Solar Photovoltaic Glass Market Research, 2033

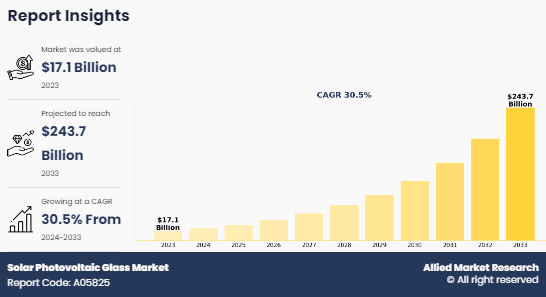

The global solar photovoltaic glass market size was valued at $17.1 billion in 2023, and is projected to reach $243.7 billion by 2033, growing at a CAGR of 30.5% from 2024 to 2033. Rise in demand for renewable energy, supportive government policies, technological advancements, cost reductions, efficiency improvements, architectural integration capabilities, environmental concerns, and public awareness are key drivers propelling the growth of the solar photovoltaic glass market. As the global transition towards clean and sustainable energy sources continues to accelerate, the demand for solar photovoltaic glass is expected to grow, creating new opportunities and driving innovations in the solar photovoltaic industry.

Introduction

Solar photovoltaic (PV) glass is a glass that utilizes solar cells to convert solar energy into electricity. It is installed within roofs or façade areas of buildings to produce power for an entire building. In these glasses, solar cells are fixed between two glass panes, which have a special filling of resin. These resins securely wrap solar cells from all sides. Each cell is connected with two electrical connections and is attached to other cells to form a module.

Key Takeaways

- The key players in the solar PV glass industry are Onyx Solar Group LLC, Shenzhen Topray Solar Co., Ltd., Borosil Glass Works Limited, Trina Solar, Ja Solar Holdings Co. Ltd, Sharp Corporation, Brite Solar, Wuxi Suntech Power Co., Ltd., Gruppo STG, and Polysolar.

- The segment analysis of each country in terms of value during the forecast period 2023-2033 is covered in the global solar photovoltaic glass market report.

- More than 6,765 product literatures, industry releases, annual reports, and other such documents of major industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

Market Dynamics

Factors boosting the solar photovoltaic glass market growth include supportive government regulations toward installation of solar PV plants. In addition, rise in demand for solar systems in residential, commercial, and utility scale boosts the growth of the solar photovoltaic glass market.

Moreover, the China solar photovoltaic industry has witnessed significant growth as compared to any other country over the years. According to data from the China Photovoltaic Industry Association, China's annual production capacity for completed solar modules reached 861 gigawatts (GW) equivalent by the end of 2023. This capacity is more than double the global installations of 390 GW during the same period.

However, high cost involved with installation, storage, and purchase of solar devices is expected to hamper the growth of the market. The global solar photovoltaic glass market is yet to explore its full potential. The upfront costs associated with the installation of solar photovoltaic (PV) systems, including expenses for solar PV glass, solar panels, inverters, mounting structures, and ancillary components, are expected to pose a significant financial burden for residential, commercial, or industrial users. This initial financial commitment may deter potential investors, despite the prospective long-term benefits of diminished energy expenses and environmental sustainability.

However, technological innovations are paving the way for growth opportunities in the solar photovoltaic glass market. The emergence of bifacial solar PV glass offers opportunities for increased energy generation, particularly in settings with high reflectivity. In addition, the integration of intelligent technologies such as sensors and energy management systems into solar PV glass opens avenues for enhanced functionality. Smart solar glass can dynamically modulate transparency and maximize energy yield in response to environmental conditions.

Segments Overview

The solar PV glass market is segmented on the basis of type, end-use industry, and region. By type, it is divided into anti-reflective coated glass, tempered glass, TCO glass, and others. By end-use industry, it is divided into residential, commercial, and utility scale. Region-wise, the solar photovoltaic glass market share is segmented into North America, Asia-Pacific, Europe, and LAMEA.

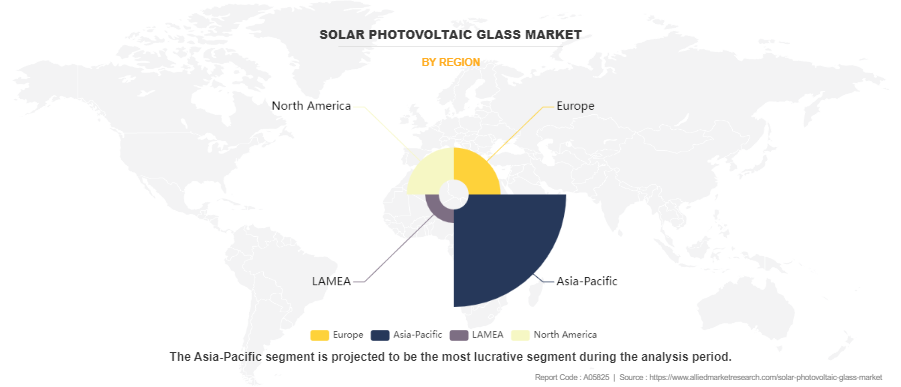

In 2023, the Asia-Pacific region held the largest share, constituting over half of the global solar photovoltaic glass market, with projections indicating its dominance to persist throughout the forecast period. Furthermore, this region is expected to experience the highest CAGR of 30.8% from 2024 to 2033. This growth trajectory is attributed to regulatory frameworks that promote the installation of photovoltaic panels and a surge in solar panel installations across the region.

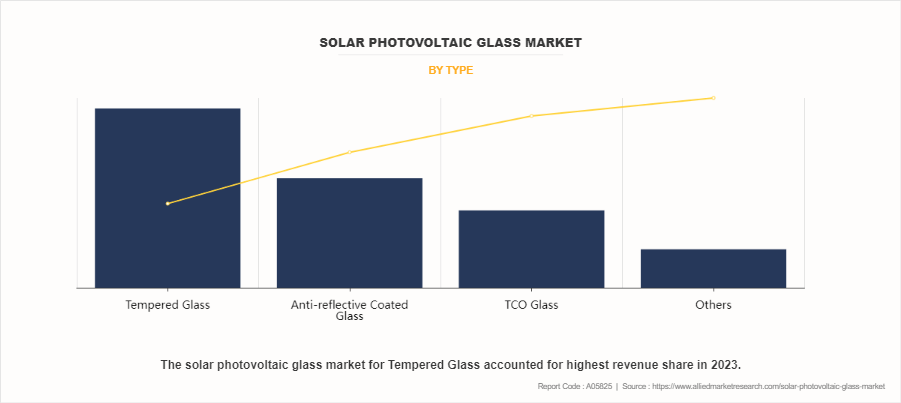

In 2023, the tempered glass segment commanded over two-fifths of the total share of the global solar photovoltaic glass market, and it is projected to retain its leading position throughout the forecast period. This is primarily attributed to its superior strength and safety features compared to other types of glass. However, the anti-reflective coated glass segment is anticipated to exhibit the fastest CAGR of 30.8% from 2024 to 2033. This growth is driven by its capability to enhance light transmittance and deliver superior overall efficiency when compared to other modules.

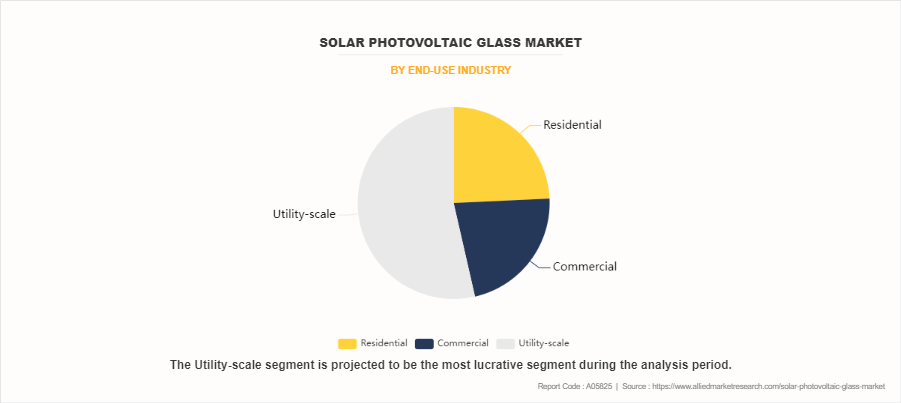

The utility-scale segment emerged as the leading contributor to the global solar photovoltaic glass market in 2023, commanding over half of the total market share. Projections indicate its continued dominance in revenue share by 2033. Additionally, this segment is anticipated to experience the highest CAGR of 30.8% from 2024 to 2033. This segment is particularly lucrative due to its ability to offer fixed-priced electricity during peak demand periods.

Competitive Analysis

The key players involved in the global solar photovoltaic glass industry are Onyx Solar Group LLC, Shenzhen Topray Solar Co., Ltd., Borosil Glass Works Limited, Trina Solar, Ja Solar Holdings Co. Ltd, Sharp Corporation, Brite Solar, Wuxi Suntech Power Co., Ltd., Gruppo STG and Polysolar. To stay competitive, these market players are adopting different strategies such as product launch, partnership, mergers, and acquisitions.

Recent Key Developments in the Solar Photovoltaic Glass Market

- In 2023, Nippon Sheet Glass Co., Ltd. (NSG Group) inaugurated a Transparent Conductive Oxide (TCO) facility in Malaysia. As a part of this venture, Malaysian Sheet Glass SDN BHD, an affiliate of the NSG Group, revamped an existing float line at its Johor Bahru plant to commence TCO glass production in December 2023. This investment aims to support the expansion of First Solar, Inc., a leading American solar technology firm with a longstanding collaboration with NSG Group. First Solar is a global provider of sustainably manufactured, energy-efficient solar modules. The glass for First Solar's operations in Southeast Asia will be supplied from this float line. This expansion is set to bolster the market for solar photovoltaic glass.

- In 2022, AGC Inc. revealed that its photovoltaic glass is to be utilized at the Singapore Institute of Technology's upcoming Punggol campus, set to open in 2024. The campus plans to incorporate AGC's photovoltaic glass in the skylight of its food court, harnessing it as an additional energy source and diminishing its dependency on primary grid electricity. This development is expected to drive the demand for solar photovoltaic glass in the market.

- In 2020, Nippon Sheet Glass Co., Ltd. (NSG Group) announced the commencement of operations for its float furnace in Luckey, Ohio, designed to produce Transparent Conductive Oxide (TCO) coated glass for solar panels. The new 500,000 square foot glass manufacturing facility was constructed to bolster the production capacity of TCO glass in response to the growing solar market demand. This investment forms part of a long-term supply agreement with First Solar, Inc., a U.S.-based company with its largest photovoltaic (PV) solar manufacturing facility in the Western Hemisphere situated in Northwest Ohio.

Key Benefits For Stakeholders

- This solar photovoltaic glass market report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the solar photovoltaic glass market analysis from 2023 to 2033 to identify the prevailing solar photovoltaic glass market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the solar photovoltaic glass market forecast assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global solar photovoltaic glass market trends, solar photovoltaic glass market statistics, key players, market segments, application areas, and market growth strategies.

Solar Photovoltaic Glass Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 243.7 billion |

| Growth Rate | CAGR of 30.5% |

| Forecast period | 2023 - 2033 |

| Report Pages | 250 |

| By Type |

|

| By End-use Industry |

|

| By Region |

|

| Key Market Players | Borosil Glass Works Limited, Wuxi Suntech Power Co., Ltd., JA Solar Holdings Co. Ltd., Sharp Corporation, Onyx Solar Group LLC, Gruppo STG, Shenzhen Topray Solar Co., Ltd., Trina Solar Limited., Brite Solar Inc. |

Analyst Review

According to the insights of the CXOs of leading companies, the solar photovoltaic glass market is driven by rise in demand for renewable energy in emerging economies such as India, China, and Japan, as well as other regions. Also, the global push towards reducing carbon emissions and combating climate change has led to a significant increase in demand for renewable energy sources, including solar power.

Moreover, supportive policies, feed-in tariffs, tax credits, and direct subsidies provided by governments globally are encouraging investments in solar PV installations and boosting the demand for solar PV glass. Renewable energy targets, carbon reduction goals, and environmental regulations are pushing industries and utilities to invest in solar power generation, thereby increasing the demand for solar PV glass.

Further, ongoing R&D activities are leading to advancements in solar PV glass technologies, improving efficiency, durability, and cost-effectiveness, which are key drivers for the market growth. Development of building-integrated photovoltaics (BIPV) and solar windows, which incorporate solar PV glass into building facades and structures, is creating new opportunities and driving the demand for innovative solar PV glass solutions.

The solar photovoltaic glass market is expected to possess high growth potential in the coming years due to supportive government regulations.

Utility scale segment contributed to the highest market share in the global solar photovoltaic glass market in 2023.

The solar photovoltaic glass market was valued at $17.1 billion in 2023, and is estimated to reach $243.7 billion by 2033, growing at a CAGR of 30.5% from 2024 to 2033

Asia-Pacific is the largest regional market for Solar Photovoltaic Glass.

The key players involved in the global solar photovoltaic glass industry are Onyx Solar Group LLC, Shenzhen Topray Solar Co., Ltd., Borosil Glass Works Limited, Trina Solar, Ja Solar Holdings Co. Ltd, Sharp Corporation, Brite Solar, Wuxi Suntech Power Co., Ltd., Gruppo STG, and Polysolar.

Loading Table Of Content...

Loading Research Methodology...