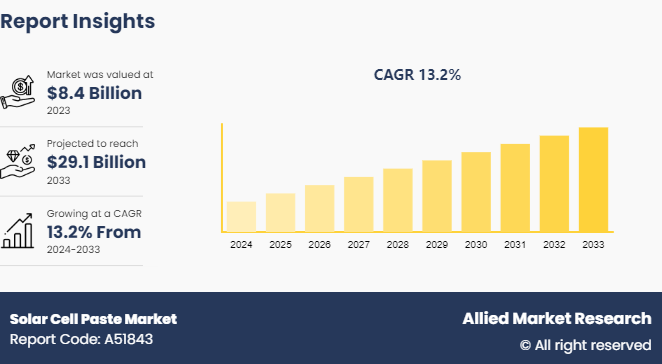

The global solar cell paste market was valued at $8.4 billion in 2023, and is projected to reach $29.1 billion by 2033, growing at a CAGR of 13.2% from 2024 to 2033.

Market Definition and Introduction

Solar cell paste refers to a specialized material used in the production of solar cells or photovoltaic (PV) cells. It plays a crucial role in the manufacturing process of solar panels, which convert sunlight into electricity. The primary function of solar cell paste is to facilitate the efficient and reliable connection between various components of a solar cell. In addition, solar cell paste is a specialized material that plays a crucial role in the manufacturing of solar cells by facilitating metallization, enhancing conductivity, promoting adhesion, and enabling the efficient conversion of sunlight into electricity. The development of advanced solar cell paste formulations is an ongoing area of research and innovation within the broader field of photovoltaic technology.

Key Takeaways

- The solar cell paste market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2033.

- More than 1,500 product literature, industry releases, annual reports, and other documents of major solar cell paste industry participants, authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve the most ambitious growth objectives.

Market Dynamics

The increase in demand for photovoltaic (PV) solar cells has emerged as a significant driver for the solar cell paste market. Photovoltaic solar cells, which convert sunlight into electricity, play a central role in harnessing solar energy for various applications, ranging from residential and commercial solar panels to large-scale solar power plants. According to PV tech org, India installed record 6.2GW of solar PV in March 2024. Metallization pastes, in particular, are crucial components used in the production process to enhance the electrical conductivity and adhesion of various cell components. As the PV solar cell market expands, there is a parallel escalation in the requirement for high-performance solar cell pastes that can optimize the efficiency and overall output of solar cells. All these factors drive the growth of solar cell paste market.

Technological barriers constitute a significant impediment to the growth of the solar cell paste market. The intricate nature of manufacturing processes and the demand for specialized equipment present formidable challenges for companies in the industry. The production of high-quality solar cell pastes requires precision and adherence to specific parameters, contributing to the complexity of the overall manufacturing process. This complexity, in turn, translates into higher operational costs for companies seeking to produce advanced and efficient solar cell pastes. In addition, the need for continuous technological innovation restrains the growth of the market players.

Advancements in solar cell technologies have emerged as a significant catalyst, opening up new and promising opportunities for the solar cell paste market. Innovations in solar cell technologies have been instrumental in enhancing the efficiency and performance of photovoltaic systems as solar energy continues to play a pivotal role in the global transition towards sustainable power sources. Moreover, the evolution of high-efficiency solar cells, including multi-junction and bifacial cells, has spurred the demand for metallization pastes capable of facilitating superior energy conversion. Solar cell paste formulations need to keep pace with these technological advancements, ensuring that they contribute to the overall efficiency gains of modern solar cells. All these factors are anticipated to offer new growth opportunities for the solar cell paste market during the forecast period.

Segment Overview

The solar cell paste market is segmented on the paste type, cell type, and region. By type, the market is classified into silver, aluminum and others. By cell type, the market is divided into n-type and p-type. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Overview

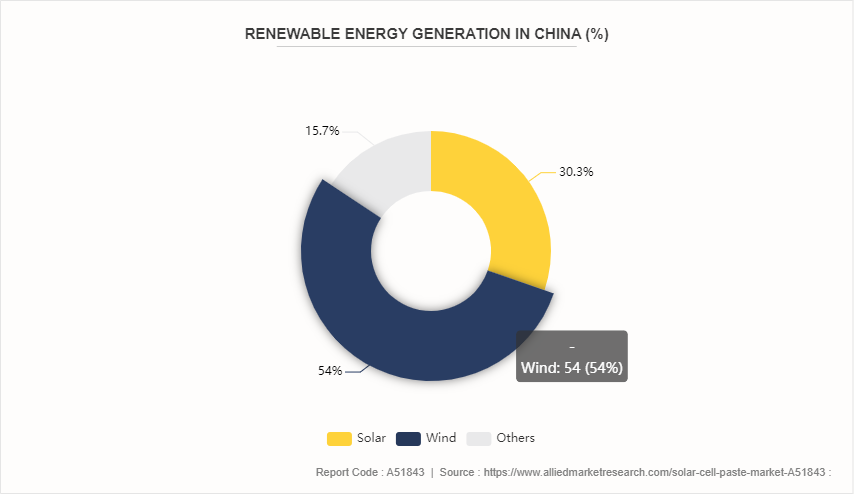

According to the BP Statistical Review of World Energy 2021, solar energy generation in Asia-Pacific in 2019 was 392, 000 GWh and reached 470, 300 GWh in 2020. The solar energy share in total electricity production of Asia-Pacific for 2020 is 3.64%. Increase in production of solar energy in Asia-Pacific is attributed to rise in usage of solar energy in standalone systems such as solar street lamps and telecommunication & signaling towers. Rapid industrialization and urbanization across countries of Asia-Pacific region such as India, China, and Thailand have led to increase in infrastructure development activities, including construction of highways and new residential complexes, which are expected to fuel the demand for standalone systems. In addition, photovoltaic panels are used in satellite to generate electricity for smooth functioning of satellite in space. Thus, increase in government investment in R&D of satellite technology for civil and military uses is expected to propel the demand for PV energy thereby increasing the demand of solar cell paste market in the region.

Competitive Analysis

Key players in the solar cell paste market include Murata Manufacturing Co., Ltd., Targray, Eastman Chemical Company, Heraeus Holding, Zhongxi Group Co., Ltd., Arraycom (India) Ltd., JA SOLAR Technology Co., Ltd., Bharat Heavy Electricals Limited, Solaronix SA, DuPont and others. The new paste, PV3NL by Solamet, launched in 2023, designed for laser carrier injection, can be adopted by cell manufacturers without significant changes to their process or machinery. According to Solamet, companies adopting the product can expect to see at least a 0.2% improvement in absolute efficiency, which it has demonstrated iterations of the TOPCon cell technology.

Semiconductor Chip Shortage Overview

- A severe semiconductor chip shortage has affected many industries since mid-to-late 2022, with the automotive, IT, and appliance industries being hit hardest.

- In the short-term, a faster than expected economic recovery led many manufacturers to quickly scale up chip orders after scaling down at the beginning of the pandemic. This left chip suppliers unprepared to meet surging demand, which led to delays and long wait times. Certain industries (e.g., microinverters) were more affected because chip manufacturers prioritized higher margin products (e.g., videogame consoles) .

- Enphase reported that despite an anticipated demand boom, the firm will likely be constrained by chip supply for at least the rest of the year.

- SolarEdge, on the other hand, reportedly stockpiled enough supply to meet demand for the year.

- Chip suppliers across the world have indicated an intent to expand type, but this could take a year or more, further contributing to the shortage.

Factors Affecting Prices of Solar Cell Production Across the Globe

- Breakthrough in Manufacturing Technology: This factor may increase the productivity and would lead to more supply. This may bring a reduction in the price.

- Government Policies and Regulations: Exchange rates, Export incentives, Fiscal policies, and export promotion also influence price.

- Cost of the Product: Price and cost of the product are closely related. A major factor is the cost of production. The product ultimately goes to end-use industry and their capacity to invest will fix the cost, or else the product would be fretted in the market.

Key Sources Referred

- BP Statistical Review of World Energy

- International Solar Alliance

- International Renewable Energy Agency (IRENA)

- National Renewable Energy Laboratory (NREL)

- Solar Energy Industries Association (SEIA)

- International Energy Agency (IEA)

- International Trade Administration

- Organisation for Economic Co-operation and Development (OECD)

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the solar cell paste market analysis from 2023 to 2033 to identify the prevailing solar cell paste market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the solar cell paste market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the Global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as Global solar cell paste market trends, key players, market segments, application areas, and market growth strategies.

Solar Cell Paste Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 29.1 Billion |

| Growth Rate | CAGR of 13.2% |

| Forecast period | 2024 - 2033 |

| Report Pages | 236 |

| By Paste Type |

|

| By Cell Type |

|

| By Region |

|

| Key Market Players | Bharat Heavy Electricals Limited, Zhongxi Group Co., Ltd., Eastman Chemical Company, Heraeus Holding, Arraycom (India) Ltd., DuPont, Targray, Murata Manufacturing Co., Ltd., JA SOLAR Technology Co., Ltd., Solaronix SA |

Loading Table Of Content...