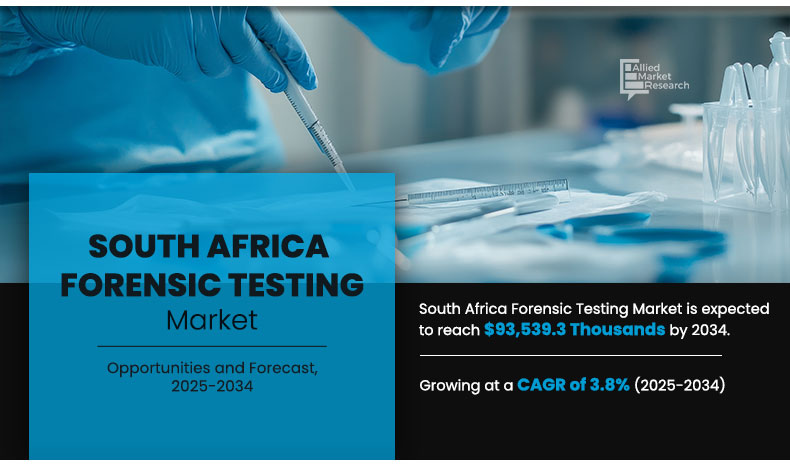

The south africa forensic testing market size valued at $64,600.0 thousands in 2024 and is estimated to reach $93,539.3 thousands by 2034, exhibiting a CAGR of 3.8% from 2025 to 2034.

Forensic testing is the process of examining materials such as biological samples, chemical substances, and electronic data using validated laboratory techniques. This scientific analysis supports law enforcement, legal proceedings, and public safety by providing objective, court-admissible evidence crucial to solving crimes and verifying claims.

Key Takeaways

- By contaminant type, the pathogen segment dominated the market in 2024.

- By sample type, the pharmaceuticals and healthcare segment dominated the market in 2024.

- By technology, the molecular technology segment dominated the market in 2024.

- By determinants, the biological determinants segment dominated the market in terms of revenue in 2024.

- By end user, the law enforcement agencies segment dominated the market in 2024.

- By region, Gauteng dominated the market in terms of revenue in 2024. However, Free State is anticipated to grow at the highest CAGR during the forecast period.

Market Dynamics

Increase in demand for trace evidence analysis is significantly driving the south africa forensic testing market growth. With rise in crime rates across the region, especially in urban centers, law enforcement agencies are depending on microscopic trace evidence, such as fibers, hair, glass fragments, paint, and soil, to establish links between suspects, victims, and crime scenes. This form of evidence plays a critical role in solving complex and violent crimes where direct proof is limited. Advanced microscopy and imaging technologies, including scanning electron microscopy and FTIR spectroscopy, are enabling more accurate and faster detection of trace materials, increasing the credibility of forensic reports in court proceedings. Furthermore, rise in awareness among legal professionals and investigators about the importance of micro-evidence is creating a consistent demand for skilled forensic analysts and upgraded lab infrastructure. This trend is expected to increase investment in forensic capabilities, particularly in public crime labs and academic research partnerships.

However, lack of standardization in protocols is a significant restraint on the growth and efficiency of the South Africa forensic testing industry. Forensic laboratories across the region operate with varying methodologies, equipment, and quality assurance procedures, leading to inconsistencies in test results and delays in case resolution. This variability can reduce the credibility of forensic evidence presented in court, resulting in legal challenges and mistrials. Moreover, absence of uniform protocols affects teamwork between different forensic units, especially in cases that require cross-provincial collaboration. It also complicates efforts to train and certify forensic professionals under a unified national framework. Without standardized procedures aligned with international best practices, forensic labs in South Africa face difficulties in achieving accreditation, limiting their capacity to participate in global criminal investigations or data sharing initiatives.

Further, rise in focus on synthetic drug detection is creating major market opportunities for growth. With rise in use of designer drugs such as synthetic cannabinoids, cathinones, and opioids, often modified to bypass traditional screening, there is an urgent need for advanced testing technologies, such as LC-MS/MS systems and expanded drug libraries. This creates opportunities for private laboratories to offer specialized toxicology services and for equipment suppliers to meet the growing demand for high-end analytical instruments. Furthermore, efforts by law enforcement agencies, public health authorities, and forensic laboratories to detect emerging substances are creating opportunities such as development of early warning and surveillance systems, as well as enhanced collaboration with international drug monitoring bodies.. There is also potential for training programs aimed at equipping forensic professionals with skills to identify and interpret synthetic drug makers. These trends collectively drive innovation and south africa forensic testing market demand

Segmental Overview

The south africa forensic testing market segmentation is divided into type of contaminant, sample type, technology, determinants, end user, and region. By type of contaminant, the market is divided into pathogens, pesticides and herbicide residues, genetically modified organism (GMO), allergens, heavy metals, mycotoxins, food adulterants and additives, radioactive contaminants, and others. By sample type, the market is divided into pharmaceuticals and healthcare, medical devices, food and beverage, environmental safety, nuclear, and chemical industries. By technology, the market is divided into molecular technology, spectroscopy, chromatographic techniques, microscopy and imaging, immunology, isotopic analysis, GM counters, liquid scintillation counting, digital forensic tools, field testing kits, and others. By determinants, the market is divided into biological determinants, trace/chemical substances, digital forensics, and other determinants. By end user, the market is divided into law enforcement agencies, private forensic laboratories, healthcare institutions, employers/private organizations, and individual/personal use. By region, the market is divided into Gauteng Province, Mpumalanga, Limpopo, Northwest, Free State, Western Cape Province, KwaZulu-Natal Province, and Rest of SA Province.

By Contaminant Type

By contaminant type, the pathogens segment dominated the market in 2024 and is anticipated to maintain its dominance during the forecast period. The growth of the pathogens segment in the south africa forensic testing market is driven by rise in incidence of foodborne illnesses, bioterrorism threats, and infectious disease outbreaks. Increase in demand for accurate microbial identification in forensic investigations further supports its continued dominance.

By Contaminant Type

South Africa Forensic Testing Market, By Contaminant Type ($Thousands)

By Sample Type

By sample type, the pharmaceuticals and healthcare segment dominated the south africa forensic testing market in 2024 and is anticipated to maintain its dominance during the forecast period, owing to increase in cases of drug counterfeiting, medication errors, and the need for quality verification in clinical and forensic investigations. Growing regulatory scrutiny and rise in demand for toxicological analysis in medical disputes further drive its sustained growth.

By Sample Type

South Africa Forensic Testing Market, By Sample Type ($Thousands)

By Technology

By technology, the molecular technology segment dominated the south africa forensic testing market in 2024 and is anticipated to maintain its dominance during the forecast period, owing to its high accuracy, sensitivity, and ability to detect minute traces of DNA, RNA, and other biomarkers. Its expanding use in criminal investigations, disease tracking, and identification of unknown substances is driving continued growth in the forensic testing market.

By Technology

South Africa Forensic Testing Market, By Technology ($Thousands)

By Determinants

By determinants, the biological determinants segment dominated the market in 2024 and is anticipated to maintain its dominance during the forecast period, owing to rise in use of DNA, blood, saliva, and other bodily fluids in criminal investigations and identity verification. Advances in molecular diagnostics and rise in demand for precise biological evidence further support its continued dominance.

By Determinants

South Africa Forensic Testing Market, By Determinants ($Thousands)

By End User

By end user, the law enforcement agencies segment dominated the market in 2024 and is anticipated to maintain its dominance during the forecast period, owing to rise in crime rates and increase in reliance on forensic evidence for criminal investigations and prosecutions. Government initiatives to strengthen forensic infrastructure and improve crime-solving efficiency further fuel the segment growth.

By End User

South Africa Forensic Testing Market, By End User ($Thousands)

By Region

By region, the Gauteng Province dominated the market in 2024 and is anticipated to maintain its dominance during the forecast period, owing to its high population density, increased crime rates, and concentration of forensic laboratories and law enforcement agencies. Presence of advanced healthcare and research institutions further supports sustained growth in forensic testing services in the region.

By Region

South Africa Forensic Testing Market, By Region ($Thousands)

Competition Analysis

Players operating in the south africa forensic testing market have adopted various developmental strategies to expand their south africa forensic testing market share, increase profitability, and remain competitive. Key players profiled in this report include SGS SA, Bureau Veritas S.A., Merieux Nutrisciences Corporation, AsureQuality Ltd., Microbac Laboratories, Inc., Interlab, Beyond Forensics, Peter Johnson Laboratories, Food Consulting Services, and National Analytical Forensic Services.

An Example of Acquisition in The Market

- In February 2025, Mérieux NutriSciences, a global leader in food safety, quality, and sustainability, completed the acquisition of Bureau Veritas’ food testing activities in Japan, Morocco, Southeast Asia, and South Africa.

An Example of Business Expansion in The Market

- In October 2024, SGS SA, a leading testing, inspection, and certification company, launched a new ISO/IEC 17025 accredited microbiological testing laboratory in Centurion, South Africa, expanding its food safety testing capabilities in the region.

Key benefits for stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the south africa forensic testing market analysis from 2024 to 2034 to identify the prevailing south africa forensic testing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the market segmentation assists to determine the prevailing market opportunities during the south africa forensic testing market forecast period.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as south africa forensic testing market trends, key players, market segments, application areas, and market growth strategies.

South Africa Forensic Testing Market Report Highlights

| Aspects | Details |

| By Sample Type |

|

| By Technology |

|

| By Determinants |

|

| By End User |

|

| By Region |

|

| By Type |

|

Analyst Review

According to CXOs of leading companies, the South Africa forensic testing market presents significant growth potential, driven by increase in demand for scientific evidence in criminal investigations, civil disputes, and regulatory enforcement. CXOs highlight that rise in crime rates, coupled with growing public and judicial reliance on forensic evidence, are driving the need for advanced, accurate, and timely forensic testing services. There is strong acceptance among industry leaders that investments in modern forensic technologies, such as DNA sequencing, toxicology, cyber forensics, and digital evidence analysis, are essential to enhance the credibility and efficiency of investigations.

CXOs also highlight the importance of compliance with evolving national and international forensic standards, which requires continuous upskilling of personnel and modernization of laboratory infrastructure. Law enforcement agencies, in particular, are increasingly seeking partnerships with private forensic labs to meet the demand for specialized services, especially in under-resourced regions. Moreover, rise in complexity of crimes, including cybercrime and synthetic drug abuse, necessitates sophisticated testing methodologies and cross-sector collaboration.

CXOs believe that consumer trust in the justice system depends on the transparency, accuracy, and impartiality of forensic outcomes. They also acknowledge that focus on traceability, data integrity, and quality assurance will be crucial in the years ahead. Overall, CXOs remain optimistic about the future of the South Africa forensic testing market, viewing it as a critical pillar in strengthening the country’s legal, healthcare, and public safety frameworks.

The South Africa forensic testing market registered a CAGR of 3.8% from 2025 to 2034.

Raise the query and paste the link of the specific report and our sales executive will revert with the sample.

The forecast period in the South Africa forensic testing market report is from 2025 to 2034.

The top companies that hold the market share in the South Africa forensic testing market include SGS SA, Bureau Veritas S.A., Merieux Nutrisciences Corporation, AsureQuality Ltd, and others.

The South Africa forensic testing market valued at $64,600.0 thousands in 2024 and is estimated to reach $93,539.3 thousands by 2034, exhibiting a CAGR of 3.8% from 2025 to 2034.

The South Africa forensic testing market report has 5 segments. The segments are contaminant type, sample type, technology, determinants, end user, and region.

The emerging region in the South Africa forensic testing market are likely to grow at a CAGR of more than 4.9% from 2025 to 2034.

Gauteng will dominate the South Africa forensic testing market by the end of 2034.

Loading Table Of Content...