Sperm Bank Market Share and Trends

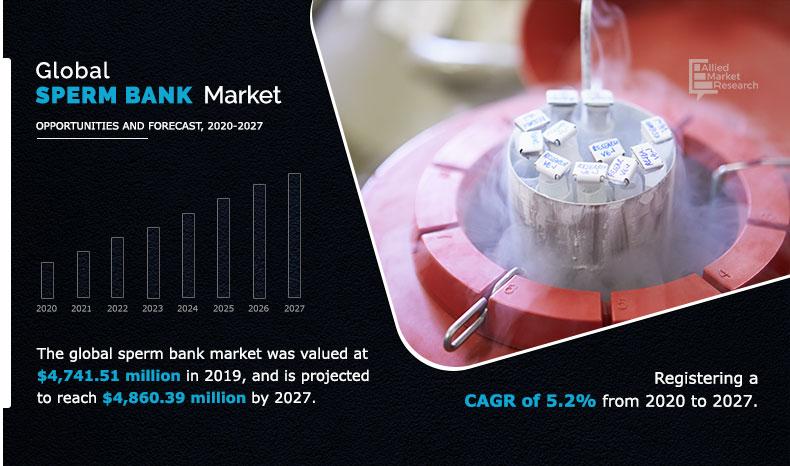

The global sperm bank market size was valued at $4,741.51 million in 2019, and is projected to reach $4,860.39 million by 2027, registering a CAGR of 5.2% from 2020 to 2027. Sperm bank is also named as cryobank and is a specialized organization that purchases and stores sperm, which is collected from human sperm donor and sold to those women who need to conceive. Sperm donor donates the sperm only when he contracts with the sperm bank, which is usually for 6-24 months. Donors can donate sperm for more than two years. The sperm donor generally meets specific requirement regarding age and medical history to donate the sperm for needy women. As per medical perspective, a pregnancy achieved by donor sperm is similar to the pregnancy achieved by sexual course. The donated sperm is introduced in women by artificial insemination technology. In the U.S., sperm banks are regulated by Human Cell and Tissue Bank Product, which is founded by the USFDA. Likewise, many countries have different regulations for sperm bank donor that legislate several rules and regulations.

COVID-19 Impact

The COVID-19 pandemic has resulted in nationwide lockdowns, thereby impacting every industry vertical. Likewise, the sperm bank market is also affected by the pandemic, owing to rise in illness, which decreases the sperm donation among people . Patients undergoing treatment lost access to services and no surgeries had happened due to lockdown in various countries. Thus, impacting the supply of the sperm during the outbreak. The disease has forced a number of industries to shut their doors temporarily and led reproductive centers to drastically limit their activities, including several sub-domains of health care. So, the outbreak of COVID-19 has disrupted demand side of the sperm bank market. Moreover, various threat and concerns regarding sperm donation, insemination treatment, and cryopreservation including, the detection of COVID-19 virus on male and female reproductive cell or tissue, contamination of semen sample during cryopreservation, and transmission of infectious disease during treatment negatively affect the growth of the sperm bank industry.

Service Segment Review

By service, the sperm bank market is categorized into sperm storage, semen analysis, and genetic consultation. Sperm storage is the process of preservation of mature viable spermatozoa after spermatogenesis but before ejaculation, for prolonged periods of time. A semen analysis evaluates certain characteristics of a male's sperm and semen. A genetic consultation provides information, support, and answers to specific questions and concerns for patients. The sperm storage segment is anticipated to garner the largest share in the market due to advancements in cryopreservation techniques used in storage of donor sperms. In addition, surge in use of donor sperm in artificial insemination methods is also expected to impel the segment growth.

By Service Type

Sperm storage segment held a dominant position in 2019 and would continue to maintain the lead over the forecast period.

Donor Segment Review

By donor, the sperm bank market is categorized into known donor and anonymous donor. Anonymous donor is someone who donates the sperm for assisted reproductive procedures such as intrauterine insemination (IUI) or in vitro fertilization (IVF), and the identity of the individual providing the donation is not known to the individual or couple receiving the donation. A known donor also known as a directed donor, is someone who donates the sperm for assisted reproductive procedures such as intrauterine insemination (IUI) or in vitro fertilization (IVF), and this person is known to the individual or couple trying to conceive a child. This segment experiences an increase in growth during the forecast year, owing to factors such as changes in regulatory environment by allowing youngsters to have the legal right to inquire about their biological parents.

By Donor Type

known donor segment is projected as one of the most lucrative segment.

Region segment review

By region, the sperm bank market is categorized into North America, Europe, Asia-Pacific and LAMEA. Asia Pacific is projected to register a profitable market growth rate during the analysis period. This is majorly attributed to enormous male populace suffering through infertility and low-cost procedures for fertility treatments. Moreover, increase in number of sperm donors, despite social myths among the population is also anticipated to impel the market growth. In addition, rise in awareness toward the availability of fertility treatment options such as IVF & ICSI and supportive government policies for sperm donations further supplement the growth of the sperm bank market. Europe held the second largest revenue share in 2019, attributed to the factors such as lower treatment cost compared to the U.S. and Canada, rise in fertility tourism, surge in grants & reimbursements for sperm donors, and increase in the number of IVF centers. Furthermore, favorable policies enacted by sperm banks for developing the supply of sperm across the region is also anticipated to impel the growth of the sperm bank market.

By Region

Asia-Pacific was holding a dominant position in 2019 and would continue to maintain the lead over the analysis period.

The key market players profiled in the report include Androcryos, Babyquest Cryobank, California Cryobank, Cryos International, European Sperm Bank, Fairfax Cryobank, New England Cryogenic Center, Nordic Cryobank Group, Xytex Sperm Bank, and Indian Spermtech.

Key Benefits For Stakeholders

- This report provides a detailed quantitative analysis of the current market trends and future estimations from 2020 to 2027, which assists in identifying the prevailing market opportunities.

- An in-depth analysis of various regions is expected to provide a detailed understanding of the current trends to the stakeholders to formulate region-specific plans.

- Comprehensive analysis of the factors that drive and restrain the growth of the sperm bank market are provided.

- Key regulatory guidelines for the sperm bank market are critically dealt with according to region.

- A deep dive analysis of various regions provides insights that will allow companies to strategically plan their business moves.

Key Market Segments

By Donor

- Known Donor

- Anonymous Donor

By Application

- Sperm Storage

- Semen Analysis

- Genetic Consultation

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- India

- Australia

- South Korea

- Rest of Asia-Pacific

- LAMEA

- Brazil

- South Africa

- Rest of LAMEA

Sperm Bank Market Report Highlights

| Aspects | Details |

| By SERVICE TYPE |

|

| By DONOR TYPE |

|

| By Region |

|

| Key Market Players | BABYQUEST CRYOBANK, INC., CALIFORNIA CRYOBANK, ANDROCRYOS , INC., FAIRFAX CRYOBANK, INC., CRYOS INTERNATIONAL, INC., .EUROPEAN SPERM BANK, INC., NEW ENGLAND CRYOGENIC CENTER, INC., NORDIC CRYOBANK GROUP, INC., XYTEX SPERM BANK, INC., INDIAN SPERMTECH |

Analyst Review

The adoption of sperm bank services among the infertile couples has increased in recent years, due to technological advancements in fertility procedures. There is a remarkable increase in the adoption of fertility treatments such as IVF, ICSI, IUI, and others for treating infertility across the world. Moreover, the occurrence of infertility in developing countries is expected to increase in the coming years, owing to increase in sperm-related issues in males due to lifestyle habits such as smoking & drinking and other age-related chronic diseases among the population. In addition, supportive government laws and legislation further supplement the demand for sperm banking services among several communities across the globe.

Furthermore, the market is projected to gain traction in the developed regions of North America and Europe during the analysis period. Advanced healthcare infrastructure, larger pool of patients suffering from infertility, increase in disposable income, awareness about sperm banking services, and availability of sperm donors are estimated to drive the market growth in the North America and Europe regions.

The total market value of sperm bank Market is $4,741.51 million in 2019

The forecast period in the report is from 2020 to 2027

The market value of sperm bank Market in 2020 was $3,409.15 Million

The base year for the report is 2019

Yes, sperm bank companies are profiled in the report

The top companies that hold the market share in sperm bank Market are California Cryobank, Cryos International, European Sperm Bank, and Fairfax Cryobank.

No, there is no value chain analysis provided in the sperm bank Market report

The key trends in the sperm bank Market are increase in prevalence of infertility among males as well as females, technologically advanced fertility treatment such as IVF, IUI and ICI.

Loading Table Of Content...