Solid-State Lithium Battery Market Research, 2030

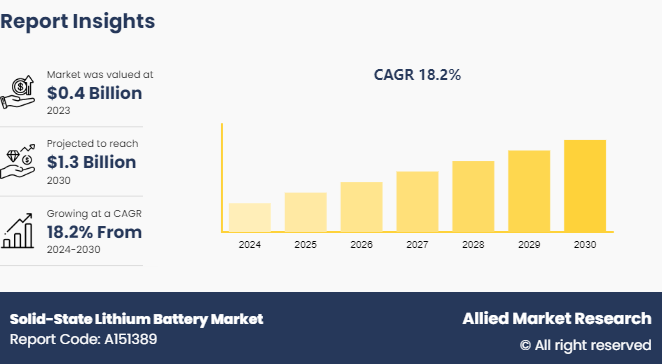

The global solid-state lithium battery market was valued at $0.4 billion in 2023, and is projected to reach $1.3 billion by 2030, growing at a CAGR of 18.2% from 2024 to 2030.

Market Introduction and Definition

A solid-state lithium battery represents a revolutionary advancement in energy storage technology, fundamentally departing from traditional lithium-ion batteries by replacing liquid or gel electrolytes with solid materials. In addition, these batteries utilize solid-state electrolytes, often ceramic or polymer-based to conduct ions between the cathode and anode. The absence of flammable liquid electrolytes enhances safety, thus addressing concerns associated with thermal runaway and battery fires in the conventional lithium-ion batteries.

Key Takeaways

- The solid-state lithium battery market report covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period.

- More than 1, 700 product literatures, industry releases, annual reports, and other such documents of major solid-state lithium battery industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

The solid-state lithium battery market is experiencing significant growth, driven by an increase in focus on energy efficiency across various industries. The demand for energy-efficient solutions has become paramount as the globe faces the challenge of climate change and strives for sustainable practices. In this context, solid-state lithium batteries have emerged as key contributors to improving energy efficiency, which fuels their widespread adoption. In addition, the extended lifespan of solid-state lithium batteries contributes significantly to energy efficiency. With a long cycle life, as compared to conventional batteries, these solid-state alternatives require less frequent replacements. This longevity reduces the environmental impact associated with battery disposal and enhances the overall energy efficiency of devices & systems utilizing these batteries. All these factors are pivotal for augmenting the growth of the solid-state lithium battery market.

According to Chemical Abstracts Service global electric car market is projected to reach $858Billion by 2027, powered by lithium-ion batteries. Yet only 5% of lithium-ion batteries are thought to be recycled globally. Historically, lithium-ion battery recycling has been limited by the volatile pricing of raw materials, lack of recycling plants, and absence of regulations. However, advances in recycling methods, high growth potential, and a fixed amount of rare metals have made recycling more attractive as market size projections are anticipated to reach $13B by 2030. However, cost challenges play a crucial role in restraining the growth of the solid-state lithium battery market. One of the primary restraints is the intricate and resource-intensive manufacturing process of solid-state lithium batteries. This process utilizes specialized materials and advanced technologies, hence elevating the production costs. Therefore, the overall cost of solid-state batteries remains considerably high as compared to traditional lithium-ion counterparts.

Furthermore, the advanced structure of solid-state battery technology complicates the production process. R&D efforts to optimize materials and streamline production are proceeding however, addressing these technological obstacles requires significant investment and time. All these factors hamper the solid-state lithium battery market growth. On the contrary, technological innovations play a pivotal role in creating numerous opportunities for the solid-state lithium battery market. As R&D activities in the field of energy storage continue to progress, breakthroughs in materials, design, and manufacturing processes enable the development of more efficient & reliable solid-state lithium batteries. In addition, advancements in manufacturing techniques streamline the production of solid-state lithium batteries, leading to cost reductions and scalability. This is particularly significant in context of EVs & consumer electronics, where cost-effectiveness and mass production capabilities are crucial for market penetration. All these factors are anticipated to open new avenues for the solid-state lithium battery market forecast.

Market Segmentation

The solid-state lithium battery market overview is segmented by manufacturing type, application, and region. By manufacturing type, the market is classified into thin-film battery, bulk battery, and others. By application, the market is divided into consumer electronics, electric vehicles, energy storage systems, medical devices, and others. Region-wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

Asia-Pacific is experiencing robust economic growth, leading to an increasing demand for energy storage solutions to support various sectors such as transportation, renewable energy integration, and consumer electronics. Solid-state lithium batteries, renowned for their superior energy density, safety, and longevity, are emerging as prominent contenders in meeting this escalating demand. Moreover, environmental concerns play a significant role in driving the adoption of solid-state lithium batteries in the Asia-Pacific region. There is a notable shift towards sustainable energy practices across industries with a growing awareness of climate change and the imperative to reduce carbon emissions. Solid-state lithium batteries offer a more sustainable option as they eliminate the need for flammable liquid electrolytes, thereby reducing the risk of thermal runaway and potential environmental hazards associated with traditional lithium-ion batteries. In addition, solid-state lithium batteries are poised to contribute to a greener future as they enable the widespread adoption of electric vehicles, renewable energy storage systems, and grid stabilization solutions, thus reducing reliance on fossil fuels and mitigating environmental impact.

Competitive Landscape

The major players operating in the solid-state lithium battery market include Solid Power Inc., SAMSUNG SDI CO., LTD., Blue Solutions, Ilika, Toyota, SES AI Corporation, Hitachi Zosen Corporation, Johnson Energy Storage, Inc., QuantumScape Battery, Inc., and Excellatron. Other players in the solid-state lithium battery market include LG chem, Robert Bosch GmbH, GS Yuasa International Ltd.

Recent Key Strategies and Developments

In March 2024, Samsung SDI announced its participation in Inter Battery 2024, which begins on March 6 and runs for three days in Seoul. At the event, the company plans to unveil a suite of 'super-gap' battery technologies, including fast-charging and ultra-long-life batteries. Additionally, Samsung SDI will present its roadmap for mass production of all solid-state batteries, a cutting-edge solution that surpasses traditional lithium-ion batteries.

In July 2022, Hitachi High-Tech Corporation announced the development of a remote diagnostic service for assessing the degradation status of on-board automotive lithium-ion batteries. Ensuring stable and efficient battery operation is crucial for the deployment of electric vehicles (EVs) . Hitachi High-Tech plans to offer this service to global customers through various networks, aiming to contribute to a circular society by addressing customer challenges.

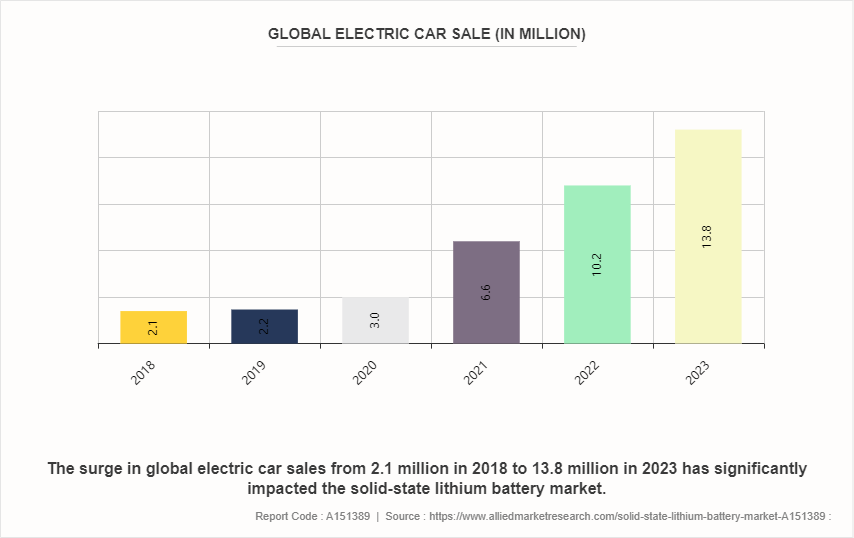

Global Electric Car Sale

The surge in global electric car sales from 2.1 million in 2018 to 13.8 million in 2023 has significantly impacted the solid-state lithium battery market. As electric vehicle (EV) adoption accelerates, the demand for more efficient, longer-lasting, and safer battery technologies has grown, driving investment and innovation in solid-state lithium battery market.

Public Policies

Good Manufacturing Practices (GMP) : Countries have GMP guidelines specific to the manufacturing of solid-state lithium batteries. These regulations establish stringent standards for the production, packaging, labeling, and storage of solid-state lithium batteries to ensure their quality, reliability, and safety. These guidelines cover aspects such as the control of raw materials, production processes, and environmental conditions to prevent contamination and defects.

Quality Control and Testing: Regulations mandate comprehensive quality control measures to ensure the integrity of solid-state lithium batteries. This includes testing for electrical performance, thermal stability, mechanical integrity, and chemical composition. Advanced analytical techniques such as X-ray diffraction (XRD) , Scanning Electron Microscopy (SEM) , and Electrochemical Impedance Spectroscopy (EIS) are utilized to validate the properties and performance of the batteries. In addition, batteries are subjected to rigorous safety tests to detect any potential for thermal runaway or failure under extreme conditions.

Safety Assessment: Regulatory bodies require extensive safety assessments and toxicological studies to evaluate the potential risks associated with solid-state lithium batteries. This involves analyzing the chemical stability of the solid electrolytes, the thermal behavior of the battery under various conditions, and the potential for toxic emissions in case of failure. Safety protocols are designed to assess and mitigate risks such as short-circuiting, overcharging, and mechanical damage.

Registration and Approval: Solid-state lithium batteries must be registered or approved by relevant regulatory authorities before they can be marketed or sold. This process typically involves the submission of detailed documentation regarding the safety, efficacy, and quality of the batteries. Manufacturers must provide data from testing and assessments, including performance metrics, safety evaluations, and compliance with international standards. Approval processes ensure that the batteries meet the necessary criteria for consumer and industrial use.

Industry Trends

- In Olen, Belgium, Umicore opened one of the world's largest and most advanced solid-state battery material prototyping labs, in June 2023. The 600-square-meter facility, outfitted with cutting-edge installations and technology, supports the entire chain of solid-state battery research.

- In 2022, China experienced a significant surge in battery demand for vehicles, with an increase of over 70%. Electric car sales in the country also increased sharply by 80% compared to the previous year. However, the growth in battery demand was slightly offset by the surge in share of Plug-in Hybrid Electric Vehicles (PHEVs) . Meanwhile, in the U.S., battery demand for vehicles also witnessed a notable rise of around 80%, despite electric car sales increasing by a comparatively lower rate of approximately 55% in 2022.

- In April 2022, Honda Motors unveiled plans for a significant investment of USD $39.84 billion over the next decade to boost its global business through electrification and software technologies. As part of this initiative, the company intends to construct a demonstration production line for all-solid-state batteries in North America, earmarking approximately USD $342.65 million for the project. In addition, Honda aims to introduce two mid-to-large-scale electric vehicle (EV) models by 2024, collaborating with General Motors to achieve this milestone

Key Sources Referred

- International Trade Administration

- MDPI

- Invest India

- Aerospace Industries Association (AIA)

- International Renewable Energy Agency

- American Chemical Society

- Department of Energy

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the solid-state lithium battery market analysis from 2024 to 2030 to identify the prevailing solid-state lithium battery market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the solid-state lithium battery market share segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market .

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global solid-state lithium battery market trends, key players, market segments, application areas, and market growth strategies.

Solid-State Lithium Battery Market Report Highlights

| Aspects | Details |

| Market Size By 2030 | USD 1.3 Billion |

| Growth Rate | CAGR of 18.2% |

| Forecast period | 2024 - 2030 |

| Report Pages | 340 |

| By Manufacturing Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Hitachi Zosen Corporation, SAMSUNG SDI CO., LTD, SES AI Corporation, QuantumScape Battery, Inc, Johnson Energy Storage, Inc., Ilika, Blue Solutions., Solid Power Inc., Toyota, Excellatron |

Advancements in Battery Technology, Increased Adoption in Electric Vehicles (EVs) are the upcoming trends of Solid-State Lithium Battery Market in the world.

Electric Vehicles (EVs) is the leading application of Solid-State Lithium Battery Market

Asia-Pacific is the largest regional market for Solid-State Lithium Battery.

The global solid-state lithium battery market was valued at $0.4 billion in 2023, and is projected to reach $1.3 billion by 2030, growing at a CAGR of 18.2% from 2024 to 2030.

Solid Power Inc., SAMSUNG SDI CO., LTD., Blue Solutions, Ilika, Toyota, SES AI Corporation, Hitachi Zosen Corporation, Johnson Energy Storage, Inc., QuantumScape Battery, Inc., and Excellatron are the top companies to hold the market share in Solid-State Lithium Battery.

Loading Table Of Content...