Southeast Asia Perovskite Solar Cell Market Research, 2033

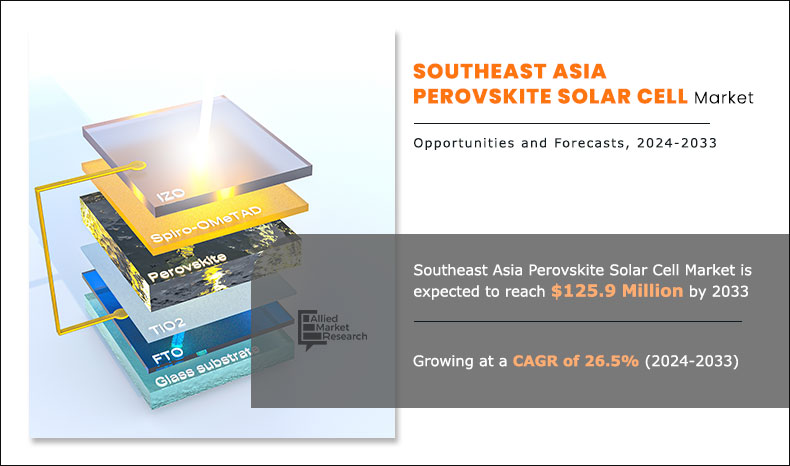

The Southeast Asia perovskite solar cell market size was valued at $12.0 million in 2023 and is estimated to reach $125.9 million by 2033, exhibiting a CAGR of 26.5% from 2024 to 2033. The surge in demand for lightweight and flexible solar panels, coupled with growing environmental concerns and ambitious renewable energy targets, is driving the demand for perovskite solar cell. These innovative cells offer a unique combination of high efficiency, low production costs, and the ability to be manufactured using low-temperature techniques that makes them suitable for a wide range of applications such as wearable electronics and building-integrated photovoltaics.

Introduction

Perovskite solar cell is a type of solar cell that uses perovskite-structured materials as the active layer to convert sunlight into electricity. Perovskite materials have a unique crystal structure that allows them to efficiently absorb light across a range of wavelengths that makes them promising candidates for next-generation solar cell. The production cost of these cells is low. They are highly efficient and flexible that makes them a rapidly advancing technology in photovoltaics.

Key Takeaways

- The Southeast Asia perovskite solar cell market has been analyzed in terms of value ($million). The analysis in the report is provided on the basis of structure, product, method, end use, and country.

- The Southeast Asia perovskite solar cell market report includes a detailed study covering underlying factors influencing the industry opportunities and trends.

- The key players in the Southeast Asia perovskite solar cell market are Oxford Photovoltaics, Front Materials Co. Ltd., Xiamen Weihua Solar Co. Ltd., Saule Technologies, Hanwha Group, Toshiba Corporation, Panasonic Holdings Corporation, LONGi, SKY ENERGY INDONESIA, and Phono Solar Technology Co., Ltd.

- The report facilitates strategy planning and industry dynamics to enhance decision making for existing market players and new entrants entering the perovskite solar cell industry.

- Countries such as Thailand, Malaysia, and Vietnam hold a significant share in the Southeast Asia perovskite solar cell market.

Market Dynamics

The surge in demand for lightweight and flexible solar panels drives the demand for perovskite solar cell. As compared to the traditional silicon-based solar panels, perovskite solar cell offer significant advantages in terms of flexibility and weight that makes it ideal for applications such as portable electronics, wearable technology, and building-integrated photovoltaics. According to the IRENA Renewable Energy Statistics 2024, the installed solar PV capacity in Vietnam was around 17,077 MW in 2023, up from 16,698 MW in 2022. In addition, perovskite solar cell is manufactured using low-cost processes, potentially reducing the overall cost of solar energy generation. As a result, industries such as electronics, telecommunications, and aerospace are increasingly turning to perovskite solar cell to meet their energy needs while also benefiting from the versatility and affordability they offer. All these factors are expected to drive the demand for perovskite solar cell.

However, the established infrastructure for silicon-based solar cell manufacturing enables economies of scale that drive down production costs and make them highly competitive in terms of cost per watt. Perovskite solar cell, while offering the potential for lower fabrication costs and simpler manufacturing processes, currently face challenges related to scalability and production yield. All these factors hamper the Southeast Asia perovskite solar cell market growth.

Integration of perovskite solar cell into building materials improves the overall energy performance and environmental sustainability of buildings. Buildings reduce their reliance on grid-supplied electricity, lower energy costs, and decrease their carbon footprint by harnessing solar energy at the point of use. In addition, the use of renewable energy technologies such as perovskite solar cell contribute to green building certifications and compliance with energy efficiency regulations that enhance the market value and attractiveness of properties. All these factors are anticipated to offer new growth opportunities for the Southeast Asia perovskite solar cell market during the forecast period.

Segments Overview

The Southeast Asia perovskite solar cell market is segmented into structure, product, method, end use, and country. On the basis of structure, the market is bifurcated into planar perovskite solar cell and mesoporous perovskite solar cell. By product, the market is divided into rigid perovskite solar cell and flexible perovskite solar cell. On the basis of method, the market is categorized into solution method, vapor-deposition method and vapor-assisted solution method. By end use, the market is segmented into aerospace, industrial automation, consumer electronics, energy, and others. Country-wise, the market is analyzed across Thailand, Malaysia, the Philippines, Indonesia, Vietnam, Singapore, Laos, Cambodia, Brunei, and rest of Southeast Asia.

On the basis of structure, the market is bifurcated into planar perovskite solar cell and mesoporous perovskite solar cell. The planar perovskite solar cell segment accounted for more than two-thirds of the Southeast Asia perovskite solar cell market share in 2023 and is expected to maintain its dominance during the forecast period. Planar perovskite solar cell exhibit a high absorption coefficient which effectively capture sunlight and convert it into electricity even in thin-film configurations. This characteristic allows for the production of lightweight and flexible solar cell, expanding their applicability beyond traditional rigid panels. Moreover, perovskites possess tunable bandgaps, enabling the optimization of the solar cell to absorb a broader spectrum of sunlight. This versatility in light absorption significantly enhances the overall efficiency of the solar cell.

By Structure

Mesoporous perovskite solar cells is projected as the most lucrative segment.

By product, the market is divided into rigid perovskite solar cell and flexible perovskite solar cell. The flexible perovskite solar cell segment accounted for less than three-fifths of the Southeast Asia perovskite solar cell market share in 2023 and is expected to maintain its dominance during the forecast period. The flexibility of perovskite solar cell is a crucial factor driving their development. This flexibility allows for their integration into a wide range of applications that are not feasible with rigid solar panels, such as wearable electronics, portable power sources, and building-integrated photovoltaics (BIPV). Flexible PSCs are incorporated into various substrates such as plastics and textiles, expanding their use in innovative and versatile ways.

By Product

Rigid perovskite solar cells is projected as the most lucrative segment.

On the basis of method, the market is categorized into solution method, vapor-deposition method and vapor-assisted solution method. The vapor-deposition method segment accounted for less than half of the Southeast Asia perovskite solar cell market share in 2023 and is expected to maintain its dominance during the forecast period. Vapor-deposition methods are highly scalable that makes them suitable for large-scale production. Techniques such as roll-to-roll vapor deposition are integrated into existing industrial manufacturing processes, facilitating the mass production of perovskite solar cell. This scalability is essential for transitioning PSC technology from laboratory research to commercial applications, meeting the growing demand for efficient and cost-effective solar energy solutions.

By Method

Vapor-assisted solution method is projected as the most lucrative segment.

By end use, the market is segmented into aerospace, industrial automation, consumer electronics, energy, and others. The energy segment accounted for two-fifths of the Southeast Asia perovskite solar cell market share in 2023 and is expected to maintain its dominance during the forecast period. The ongoing R&D efforts in the field of perovskite solar cell are driving significant advancements in their stability and scalability. PSCs faced challenges related to their long-term stability, as perovskite materials were prone to degradation under environmental conditions such as moisture, heat, and UV exposure. However, recent innovations in material composition, encapsulation techniques, and device engineering have substantially improved the durability and lifespan of PSCs. Researchers are exploring hybrid tandem configurations that combine perovskite layers with other photovoltaic materials such as silicon, to achieve even higher efficiencies and enhanced stability. These advancements are crucial for the commercialization and widespread deployment of PSCs, positioning them as a viable solution for large-scale renewable energy generation.

By End Use

Consumer electronics is projected as the most lucrative segment.

Country-wise, the market is analyzed across Thailand, Malaysia, the Philippines, Indonesia, Vietnam, Singapore, Laos, Cambodia, Brunei, and rest of Southeast Asia. Vietnam accounted for two-thirds of the Southeast Asia perovskite solar cell market share in 2023 and is expected to maintain its dominance during the forecast period. Vietnam's rapid economic growth has led to an increase in energy demand that drive the exploration of diverse and sustainable energy sources. Perovskite solar cell offer a promising solution due to their high efficiency, lower production costs, and potential for integration into various applications that makes them a viable option to meet the country's growing energy needs.

Competitive Analysis

Key players in the Southeast Asia perovskite solar cell market include Oxford Photovoltaics, Front Materials Co. Ltd., Xiamen Weihua Solar Co. Ltd., Saule Technologies, Hanwha Group, Toshiba Corporation, Panasonic Holdings Corporation, LONGi, SKY ENERGY INDONESIA, and Phono Solar Technology Co., Ltd.

In the Southeast Asia perovskite solar cell market, companies have adopted agreements and innovation to expand the market or develop new products. For instance, in June 2024, At the Intersolar Europe 2024 event, Oxford PV unveiled a double-glass, 60-cell "residential-sized" perovskite tandem module boasting a record-setting efficiency of 26.9%. With a surface area slightly exceeding 1.6 square meters (1m x 1.7m) and a weight just under 25 kg, the module is described by Oxford PV as "the ideal size for residential applications. Moreover, in September 2021, Toshiba Corporation developed a new coating method for the perovskite layer that boosts power conversion efficiency (PCE) to 15.1% for Toshiba’s 703cm2 module*1, the highest for any large, polymer film-based perovskite photovoltaic module*2. The innovative coating method for perovskite layer also greatly reduces production time and costs, contributing to a lower cost for solar power generation.

Key Benefits of Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the Southeast Asia perovskite solar cell market analysis from 2023 to 2033 to identify the prevailing Southeast Asia perovskite solar cell market opportunities.

- The market research is offered along with information related to key drivers, restraint, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the Southeast Asia perovskite solar cell market statistics and segmentation assists to determine the prevailing market opportunities.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the Southeast Asia perovskite solar cell market trends, key players, market segments, application areas, and market growth strategies.

Southeast Asia Perovskite Solar Cell Market Report Highlights

| Aspects | Details |

| By Structure |

|

| By Product |

|

| By Method |

|

| By End Use |

|

| By Country |

|

| Key Market Players | Oxford Photovoltaics, LONGi, Phono Solar Technology Co., Ltd, Saule Technologies, SKY ENERGY INDONESIA, Hanwha Group, Xiamen Weihua Solar Co. Ltd., Toshiba Corporation, Panasonic Holdings Corporation, Front Materials Co. Ltd. |

Analyst Review

According to the opinions of various CXOs of leading companies, the Southeast Asia perovskite solar cells market is expected to witness an increase in demand during the forecast period. A surge in demand for lightweight and flexible solar panels and growing environmental concerns and renewable energy targets have increased the demand for perovskite solar cells in the Southeast Asia region during the forecast period. As the region experiences rapid urbanization and infrastructure development, there is a growing need for innovative and versatile solar energy solutions that is integrated seamlessly into various applications such as portable electronics, wearable devices, building-integrated photovoltaics (BIPV), and off-grid power systems. Perovskite solar cells offer distinct advantages in terms of their lightweight nature, flexibility, and potential for customization that makes them well-suited for applications where traditional rigid solar panels are impractical.

Moreover, the lightweight and flexible nature of perovskite solar cells make them particularly suitable for off-grid and remote applications, where access to electricity is limited or unreliable. These include rural electrification projects, off-grid communities, and disaster relief efforts, where portable and easy-to-deploy, solar solutions are needed to provide essential power for lighting, communication, and other basic needs. By addressing energy access challenges in underserved areas, perovskite solar cells help to improve quality of life, spur economic development, and reduce reliance on fossil fuels, thereby contributing to a more sustainable and resilient energy future in Southeast Asia.

Surge in demand for lightweight and flexible solar panels and rise in environmental concerns and renewable energy targets are the key factors boosting the Southeast Asia Perovskite Solar Cell Market growth.

The Southeast Asia perovskite solar cells market was valued at $12.1 million in 2023 and is estimated to reach $125.9 million by 2033, exhibiting a CAGR of 26.5% from 2024 to 2033.

Key players in the Southeast Asia perovskite solar cells market include Oxford Photovoltaics, Front Materials Co. Ltd., Xiamen Weihua Solar Co. Ltd., Saule Technologies, Hanwha Group, Toshiba Corporation, Panasonic Holdings Corporation, LONGi, SKY ENERGY INDONESIA, and Phono Solar Technology Co., Ltd.

Integration into building materials is the opportunity to the Southeast Asia Perovskite Solar Cell Market growth.

The Southeast Asia perovskite solar cells market is segmented into structure, product, method, end use, and country. On the basis of structure, the market is bifurcated into planar perovskite solar cells and mesoporous perovskite solar cells. By product, the market is divided into rigid perovskite solar cells and flexible perovskite solar cells. On the basis of method, the market is categorized into solution method, vapor-deposition method and vapor-assisted solution method. By end use, the market is segmented into aerospace, industrial automation, consumer electronics, energy, and others. Country-wise, the market is analyzed across Thailand, Malaysia, the Philippines, Indonesia, Vietnam, Singapore, Laos, Cambodia, Brunei, and Rest of Southeast Asia.

Competition from established solar technologies hamper the growth of Southeast Asia Perovskite Solar Cell Market growth.

Consumer electronics is the fasting growing segment on the basis of end use in Southeast Asia Perovskite Solar Cell Market.

Loading Table Of Content...