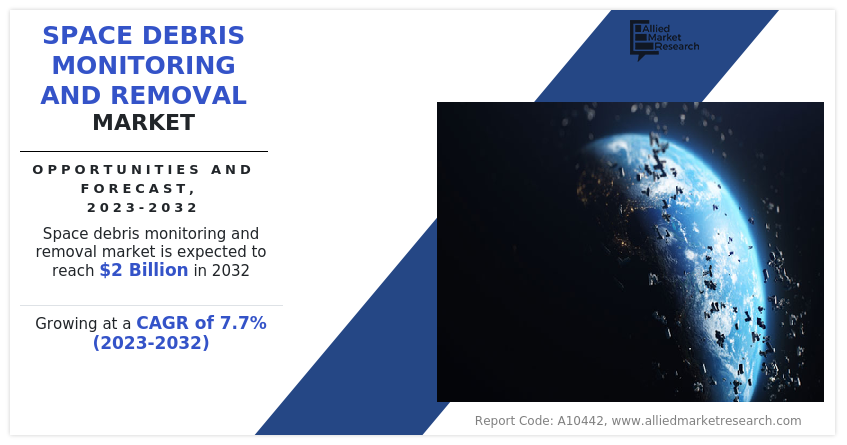

The global space debris monitoring and removal market size was valued at $976 million in 2022, and is projected to reach $2,010.3 million by 2032, growing at a CAGR of 7.7% from 2023 to 2032.

Key Highlighters:

- The report covers segments such activity, debris size, and orbit. The report is studied across different regions such as North America, Europe, Asia-Pacific, and LAMEA.

- The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literatures, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

Space debris monitoring and removal refers to a set of activities and technologies designed to detect, track, and mitigate the presence of space debris or space junk in Earth's orbit. Space debris consists of defunct satellites, spent rocket stages, fragments from previous collisions, and other man-made objects that remain in orbit after their operational life has ended. Monitoring and removal are critical aspects of space situational awareness and space sustainability, aimed at reducing the risks posed by space debris to operational satellites, spacecraft, and the safety of space activities.

In recent years, space sustainability has become a major concern for space agencies and governments worldwide. The exponential increase in space debris and the potential risks it poses to operational satellites, space missions, and even future space exploration endeavors have prompted governments to take proactive measures. As a result, many countries have initiated policy frameworks and national strategies to address the space debris issue. These policies set the stage for investments in space debris monitoring and removal technologies.

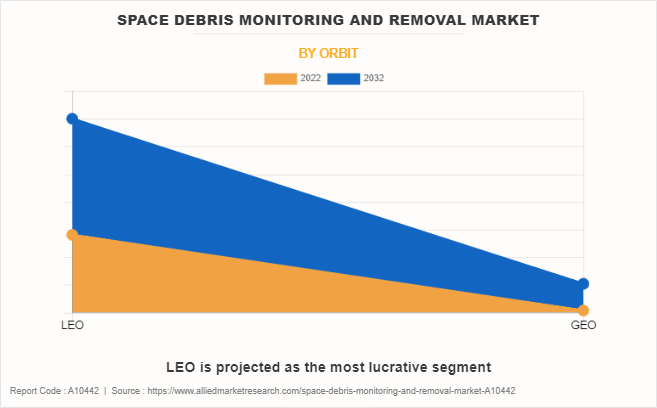

Moreover, many satellites in GEO are approaching the end of their operational life cycles. These aging satellites pose a twofold challenge: they contribute to the space debris population when they become defunct, and they risk collisions with operational satellites. The necessity to address this issue is driving the demand for monitoring, removal, and end-of-life solutions.

Stricter regulations and guidelines require satellite operators to adhere to deorbiting and removal requirements for GEO satellites. This regulatory environment has significant implications for satellite operators, creating opportunities for service providers specializing in the deorbiting of defunct satellites.

Factors such as surge in space debris threat, increase in tendency of satellite constellations and rise in development of initiatives by various space agencies and government drive the growth of the market across the globe. However, factors such as high development costs and regulatory compliance with international space regulations and agreements act as a barrier for the growth of the market across the globe. Nevertheless, rise in demand for space tourism and development of advanced technologies create ample opportunities for the growth of the space debris monitoring market during the forecast period.

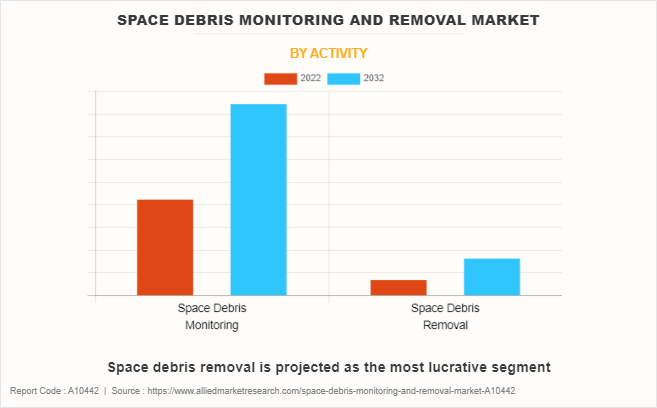

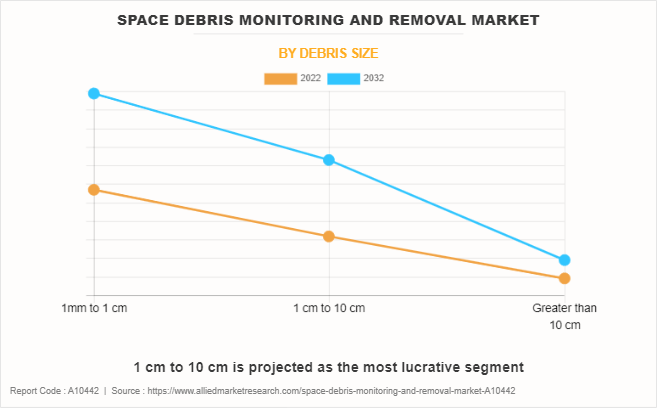

The space debris monitoring and removal market is segmented on the basis of activity, debris size, orbit, and region. On the basis of activity, the market is classified into space debris removal, and space debris monitoring. On the basis of debris size, the market is divided into 1mm to 1 cm, 1 cm to 10 cm, and greater than 10 cm. On the basis of orbit, the market is bifurcated into LEO and GEO. By region, the market is studied across North America, Europe, Asia-Pacific and LAMEA.

Governments in North America are actively involved in space sustainability efforts. In the U.S., agencies such as NASA and the Department of Defense play a pivotal role in space debris monitoring and research. Government-driven initiatives and regulations influence the growth of the space debris removal market and promote responsible space activities.

North America attracts significant private investments in space activities, leading to an increasing number of commercial satellite constellations, space tourism ventures, and more. This surge in commercial space endeavors fuels the demand for effective space debris monitoring and mitigation solutions. The region hosts a multitude of defense and national security assets in space. Protecting these assets from space debris threats is a priority, creating a demand for advanced monitoring systems and the potential for public-private partnerships in debris removal efforts.

Therefore, the region presents opportunities for service providers, technology innovators, and collaboration with government agencies to contribute to the safety and sustainability of space activities.

The key players profiled in the global space debris monitoring and removal market include Obruta Space Solutions Corp., Lockheed Martin Corporation, Northrop Grumman, Share My Space SAS, Astroscale, Electro Optic Systems, OrbitGuardians, Voyager Space Holdings Inc., ClearSpace, and Airbus SE. These players have adopted strategies such as product launches and partnerships to increase their space debris monitoring and removal market share.

Surge in space debris threat

Space debris poses a significant risk to operational satellites and spacecraft. Collisions with even small pieces of debris can cause catastrophic damage. This risk can disrupt vital services such as communication, weather forecasting, navigation, and earth observation, affecting both government and commercial entities. Space debris also poses a threat to astronauts and manned space missions. Even the International Space Station (ISS) has had to adjust its orbit to avoid potential collisions with debris. Protecting astronauts and space assets is important for space agencies and organizations.

Moreover, the Kessler Syndrome is a theoretical scenario proposed by NASA scientist Donald J. Kessler. It suggests that as the amount of space debris continues to increase, it can reach a critical density where collisions between objects generate more debris, creating a self-sustaining cascade of collisions. This could render certain orbital regions unusable for both satellites and crewed missions. Such scenarios create many opportunities for companies operating in the space debris monitoring and removal market.

Therefore, the surge in the space debris threat is a significant driver for the space debris monitoring and removal market. It leads to increased awareness, regulatory actions, and investment in technologies and services aimed at ensuring the sustainability of space operations and exploration.

Increase in satellite constellations

Satellite constellations, characterized by the deployment of numerous small satellites working together to provide various services, have become increasingly popular in recent years. This trend is driven by several key factors such as the demand for global connectivity and internet access in underserved or remote areas. Companies like SpaceX's Starlink, OneWeb, and Amazon's Project Kuiper are racing to deploy thousands of satellites in low Earth orbit (LEO) to provide high-speed internet access to a global audience. This surge in satellite deployments contributes to the overall increase in the number of objects in orbit.

Moreover, satellite constellations are not limited to providing internet services. They have diverse applications, including Earth observation, climate monitoring, disaster management, and military surveillance. This wide range of applications means more satellites are being launched into orbit, often to different altitudes and orbits, which adds complexity to the space debris challenge.

The growth of satellite constellations also underscores the need for improved space traffic management and space situational awareness (SSA) systems. Tracking their positions and trajectories becomes essential to avoid collisions with more objects in orbit. Companies and governments are investing in SSA technologies to monitor these satellites and to ensure they can safely navigate through increasingly crowded space.

There is an increase in level of collaboration and regulation within the space industry in response to these challenges. Companies, space agencies, and governments are working together to establish guidelines for responsible satellite deployment, disposal, and debris mitigation. This collaborative effort further drives the development and adoption of space debris monitoring and removal solutions.

Growing initiatives associated with space sustainability

In recent years, space sustainability has become a major concern for space agencies and governments worldwide. The exponential increase in space debris and the potential risks it poses to operational satellites, space missions, and even future space exploration endeavors have prompted governments to take proactive measures. As a result, many countries have initiated policy frameworks and national strategies to address the space debris issue. These policies set the stage for investments in space debris monitoring and removal technologies.

The space environment is a global common, and space debris affects all spacefaring nations. Recognizing this, various countries and space agencies are increasingly cooperating at an international level to tackle space debris challenges. Initiatives such as the United Nations Committee on the Peaceful Uses of Outer Space (COPUOS) and its guidelines on space debris mitigation and removal encourage collaboration among nations. This collaboration drives the market for space debris solutions as governments work together to develop and implement international standards.

Some governments are taking proactive steps to actively remove defunct satellites and space debris from orbit. Initiatives like the European Space Agency's Clean Space program and Japan's Kounotori program focus on developing technologies and missions to capture and deorbit space debris. These ADR efforts drive both technological innovation and commercial opportunities for companies involved in debris removal.

Moreover, in 2022, ISRO established the System for Ensuring the Safety and Sustainability of Operational Management (SE 4 OSM). Its primary purpose is to maintain constant surveillance over objects that could potentially collide, forecast the development of orbital debris, and reduce the hazards associated with space junk. This, in turn, creates many opportunities for the growth of the space debris monitoring and removal market.

Recent Developments:

In July 2023, Obruta Space Solutions corp. was awarded a contract from Canadian Space Agency through Space Technology Development Program for a Novel Multi-Target Space Debris Removal Technology Feasibility Study.

In May 2023, ClearSpace and Arianespace signed contract to launch ClearSpace-1, the active debris removal mission. It captures and deorbits a derelict space debris object of more than 100 kg.

The space debris monitoring and removal market is segmented into Activity, Debris size and Orbit.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the space debris monitoring and removal market analysis from 2022 to 2032 to identify the prevailing space debris monitoring and removal market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the space debris monitoring and removal market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global space debris monitoring and removal market trends, key players, market segments, application areas, and market growth strategies.

Space Debris Monitoring and Removal Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 2 billion |

| Growth Rate | CAGR of 7.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 230 |

| By Activity |

|

| By Debris size |

|

| By Orbit |

|

| By Region |

|

| Key Market Players | OrbitGuardians, Voyager Space Holdings Inc., Northrop Grumman, Obruta Space Solutions Corp., ClearSpace, Astroscale, Electro Optic Systems, Share My Space SAS, Airbus SE, Lockheed Martin Corporation |

The global space debris monitoring and removal market was valued at $976.0 million in 2022, and is projected to reach $2,010.3 million by 2032, registering a CAGR of 7.7% from 2023 to 2032.

The largest regional market for Space Debris Monitoring and Removal is North America.

The leading application of Space Debris Monitoring and Removal Market is Space Debris Monitoring.

The key players in the global space debris monitoring and removal market include Obruta Space Solutions Corp., Lockheed Martin Corporation, Northrop Grumman, Share My Space SAS, Astroscale, Electro Optic Systems, OrbitGuardians, Voyager Space Holdings Inc., ClearSpace, and Airbus SE.

The upcoming trends in space debris monitoring include surge in space debris threat and growing initiatives associated with space sustainability.

Loading Table Of Content...

Loading Research Methodology...