Spain Health Insurance Third Party Administrator Market Research, 2032

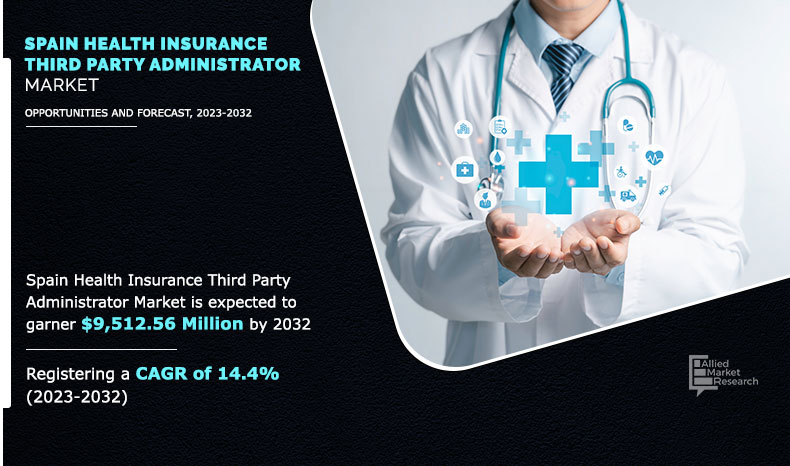

The Spain health insurance third party administrator size was valued at $2,524.72 million in 2022, and is projected to reach $9,512.56 million by 2032, growing at a CAGR of 14.4% from 2023 to 2032.

Third-party administrator is a licensed third-party entity, which provides management solutions to health insurance companies and employment firms. It acts as an intermediary between the insurance company and the policyholder to ensure cashless claims and reimbursement claims are settled effectively. The increase in health insurance customers has accelerated the quantity of work and led to a decrease in the quality of services. Therefore, third-party administrators are established to assist insurers in arranging cashless treatments for customers demanding seamless claim settlements. In addition, third-party administrators scrutinize hospital bills and documents for their accuracy and help in the processing of the claim.

The Spain health insurance third party administrator is expected to witness significant growth during the forecast period, owing to a rise in the need for effective claim handling & payment settlement, achieving operational efficiency & transparency in the insurance business process, and adoption of third-party administrator in health insurance.

However, the risk of data theft and security issues are the major factors limiting the market growth. On the contrary, with the rising number of health insurance policyholders, worker compensation prefers third-party administrators to effectively handle claims and settlement of payment on behalf of the insurance companies. Thus, the demand for insurance third-party administrators is anticipated to increase exponentially in the coming years, which is expected to offer remunerative opportunities for the expansion of the Spain health insurance third party administrator market.

Depending on the insurance service type, the health value services segment dominated the Spain health insurance third party administrator market share in 2022 and is expected to continue this trend during the forecast period, owing to growing awareness among the Spanish population about the importance of preventive health measures and overall well-being, such as wellness programs, health screenings, and mental health support. However, the medical claims management segment is expected to witness the highest growth in the upcoming years, due to the fact that third-party administrators help to make claim processes more efficient by identifying several complications in claims.

The report focuses on growth prospects, restraints, and analysis of the Spain health insurance third party administrator trend. The study provides Porter’s five forces analysis to understand the impact of various factors, such as the bargaining power of suppliers, competitive intensity of competitors, the threat of new entrants, the threat of substitutes, and the bargaining power of buyers on the Spain health insurance third party administrator share.

Segment Review

The Spain health insurance third party administrator is segmented based on insurance service type, product type, enterprise size, and distribution channel. By insurance service type, the market is divided into medical claims management, medical provider management, and health value services. Depending on product type, it is categorized into medical insurance, critical insurance, and others. On the basis of enterprise size, it is fragmented into large enterprises and small and medium-sized enterprises. According to the distribution channel, it is classified into direct sales, brokers/agents, and others.

The major players operating in the Spain health insurance third party administrator market are Adeslas, Aon Plc, AP Companies, Asisa, Charles Taylor, DKV Seguros, Henner, Marsh LLC, McLarens, and Sedgwick. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

By Enterprise Size

Large enterprises segment accounted for the highest market share in 2022.

Top Impacting Factors

Surge in Adoption of Third-party Administration Services in the Health Insurance Industry

Third-party administrator outsourcing plays a vital role in the health insurance industry, as it helps health insurance companies to increase their efficiency by processing claims and settling payments. In addition, third-party administrators provide various features to end users, which include 24/7 support; responding to customer queries over multiple channels such as social media, chat, and email; and capitalizing on sales opportunities beyond geographical locations. However, due to COVID-19, increase has been witnessed in the number of health insurance customers, which led to surge in the burden of work and decrease in the quality of claim processing & settlement services, thereby driving the growth of the market. In addition, third-party administration services are increasingly adopted by health insurance companies, as they offer various value-added services along with processing of the claim and scrutinizing the hospital bills such as ambulance, helpline facilities for knowledge sharing, and providing a long list of network hospitals. This subsequently fuels the growth of the Spain health insurance third-party administrator market.

By Product Type

Medical insurance segment accounted for the highest market share in 2022.

Rise in need for Operational Efficiency & Transparency in Insurance Business Process

During the COVID-19 pandemic, upsurge in demand for third-party administrator services supported insurance companies to sustain disruptions. In addition, the third-party administrator services solution played an important role in keeping the entire insurance business processes efficient by allowing insurance companies to use their internal resources for core competencies and essential business function. Furthermore, third-party administrator helps insurance companies to improve performance through various features such as expedite claims while providing timely customer service, risk management, billing services, data & analytics, and in some cases subrogation expertise. In addition, the pandemic has forced the insurance sector to invest in such solutions, which balance overworked & under-resourced insurers, streamline their products & services, cut costs, and bring added value for investors & customers through outsourcing. This factor has led to a surge in demand for insurance third-party administrator services, thereby fueling the growth of the market in the country.

By Insurance Service Type

Health value services segment accounted for the highest market share in 2022.

Digital Capabilities

Health Insurance Third-Party Administrators (TPAs) have increasingly adopted digital capabilities to streamline their operations, enhance customer service, improve data management, and stay competitive in the evolving insurance industry. Some common digital potentials in the insurance third party administrator are online portals, integration of mobile apps, electronic claims submission, automated claims processing, implementation of customer chatbots, and data analytics, among others. Hence, the surge in technological advancements in insurance third party administrator services is expected to create numerous opportunities for global market growth. In addition, the rise in demand for automation in claim processing and policy administration, and other technologies such as artificial intelligence (AI) and machine learning (ML) contribute to the growth of the market. For instance, in February 2022, Aon Plc launched its digital insurance platform in Spain. The new platform targets small and medium-sized businesses, offering a range of products such as health insurance, general liability, and cyber insurance. Such strategic developments in the field of autonomous claims management are anticipated to pave the growth outlook of the Spain health insurance third party administrator market. Overall, the digital capabilities of health insurance TPA in Spain are helping organizations improve their performance, make better decisions, and increase their competitiveness in the marketplace.

End-User Adoption

The growing adoption of insurance services by third party administrators is accelerating end-user adoption. The end users in the insurance TPA market may vary based on the specific services provided by the TPA and the insurance type it manages. However, a few common end-users for insurance third-party administrators are policyholders, beneficiaries, healthcare providers, employers, employees, claimants, and more. Further, the health insurance third-party administrator services find a wider application in large enterprises, as they manage administrative tasks related to health insurance policies at a wider scale. In addition, it helps in end-to-end claim processing by verifying policyholder information, assessing the validity of claims, and facilitating the settlement process. Hence, such remarkable benefits of TPA service in the health insurance segment are expected to contribute to its high demand, and eventually result in numerous opportunities for market growth.

Government Initiatives

The Spanish government has taken a number of initiatives to support the growth of the health insurance third party administrator market in the country. Some of these initiatives include encouraging the use of technology, investment in digital infrastructure, and service standardization. The Spanish government has promoted the use of technology and advanced insurance services, including health insurance TPAs, to improve the competitiveness of Spanish insurance businesses and drive economic growth. In addition, the government has made significant investments in digital infrastructure to support the growth of technology-based industries. Furthermore, the Spanish government has also implemented initiatives and prescribed standards for the services provided by TPAs. This may include guidelines on claims processing, customer service, and data management to certify that policyholders receive consistent and high-quality service, which is expected to create growth opportunities for the market during the forecast period.

Key Benefits for Stakeholders

- The study provides an in-depth analysis of the Spain health insurance third party administrator forecast along with current & future trends to explain the imminent investment pockets.

- Information about key drivers, restraints, & opportunities and their impact analysis on Spain health insurance third party administrator market trends is provided in the report.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers operating in the industry.

- The quantitative analysis of the market from 2018 to 2032 is provided to determine the market potential.

Spain Health Insurance Third Party Administrator Market Report Highlights

| Aspects | Details |

| By Application |

|

| By Type |

|

Analyst Review

In accordance with several interviews that were conducted of the top level CXOs, the demand for insurance third-party administrators has been witnessed to increase rapidly to handle the claims of worker’s compensation offered by employment firms under employee benefits in the country. In addition, third-party administrators are used to manage company’s group benefits, particularly health, workers compensation, and dental claims that are self-funded.

Furthermore, health insurance companies use third-party administrators to handle claims of the policyholders and provide value-added services, including hospitalization of patients, medical facilities such as arrangement of wheelchairs, beds, and medicines. The CXOs further added that during the COVID-19 pandemic, third-party administrator services increased significantly. This was attributed to increased need for hospitalization and unavailability of hospital beds that accelerated the dependency on third-party administrators for arrangement of beds and medical equipment. Therefore, increase in adoption of third-party administrators by insurance companies for effectively handling the claims & providing other related insurance services during the pandemic notably contributed toward the market growth.

In addition, with the surge in demand for insurance TPA services, various companies have expanded their current product portfolio to continue with the surge in demand in the market. For instance, in December 2021, Adeslas launched Adeslas Pediatrics type of medical health insurance for children in Spain. The service deals not only with the immediate treatment of the sick child, but also with the long-term effects on quality of life, disability and survival, such as: developmental delays and disorders, functional disabilities and social stress, among others. These developmental initiatives are expected to create future growth opportunities.

Loading Table Of Content...