Spinal Muscular Atrophy Treatment Market Research, 2032

The global spinal muscular atrophy treatment market size was valued at $4.3 billion in 2022, and is projected to reach $8.4 billion by 2032, growing at a CAGR of 6.8% from 2023 to 2032. Spinal muscular atrophy (SMA) is a neuromuscular disorder characterized by the progressive deterioration of alpha motor neurons in the spinal cord. This degeneration leads to a gradual weakening and loss of function in the proximal muscles, eventually resulting in paralysis. Spinal muscular atrophy (SMA) is a genetic disorder that refers to the absence or alteration of the SMN1 gene, which is inherited in an autosomal recessive manner. The development of SMA drugs that enhance the levels of survival motor neuron (SMN) protein is dramatically transforming the progression and management of spinal muscular atrophy (SMA) in individuals at all stages of the disease.

Market Dynamics

Rise in number of people suffering from spinal muscular atrophy drives the demand for SMA drugs that supports the market growth. For instance, according to an article published by the American Academy of Neurology in March 2023, the estimated prevalence for all cases of SMA, including presymptomatic patients, was 2.12 per 100,000. Thus, an increase in cases of spinal muscular atrophy propels the market growth.

The growth of the spinal muscular atrophy treatment market is expected to be driven by high potential in untapped emerging markets, due to availability of improved healthcare infrastructure, increase in unmet healthcare needs, and surge in demand for SMA drugs. Furthermore, the healthcare industry in emerging economies is developing at a significant rate, owing to significant investments by the government to improve healthcare infrastructure.

The demand for spinal muscular atrophy treatment is not only limited to developed countries but is also being witnessed in the developing countries, such as China, Brazil, and India, which fuel the growth of the market. Factors such as increase in awareness toward early diagnosis and treatment further drive the growth of the market.

In addition, reimbursement policies play a crucial role in driving the market growth for SMA treatments. Favorable reimbursement policies can significantly impact the accessibility and affordability of these therapies for patients, thereby increasing market demand. When reimbursement policies provide adequate coverage and support for SMA treatments, it encourages healthcare providers to prescribe and administer these medications. This, in turn, leads to higher adoption rates and increased market growth.

Furthermore, advancements in SMA treatment played a crucial role in the development of treatments for spinal muscular atrophy thereby boosting the market growth. Gene therapy approaches, such as Spinraza and Zolgensma (onasemnogene abeparvovec), have revolutionized the treatment landscape by directly addressing the underlying genetic cause of SMA. These therapies involve the delivery of functional SMN1 genes or their variants to motor neurons, restoring SMN protein production. For instance, nusinersen (Spinraza) have molecules that target specific RNA sequences and modulate gene expression, promoting the production of functional SMN protein and showing promising results in the treatment of SMA. Such advancements and availability of gene therapy for SMA drive the spinal muscular atrophy treatment market growth.

The limited availability of potentially life-changing therapies for SMA patients and high cost of SMA treatments limits the adoption of SMA drugs in emerging countries, which is expected to restrain the market growth. These costs, including preclinical studies, clinical trials, regulatory approvals, and post-marketing surveillance, contribute to the overall pricing of therapies, which can hinder the market growth.

The outbreak of COVID-19 has disrupted workflows in the health care sector around the world. The disease forced several industries to shut temporarily, including several sub-domains of health care. The global spinal muscular atrophy treatment market experienced a decline in 2020 due to global economic recession led by COVID-19. In addition, the COVID-19 outbreak disrupted the supply chain, causing delays in non-emergency medical procedures, including SMA diagnosis and treatment. This affected the access to SMA therapies for patients and negatively impacted the market growth.

However, the market is recovering after the pandemic, and shows stable growth for spinal muscular atrophy treatment market. This is attributed to the efforts to raise awareness about SMA that continued despite the pandemic. This ongoing awareness campaign, coupled with advancements in genetic testing and rise in demand for SMA drugs, thereby propels the market growth. Moreover, early and accurate diagnosis drives the demand for SMA treatments and boosts the spinal muscular atrophy market opportunity.

Segmental Overview

The spinal muscular atrophy treatment market is segmented into type, route of administration, end user, and region. By type, the market is categorized into type 1, type 2, and others. On the basis of the route of administration, the market is segregated into oral and parenteral. By end user, the market is classified into hospitals and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

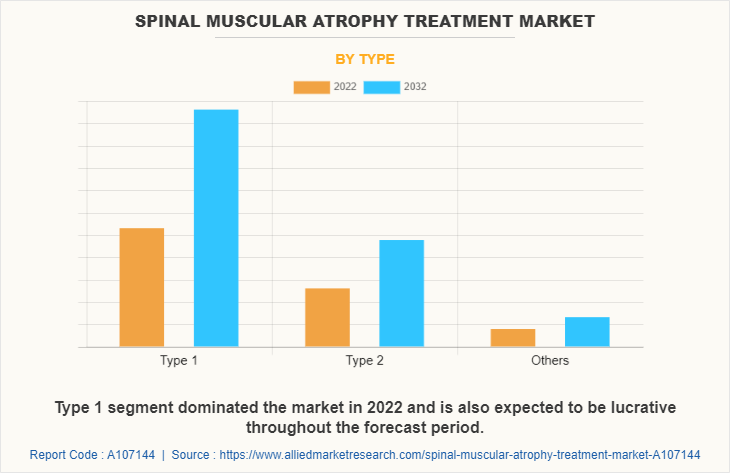

By Type

The type 1 segment dominated the spinal muscular atrophy treatment market size in 2022 and is expected to remain dominant throughout the forecast period, owing to type 1 SMA, which is the most severe form of the disease and typically present within the first few months of life. In addition, rise in cases of type 1 SMA, improved awareness, and advancements in genetic testing have contributed to higher diagnosis rates for type 1 SMA that further supports the segment growth and spinal muscular atrophy market forecast.

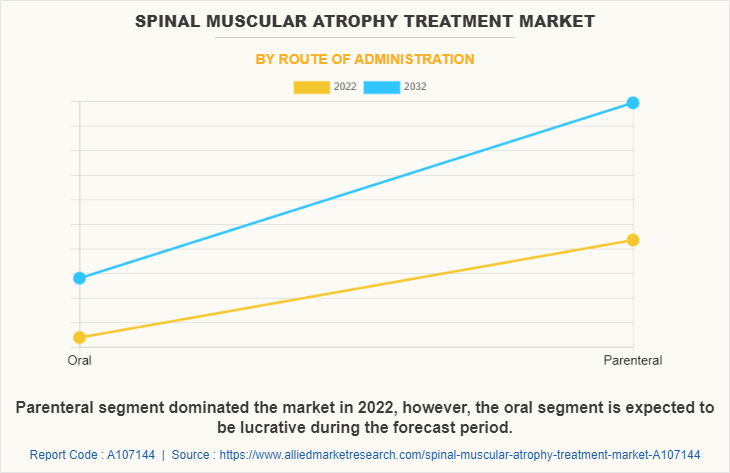

By Route of Administration

The parenteral segment dominated the spinal muscular atrophy treatment market size in 2022 and is anticipated to continue this trend during the forecast period. This was attributed to a rise in demand for parenteral medications for SMA treatment as they provide several benefits to patients and healthcare providers such as high efficacy, designed to target specific areas and delivering the drug directly to the affected site.

However, the oral segment is expected to register the highest CAGR during the forecast period owing to numerous advantages over other administration methods. These benefits include non-invasiveness, pain avoidance, versatility, and minimal side effects. Currently, Evrysdi is the FDA-approved oral medication for treating pediatric patients with SMA.

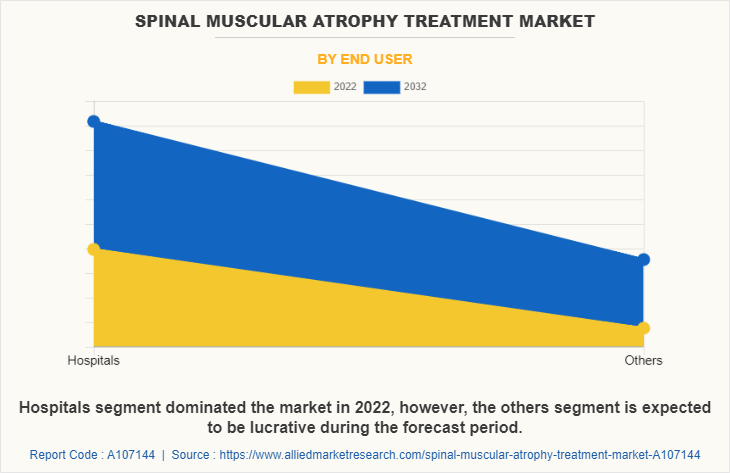

By End User

The hospitals segment held the largest spinal muscular atrophy treatment market share in 2022 and is expected to remain dominant throughout the forecast period, owing to availability of specialized care and expertise that makes hospitals the primary choice for SMA treatment. In addition, hospitals are equipped to provide the necessary inpatient care and monitoring for SMA patients and play a significant role in managing the disease, thereby contributing toward spinal muscular atrophy treatment market growth.

However, the others segment is expected to register the highest CAGR during the forecast period owing to rise in cases of spinal muscular atrophy led to rise in the demand for SMA drugs in homecare settings.

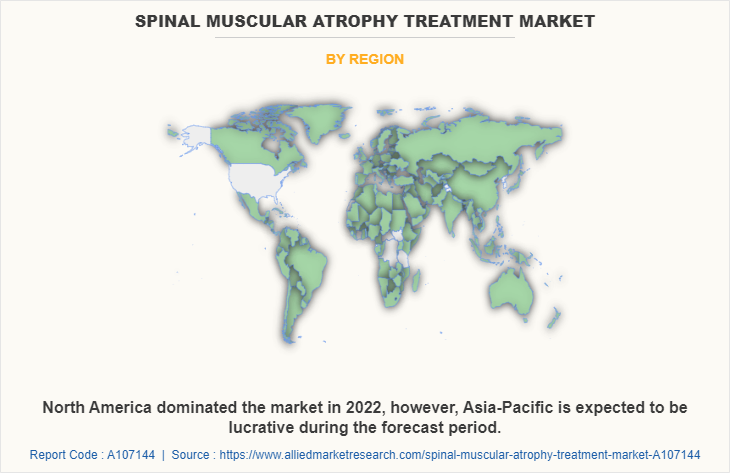

By Region

The spinal muscular atrophy treatment market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major spinal muscular atrophy treatment market share in 2022 and is expected to maintain its dominance during the forecast period.

The presence of several major players, such as Novartis AG, F. Hoffmann-La Roche Ltd., and Pfizer Inc.in the region drives the growth of the market. In addition, increase in R&D initiatives in treatment of spinal muscular atrophy and rise in number of pipelines drugs is one of the key market trends in the spinal muscular atrophy treatment market.

Furthermore, product approval adopted by the key players in this region boosts the growth of the market. For instance, in August 2020, Scholar Rock, a clinical-stage biopharmaceutical company announced that the U.S. Food and Drug Administration (FDA) has granted Rare Pediatric Disease (RPD) designation for SRK-015 for the treatment of Spinal Muscular Atrophy (SMA). Moreover, the increase in incidence and prevalence of SMA fueled the demand for effective treatments and propels the market growth in North America.

Asia-Pacific is expected to grow at the highest rate during the forecast period. The market growth in this region is attributable to presence of pharmaceutical companies in the region as well as growth in the purchasing power of populated countries, such as China and India. Moreover, with the increase in awareness about SMA among healthcare professionals and patients, there is a greater recognition of the need for effective treatment options. Thus, increased awareness has led to improved diagnosis rates that boost the demand for SMA treatments.

Asia-Pacific offers profitable opportunities for key players operating in the spinal muscular atrophy treatment market, thereby registering the fastest growth rate during the forecast period, owing to the growing infrastructure of industries, as well as well-established presence of pharmaceutical companies in the region. In addition, increase in awareness and early diagnosis about SMA among healthcare professionals and the general population led to increased diagnosis rates in the Asia-Pacific region. As awareness spreads and diagnostic capabilities improve, more patients are identified and can benefit from SMA treatments, which is expected to drive the market growth in this region.

Competition Analysis

Competitive analysis and profiles of the major players in the spinal muscular atrophy treatment include Biogen, Beijing Jinlan Gene Technology Co., Ltd., Cytokinetics, F. Hoffmann-La Roche Ltd., Hanugen Therapeutics, Ionis Pharmaceuticals, Inc. NMD PHARMA A/S, Novartis AG, Pfizer Inc., and Scholar Rock Holding Corporation. Major players have adopted product launch, product expansion and acquisition as key developmental strategies to improve the product portfolio of the spinal muscular atrophy treatment market.

Recent Product Approval In The Spinal Muscular Atrophy Treatment Market

- In August 2020, Scholar Rock, a clinical-stage biopharmaceutical company focused on the treatment of serious diseases in which protein growth factors play a fundamental role, announced that the U.S. Food and Drug Administration (FDA) has granted Rare Pediatric Disease (RPD) designation for SRK-015 for the treatment of Spinal Muscular Atrophy (SMA).

- In April 2021, F. Hoffmann-La Roche Ltd, announced that Health Canada has granted EVRYSDI (risdiplam) market authorization for the treatment of spinal muscular atrophy (SMA) in infants aged two months or older.

- In May 2020, AveXis, a Novartis company, announced that the European Commission (EC) granted conditional approval for Zolgensma (onasemnogene abeparvovec) for the treatment of patients with 5q spinal muscular atrophy (SMA) with a bi-allelic mutation in the SMN1 gene and a clinical diagnosis of SMA Type 1; or for patients with 5q SMA with a bi-allelic mutation in the SMN1 gene and up to three copies of the SMN2 gene.

Recent Clinical Trials In The Spinal Muscular Atrophy Treatment Market

- In December 2022, NMD Pharma A/S, a clinical stage biotech company developing first-in-class, small molecule ClC-1 inhibitors for neuromuscular disorders, announced that it has received clearance for its Investigational New Drug (IND) application from the U.S. Food and Drug Administration (FDA) to advance NMD670 into a phase II clinical study in patients of spinal muscular atrophy (SMA) type 3.

- In April 2023, Beijing Jinlan Gene Technology Co., Ltd. submitted an Investigational New Drug (IND) application for the therapy and received clinical implied approval from the National Medical Products Administration for the treatment of spinal muscular atrophy.

Recent Product Launch In The Spinal Muscular Atrophy Treatment Market

- In August 2021, Chugai Pharmaceutical Co., Ltd. a part of F. Hoffmann-La Roche Ltd. announced the launch of Evrysdi Dry Syrup 60 mg (risdiplam) for the treatment of spinal muscular atrophy (SMA).

Recent Agreement In The Spinal Muscular Atrophy Treatment Market

- In August 2021, Biogen Inc. and Ionis Pharmaceuticals, Inc. collaborated to develop novel therapies for neurological disorders. As part of this collaboration, Biogen exercised its option to obtain a worldwide, exclusive, royalty-bearing license from Ionis for the development and commercialization of BIIB115/ION306, an investigational antisense oligonucleotide (ASO) being developed for spinal muscular atrophy (SMA).

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the spinal muscular atrophy treatment market analysis from 2022 to 2032 to identify the prevailing spinal muscular atrophy treatment market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the spinal muscular atrophy treatment market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the spinal muscular atrophy treatment industry.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players in spinal muscular atrophy treatment industry.

- The report includes the analysis of the regional as well as global spinal muscular atrophy market trends, key players, market segments, application areas, and market growth strategies.

Spinal Muscular Atrophy Treatment Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 8.4 billion |

| Growth Rate | CAGR of 6.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 239 |

| By Type |

|

| By Route of Administration |

|

| By End User |

|

| By Region |

|

| Key Market Players | Ionis Pharmaceuticals, Inc., F. Hoffmann-La Roche Ltd., Scholar Rock Holding Corporation, Cytokinetics, NMD Phrama A/S, Pfizer Inc., Beijing Jinlan Gene Technology Co., Ltd., Biogen, Hanugen Theraputics, Novartis AG |

Analyst Review

This section provides various opinions of top-level CXOs in the global spinal muscular atrophy treatment market. According to the insights of CXOs, the global spinal muscular atrophy treatment market is expected to exhibit high growth potential attributable to rise in demand for spinal muscular atrophy treatment and rise in pipeline products for the treatment of spinal muscular atrophy. However, side effects of drugs hamper the market growth.

CXOs further added that rise in the number of product approvals for the spinal muscular atrophy treatment drives the market growth. Moreover, rise in awareness about spinal muscular atrophy and increase in prevalence of spinal muscular atrophy are some factors which further boost the market growth.

Furthermore, North America is expected to witness the largest growth, in terms of revenue, owing to the increase in prevalence of spinal muscular atrophy, easy availability of SMA drugs, and rise in awareness about the early diagnosis and treatment in the region. However, Asia-Pacific is anticipated to witness notable growth, owing to rise in healthcare awareness, increase in incidence of spinal muscular atrophy and availability of SMA drugs.

Increase in prevalence of spinal muscular atrophy and rise in pipeline drugs are the upcoming trends of this market.

Type 1 is the leading type of spinal muscular atrophy for treatment.

North America is the largest regional market for spinal muscular atrophy treatment.

The spinal muscular atrophy treatment market was valued at $4,342.6 million in 2022 and is expected to reach $8,361.3 million by 2032, registering a CAGR of 6.8% from 2023 to 2032.

Biogen, Beijing Jinlan Gene Technology Co., Ltd., Cytokinetics, F. Hoffmann-La Roche Ltd., Hanugen Theraputics, Ionis Pharmaceuticals, Inc. NMD PHARMA A/S, Novartis AG, Pfizer Inc., and Scholar Rock Holding Corporation are the key players operating in the market.

2022 is the base year of spinal muscular atrophy treatment market.

2023-2032 is the forecast period of spinal muscular atrophy treatment market.

Loading Table Of Content...

Loading Research Methodology...