South East Asia & Middle East Pressure Sensitive Adhesives Market Outlook - 2026

The South East Asia & Middle East pressure sensitive adhesives market was valued at $1,175.4 million in 2018, and is expected to reach $1,890.9 million by 2026, registering a CAGR of 6.1% from 2019 to 2026.Pressure-sensitive adhesive (PSA) is a type of self-adhesive material designed to adhere on almost on any surface by simple contact under light pressure. PSA does not undergo any physical transformation or chemical reaction during the bonding process.

South East Asia & Middle East pressure sensitive adhesives market is anticipated to grow significantly during the forecast period owing to numerous factors such as abundant availability of raw materials such as natural rubber in South East Asian countries. For instance, Thailand, Malaysia, Vietnam, India, and others are world’s largest producers of natural rubber. However, the rise in concerns regarding volatile organic compound content in adhesives is anticipated to hinder the growth of the solvent based pressure sensitive adhesives market. On the contrary, the rise in construction activities in countries such as the UAE and India is expected to create lucrative opportunities during the analysis period.

The South East Asia & Middle East pressure sensitive adhesives market is segmented into composition, type, application, end use industry, and region. Based on composition, the market is divided into acrylic, rubber, ethylene vinyl acetate, silicone, polyurethane, and others. Based on type, the market is categorized into water based, hot melt, solvent based, and radiation based. Based on application, the market is classified into labels, medical, graphics, tapes, and others. End use industries analyzed in the report include automotive, packaging, building & construction, electronics, medical, consumer goods, and others. Based on region, the market is analyzed across South East Asia and Middle East. South East Asian countries included in the scope of the report are Thailand, Vietnam, Philippines, Malaysia, India, Indonesia, Myanmar, Cambodia, and rest of South East Asia. Whereas, Middle East countries analyzed in the market are Saudi Arabia, Turkey, UAE, Qatar, and rest of Middle East. South East Asia & Middle East Pressure sensitive adhesives market trends are analyzed for all the segments.

The South East Asia & Middle East pressure sensitive adhesives market analysis covers in-depth information of major industry participants. Some of the major players in the market include Arkema Group, Ashland Inc., Avery Dennison, Dow, Jowat Corporation, H.B. Fuller Company, BASF SE, 3M, Sika AG, and Henkel AG & CO.KGAA.

Other players in the value chain of the South East Asia & Middle East pressure sensitive adhesives market include Wacker Chemie, Momentive, Evonik, Advance Polymers., Ester Chemical Industries Pvt. Ltd., Aik Chiang Sdn Bhd, GB Chemical (M) Sdn. Bhd., and others.

The South East Asia & Middle East pressure sensitive adhesives market share has been analyzed across all segments and regions. Key players are adopting numerous strategies such as product launch, joint venture, acquisition, collaboration, partnership, product development, agreement, and business expansion, to stay competitive in the South East Asia & Middle East pressure sensitive adhesives market. For instance, H.B. Fuller Company acquired Wisdom Worldwide Adhesives. Wisdom Worldwide Adhesives is a provider of paper, converting, and packaging adhesives. This acquisition has not only reinforced its product portfolio but also strengthened its position in the adhesives market.

In addition, Sika AG acquired adhesives and sealants manufacturer, ABC Sealants based in Turkey. This acquisition strengthened its market position in Turkey for adhesives and sealants as well as reinforced its geographical presence.

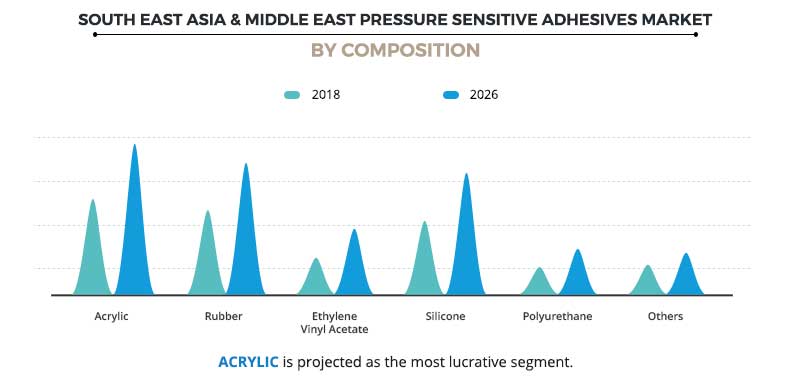

South East Asia & Middle East Pressure Sensitive Adhesives Market, by Composition

Based on composition, ethylene vinyl acetate is expected to grow at the fastest rate. This is attributed to its cost-effective nature than polyolefin based sensitive adhesives. Furthermore, as compared to other composition type, acrylic is anticipated to gain highest market share, this is owing to its high adoption in the automotive end use industry.

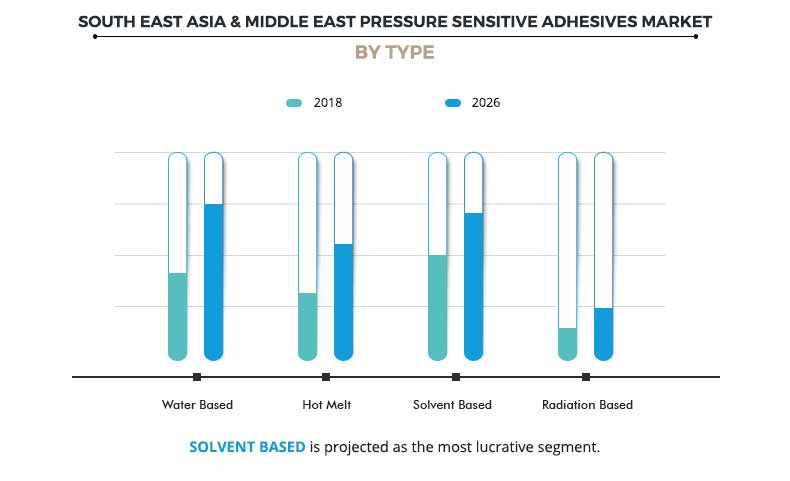

South East Asia & Middle East Pressure Sensitive Adhesives Market, by Type

Based on type, water based pressure sensitive adhesives are expected to grow at the fastest growth rate. This is attributed to less volatile organic compound (VOC) content and increase in demand from countries such as India, Indonesia, and others.

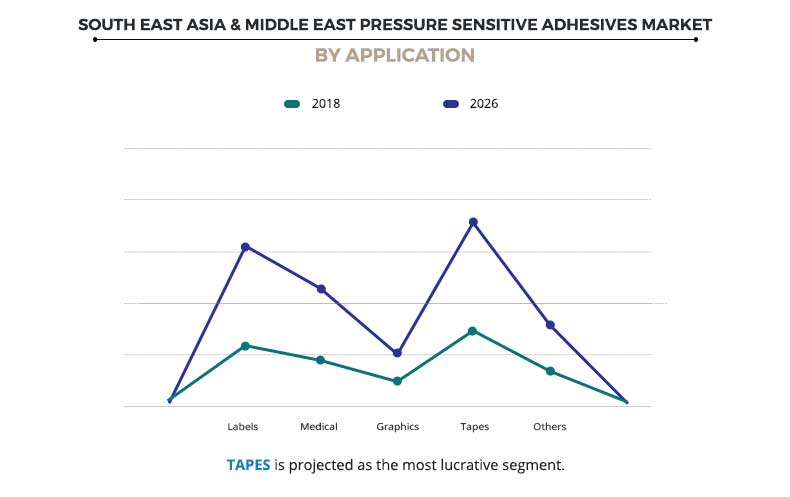

South East Asia & Middle East Pressure Sensitive Adhesives Market, by Application

Based on application, tapes are expected to gain a dominant market share. This is attributed to its increased usage in the production of various automobiles, aerospace components, and electrical & electronic components.

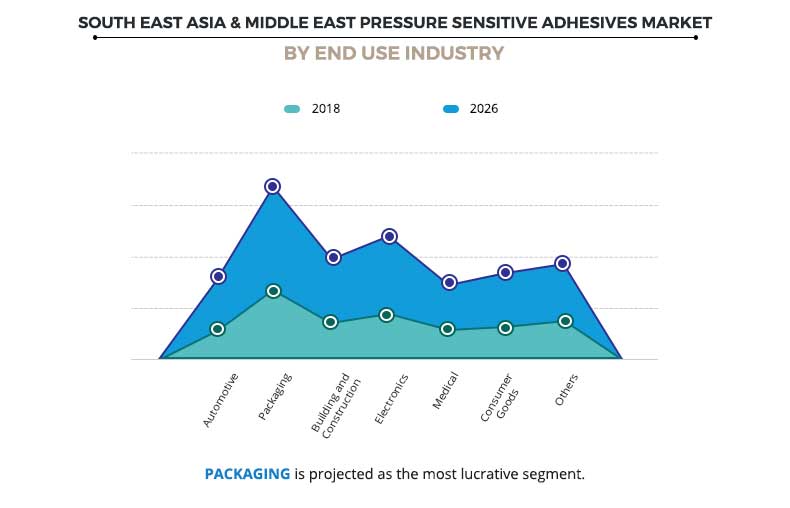

South East Asia & Middle East Pressure Sensitive Adhesives Market, by End Use Industry

Based on end use industry, automotive is expected to grow at the fastest rate. This attributed to the large and rise in consumer base in countries such as Thailand, India, Indonesia, and others.

South East Asia & Middle East Pressure Sensitive Adhesives Market, by Region

Based on region, South East Asia is anticipated to gain dominant market share. This is attributed to numerous factors such as a large number of key players, large consumer base, and rise in end use industries such as automotive, construction, electronics, and others.

Key Benefits for South East Asia & Middle East Pressure Sensitive Adhesives Market:

- The South East Asia & Middle East pressure sensitive adhesives market forecast is studied from 2019 to 2026

- The report provides an in-depth analysis of the forecast along with the current and future market trends

- This report highlights the key drivers, opportunities, and restraints of the market along with the impact analyses during the forecast period

- Porter’s five forces analysis helps analyze the potential of the buyers & suppliers and the competitive scenario of the South East Asia & Middle East pressure sensitive adhesives market industry for strategy building

- The qualitative data in this report aims on market dynamics, trends, and developments

- A comprehensive analysis of the factors that drive and restrain the South East Asia & Middle East pressure sensitive adhesives market growth is provided in the report.

- The South East Asia & Middle East pressure sensitive adhesives market size is provided in terms of revenue and volume

- An extensive analysis of various regions provides insights that are expected to allow companies to strategically plan their business moves

- The profiles of key players along with their key strategic developments are enlisted in the report

South East Asia & Middle East Pressure Sensitive Adhesives Market Report Highlights

| Aspects | Details |

| By Composition |

|

| By Type |

|

| By Application |

|

| By End Use Industry |

|

| By Region |

|

| Key Market Players | ARKEMA GROUP, HENKEL AG & CO. KGAA, H. B. FULLER COMPANY, AVERY DENNISON CORPORATION, JOWAT CORPORATION LTD., DOW, SIKA AG, BASF SE, 3M, ASHLAND INC. |

Analyst Review

In accordance with several interviews conducted of the top-level CXOs, development of the flexible packaging industry drives the growth of the Southeast Asia & Middle East pressure-sensitive adhesives market. Surge in demand for radio frequency identification (RFID) & luminescent labels in various industries, such as medical and miniaturization of electrical devices, augments the market growth. Furthermore, current innovations in the pressure-sensitive adhesive industry regarding enhancement in modulus of elasticity and rigidity are anticipated to widen the application scope of these adhesives in structural applications. According to the CXOs, increase in urbanization boost the growth of the market in the emerging economies, such as India, Indonesia, Vietnam, and others. In addition, increase in automotive production in Asia and rise in focus of manufacturers’ to reduce weight of vehicles accelerate the market growth.

Loading Table Of Content...