The South Korea unsecured business loans market has witnessed significant traction in recent years. This is attributed to the dynamic economic landscape of South Korea, characterized by its robust industrial base and rapidly growing entrepreneurship. The market has been driven due to surge in need for instant capital infusion to fuel expansion, diversification, and innovation of new businesses. In addition, the short application process of unsecured loans is a key driver for the growth of the market.

However, there are various restraints of the growth of the South Korea unsecured business loans market. Key restraint of the market is high interest rates associated with these loans, which prevent many small businesses from taking up the loan. In addition, high eligibility criteria such as large credit scores and income for unsecured loans prevent various businesses from accessing these; therefore, hampering the development of the market.

On the contrary, several lucrative opportunities are available for the growth of the South Korea unsecured business loans market. Technological advancements, such as fintech innovations, and upsurge in emphasis on financial inclusivity are anticipated to open new remunerative avenues for the market. Digital lending platforms are anticipated to enhance the reach of unsecured business loans among its potential customers.

Recent trends in the South Korea unsecured business loans market reflect the changing preferences and advancements in the industry. The collaborative relationship between technological innovation and financial services is projected to revolutionize the business loans landscape. For instance, blockchain-powered smart contracts and Artificial Intelligence (AI)-driven credit assessment algorithms are expected to redefine risk evaluation and streamline loan disbursal processes. In addition, increase in penetration of digital platforms and mobile applications in the financial sector is anticipated to facilitate high accessibility and convenience for borrowers, particularly for Small & Medium-sized Enterprises (SMEs). Furthermore, regulatory landscapes are evolving, with considerable focus on balancing risk mitigation with the promotion of a vibrant business environment. Regulatory authorities of South Korea are expected to implement stringent policies that foster responsible lending practices while nurturing a profitable ecosystem for financial institutions to thrive.

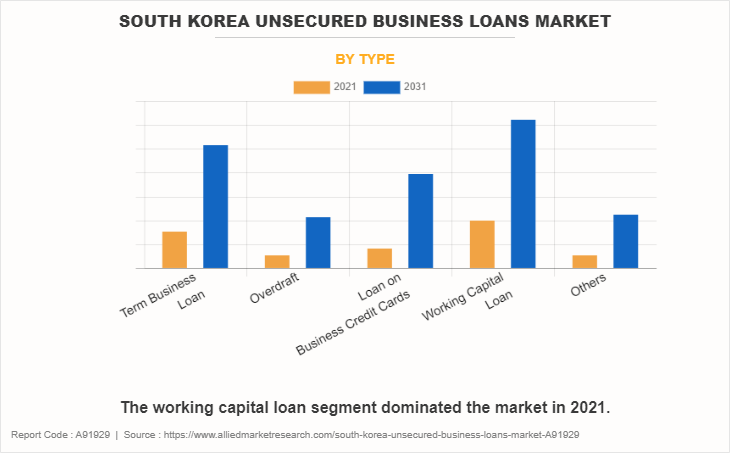

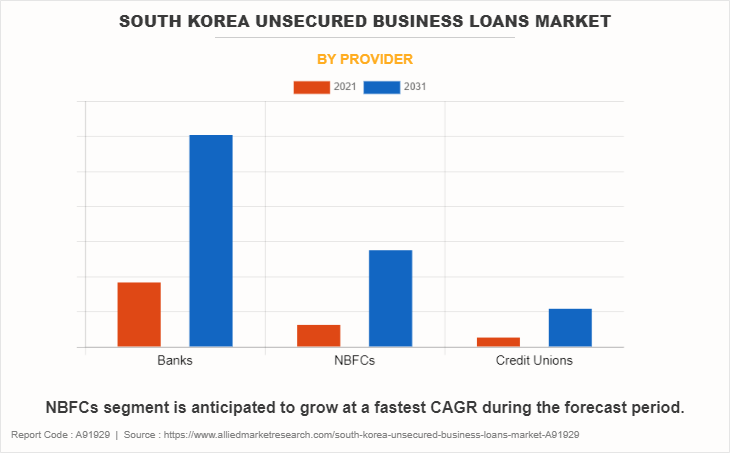

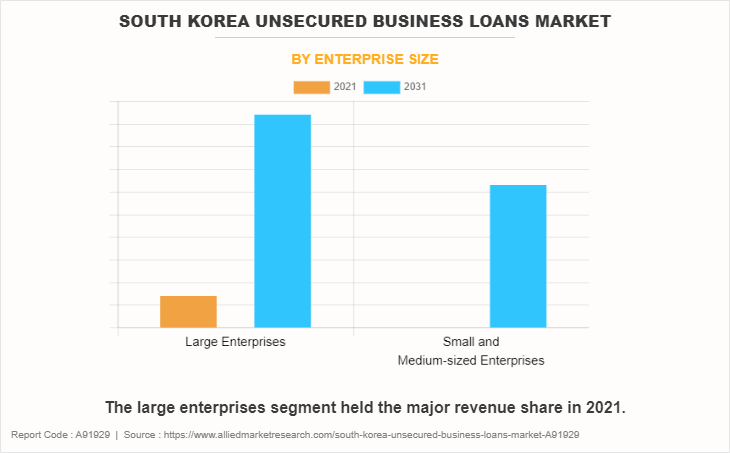

The South Korea unsecured business loans market is segmented by type, enterprise size, and provider. On the basis of type, the market is divided into term business loan, overdraft, loan on business credit cards, working capital loan, and others. Depending on enterprise size, the market is bifurcated into large enterprises and small & medium-sized enterprises. As per provider, the market is classified into banks, Non-banking Financial Companies (NBFCs), and credit unions.

Qualitative developments provide deep understanding about the insights of the South Korea unsecured business loans market. New product development holds considerable importance, as financial institutions vie to introduce innovative loan offerings that cater to the evolving needs of businesses. In addition, robust R&D efforts are necessary to improve lending practices, thereby ensuring they remain attuned to market dynamics. Furthermore, understanding end-user perceptions is pivotal for lenders to meet the expectations and preferences of the businesses. Moreover, flexible pricing strategies are adopted to maintain a balance between competitiveness and profitability.

The Porter’s five forces analysis assesses the competitive strength of the players in the South Korea unsecured business loans market. The five forces include threat of new entrants, threat of substitutes, bargaining power of buyers, bargaining power of suppliers, and competitive rivalry. The bargaining power of suppliers is high as they hold the supreme power of lending finances. The bargaining power of buyers is significant due to the presence of numerous suppliers in the market. The threat of new entrants is moderate owing to notable barriers to entry for the new market players. Competitive rivalry is intense as various market players strive to garner a large share of the market. The threat of substitutes is significant as businesses explore alternative options for their financing needs.

SWOT analysis offers an insightful perspective on the South Korea unsecured business loans market, dissecting its strengths, weaknesses, opportunities, and threats. The strengths of the market lie in the diverse array of loan types and providers, offering businesses a wide variety of options. However, the weaknesses include stringent regulatory environment and inherent risks associated with unsecured lending. On the contrary, opportunities include technological advancements and untapped potential of SMEs seeking financial support. The threats for the market are in the form of market saturation and economic volatility.

Key players operating in the South Korea unsecured business loans market are Shinhan Bank, KEB Hana Bank, Woori Bank, KB Kookmin Bank, Industrial Bank of Korea, NH Nonghyup Bank, Samsung Card Co., Ltd., Hyundai Card Co., Ltd., SC First Bank, and Shinsegae Savings Bank.

Key Benefits For Stakeholders

- Enable informed decision-making process and offer market analysis based on current market situation and estimated future trends.

- Analyze the key strategies adopted by major market players in South Korea unsecured business loans market.

- Assess and rank the top factors that are expected to affect the growth of South Korea unsecured business loans market.

- Top Player positioning provides a clear understanding of the present position of market players.

- Detailed analysis of the South Korea unsecured business loans market segmentation assists to determine the prevailing market opportunities.

- Identify key investment pockets for various offerings in the market.

South Korea Unsecured Business Loans Market Report Highlights

| Aspects | Details |

| Forecast period | 2021 - 2031 |

| Report Pages | 71 |

| By Type |

|

| By Enterprise Size |

|

| By Provider |

|

| Key Market Players | Hyundai Card Co., Ltd., Samsung Card Co., Ltd., Shinsegae Savings Bank, KEB Hana Bank, Woori Bank, Industrial Bank of Korea, NH Nonghyup Bank, KB Kookmin Bank, SC First Bank, Shinhan Bank |

The South Korea Unsecured Business Loans Market is projected to grow at a CAGR of 14.2% from 2021 to 2031

hinhan Bank, KEB Hana Bank, Woori Bank, KB Kookmin Bank, Industrial Bank of Korea, NH Nonghyup Bank, Samsung Card Co., Ltd., Hyundai Card Co., Ltd., SC First Bank, and Shinsegae Savings Bank are the leading players in South Korea Unsecured Business Loans Market

1. Enable informed decision-making process and offer market analysis based on current market situation and estimated future trends.

2. Analyze the key strategies adopted by major market players in south korea unsecured business loans market.

3. Assess and rank the top factors that are expected to affect the growth of south korea unsecured business loans market.

4. Top Player positioning provides a clear understanding of the present position of market players.

5. Detailed analysis of the south korea unsecured business loans market segmentation assists to determine the prevailing market opportunities.

6. Identify key investment pockets for various offerings in the market.

South Korea Unsecured Business Loans Market is classified as by type, by enterprise size, by provider

Loading Table Of Content...

Loading Research Methodology...