South Korea Automotive Composites Market Research, 2033

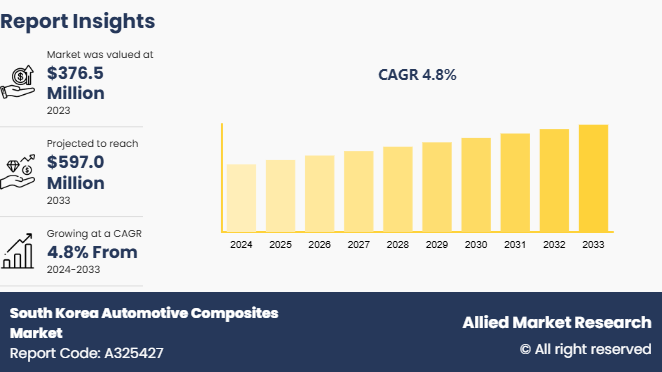

The South Korea automotive composites market was valued at $376.5 million in 2023, and is projected to reach $597.0 million by 2033, growing at a CAGR of 4.8% from 2024 to 2033.

Market Introduction and Definition

Automotive composites are materials made from two or more distinct substances, typically reinforcing fibers such as carbon fiber, glass fiber, or aramid which is embedded in a matrix material. These composites are designed to combine the best properties of both components, resulting in lightweight, high-strength materials that offer improved performance compared to traditional materials such as steel or aluminum. In the automotive industry, composites are used to reduce vehicle weight, enhance fuel efficiency, and improve safety & durability, which make them essential in the development of electric and hybrid vehicles, as well as in high-performance sports cars.

Key Takeaways

- The South Korea automotive composites market study includes a segment analysis in terms of value for the projected period.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major South Korea automotive composites industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

The growing demand for electric and hybrid vehicles (EVs and HEVs) is a significant driver for the increased use of automotive composites. As the push for greener, more sustainable transportation intensifies, car manufacturers are seeking ways to improve the energy efficiency and performance of electric vehicles. Composites are known for their high strength-to-weight ratio, are ideal materials to replace heavier conventional materials such as steel and aluminum that makes them key to meeting the weight reduction goals of electric and hybrid vehicles. All these factors are expected to drive the growth of the South Korea automotive composites market during the forecast period.

However, the raw materials used in composites such as carbon fiber and certain high-performance resins, are inherently expensive. The cost of carbon fiber is significantly higher than that of steel or aluminum that makes it less accessible for automakers aiming to keep production costs low. While composites offer significant weight savings and performance improvements, the high initial investment needed to integrate them into vehicle production deters automakers, particularly those focused on producing vehicles at scale. As a result, the use of composites is often limited to high-performance, luxury, or niche electric vehicles, where the performance benefits outweigh the cost constraints. All these factors hamper the growth of the South Korea automotive composites market.

Moreover, as environmental concerns intensify, there is a growing demand for more sustainable materials in the automotive industry. Bio-based composites which are derived from renewable resources such as natural fibers (like hemp, flax, and jute) and bio-resins, offer an eco-friendly alternative to traditional composites. South Korea, with its strong focus on innovation and environmental sustainability, is well-positioned to embrace these materials as part of its automotive sector's commitment to reducing carbon emissions and improving the environmental footprint of vehicles. All these factors are anticipated to offer new growth opportunities for the South Korea automotive composites market during the forecast period.

Market Segmentation

The South Korea automotive composites market is segmented into fiber type, resin type, and application. By fiber type, the market is classified into glass fiber, carbon fiber, and others. By resin type, the market is divided into thermosets and thermoplastics. By application, the market is categorized into exterior, interior, and others.

Automotive Sale in South Korea

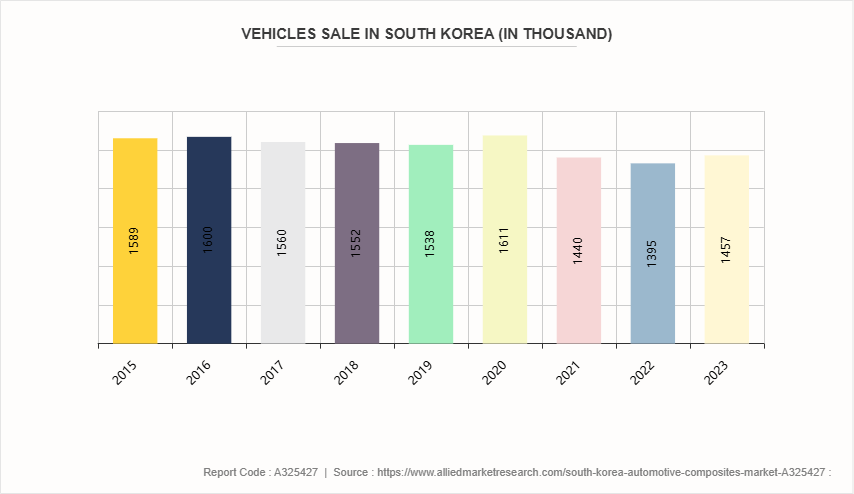

The relatively stagnant vehicle sales in South Korea, with figures hovering around 1.4 to 1.6 million units annually from 2015 to 2023, have implications for the demand for automotive composites. The lack of significant growth in vehicle sales suggests that the automotive industry is not rapidly expanding, which limits the immediate demand for large-scale adoption of advanced materials such as automotive composites. Automotive manufacturers typically scale up investments in new materials such as composites when vehicle production volumes increase. With low sales, automakers are more cautious in committing to costly transitions from traditional materials such as steel and aluminum to composites.

However, the dip in vehicle sales from 2021 to 2022, followed by a slight recovery in 2023, indicates that while total vehicle production might not be surging, there is growing pressure for automakers to innovate and differentiate themselves. This provides an opportunity for composites to play a role in developing electric and hybrid vehicles, which are becoming a greater focus for the industry, even amid stagnant overall vehicle sales. The need for lightweight materials to improve fuel efficiency, meet emissions regulations, and enhance the performance of electric vehicles creates a niche demand for composites, particularly in high-value or next-generation models, despite the broader market trends. Moreover, automakers prioritize integrating composites into electric vehicles or luxury models where performance and efficiency gains justify the higher cost of composite materials.

Competitive Landscape

The major players operating in the South Korea automotive composites market include HYOSUNG, Sungwoo Hitech, HANKUK CARBON CO., LTD., SK chemicals, KUMHO P&B CHEMICALS., INC, Hanwha Advanced Materials, Kolon Industries, Inc., Evonik Industries AG, Mitsubishi Chemical Group Corporation, and BASF.

Key Sources Referred

- International Trade Administration

- The Korean Society of Automotive Engineers

- InvestKOREA

- Organisation Internationale des Constructeurs d'Automobiles

- Federation Internationale de l'Automobile

- The Association for Manufacturing Technology

Key Benefits for Stakeholders

- Enable informed decision-making process and offer market analysis based on current market situation and estimated future trends.

- Analyze the key strategies adopted by major market players in South Korea automotive composites market.

- Assess and rank the top factors that are expected to affect the growth of South Korea automotive composites market.

- Top Player positioning provides a clear understanding of the present position of market players.

- Detailed analysis of the South Korea automotive composites market segmentation assists to determine the prevailing market opportunities.

- Identify key investment pockets for various offerings in the market.

South Korea Automotive Composites Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 597.0 Million |

| Growth Rate | CAGR of 4.8% |

| Forecast period | 2024 - 2033 |

| Report Pages | 310 |

| By Fiber Type |

|

| By Resin Type |

|

| By Application |

|

| Key Market Players | Hanwha Advanced Materials, SK chemicals, HYOSUNG, Sungwoo Hitech, KUMHO P&B CHEMICALS.,INC, Kolon Industries, Inc., Mitsubishi Chemical Group Corporation, BASF SE, HANKUK CARBON CO., LTD. , Evonik Industries AG |

The South Korea Automotive Composites market is projected to grow at a CAGR of 4.8 % from 2024 to 2033

HYOSUNG, Sungwoo Hitech, HANKUK CARBON CO., LTD. , SK chemicals, KUMHO P&B CHEMICALS.,INC, Hanwha Advanced Materials, Kolon Industries, Inc., Evonik Industries AG, Mitsubishi Chemical Group Corporation, BASF SE are the leading players in South Korea Automotive Composites Market

Interior is the major application in the South Korea Automotive Composites Market.

South Korea Automotive Composites Market is classified as by fiber type, by resin type, by application

Loading Table Of Content...