The Spain augmented analytics in BFSI market is expected to augment during the forecast period due to the adoption of digital technologies and increase in demand for improved customer experience. Augmented analytics technology integrates Artificial Intelligence (AI) and Machine Learning (ML) tools with existing analytics solutions to provide increased automation and user-friendly insights into complex data sets. In the BFSI sector, augmented analytics technology is majorly used for customer analytics, customer segmentation, customer profiling, and risk management.

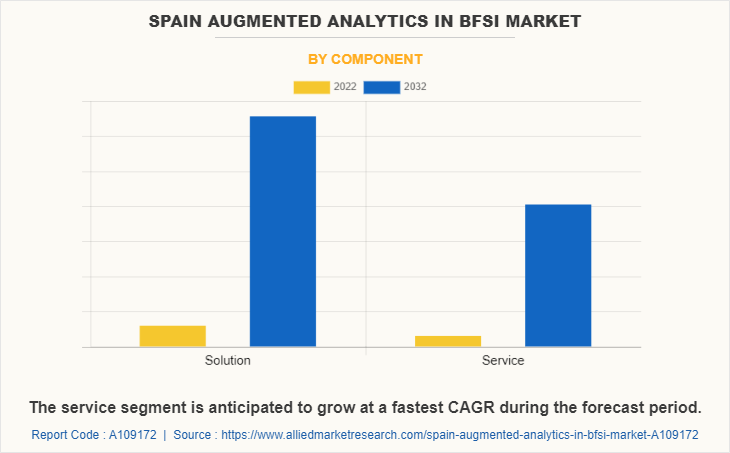

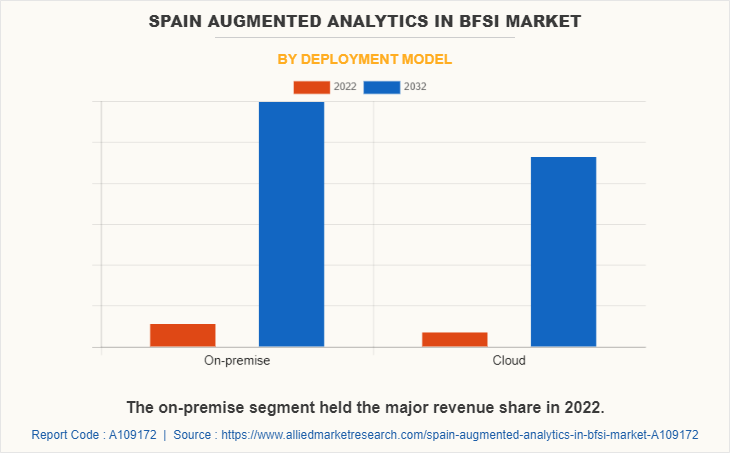

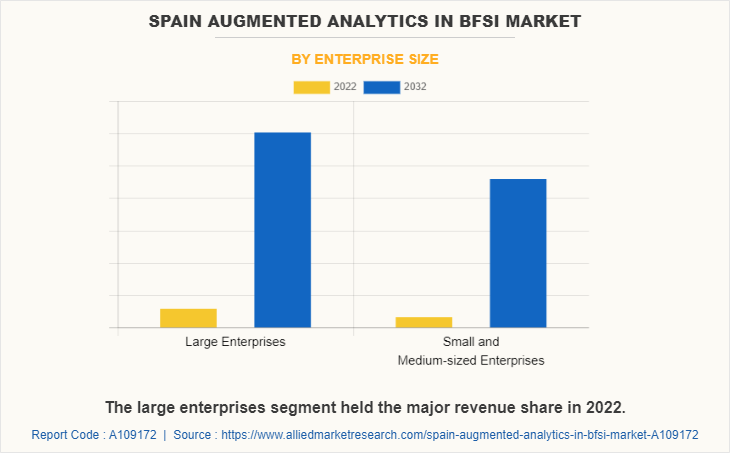

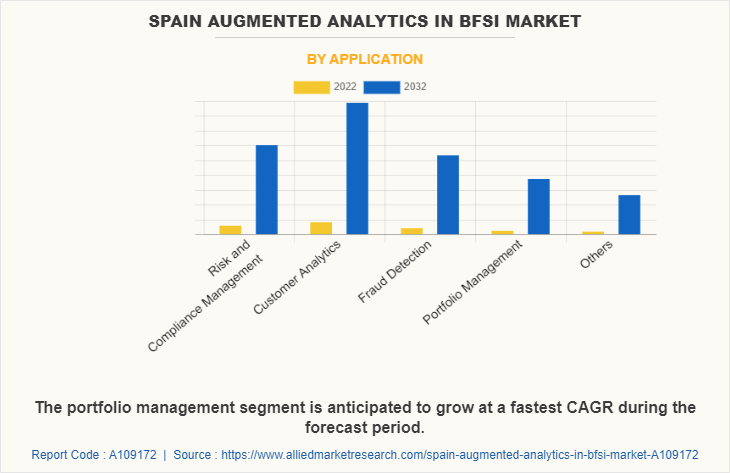

The Spain augmented analytics in BFSI market is segmented by component, deployment model, enterprise size, and application. On the basis of component, the market is bifurcated into solution and service. The solution segment is expected to account for major share during the forecast period, owing to increase in demand for solutions such as NLP, voice recognition, optical character recognition, ML, deep learning, policy management, and workflow maintenance. Depending on deployment model, the market is divided into on-premise and cloud. The cloud segment is expected to witness the highest CAGR during the forecast period. As per enterprise size, the market is classified into large enterprises and small & medium-sized enterprises. The large enterprises segment is expected to dominate the market due to boost in investments of large enterprises in modern technology and solutions such as augmented analytics. According to application, the market is categorized into rise & compliance management, customer analytics, fraud detection, portfolio management, and others.

The Spain augmented analytics in BFSI market is driven by rapid technological advancements, rise in demand for improved customer experience, and need to reduce operational costs. In addition, boost in involvement of the government in setting up innovative financial services has enabled banking and financial institutions to adopt advanced analytics solutions as well as augment their existing solutions with AI and ML tools, thus augmenting the growth of the market. Moreover, surge in awareness among financial institutions to leverage external data to segment customer profiles and provide tailored services has increased the demand for augmented analytics technology.

However, there are various restraints of the Spain augmented analytics in BFSI market. The stringent data privacy regulations and lack of standardization, which prevents interoperability among different analytics solutions act as restraints of the market growth. In addition, inadequate infrastructure and high costs associated with the deployment of augmented analytics solutions are anticipated to hamper the growth of the market.

On the contrary, the Spain augmented analytics in BFSI market is projected to witness rapid growth in the coming years, owing to increase in demand for improved customer experience and real-time decisions. In addition, surge in need to better understand customer behavior and financial risks & trends as well as boost in popularity of open banking is expected to drive the market growth. Furthermore, key regulations such as the second Payment Services Directive (PSD2) are anticipated to benefit the market by removing restrictions on the access and use of customer data. Moreover, factors such as surge in digitalization and recent government initiatives such as 'Open Data' offer huge growth opportunity for the market. Increase in demand for improved customer experience and better fraud prevention solutions are some major factors driving the growth of the Spain augmented analytics in BFSI market.

Key players operating in the Spain market are SAS, Qlik, Tableau, Microsoft, IBM, Oracle, SAP, Accenture, Deloitte, and Capgemini. These companies have adopted strategies such as product/service launches, acquisitions, business expansions, partnerships, and investments to gain a competitive edge in the market. For instance, in 2020, Microsoft formed a partnership with Barclays to develop and deploy cutting-edge money management app in the market. In addition, in 2020, SAP acquired Contextor, a French AI and automation software provider to expand its impression in the market.

Furthermore, there are five emerging companies in the Spain augmented analytics in BFSI market striving to strengthen their foothold. These include AlgoApp Ltd., Allganize, Clover Plann, DataRobot, and Mentis. Allganize provides AI-driven solutions and services to financial organizations for insights generation. Moreover, DataRobot is a provider of automated machine learning platform and offers a suite of products for operationalization of automated ML.

Key Benefits For Stakeholders

- Enable informed decision-making process and offer market analysis based on current market situation and estimated future trends.

- Analyze the key strategies adopted by major market players in Spain augmented analytics in BFSI market.

- Assess and rank the top factors that are expected to affect the growth of Spain augmented analytics in BFSI market.

- Top Player positioning provides a clear understanding of the present position of market players.

- Detailed analysis of the Spainaugmented analytics in BFSI market segmentation assists to determine the prevailing market opportunities.

- Identify key investment pockets for various offerings in the market.

Spain Augmented Analytics in BFSI Market Report Highlights

| Aspects | Details |

| Forecast period | 2022 - 2032 |

| Report Pages | 87 |

| By Component |

|

| By Deployment Model |

|

| By Enterprise Size |

|

| By Application |

|

| Key Market Players | Oracle, Accenture, Microsoft, SAS, Tableau, Deloitte, Qlik, SAP, Capgemini, IBM |

The Spain Augmented Analytics in BFSI Market is estimated to reach $531.1 million by 2032

SAS, Qlik, Tableau, Microsoft, IBM, Oracle, SAP, Accenture, Deloitte, Capgemini are the leading players in Spain Augmented Analytics in BFSI Market

1. Enable informed decision-making process and offer market analysis based on current market situation and estimated future trends.

2. Analyze the key strategies adopted by major market players in spain augmented analytics in bfsi market.

3. Assess and rank the top factors that are expected to affect the growth of spain augmented analytics in bfsi market.

4. Top Player positioning provides a clear understanding of the present position of market players.

5. Detailed analysis of the spain augmented analytics in bfsi market segmentation assists to determine the prevailing market opportunities.

6. Identify key investment pockets for various offerings in the market.

Spain Augmented Analytics in BFSI Market is classified as by component, by deployment model, by enterprise size, by application

Loading Table Of Content...

Loading Research Methodology...