Southeast Asia Food Processing Equipment Market:

The Southeast Asia food processing equipment market size was valued at $993.90 million in 2017, and is projected to reach $1,434.89 million by 2025, growing at a CAGR of 4.7% from 2018 to 2025.

Food processing machines are tools that facilitate commercial production and packaging of different kind of food products such as meat, baked items, seafood, poultry, dairy, beverages, and others. These products are gaining popularity globally as they are considered nutritionally rich, shelf-stable, and have lower risk of contamination. They exist in a variety of design, size, and configuration and can be conveniently operated. Earlier, conventional tools were designed to perform single task but at present, advanced equipment are designed, which comprises multiple processing lines capable of accommodating continuous and automated operations.

The leading players in the meat, poultry, and seafood industries have focused on product launch, acquisition, and business expansion as their key strategies to gain a significant share in the market. The key players profiled in the report include Alfa Laval AB, Auto Kinetics (M) Sdn Bhd, Baader Group, Bucher Industries AG, Buhler AG, Emura Food Machine Co., Ltd., Euroasia Food Equipment Sdn Bhd, GEA Group AG, Gold Peg International Pty Ltd, Heat and Control, Inc., Keto Agricultural Engineering Sdn. Bhd., Key Technology, Inc, Krones AG, Marel HF, Marlen International, Inc., Nichimo International Inc., Paul Mueller Company, Tetra Pak International S.A., The Middleby Corporation, Topsteel Holdings Pte Ltd, and Yanagiya machinery Co., Ltd.

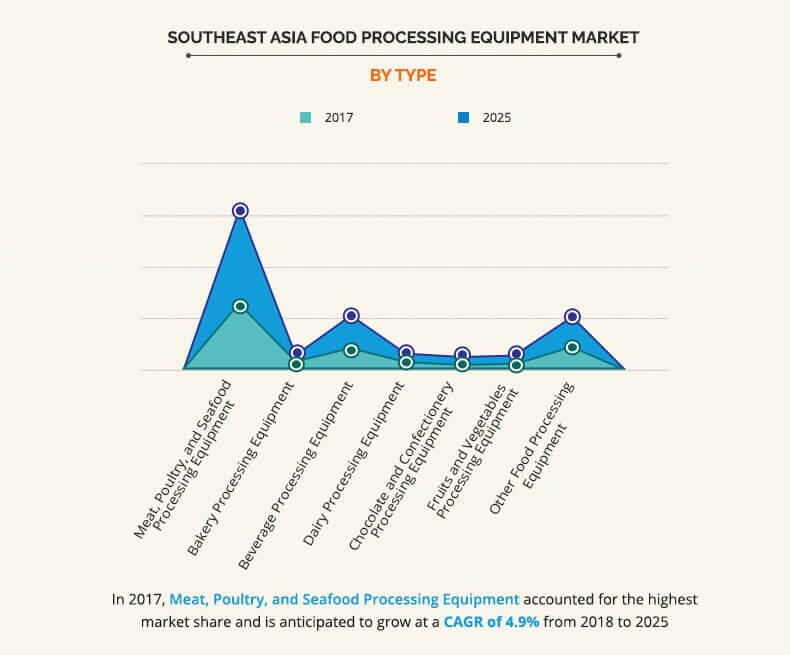

In 2017, the meat, poultry and seafood processing equipment was dominant segment in the Southeast Asia. The number of meat products available globally is very high, with a large number of new products launched every year. These meat processing equipment with improved technology focuses on retaining maximum nutrients and sensory properties and help to extend the shelf life of food without any adverse effect on the quality of food. The consumption of processed meat products such as bacon, ham, hotdogs, sausages, salami, corned beef, beef jerky, canned meat, and meat-based sauces has increased rapidly in recent decades, thereby driving the growth of the Southeast Asia food processing equipment market.

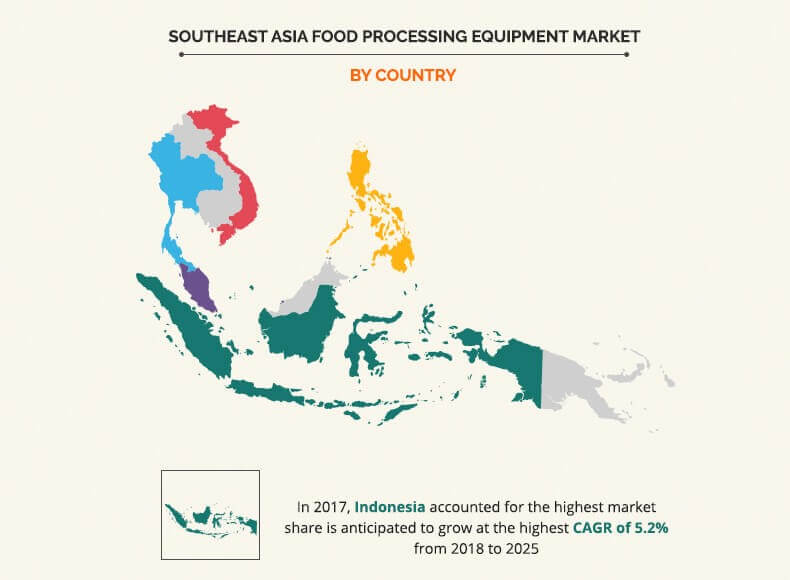

In 2017, Indonesia was the highest revenue contributor to the Southeast Asian market, owing to rise in demand for processed food due to preference of consumers for nutritious, hygienic, and safe food products. Moreover, replacement of conventional tools over the advanced technology in some of the countries in the Southeast Asia is expected to increase the demand for the market.

Key Benefits for Southeast Asia Food Processing Equipment Market:

The report presents an in-depth analysis of the current trends, drivers, and dynamics of the Southeast Asia food processing equipment market to elucidate the prevailing opportunities and tap the investment pockets.

It offers qualitative trends and quantitative analysis of the global market for the period of 20182025 to assist stakeholders to understand the market scenario.

In-depth analysis of the key segments demonstrates the types of food processing equipment available.

Competitive intelligence of the industry highlights the business practices followed by key players across geographies and the prevailing market opportunities.

Key players and their strategies and developments are profiled to understand the competitive outlook of the market.

Southeast Asia Food Processing Equipment Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Geography |

|

| Key Market Players | KEY TECHNOLOGY, INC., HEAT AND CONTROL, INC., YANAGIYA MACHINERY CO., LTD., EMURA FOOD MACHINE CO., LTD., EUROASIA FOOD EQUIPMENT SDN BHD, MAREL, PAUL MUELLER COMPANY, AUTO KINETICS (M) SDN BHD, GEA GROUP AKTIENGESELLSCHAFT, ALFA LAVAL AB, MARLEN INTERNATIONAL, INC. (A DURAVANT COMPANY), BUHLER AG, BUCHER INDUSTRIES AG, THE MIDDLEBY CORPORATION, KRONES AG, TOPSTEEL HOLDINGS PTE LTD., BAADER GROUP, NICHIMO CO., LTD, KETO SDN. BHD., GOLD PEG INTERNATIONAL, TETRA PAK INTERNATIONAL S.A. |

Analyst Review

Food processing equipment are machineries used to alter physical properties of food and aid commercial production and packaging of different kind of food products such as dairy, beverages, baked items, meat, poultry, and seafood.

Increase in need for readily available processed food products by the consumers due to changing lifestyle drives the growth of the Southeast Asia food processing equipment market. In addition, rise in the disposable income and improved financial stability of people in the Southeast Asia has increased the demand for processed food, which in turn is expected to boost the growth of the Southeast Asia food processing equipment market.

Moreover, replacement of conventional equipment with new advanced machines equipped with high-end technologies such as high-pressure processing is expected to increase the demand for the food processing equipment market.

The Southeast Asia food processing equipment market size was valued at $993.90 million in 2017, and is projected to reach $1,434.89 million by 2025

The global Southeast Asia Food Processing Equipment market is projected to grow at a compound annual growth rate of 4.7% from 2018 to 2025

TOPSTEEL HOLDINGS PTE LTD., MAREL, NICHIMO CO., LTD, HEAT AND CONTROL, INC., KRONES AG, GOLD PEG INTERNATIONAL, EUROASIA FOOD EQUIPMENT SDN BHD, BAADER GROUP, BUHLER AG, GEA GROUP AKTIENGESELLSCHAFT, KETO SDN. BHD., KEY TECHNOLOGY, INC., AUTO KINETICS (M) SDN BHD, THE MIDDLEBY CORPORATION, BUCHER INDUSTRIES AG, EMURA FOOD MACHINE CO., LTD., PAUL MUELLER COMPANY, TETRA PAK INTERNATIONAL S.A., MARLEN INTERNATIONAL, INC. (A DURAVANT COMPANY), ALFA LAVAL AB, YANAGIYA MACHINERY CO., LTD.

Increased preference toward processed food, rise in disposable income, and pressing need to replace old equipment drive the growth of the Southeast Asia food processing equipment market.

Loading Table Of Content...