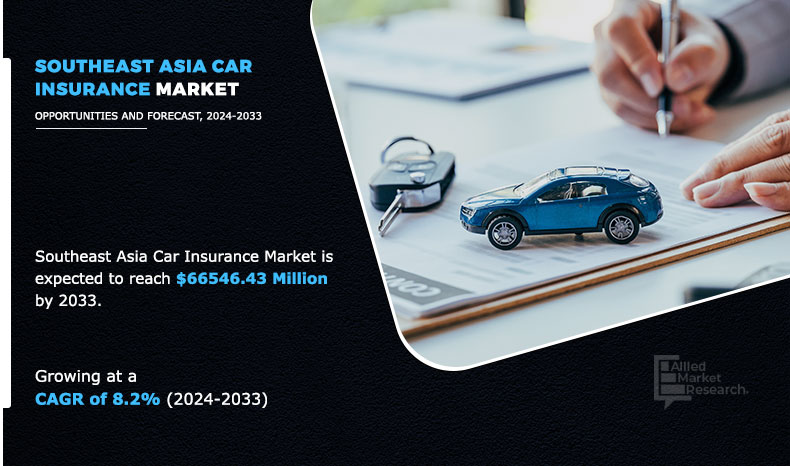

The Southeast Asia Car Insurance Market was valued at $ 30,692.62 million in 2023 and is estimated to reach $ 66,546.43 million by 2033, exhibiting a CAGR of 8.2% from 2024 to 2033.

Car insurance is a contract that protects the insured against financial loss in the event of an accident or theft. It is a legal arrangement between the policyholder and the insurer. The insurance provider promises to cover the insured losses according to the terms of your policy in return for a premium. Customers are financially protected by car insurance from physical damage brought on by traffic collisions and vehicle theft. Additionally, it covers the costs incurred when an insured owner of a vehicle causes injuries, fatalities, or property damage to another driver, vehicle, or third-party property like a building, fence, or utility pole. Although state-by-state auto insurance laws differ, many jurisdictions have necessitated bodily injury and property damage liability coverage before operating or maintaining a vehicle on public roadways. Given that there are more road incidents, the car insurance market has significant development potential.

Key Takeaways

- By type, the third-party liability coverage segment accounted for the largest Southeast Asia car insurance market share in 2023.

- Country-wise, India generated the highest revenue in 2023.

- Depending on the mode, the offline segment generated the highest revenue in 2023

- By Application, the personal segment generated the highest revenue in 2023.

- By Distribution channel, the Insurance Agents/Brokers segment generated the highest revenue in 2023.

- By vehicle age, the used vehicles segment generated the highest revenue in 2023.

- By Propulsion, ICE segment generated the highest revenue in 2023.

The rise in the middle-class population and urbanization and regulatory changes and government initiatives are boosting the growth of the global Southeast Asia car insurance market. in addition, growth in the adoption of technological advancements and digital transformation positively impacts the growth of the Southeast Asia car insurance market. However, rising claim costs fraudulent activities, and limited awareness and penetration in rural areas issues hamper the Southeast Asia car insurance market growth. On the contrary, the expansion of digital and micro-insurance solutions is expected to offer remunerative opportunities for the expansion of the Southeast Asia car insurance market during the forecast period.

By type, the third-party liability coverage insurance segment holds the highest market share. The demand for third-party insurance can be attributed to the awareness of legal requirements and the need to comply with mandatory auto insurance regulations. However, comprehensive insurance is expected to grow at the highest rate during the forecast period, owing to the growing popularity that stems from the comprehensive coverage it offers, making it an attractive choice for car owners looking for complete protection.

The report focuses on the growth prospects, restraints, and trends of Southeast Asia car insurance market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors such as the bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the global Southeast Asia car insurance market.

Segment review

The Southeast Asia car insurance market is segmented by type, application, distribution channel, vehicle age, propulsion, mode, and region. On the basis of type, the market is categorized into third-party-liability coverage, comprehensive, collision, and other optional coverages. Based on application, the market is divided into personal, and commercial. On the basis of distribution channel, the market is divided into insurance agents/brokers, direct response, banks, and others. Based on vehicle age the market is classified into new vehicles and used vehicles. Based on propulsion the market is segmented into ice, and electric and hybrid. On the basis of mode, the market is segmented into online, and offline. By country, the market is analyzed across Singapore, Malaysia, Thailand, Indonesia, Vietnam, Philippines, India, and Rest of Southeast Asia.

The key players that operate in the Southeast Asia car insurance market are Allianz, Liberty Mutual Insurance Company, AXA UK Group, HDFC Ergo General Insurance Company Limited, American International Group, Inc., Pt Asuransi MSIG Indonesia, ETIQA Insurance Pte. Ltd., Great Eastern General Insurance Indonesia, Sompo Insurance, and Income Insurance Limited. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Market Landscape and Trends

The Southeast Asia car insurance market is experiencing significant growth, characterized by a dynamic landscape and evolving trends. Increasing vehicle ownership, driven by rising incomes and urbanization, is a primary factor boosting demand for car insurance. Stricter government regulations mandating insurance coverage are also playing a crucial role in this expansion. Consumers are becoming more financially aware and seeking insurance to protect against potential financial losses from accidents, theft, and natural disasters. Technological advancements are transforming the market, with digital platforms simplifying the purchase and renewal of insurance policies, thereby enhancing accessibility. Additionally, insurance companies are offering more customized and flexible products to cater to diverse customer needs. Among the various segments, third-party liability coverage is expected to dominate, propelled by regulatory requirements and heightened consumer awareness of the need for financial protection against legal liabilities and third-party damages.

Competition Analysis

Recent Strategies in the Southeast Asia Car Insurance Market:

January 2024: Automart.Ph, a prominent used car marketplace in the Philippines, announced its partnership with Malayan Insurance. This partnership focused on offering vehicle insurance directly through Automart.Ph's platform, streamlines the process for customers and provides competitive insurance options.

In June, 2023, Carro, a major used car platform, teamed up with Tokio Marine Insurance. This collaboration aimed to deliver customized insurance products tailored to the needs of used car buyers, ensuring comprehensive coverage and enhancing the overall buying experience.

On July 2023, Carousell partnered with partnered with Carzuno and launched the Carousell Car Subscription in Singapore, providing further convenience for users. This subscription also includes preferred car, comprehensive insurance, servicing, maintenance, 24/7 roadside assistance, unlimited mileage, and free doorstep delivery and return.

Top Impacting Factors

Growing middle-class population and urbanization

Southeast Asia is experiencing significant economic growth, leading to an expanding middle-class population. This demographic shift is characterized by increased disposable income, which drives higher spending on consumer goods, including automobiles. There is an increase in the demand for car insurance with rise in the number of people purchasing cars. Urbanization is another critical factor contributing to market growth. As people migrate from rural to urban areas, they often need personal vehicles for commuting and daily activities, further boosting car ownership rates. This trend is particularly evident in countries like Indonesia, Vietnam, and the Philippines, where rapid urbanization is transforming the transportation landscape. In addition, urban environments typically have higher risks of traffic accidents and theft, making car insurance not just a luxury but a necessity for car owners.

By Offering

Southeast Asia Car Insurance Market, By Offering, 2023-2033 ($Million)

For instance, In December 2023, the World Bank reported that the middle-class population in Indonesia had grown by over 10% in the past five years. This demographic shift was accompanied by a significant rise in car ownership, with over 1.2 million new vehicles registered in the same period. Urban areas like Jakarta and Surabaya witnessed improved economic conditions and infrastructure development. The surge in car ownership has led to a parallel increase in the demand for car insurance, as more individuals seek to protect their valuable assets against potential risks associated with urban driving conditions. The increase in density of vehicles in urban areas also puts pressure on governments and regulatory bodies to enforce mandatory car insurance policies. Such growing factors are driving market growth.

By Application

Southeast Asia Car Insurance Market, By Application, 2023-2033, ($Million)

Regulatory Changes and Government Initiatives

Governments in Southeast Asia are increasingly recognizing the importance of comprehensive car insurance in promoting road safety and financial protection for citizens. Several countries in the region have introduced mandatory car insurance laws, ensuring that all vehicle owners must have at least basic coverage. For instance, in March 2024, Malaysia's Ministry of Transport announced the implementation of stricter enforcement measures for the Road Transport Act, mandating comprehensive motor insurance for all vehicles. This move aimed to reduce the number of uninsured vehicles on the road and enhance financial protection for accident victims. The government also introduced an awareness campaign to educate the public about the importance of car insurance, leading to a 15% increase in insurance policy registrations within the first three months of the initiative. Such regulatory changes have provided a significant boost to the car insurance market by ensuring broader compliance and increasing consumer confidence. Moreover, government initiatives aimed at improving road infrastructure and reducing traffic accidents indirectly boost the insurance sector. By enhancing road safety, these measures reduce the risk for insurers, encouraging them to offer more competitive premiums and innovative products. Such regulatory environments not only ensure market stability but also foster consumer confidence in insurance products, driving overall market growth.

By Distribution Channel

Southeast Asia Car Insurance Market, By Distribution Channel, 2023-2033, ($Million)

Restraints

Rising Claim Costs and Fraudulent Activities

One of the significant restraints of the car insurance market is the increasing cost of claims. Factors such as higher repair costs, medical expenses, and legal fees contribute to rising claim payouts for insurance companies. This can lead to increased premiums for policyholders, potentially impacting affordability and discouraging some individuals from purchasing or renewing car insurance policies. Moreover, fraudulent activities, including false claims and insurance scams, pose a significant challenge for the car insurance industry. These activities increase costs for insurers, which can impact premiums and profitability. Insurers need to invest in robust fraud detection systems and processes to mitigate these challenges effectively. Fraudulent activities not only harm insurance companies but also impact genuine policyholders by increasing premiums and creating a less favorable market environment.

By Vehicle Age

Southeast Asia Car Insurance Market, By Vehicle Age, 2023-2033, ($Million)

Limited awareness and penetration in rural areas

Despite the overall growth in car insurance uptake, there remains a significant gap in awareness and penetration, particularly in rural areas of Southeast Asia. Many rural consumers lack sufficient knowledge about the benefits and necessity of car insurance, viewing it as an additional, non-essential expense. This lack of awareness is often compounded by limited access to insurance services and agents in these regions. Additionally, the lower purchasing power and limited car ownership in rural areas reduce the potential customer base for insurers. Cultural factors and a general mistrust of financial institutions can also hinder the adoption of insurance products.

By Propulsion

Southeast Asia Car Insurance Market, By Propulsion, 2023-2033, ($Million)

Insurers face the challenge of educating and reaching these underserved populations, which requires substantial investment in marketing, outreach programs, and distribution networks. Bridging this gap is essential for achieving more comprehensive market penetration and ensuring financial protection for all vehicle owners. For instance, in April 2024, a study conducted by the Asian Development Bank (ADB) revealed that car insurance penetration in rural areas of Vietnam remained below 20%. The report highlighted that many rural residents were unaware of the benefits of car insurance and viewed it as an unnecessary expense. To address this issue, the Vietnamese government partnered with several local insurers to launch an outreach program aimed at educating rural communities about the importance of insurance. Despite these efforts, the study indicated that overcoming cultural barriers and building trust in financial institutions would require sustained efforts over several years.

By Mode

Southeast Asia Car Insurance Market, By Mode, 2023-2033, ($Million)

Opportunities

Expansion of Digital and Micro-Insurance Solutions

One of the most promising opportunities in the Southeast Asian car insurance market is the expansion of digital and micro-insurance solutions. The region's growing internet penetration and widespread use of mobile devices create a fertile ground for digital insurance platforms. Insurtech companies are at the forefront of this transformation, offering user-friendly mobile applications and online platforms that simplify the process of purchasing and managing insurance policies. For instance, in February 2024, the Philippines saw the launch of a new digital insurance platform called MicroProtect, developed by a leading insurtech startup. The platform offers micro-insurance products specifically designed for low-income and rural populations, providing coverage for a fraction of the cost of traditional policies. Within two months, MicroProtect had registered over 100,000 users, many of whom were first-time insurance buyers.

By Country

Southeast Asia Car Insurance Market, By Country, 2023-2033 ($Million)

The platform's success was attributed to its user-friendly interface, affordability, and extensive marketing campaign highlighting the benefits of insurance. This initiative demonstrated the potential of digital and micro-insurance solutions to expand market reach and improve financial inclusion in underserved areas. These digital solutions not only enhance customer convenience but also allow insurers to reach a broader audience, including the underserved rural and lower-income segments. Micro-insurance products, which offer smaller coverage amounts at lower premiums, are particularly well-suited for these markets. They provide an affordable entry point for consumers who may not be able to afford traditional insurance policies. Additionally, digital platforms enable the collection and analysis of vast amounts of data, allowing insurers to develop more personalized and targeted products. By leveraging digital technology and micro-insurance, insurers can tap into new customer segments, improve accessibility, and drive significant growth in the car insurance market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the Southeast Asia car insurance market analysis from 2024 to 2033 to identify the prevailing Southeast Asia car insurance market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the Southeast Asia car insurance market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as Southeast Asia car insurance market trends, key players, market segments, application areas, and market growth strategies.

Southeast Asia Car Insurance Market Report Highlights

| Aspects | Details |

| By Types |

|

| By Application |

|

| By Distribution Channel |

|

| By Vehicle Age |

|

| By Propulsion |

|

| By Mode |

|

| By Region |

|

| By Key Market Players |

|

Analyst Review

Car insurance, also known as auto or motor insurance, is a financial protection plan for vehicle owners against financial losses arising from accidents, theft, or other unforeseen events. It covers damages to the insured vehicle, third-party liabilities, and medical expenses. Typically mandatory, motor insurance offers different coverage levels, including comprehensive and third-party options. Premiums are determined by factors such as the vehicle's value, driver's history, and coverage chosen. The industry continually evolves with advancements like telematics and usage-based insurance, enhancing risk assessment. Motor insurance plays a crucial role in ensuring financial security and legal compliance for vehicle owners worldwide.

Key providers in the southeast Asia car insurance market are Singapore Life Ltd, MSIG Insurance (Singapore) Pte Ltd, Tokio Marine Life Insurance Singapore Ltd, Etiqa Insurance Pte Ltd, The Great Eastern Life Assurance Company Ltd. With growth in demand for Southeast Asia car insurance solutions, various companies have established partnership strategies to increase their offerings in digital solutions. For instance, in September 2022, MSIG Insurance (MSIG) and Klook, through a distribution relationship, offer TravelCare insurance as an add-on when Singaporean clients book travel-related activities and services via Klook's mobile app or website.. Thus, such strategies drive the market growth.

In addition, with the surge in demand for southeast Asia car insurance, several companies have expanded their current product portfolio to continue with the rise in demand in the market. For instance, in March 2022, AXA Singapore ceased to offer Motor and General Insurance Businesses. AXA Singapore operations were merged with the existing HDFC Life Singapore Business.

Also, in November 2023, in a significant move, Vietnam joined the Association of Southeast Asian Nations (ASEAN) Compulsory Motor Insurance Scheme (ACMI). Under this scheme, all motor vehicles, while in transit or en route to any ASEAN member state, must have mandatory third-party motor liability insurance.

Loading Table Of Content...