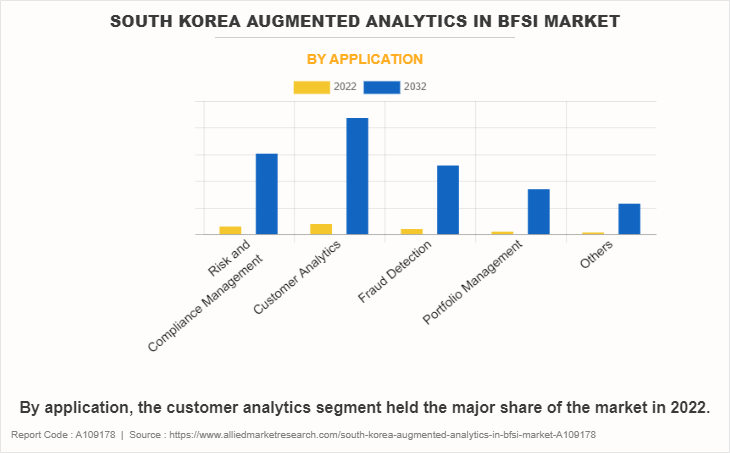

The South Korea augmented analytics in BFSI market is witnessing traction due to wide range of applications of augmented analytics technology such as risk & compliance management, customer analytics, fraud detection, and portfolio management. Rise in demand for advanced analytics and big data solutions & services in the BFSI industry has encouraged the adoption of augmented analytics technology by large financial institutions as well as by Small & Medium-sized Enterprises (SMEs). This is expected to augment the market growth in the future. In addition, boost in investments by financial institutions in advanced technologies such as Artificial Intelligence (AI) and Machine Learning (ML) to enhance their operations and rationalize cost is anticipated to drive the market development. South Korea is home to numerous leading technology companies that actively engage in delivering advanced analytics solutions and services to the BFSI industry, hence, they are projected to propel the development of the South Korea augmented analytics market in BFSI during the forecast period.

However, there are certain restraints of the market growth. The adoption of advanced technologies poses the threat of data breach, therefore lack of efficient cybersecurity is expected to hamper the growth of the market. On the contrary, deployment of advanced analytics solutions within several banks and insurance companies in the country are playing a key role in driving the digital transformation of the BFSI industry. This is projected to create significant opportunities for augmented analytics vendors in the future.

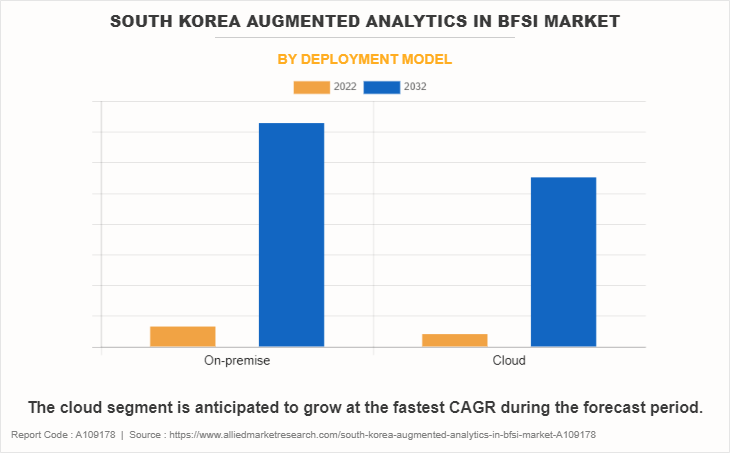

In the coming years, exponential growth of big data and increase in popularity of cloud computing technology in South Korea is anticipated to drive the market growth. In addition, emergence of expert data scientists in South Korea, coupled with rise in advanced analytics is projected to boost the adoption of augmented analytics technology. Furthermore, surge in inclination of organizations toward superior customer experience by leveraging ML, predictive analysis, and AI-driven technologies such as chatbots, decision trees, as well as digital assistants, is expected to provide a strong opportunity for growth in the South Korea augmented analytics in BFSI market.

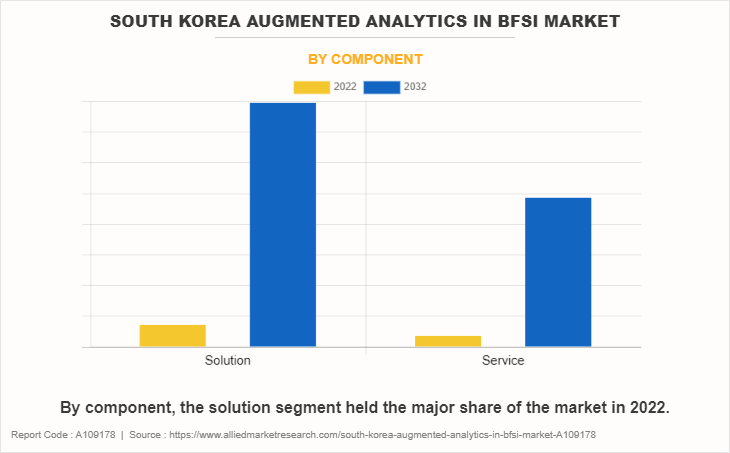

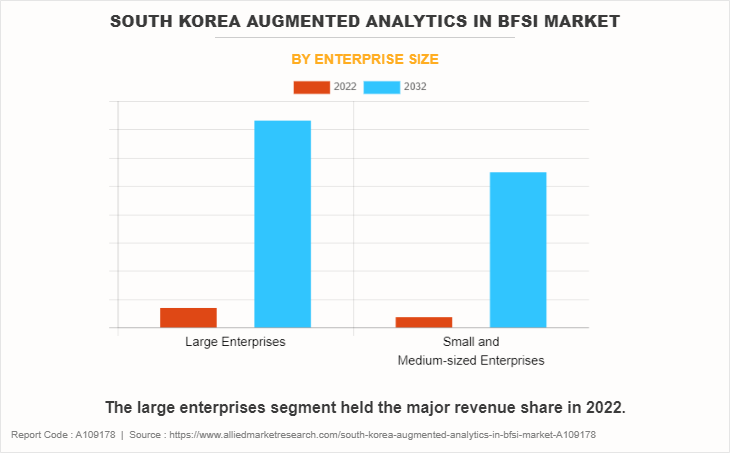

The South Korea augmented analytics in BFSI market is segmented by component, deployment model, enterprise size, and application. On the basis of component, the market is bifurcated into solution and service. By deployment model, the market is bifurcated into on-premise and cloud. As per enterprise size, the market is divided into large enterprises and small and medium-sized enterprises. Depending on application, the market is categorized into risk & compliance management, customer analytics, fraud detection, portfolio management, and others.

Key players such as Samsung SDS, Mirae Asset Daewoo, Hana Bank, Hyundai Motor Group, KDB Bank, Shinhan Financial Group, Woori Bank, KEB Hana Bank, KB Financial Group, and Nonghyup Bank adopt numerous strategies such as product launches, business expansions, new service offerings, and acquisitions to strengthen their foothold in the South Korea augmented analytics in BFSI market. In addition, several companies in the market embrace various other strategies, including expanding their product & service portfolios, launching customer-centric solutions, and introducing innovative pricing policies. These strategies aid to tap the customer base who seek great value addition in terms of cost, time, and convenience when opting for analytics technology. Furthermore, several new emerging companies such as NTT DATA, DataSmart & Co, Appiterate, and Essalora are leveraging numerous opportunities to gain a competitive edge in the market.

Various vendors in the South Korea augmented analytics in BFSI market focus on technological innovations in their products and services to stay ahead of their competitors. For instance, Samsung SDS launched its Nexledger, an advanced analytics platform that provides predictive analytics for the BFSI sector. Similarly, Hana Bank recently unveiled its Smart Banking Platform, designed to provide customers with an integrated banking experience. Such efforts by vendors to continuously improve their solutions and services as per customer preferences are anticipated to augment the growth of the market during the forecast period.

Key Benefits For Stakeholders

- Enable informed decision-making process and offer market analysis based on current market situation and estimated future trends.

- Analyze the key strategies adopted by major market players in South Korea augmented analytics in BFSI market.

- Assess and rank the top factors that are expected to affect the growth of South Korea augmented analytics in BFSI market.

- Top Player positioning provides a clear understanding of the present position of market players.

- Detailed analysis of the South Korea augmented analytics in BFSI market segmentation assists to determine the prevailing market opportunities.

- Identify key investment pockets for various offerings in the market.

South Korea Augmented Analytics in BFSI Market Report Highlights

| Aspects | Details |

| Forecast period | 2022 - 2032 |

| Report Pages | 76 |

| By Component |

|

| By Deployment Model |

|

| By Enterprise Size |

|

| By Application |

|

| Key Market Players | KEB Hana Bank, Shinhan Financial Group, KDB Bank, Mirae Asset Daewoo, Hyundai Motor Group, Nonghyup Bank, KB Financial Group, Samsung SDS, Hana Bank, Woori Bank |

The South Korea Augmented Analytics in BFSI Market is projected to grow at a CAGR of 28.5% from 2022 to 2032

Samsung SDS, Mirae Asset Daewoo, Hana Bank, Hyundai Motor Group, KDB Bank, Shinhan Financial Group, Woori Bank, KEB Hana Bank, KB Financial Group, Nonghyup Bank are the leading players in South Korea Augmented Analytics in BFSI Market

1. Enable informed decision-making process and offer market analysis based on current market situation and estimated future trends.

2. Analyze the key strategies adopted by major market players in south korea augmented analytics in bfsi market.

3. Assess and rank the top factors that are expected to affect the growth of south korea augmented analytics in bfsi market.

4. Top Player positioning provides a clear understanding of the present position of market players.

5. Detailed analysis of the south korea augmented analytics in bfsi market segmentation assists to determine the prevailing market opportunities.

6. Identify key investment pockets for various offerings in the market.

South Korea Augmented Analytics in BFSI Market is classified as by component, by deployment model, by enterprise size, by application

Loading Table Of Content...

Loading Research Methodology...