South Korea Sharing Economy Market Research, 2034

Market Introduction

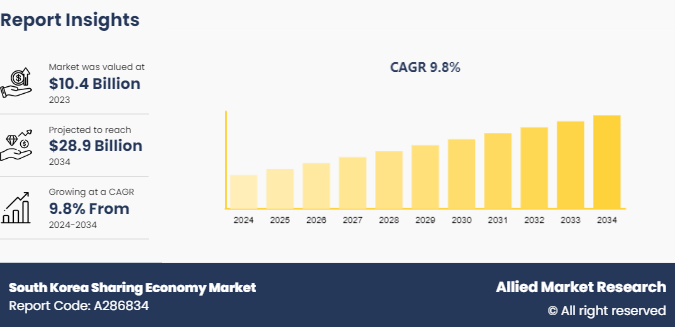

The South Korea sharing economy market size was valued at $10.4 billion in 2023, and is projected to reach $28.9 billion by 2034, growing at a CAGR of 9.8% from 2024 to 2034. South Korea sharing economy involves the collaborative consumption of resources, products, and services through digital platforms. It ranges across various sectors, including transportation, accommodation, finance, and knowledge sharing. Key players such as TADA, Socar, and Airbnb have fueled growth by enabling individuals to share assets for monetary gains or efficient use. The government has supported this model by enacting policies encouraging innovation while addressing regulatory challenges. However, it faces resistance from traditional industries, particularly in ride-sharing, due to concerns over competition. The rise of digital technologies and high mobile penetration have accelerated shift of South Korea toward a more shared, platform-driven economy. South Korea sharing economy market trends is also shaped by its strong emphasis on sustainability, with initiatives aimed at reducing waste and promoting community-based consumption.

Key Market Dynamics

One major driver of South Korea sharing economy market growth is the widespread adoption of mobile technology. South Korea has one of the highest smartphone penetration rates in the world, exceeding 95% as of 2023. This digital connectivity has allowed sharing platforms to increase, especially in transportation and accommodation services. Companies such as Socar, a leading car-sharing service, have taken advantage of the digital infrastructure to offer seamless, app-based services to users. The government has actively supported the development of such platforms, aligning with its broader goals of digital innovation and a smart economy. As a result, mobile technology serves as the basis of peer-to-peer exchanges in South Korea, facilitating the rapid growth of the sharing economy, with new sectors such as shared workspaces and education platforms also gaining traction due to the ease of accessibility.

However, a significant restraint to the growth of the sharing economy in South Korea is regulatory pushback, particularly from established industries such as taxis and hotels. For instance, ride-sharing platforms have faced strong opposition from traditional taxi unions, leading to stringent regulations on services such as TADA, which was forced to halt its operations owing to new government policies favoring traditional taxi services. The hospitality industry has also urged against platforms such as Airbnb, citing unfair competition and concerns over safety regulations. Despite public demand for more flexible, tech-driven services, these traditional sectors have considerable influence, slowing down the adoption of South Korea sharing economy market demand. The regulatory framework remains a contentious issue, as the government must balance the interests of both innovative sharing platforms and long-established industries resistant to change.

Furthermore, South Korea sharing economy market opportunities lies in the sustainability movement. The South Korean government has set ambitious goals for carbon neutrality by 2050, encouraging businesses to adopt eco-friendly practices. The sharing economy aligns well with these goals, particularly in sectors like transportation and goods sharing. Car-sharing services such as Socar and GreenCar have introduced electric and hybrid vehicles into their fleets, reducing the carbon footprint associated with transportation. In addition, platforms facilitating the exchange of goods, such as Danggeun Market, a secondhand marketplace, contribute to reducing waste by encouraging reuse. With government policies increasingly supporting environmental sustainability, the sharing economy in South Korea is anticipated to position itself as a crucial player in achieving these national goals during the South Korea sharing economy market forecast, attracting environmentally conscious consumers and investors.

Market Segmentation

The South Korea sharing economy market is analyzed on the basis of type, and end user. By type, the market is classified into sharing accommodation, sharing transportation, sharing finance, and others. By end user, the market is classified into generation Z, millennials, generation X, and boomers.

Key players in South Korea sharing economy market are adopting strategies focused on diversification and localized services to stay ahead in the market. Many platforms are expanding their offerings beyond traditional sectors such as transportation and accommodation, moving into niche areas such as shared logistics, personal services, and eco-friendly initiatives. Companies are also making use of AI and big data analytics to provide personalized experiences and optimize operations, ensuring better user retention. In addition, strategic partnerships with local governments and businesses have allowed for faster integration into regional markets, creating a stronger presence at the community level. Moreover, to remain competitive, these players are prioritizing customer trust and safety through stringent verification processes, ensuring compliance with regulations. This combination of innovation, diversification, and community-focused services has helped key players maintain their edge in the fast-evolving South Korea sharing economy market share.

Industry Trends

One prevalent trend in South Korea sharing economy industry is the rise of knowledge-sharing platforms, driven by the growing demand for online education and skill development. Platforms such as Class101 and LingoTalk have gained significant traction, enabling users to access and share specialized knowledge in areas such as languages, arts, and professional skills. In 2023, Class101 reported a 30% increase in user engagement as more South Koreans turned to these platforms to improve skills for career advancement and personal growth. The COVID-19 pandemic accelerated the trend, with many seeking remote learning opportunities. Furthermore, the South Korean government has supported digital education through initiatives like K-Education, enhancing the digital infrastructure to promote online learning. This trend highlights a shift toward a knowledge-based sharing economy, where the exchange of expertise and education becomes a key component, alongside traditional asset-sharing models such as transportation or housing.

Competitive Landscape

The key players operating in the South Korea sharing economy market are Socar, GreenCar, TADA, Airbnb Korea, Danggeun Market, WeWork Korea, Class101, Zipcar Korea, Mable, and Peoplecar. Key players in South Korea sharing economy market analysis have taken several initiatives to drive market growth. Socar and GreenCar have expanded their fleets by incorporating electric and hybrid vehicles, aligning with government sustainability goals and reducing the carbon footprint of car-sharing. TADA adapted to regulatory challenges by introducing legally compliant mobility services, such as offering ride-hailing for premium services to avoid restrictions. Danggeun Market focused on hyper-local community engagement by enhancing its secondhand marketplace platform, which has made it easier for users to exchange goods within their neighborhoods. Class101 and LingoTalk have made use of the rise of digital education, offering a diverse range of online courses to meet the growing demand for remote learning. These companies have invested in technology and user experience improvements, such as seamless mobile apps, which have enabled more convenient and efficient peer-to-peer exchanges, further propelling the growth of sharing economy market across various sectors.

Key Benefits For Stakeholders

- Enable informed decision-making process and offer market analysis based on current market situation and estimated future trends.

- Analyze the key strategies adopted by major market players in South Korea sharing economy market.

- Assess and rank the top factors that are expected to affect the growth of South Korea sharing economy market.

- Top Player positioning provides a clear understanding of the present position of market players.

- Detailed analysis of the South Korea sharing economy market segmentation assists to determine the prevailing market opportunities.

- Identify key investment pockets for various offerings in the market.

South Korea Sharing Economy Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 28.9 Billion |

| Growth Rate | CAGR of 9.8% |

| Forecast period | 2024 - 2034 |

| Report Pages | 90 |

| By Type |

|

| By End User |

|

| Key Market Players | Socar, Mable, WeWork Korea, GreenCar, Danggeun Market, Peoplecar, Airbnb Korea, Zipcar Korea, TADA, Class101 |

The South Korea Sharing Economy Market is projected to grow at a CAGR of 9.8 % from 2024 to 2034

Socar, GreenCar, TADA, Airbnb Korea, Danggeun Market, WeWork Korea, Class101, Zipcar Korea, Mable, Peoplecar are the leading players in South Korea Sharing Economy Market

1. Enable informed decision-making process and offer market analysis based on current market situation and estimated future trends. 2. Analyze the key strategies adopted by major market players in South Korea sharing economy market. 3. Assess and rank the top factors that are expected to affect the growth of South Korea sharing economy market. 4. Top Player positioning provides a clear understanding of the present position of market players. 5. Detailed analysis of the South Korea sharing econom

The South Korea sharing economy market is segmented into type, and end user.

Loading Table Of Content...