Southeast Asian Tire Market Insights, 2030

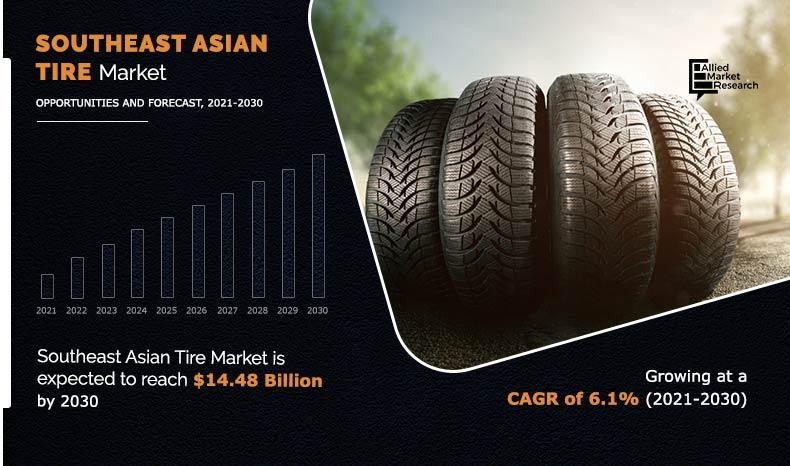

The Southeast Asian tire market was valued at USD 8.21 billion in 2020, and is projected to reach USD 14.48 billion by 2030, registering a CAGR of 6.1%. The factors, such as high rubber production in the Southeast Asian region, and growing automotive exports, and rising passenger car sales, are expected to drive the Southeast Asian tire market. However, development in the market of retreading tires and lack of infrastructure are expected to restrict the growth of the market during the forecast period. Moreover, rise in southeast Asian government initiatives to increase automotive component manufacturing, and advancement in technology are the factors anticipated to supplement the southeast Asian tire market growth.

Key Market Trends

- Seasonal Demand: The summer tire segment is anticipated to witness significant growth during the forecast period.

- Vehicle Preference: Two-wheeler tires are projected to hold the largest market share by the end of the forecast period.

- Rim Size Adoption: Tires with rim sizes between 16 to 18 inches are expected to register notable CAGR.

- Regional Dominance: Thailand led the Southeast Asian tire market in 2020 and is expected to maintain its dominance.

Market Size & Forecast

- 2030 Projected Market Size: USD 14.48 billion

- 2020 Market Size: USD 8.21 billion

- Compound Annual Growth Rate (CAGR) (2021-2030): 6.1%

Introduction

The automotive tire is an important component of any vehicle, since it ensures the driver and passengers' safety and comfort. The tire's primary duty is to protect the wheel rim and provide tractive force between the vehicle and the road surface. As it is made of rubber, it also provides a flexible cushion, lessening the impact of vibrations and absorbing the vehicle's shock. Tread, jointless cap heaps, beads, and additional components such as synthetic rubber, carbon black, and fabric make up a rubber tire. Automobile output ultimately determines tire demand.

Due to the abundant availability of rubber and the rise in need for vehicle production to meet the spike in demand for automobiles across all segments, the demand for tires is increasing tremendously across Southeast Asia. The increased need for automotive tires has enticed major automakers to establish a presence in the region. For instance, Sumitomo Rubber Industries, Ltd. announced the development of a natural rubber procurement subsidiary in Singapore to manufacture tires in January 2020. Such developments are expected to provide profitable prospects for the Southeast Asian tire market during the forecast period.

Market Segmentation

The Southeast Asian tire market is segmented on the basis of type, vehicle type, rim size, and countries. Based on type, it is divided into summer, winter, and all-season. On the basis of vehicle type, it is divided into passenger cars, commercial vehicles, electric vehicles, two-wheelers, three-wheelers, and off-road vehicles. Based on rim size, it is segmented into 13 to 15, 16 to 18, 19 to 21, and more than 21. Country-wise it is analyzed across Indonesia, Malaysia, the Philippines, Thailand, Vietnam, and the rest of Southeast Asia. Thailand was the highest revenue contributor, accounting for $2.68 billion in 2020, and is estimated to reach $4.59 billion by 2030, with a CAGR of 5.8%.

Which are the Top Southeast Asian Tire companies

The following are the leading companies in the market. These players have adopted various strategies to increase their market penetration and strengthen their position in the Southeast Asian tire industry.

- Bridgestone Corporation

- Continental AG

- Dunlop Tires

- PT Gajah Tunggal Tbk

- Goodyear Tire

- Hankook Tire & Technology Co., Ltd.

- Michelin

- Pirelli & C. S.p.A

- PT Multistrada Arah Sarana Tbk

- Sumitomo Rubber Industries, Ltd.

- The Yokohama Rubber Co., Ltd.

- Inoac Corporation

- PT Suryaraya Rubberindo Industries

- PT Tiga Berlian Mandiri

What are the Top Impacting Factors

Key Market Driver

High rubber production in the Southeast Asian region

Thailand, Indonesia, Vietnam, and other growing economies constitute the Southeast Asian region. In recent years, these countries have seen a surge in the presence of international automobile component manufacturers. The abundant availability of rubber and cheap attracts international automotive tire manufacturers to setup their production facilities in the region. The demand for natural rubber in Southeast Asia will continue to push a departure from traditional farming techniques and toward rubber plantations. Thailand is the world's largest producer of natural rubber, accounting for 97% of global output, followed by Indonesia, Vietnam, and Malaysia. On-site production for foreign manufacturers is easier than exporting tires to Southeast Asia.

Furthermore, Indonesia has a significant comparative advantage over other countries in this regard, owing to its enormous rubber-growing area. Thailand is the largest producer and exporter of natural rubber in the world, produces about 3 million tons a year, accounting for up to 40% of worldwide supply. Indonesia produced around 2.88 metric tons of rubber in 2020. Together with Thailand and Malaysia, Indonesia is a member of the International Tripartite Rubber Council. The rubber industry contributes an important role to Indonesia’s GDP. Several international businesses, including Lanxess of Germany, are establishing manufacturing facilities in Singapore and Thailand for expanding massive operations to manufacture sophisticated elastomers for tire manufacturing. Due to the region's booming tire manufacturing and the availability of raw materials from local refineries, multinational companies are expanding into Southeast Asia. More than labor costs, natural rubber is a crucial component of tire production. As a result, various major tire manufacturers, such as Bridgestone, Goodyear, Hankook, and Michelin, are established in the archipelago with state-of-the-art factories. S-SBR, which is used to produce tire treads, is a rubber technology that enables tire manufacturers to cater to the demands of fuel efficiency and wet traction. Demand for S-SBR is soaring, fuelled by rising concerns about energy conservation. High-performance tires with S-SBR treads are becoming more common as standard equipment on new automobiles. Gajah Tunggal, the country's largest tire maker, manufactured 43 million tires in 2018, according to its annual balance sheet. Bridgestone is the second-largest producer, with two factories in Bekasi and Karawang, both near Jakarta. Multistrada Arah Sarana (MAS), which exports 80% of its manufacturing, is also a major player in the market. The Southeast Asian tire business is booming due to the region's substantial rubber output.

Growing automotive exports and rising passenger car sales

Automobile production and manufacturing have increased dramatically in recent years, particularly in Thailand, Indonesia, Vietnam, and Malaysia. Thailand has long been recognized as Southeast Asia's primary vehicle manufacturer, and it has gained traction in the automobile export business. In 2018, the country manufactured 2 million vehicles, an increase of 8.7% from 2017, and exports more than half of its output to more than 100 countries, with just over 1 million vehicles sold domestically. While Thailand focuses on vehicle exports, Indonesia has a considerable domestic automobile market, fuelled by a growing middle class. The number of people buying cars in Indonesia is predicted to increase dramatically, with the majority of purchases taking place in the country's cities, particularly Jakarta. By the end of 2018, car sales had increased by 6% to slightly over 1.3 million vehicles, with 346,000 units shipped to countries such as the Philippines, Saudi Arabia, and Vietnam. Indonesia exports approximately 70% passenger vehicle tires and 30% motorcycle tires produced in the country to over 70 nations throughout the globe. Due to fast industrialization, the automobile industry in Southeast Asia has recently experienced tremendous growth, resulting in an increase in the sale of commercial vehicles such as trucks, tractors, and trailers throughout the region.

Furthermore, as people's disposable money rises and their standard of living improves, the sale of luxury passenger vehicles and premium segment motorcycles also witnesses a rise. In addition, during the projected period, electric vehicle sales are expected to rise across the region. Electric vehicle sales are further boosted by lower prices for parts such as batteries, transmissions, and alternators. As a result, an increase in consumer demand for vehicles across all segments leads to an increase in the manufacturing of automobiles and the tires that are associated with the vehicles. For instance, Thailand, Vietnam, Indonesia, and the Philippines, have a thriving transport and logistics industry. Southeast Asian trade volumes have risen considerably in recent years as a result of the deregulation of imports and exports as well as large inflows of foreign direct investment. The booming automotive exports and passenger car sales further fuels the growth of the automotive tires in the region. The availability of a low-cost, highly skilled labor population has resulted in the region's economic activity developing at a quick pace.

By Type

Summer is projected as the most lucrative segment

According to a recent announcement by the Vietnamese government in February 2021, the logistics industry is expected to experience growth by 15-20% in the next five years, and Vietnam is seeking to boost the contribution of logistics services in its gross domestic product to 5-6 % by 2025. Moreover, according to data provided by the Indonesia Economic Forum in 2019, the Indonesian logistic market revenue is estimated to reach $300.3 billion by 2024, presenting lucrative potential for the Southeast Asia tire market.

By Vehicle Type

Electric Vehicle is projected as the most lucrative segment

Restraints

Development in the market of retreading tires

The process of retreading involves replacing the tread on old tires. It's also known as a recap or remold, and it's the process of re-manufacturing tires. When compared to the creation of a new tire, the re-manufacturing procedure of the tire spares a large quantity of material. As a result, the material prices for this procedure are lower. Furthermore, when compared to constructing a new one, it helps save a significant amount of money on tire and material costs. Retreading is far less expensive and environment-friendly than buying a new set of tires because the labor and costs are much lower. One tire may be retreaded up to ten times, thus prolonging its service life and conserving limitless quantities of oil in the manufacturing process as well as lowering carbon emissions and landfill waste. When it comes to businesses with large fleets of vehicles, the savings can be significant. The tire manufacturing business has seen a lot of progress over the years all around the world. Premium technologies are used to create high-quality tires that will work flawlessly not only in their first life, but also in their second, third, and even fourth lives. Stronger tire casings, improved re-manufacturing procedures, and high-quality rubber compounds are being used in the growing retreaded tire business. OEMs' aftermarket costs are directly reduced by retreading. The rise of the retreading tire market is due to factors such as the availability of less expensive tire brands and the discomfort of the roads. Furthermore, the demand for retreaded tires is accelerated by a significant increase in tire prices due to high production costs. Retreading gives tires a fresh chance at life, and it can be done two to three times depending on the tire's condition. This stimulates the retreading tire market, limiting the growth of the Southeast Asia tire market.

By Rim Size

16 to 18 is projected as the most lucrative segment

Opportunity

Rise in Southeast Asian government initiatives to increase automotive component manufacturing

Various incentives have been offered by the governments of Southeast Asian countries to help the region's automobile industry thrive. Tax incentives of up to 300% for conducting R&D and 200% for engaging in vocational activities are among these incentives. In addition, governments of these countries are encouraging the export of locally manufactured sophisticated automotive technology. For instance, in June 2019, Vietnam signed the European Union-Vietnam Free Trade Agreement (EVFTA), which eliminates 71% of levies on Vietnamese exports, including automobiles and automobile parts. The EVFTA, when combined with Vietnam's cheap production costs, may encourage certain automotive and component manufacturers to migrate from other countries to Vietnam. Furthermore, to support local manufacturing industries, Southeast Asian governments are imposing taxes and regulations on the import of automobiles and car components. For instance, Malaysia continues to levy excise rates ranging from 75% to 105% on any passenger cars from ASEAN that are not new energy vehicles(NEV) and do not have local content. Thailand, however, continues to impose a duty of 80% and excise taxes of up to 50% on new non-NEV cars imported. According to the Indonesian Association of Tire Manufacturers, or APBI, up to 40% of all tire imports fail to meet national product standards. Moreover, increased government initiatives in the region to adopt safe and environment-friendly domestically manufactured automotive technologies provide an opportunity for the Southeast Asian tire market to expand.

By Country

Vietnam would exhibit the highest CAGR of 7.3% during 2021-2030.

Key Benefits For Stakeholders

- This study presents the analytical depiction of the Southeast Asian tire analysis along with the current trends and future estimations to depict imminent investment pockets.

- The overall Southeast Asian tire market opportunity is determined by understanding profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities of the market with detailed impact analysis.

- The current market is quantitatively analyzed from 2020 to 2030 to benchmark financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the industry.

Southeast Asian Tire Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Vehicle Type |

|

| By Rim Size |

|

| By Country |

|

| Key Market Players | MICHELIN, PIRELLI & C. S.P.A., PT MULTISTRADA ARAH SARANA TBK, THE GOODYEAR TIRE, DUNLOP TIRES, PT TIGA BERLIAN MANDIRI, THE YOKOHAMA RUBBER CO., LTD., PT. SURYARAYA RUBBERINDO INDUSTRIES, INOAC CORPORATION, PT GAJAH TUNGGAL TBK, BRIDGESTONE CORPORATION, SUMITOMO RUBBER INDUSTRIES, LTD., HANKOOK TIRE & TECHNOLOGY CO., LTD., CONTINENTAL AG |

Analyst Review

The Southeast Asian tire market is expected to witness significant growth, due to rise in production and sales of automobiles across Southeast Asia.

According to leading CXOs, automotive tire manufacturers are concentrating on providing innovative, lightweight, and long-lasting tires. The automotive tire market is expected to grow at a remarkable rate in the future, owing to the booming e-commerce and logistics industries in Southeast Asia. The need for automotive tires is being driven by increasing vehicle production operations across Southeast Asia. Global automobile production, on the other hand, has declined in the last two years, and the COVID-19 pandemic has pushed back global automotive manufacturing until 2020. In addition, rising passenger car sales are expected to increase the demand for automobile tires in Southeast Asia in the near future.

To deal with the changing demand scenarios, market participants are entering into contracts and agreements to secure long-term commercial opportunities. In addition, market participants are continuously focusing on product development efforts to match changing end-user requirements and improve vehicle operational efficiency. Southeast Asia is predicted to have a tremendous increase in automotive tire production activities due to abundant raw material availability, a cost-effective workforce, and government attempts to encourage manufacturing activities. Due to the abundance of rubber in the countries, Thailand and Indonesia are expected to be the most attractive markets for the Southeast Asian tire market.

Furthermore, the Southeast Asian tire market is segmented on the basis of type, vehicle type, rim size, and country. Based on type, it is divided into summer, winter, and all-season. On the basis of vehicle type, it is divided into passenger cars, commercial vehicles, electric vehicles, two-wheelers, three-wheelers, and off-road vehicles. Based on rim size, it is segmented into 13 to 15, 16 to 18, 19 to 21, and more than 21. Country-wise, it is analyzed across Indonesia, Malaysia, the Philippines, Thailand, Vietnam, and the rest of Southeast Asia.

The Southeast Asian tire market is projected to reach $14,476.8 million by 2030, registering a CAGR of 6.1%.

Thailand accounts for 32.6% share of Southeast Asian tire market.

The report sample for Southeast Asian tire market report can be obtained on demand from the website.

The Southeast Asian tire market was valued at $8,210.9 million in 2020.

High rubber production in the Southeast Asian region, and advancement in technology are the known and unknown adjacencies impacting the Southeast Asian tire market.

The company profiles of the top players of the market can be obtained from the company profile section mentioned in the report. This section includes analysis of top ten player’s operating in the industry along with their last three-year revenue, segmental revenue, product offerings, key strategies adopted, and geographical revenue generated.

The two wheeler and passenger car segments collectively accounted for around 59.7% market share in 2020, with the former constituting around 34.7% share.

Bridgestone Corporation is a prominent tire manufacturer in Southeast Asia.

As per AMR analysis, leading tire manufacturing companies in Southeast Asian region are Bridgestone Corporation, Continental AG, Dunlop Tires, Suryaraya Rubberindo Industries, and Goodyear Tire, among others.

The all-season tire has huge demand in Southeast Asia.

Loading Table Of Content...