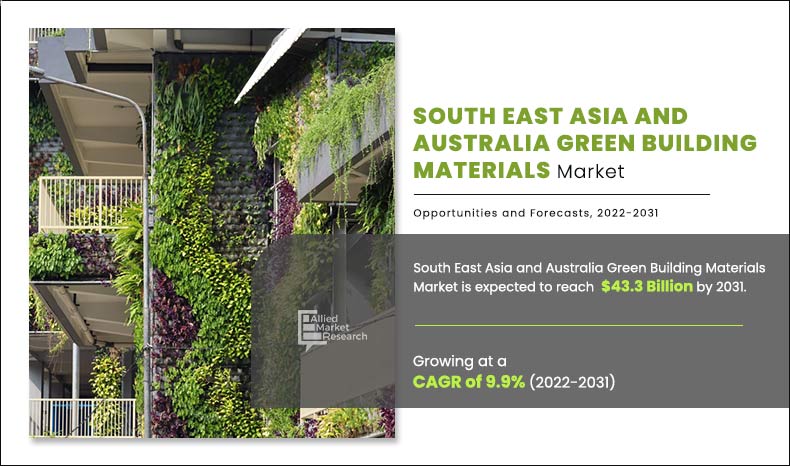

South East Asia and Australia Green Building Materials Market Outlook - 2031

The South East Asia and Australia green building materials market size was valued at $16.8 billion in 2021, and is projected to reach $43.3 billion by 2031, growing at a CAGR of 9.9% from 2022 to 2031.

The eco-friendly construction technique is known as green building. Utilizing green building materials for the best possible site selection, construction, design, maintenance, and removal, green building technology seeks to decrease the negative impacts of buildings on both human health and the environment. Green building materials include advantages such low operating costs, design adaptability, and lower cost of repairs.

In the Philippines, there are a number of council committees dedicated to green building that aid the industry expand. For instance, The Philippine Green Building Council (PHILGBC) is actively engaged in conducting online conferences to support the growing demand for green building construction projects and to emphasize the benefits related with the usage of sustainable building materials. In order to further reduce the impact on the environment, foreign nations and other financial organizations are promoting the construction of green buildings around the Philippines. For instance, it is projected that by 2030, the International Finance Corporation (IFC) would invest $3.4 trillion in the Philippines to create new green structures. This factor is anticipated to offer new growth opportunities in the South East Asia and Australia green building materials market.

In addition, several schemes and development plans have been adopted in Singapore to support the growth of green building construction. For instance, BCA green mark scheme was formed in 2005, which supported the growth of green building sector since 2005 and has attracted several stakeholders in the country for adoption of new green buildings. In addition, Singapore green building masterplan (SGBMP) is also set up to support the growth and construction of new green building in the country. The Singapore construction sector is adopting innovative architectural designs and other energy saving building technologies that are expected to further support the motive of green buildings. Singapore has taken lead in the green building sector in the Asia region owing to surge in number of green building projects and rapid urbanization. There are several malls and other commercial buildings in Singapore that are built using green building materials, such as solar panels at the top of the building, skylights, energy saving elevators, air conditioning systems that are highly efficient, and several software are implemented that will help to monitor the carbon monoxide emission. Moreover, government body in Singapore is inclined toward offering incentives for construction of green buildings in the country. All these factors are driving the demand for green building materials in Singapore. All these are South East Asia and Australia green building materials market growth factors.

However, cost concern and market barriers are anticipated to hamper the market growth. For instance, cost concerns and several market barriers, including “split incentive” barrier, that is, owners of the houses do not make effective investments in their properties, as its occupants who reap benefits from these investments and not owners, exist in the green building construction market. About 40% of commercial buildings and 32% of households in the world are rented or leased. Tenants do not have much control over building improvements, and owners do not intend to invest, as they cannot reap the benefits.

Conversely, growth in construction sector across South East Asia and Australia is anticipated to offer new growth opportunities in the forecast period. Infrastructure development, spiraling number of residential and commercial buildings, and favorable public– private partnerships are the major factors driving the construction industry across South East Asia and Australia. In addition, continuous technological advancements and penetration of international infrastructure players into emerging economies boost the construction market. Residential construction is expected to register substantial growth in Indonesia due to low interest rates, high employment rate, and the need to provide housing for asylum seekers and refugees. The South East Asia and Australia governments have initiated tax incentives for builders developing green buildings to encourage green construction. The usage of green building materials has witnessed rapid adoption in construction and retrofitting of residential and non-residential buildings. Thus, growth in the construction industry is expected to fuel the demand for green building materials.

The roofing green building material is expected to show significant growth rate over the forecast period. Green roofs improve energy efficiency of building structures, improve air quality, and enhance the aesthetics of urban rooftops. Proper installation of roofs is fundamental for the structural integrity of a building, and thus, the choice of roofing materials affects the energy-efficiency of a building. Steel, slate/stone, and composite materials are used as green materials in roofing. Steel roofing of panels and shingles is a preferred in the market, owing to its high recycled content and durability. Slate/stone offer long shelf life and better aesthetic quality to roofs but are expensive and difficult to install.

Weatherproof shingles manufactured using recycled aluminum alloys offers a combination of features, such as durability of metals and aesthetics of wood shakes. Unlike wood, aluminum alloys are fireproof and can reflect radiant heat, which can reduce heat gain by 34% as compared to asphalt shingles. Roofing membranes manufactured using vinyl and other single-ply technologies have revolutionized in roofing installation and specification over the past 30 years, offering quick, efficient, and clean alternatives to build roofs with superior design flexibility. Vinyl single-ply roofing membranes offer energy savings from its manufacture to reuse and provide both, financial and performance benefits. These membranes can be efficiently produced and transported to the installation sites, owing to their compactness and lightweight.

Growing demand for green building systems

Advanced building systems offer cost savings and assist in creating healthier indoor environment. Heating, ventilation and air conditioning (HVAC) is a mechanical system, which delivers thermal comfort and improved air quality to new constructions and existing buildings. The design of this system is based on the principles of fluid mechanics, thermodynamics, and heat transfer. The installation of dust mastic on all dust joints, attic ventilation systems, whole house fan, sealed combustion furnaces, hot water heaters, air conditioning systems with non-HCFC refrigerants, high efficiency particulate air filter (HEPA filter), and heat recovery ventilation unit improves indoor air quality, reduces energy loss & air emissions, increases comfort, and enables cost savings.

Forced air system and radiant heating system are two types of heating systems used in green buildings. Force air system operates through a series of ducts for distribution of conditioned air throughout the house, while radiant heating system uses radiators, radiant slabs, and underfloor piping to heat the house. HVAC forms a significant part of residential structures including apartment buildings, single family homes, and hotels. The capacity of HVAC systems plays a vital role in deciding its efficiency, which in turn depends on factors such as heating and cooling load of a house being built and proper selection & installation of controls. Sealing and insulating of all ductwork are crucial for maximizing energy efficiency.

the green building materials market in Singapore is gaining importance owing to rise in demand for recycled construction materials.

For instance, mass engineered timber (MET) is used as green building material for constructing 12-storey academic block in Eunoia Junior College. MET is produced substantially from recycled timber and is managed under Programme for the Endorsement of Forest Certification 2019 to minimize deforestation and support the growth of green building across Singapore. MET buildings tend to have lower carbon footprint and minimal net carbon emission as compared to other traditional construction materials, such as steel or concrete buildings. Green concrete is another green building material that is gaining importance across the Singapore construction industry. Green concrete is manufactured with use of minimal sand content, partially replaced with copper slag, recycled concrete aggregates, and ground granulated blast furnace slag. All these raw materials used are considered as green building materials owing to minimal carbon emission.

The South East Asia and Australia green building materials market is segmented on the basis of product type and country. By product type, the market is divided into exterior products, interior products, building systems, solar products, and others. Country wise, it is analyzed across Singapore, Malaysia, Philippines, Indonesia, Vietnam, Thailand, and Australia.

Key players in South East Asia and Australia green building materials industry includes PT Bakrie & Brothers Tbk, Siam Cement Group, Kee Kiong (A2Z) SDN BHD, Aathworld Sdn Bhd, Interface Inc., PT. Modern Panels Indonesia, Brickworks Building Products Ltd., James Hardie Australia Pty Ltd., GreenPan, and CSR Limited.

Key players are focusing on product launch and acquisition to expand their product portfolio and to strengthen their production capacity. For instance, in 2021, Siam Cement Group launched PVC pipe that is designed and developed to support green building construction. This product is to be sold in the market under the trade name of SCG PVC Pipe (Green Premium Model). This new product is lead--ree pipe that is developed to offer safety, cleanliness, and reliability. In addition, Interface Inc. Launched w rubber-based green building flooring material that is to be sold under the trade name of Norament 926 Arago. This flooring product is designed to offer aesthetic look and it is best suitable for different environmental conditions. In addition, it can be used in sectors, such as public building, educational institutes, healthcare, and others. This product launch has supported customers with wide range of flooring products that are best suited for modern design and are environment-friendly.

By Product Type

Solar Product is the most lucrative segment

South East Asia and Australia green building materials market, by product type

On the basis of product type, the exterior products segment accounted for 35.0% of South East Asia and Australia green building materials market share in 2021, and is expected to maintain its dominance during the forecast period. Windows, roofing, doors, and sidings are types of exterior green building materials available in the market. Energy-efficient windows are cost-effective solutions installed to minimize the energy loss caused due to radiation, convention currents, conduction, and air-leakage. These windows reduce the requirement for cooling, artificial lighting, and heating by using a combination of multiple panes, insulated frames, gas fills, window glazes, and tightly sealed edges. Doors serve as a barrier between internal and external environment, and provide durability, noise abatement, energy-efficiency, and security.

Numerous durable and efficient plastic solutions with greater R-values (resistance to heat) are available for manufacturing doors. Entry doors with a foam plastic core enable soundproofing and improve insulation value to reduce energy requirements for cooling and heating. Energy efficient doors are manufactured using fiberglass, wood-clad steel, and painted steel. These materials are filled with a core of polyurethane foam. These foams are used to caulk around doors to seal the entry of air. Fiberglass is a lightweight product available in variety of textures and styles, including flush, smooth, and paneled forms. It offers great thermal efficiency and can be recycled through a two-step process.

South East Asia and Australia green building materials market, by country

By country, it is divided into Singapore, Malaysia, Philippines, Indonesia, Vietnam, Thailand, and Australia. Singapore accounted for the largest revenue share in the South East Asia and Australia green building materials market in 2021. Several schemes and development plans have been adopted in Singapore to support the growth of green building construction. For instance, Programme for the Endorsement of Forest Certification 2019 to minimize deforestation and support the growth of green building across Singapore. MET buildings tend to have lower carbon footprint and minimal net carbon emission as compared to other traditional construction materials, such as steel or concrete buildings. Green concrete is another green building material that is gaining importance across the Singapore construction industry. Green concrete is manufactured with use of minimal sand content, partially replaced with copper slag, recycled concrete aggregates, and ground granulated blast furnace slag. All these raw materials used are considered as green building materials owing to minimal carbon emission.

IMPACT OF COVID-19 ON THE SOUTH EAST ASIA AND AUSTRALIA GREEN BUILDING MATERIALS MARKET

The increase in risk of infection among the workforce has resulted in delayed construction projects amid the COVID-19 scenario. For instance, according to an article published by CNA, the construction Industry Joint Committee (CIJC) has said that the shortage of manpower may lead to delay in construction projects attributed to workplace safety, and other factors. The decreased purchasing potential of

suppliers has also negatively impacted the market amid the COVID-19 scenario. Furthermore, the COVID-19 pandemic has led to disruptions in transportation, contractual implications problems, labor shortage, and other factors that together have led the construction sector to witness a downfall. For instance, according to a report published by the Australian Performance of Construction Index (PCI) Survey, the construction activity dropped by 16.3 points to 21.6 points from March 20201 to August 2020.

However, emerging geographic scenarios, enhanced domestic supply chain, and strong public investments are projected to drive the growth of South East Asia and Australia green building materials market. For instance, according to an interim report for the 2021 Australian infrastructure plan, the Australian Construction Industry Forum (ACIF) expects the construction industry to return to pre-COVID-19 levels by 2022-23, driven by strong public investments. This is predicted to boost the growth of the South East Asia and Australia green building materials market post-COVID-19 period.

By Country

Philippines is projected as the fastest growing segment

KEY BENEFITS FOR STAKEHOLDERS

- The report provides an in-depth analysis of the South East Asia and Australia green building materials market trends along with the current and future market forecast.

- This report highlights the key drivers, opportunities, and restraints of the market along with the impact analyses during the forecast period.

- Porter’s five forces analysis helps analyze the potential of the buyers & suppliers and the competitive scenario of the phenolic resin industry for strategy building.

- A comprehensive South East Asia and Australia green building materials market analysis covers factors that drive and restrain the market growth.

- The qualitative data in this report aims on market dynamics, trends, and developments.

South East Asia and Australia Green Building Materials Market Report Highlights

| Aspects | Details |

| By Product Type |

|

| By Country |

|

| Key Market Players | GreenPan, Siam Cement Group, Brickworks Building Products Ltd., Interface Inc., Aathworld Sdn Bhd, CSR Limited, PT Bakrie & Brothers Tbk, James Hardie Australia Pty Ltd., PT. Modern Panels Indonesia, Kee Kiong (A2Z) SDN BHD |

Analyst Review

The South East and Australia green building materials market is expected to exhibit high growth potential. Green roofs improve energy efficiency of building structures, improve air quality, and enhance the aesthetics of urban rooftops. Proper installation of roofs is fundamental for the structural integrity of a building, and thus, the choice of roofing materials affects the energy-efficiency of a building. In addition, roofing membranes manufactured using vinyl and other single-ply technologies have revolutionized in roofing installation and specification over the past 30 years, offering quick, efficient, and clean alternatives to build roofs with superior design flexibility, which is predicted to offer lucrative growth opportunities in the future.

Doors serve as a barrier between internal and external environment, and provide durability, noise abatement, energy-efficiency, and security. Numerous durable and efficient plastic solutions with greater R-values (resistance to heat) are available for manufacturing doors. Entry doors with a foam plastic core enable soundproofing and improve insulation value to reduce energy requirements for cooling and heating. Siding plays a crucial role in enhancing aesthetics of a structure. Wood, fiber cement, and composites, including plastics and vinyl are used in the manufacturing of sidings. Reclaimed and recycled wood is a traditional siding choice for green architects and builders. Green builders and designers intend to replace synthetic materials used in building structures with low impact natural materials. Natural clay plaster, natural fiber flooring, and paperless drywall are green building materials used in interior finishing of a building structure. The use of low/no volatile organic compound (VOC) paints, coatings, and stains assists in improving indoor air quality. Casein paint made from natural pigments, such as milk solids, talcum, lime, and salt reduce waste generation.

Reduction of emission from green building materials and growing demand for green building materials market across Philippines are the key factors boosting the South East Asia and Australia green building materials growth.

The South East and Australia green building materials market forecast was valued at $16.8 billion in 2021, and is projected to reach $43.3 billion by 2031, growing at a CAGR of 9.9% from 2022 to 2031.

Interface Inc., James Hardie Australia Pty Ltd., CSR Limited, and Aathworld Sdn Bhd are the most established players of the South East Asia and Australia green building materials market.

Green building construction industry is projected to increase the demand for South East Asia and Australia green building materials.

The South East and Australia green building materials market is segmented on the basis of product type and country. On the basis of product type, the market is categorized into exterior products, interior products, building systems, solar products, and others. On the basis of country, the market is categorized into Singapore, Malaysia, Philippines, Indonesia, Vietnam, Thailand, and Australia.

The building & construction sector accounts for more than two-thirds share of total greenhouse gas emissions across the globe. Thus, there is a great potential for reducing greenhouse emissions by increasing the energy efficiency of buildings and communities. Reductions in greenhouse emissions can be accomplished by construction of new green buildings with low energy consumption and retrofitting of existing buildings. The use of recycled-content decking, treated wood, fiber-cement siding, house-wrap, energy conserving windows, sustainable roofing, and thermal doors, while constructing a building structure offers intrinsic advantages, such as low maintenance and operation cost, energy efficiency, durability, and waste reduction over traditional construction techniques is the main driver of South East Asia and Australia green building materials market.

Exterior products and solar products applications are expected to drive the adoption of South East Asia and Australia green building materials market.

The South East Asia and Australia green building materials market has been negatively impacted due to the wake of the COVID-19 pandemic, owing to its dependence on the building & construction sector. The increase in risk of infection among the workforce has resulted in delayed construction projects amid the COVID-19 scenario. For instance, according to an article published by CNA, the construction Industry Joint Committee (CIJC) has said that the shortage of manpower may lead to delay in construction projects attributed to workplace safety, and other factors. Moreover, several green building materials manufacturers in South East Asia and Australia have either shut down or shrank their operations, which in turn have resulted in supply chain disruptions. Also, different raw materials for producing green building materials are purchased or hired from other enterprises. The decreased purchasing potential of suppliers has also negatively impacted the market amid the COVID-19 scenario. Furthermore, the COVID-19 pandemic has led to disruptions in transportation, contractual implications problems, labor shortage, and other factors that together have led the construction sector to witness a downfall.

Loading Table Of Content...