Sorghum And Sorghum Seeds Market Overview:

Global Sorghum And Sorghum Seeds Market was valued at $8,279 million in 2016, and is expected to reach $10,591 million by 2023, registering a CAGR of 3.6% from 2017 to 2023. Sorghum is a genus of flowering plants of the grass family Poaceae. Sorghum is a cereal grain that grows tall (similar to corn), and is used for a lot of purposes such as sweetening, human food, and livestock feed.

Sorghum is used as human feed and livestock feed and the rest is turned into ethanol. It is a popular crop to grow within the drier regions, since it is drought resistant and shows efficient yields even in regions with scarcity of water. One species is grown for grain, while many others are used as fodder plants, either cultivated in warm climates across the globe or naturalized, in pasture lands. Sorghum is efficient in converting solar energy to chemical energy, and also uses less water compared to other grain crops. Biofuel is produced using sweet and biomass sorghum and is being developed with biomass, which can be turned into syngas, charcoal, and bio-oil.

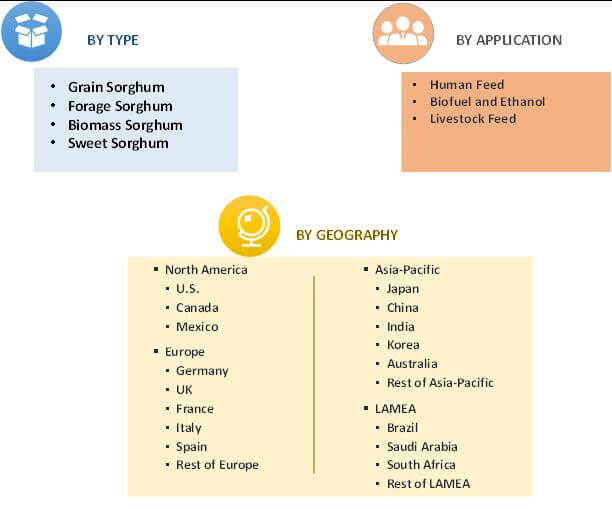

The global sorghum and sorghum seeds market is segmented based on type, application, and geography. On the basis of type, the market is categorized into grain sorghum, forage sorghum, biomass sorghum, and sweet sorghum. On the basis of application, the market is classified into human feed, biofuel & ethanol, and livestock feed. By geography, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Global Sorghum and Sorghum Seeds Market Segmentation

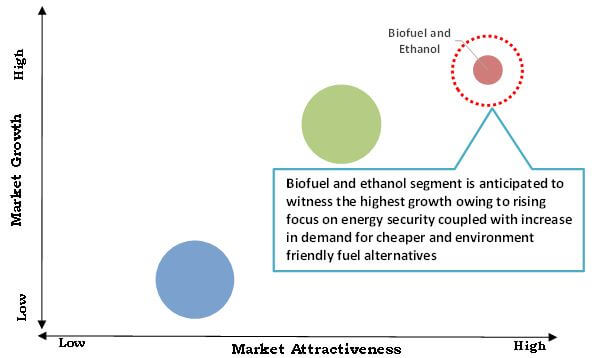

Top Investment Pockets, by Application

The biofuel and ethanol segment offers maximum market potential in the global sorghum and sorghum seeds market, due to increase in demand for cost-effective and greener fuel alternatives especially in the developing countries of Russia, China, India, Indonesia, and others. In addition, rise in focus on energy security and increase in prices of crude oil are some other major aspects fueling the demand for sorghum in the global sorghum and sorghum seeds market.

Moreover, owing to technological advances in production methods and excellent chemical and physical characteristics, sorghum is not only well-recognized for its use in biofuel, but also plays a major role in human and animal feed as well as other industrial applications. The biofuel and ethanol segment is expected to register a CAGR of 3.8% during the forecast period. However, shift in consumer preferences and increase in introduction of new and cheaper alternatives are some key factors anticipated to hamper the market growth in the near future. Furthermore, investments in R&D activities to produce more efficient yields of sorghum is expected to provide growth opportunities in the future.

Global Sorghum and Sorghum Seeds Market: Top Investment Pockets, by Application

Segment Overview

The grain sorghum segment accounted for the largest share in the global market in 2016, and is anticipated to maintain its dominance throughout the forecast period, growing at a CAGR of 3.4%.

Sorghum and Sorghum Seeds Market Share, by Type, 2016 (%)

Geographical Overview

LAMEA accounted for more than 35% share of the total revenue in 2016, followed by Asia-Pacific and North America. The developing countries in LAMEA region are anticipated to register steady growth rate, owing to the surge in the overall economy. Moreover, rise in investments by key manufacturers fuel the market growth.

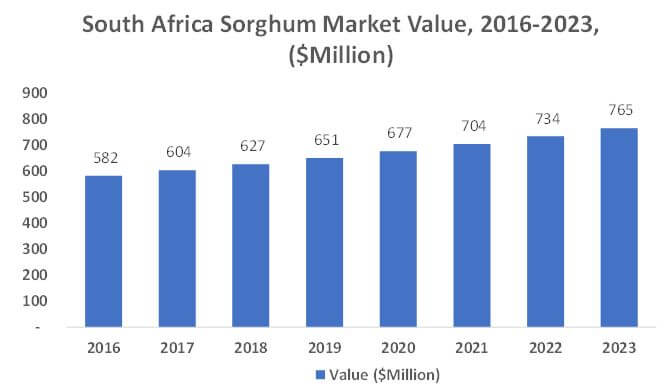

South Africa Sorghum and Sorghum Seeds Market, 2016-2023 ($million)

Key market players have invested in R&D activities to develop advanced products to cater to the growing requirements of the consumers. The players operating in the industry include National Sweet Sorghum Producers & Processors Assn, National Sorghum Producers, Sorghum Forum Of South Africa, Shri Lal Mahal Group, Richardson Seeds, Mabele Fuels, Advanta Seeds US, DuPont, Archer Daniels Midland, and Ingredion.

The other players in the value chain (profiles not included in the report) include Associated British Foods, General Mills, Sai Agro Exim, and SEMO Milling, Chromatin Inc., Bunge Limited, Cargill Incorporated, Dow AgroSciences LLC, Blue River Hybrids, Taj Agro International Ltd., La Crosse Seed LLC, Hancock Farm and Seed Company, Pacific Seeds, Allied Seed LLC and Dyna-Gro Seed, and others.

Key Benefits

- The report provides extensive qualitative & quantitative analysis of the current trends and future estimations of the market from 2016 to 2023 to determine the prevailing opportunities.

- It offers comprehensive analysis of key regions, such as North America, Europe, Asia-Pacific, and LAMEA, to understand the regional trends.

- In-depth analysis of factors that drive and restrict the growth of the market is provided.

- Extensive analysis is conducted by following key product positioning and monitoring the top competitors within the market framework.

- It offers key insights on strategic analysis of various companies and the value chain analysis of sorghum.

Sorghum and Sorghum Seeds Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Application |

|

| By Geography |

|

| Key Market Players | SHRI LAL MAHAL GROUP, SORGHUM FORUM OF SOUTH AFRICA, ARCHER DANIELS MIDLAND, MABELE FUELS, NATIONAL SORGHUM PRODUCERS, RICHARDSON SEEDS, DUPONT, INGREDION, NATIONAL SWEET SORGHUM PRODUCERS & PROCESSORS ASSN, ADVANTA SEEDS US |

Analyst Review

Sorghum is widely used as an alternative sweetener for alcoholic beverages. It has a variety of applications in pet food, fencing, building material, floral arrangements, and biofuel production. It is a substitute for a wide range of food products which has acted as a catalyst for sorghum producers to offer healthier products with the help of genetic engineering of crop seeds.

Surge in demand for sorghum especially from livestock feed application boosts the growth of the market. Moreover, increase in demand especially from developing countries, such as China and India, due to rapid urbanization and rise in consumer expenditure fuels the market growth. Increase in demand for sorghum especially for the production of artificial sweeteners along with increase in the usage of sorghum stem for fencing and other industrial purposes such as building and construction is projected to boost the demand for sorghum mainly in LAMEA regions. Also, farmers are increasingly shifting toward cultivating sorghum since it require less water, fertilizers and other artificial crop additives, thus increasing the overall demand across the globe.

The LAMEA sorghum and sorghum seeds market offers numerous opportunities for the manufacturers, owing to increase in demand for cheaper and healthier livestock feed, especially in Brazil and South Africa. Moreover, growth in the number of manufacturers and rise in demand for cost-effective and efficient biofuel products drive the growth of the LAMEA market. Asia-Pacific is estimated to account for the second largest market share in the near future, followed by North America.

Global Sorghum And Sorghum Seeds Market was valued at $8,279 million in 2016, and is expected to reach $10,591 million by 2023

The global Sorghum and Sorghum Seeds market is projected to grow at a compound annual growth rate of 3.6% from 2017 to 2023 to reach $10,591 million by 2023

NATIONAL SORGHUM PRODUCERS, SORGHUM FORUM OF SOUTH AFRICA, ADVANTA SEEDS US, NATIONAL SWEET SORGHUM PRODUCERS & PROCESSORS ASSN, SHRI LAL MAHAL GROUP, MABELE FUELS, INGREDION, DUPONT, RICHARDSON SEEDS, ARCHER DANIELS MIDLAND

LAMEA

Government policies and incentives to promote sustainable agriculture and sorghum cultivation can create a conducive environment for farmers and businesses, driving market growth.

Loading Table Of Content...