Spintronic Logic Devices Market Outlook - 2026

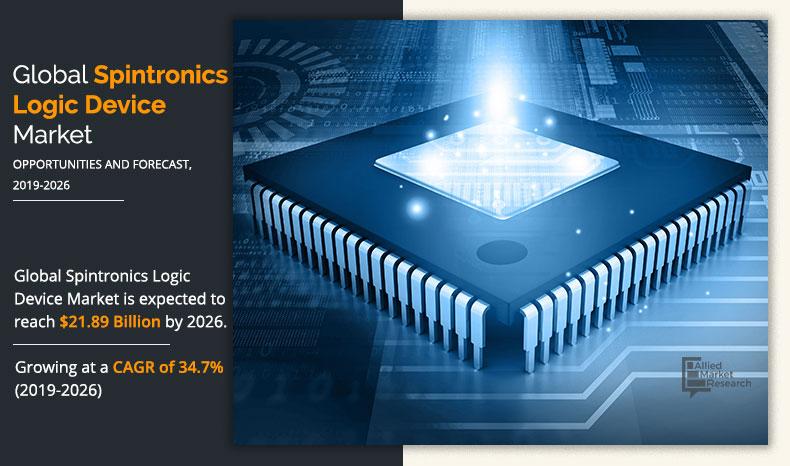

The global spintronic logic devices market size was valued at $2.14 billion in 2018, and is projected to reach $21.89 billion by 2026, registering a CAGR of 34.7% from 2019 to 2026.

Spintronics refers to spin-based electronics used in many solid-state devices to study the intrinsic spin of electrons. Its major motive is to use the spin of the electrons rather than their charge, and to utilize the magnetic moment associated with them.

All spintronic technology devices act according to the information stored in spins as per spin orientation. Subsequently, the spins, being attached to mobile electrons, carry the information along a wire, leading to a terminal that reads the information.

In electronic devices, information is traditionally stored, processed, and communicated using electrons. This pattern is increasingly turning out to be energy-inefficient because the movement of charge within an information-processing device always leads to current flow and an associated dissipation. Replacing “charge” with the “spin” of an electron to convert information may eliminate much of this power dissipation and lead to the introduction of more energy-efficient “green electronics”. This has spurred the demand for spintronic logic devices, thereby augmenting the market growth.

The spintronic logic devices are widely used in various industries and automotive applications, where the reliability of the connection is a major concern. Furthermore, the industrial spintronics provide reliability of operation in harsh environments. According to the Global EV Outlook 2019 report by the International Energy Agency (IEA), China remains the world's largest electric car market, followed by Europe and the U.S., and the global electric car fleet exceeded 5.1 million in 2018, up by two million from the previous year.

The growth of the global spintronic logic devices market is driven by a substantial rise in demand for spin electronics in electronic devices, due to their several advantages over conventional electronics, such as it has been extensive deployment in data storage devices, due to their faster data transmission capabilities and increased storage capacity. Also, the surge in penetration of electric vehicles, which helps to grow the demand for lightweight construction and reduces battery operation space & power consumption in electric vehicles, has driven the adoption of spintronics devices.

Furthermore, the automobile industry has witnessed a shift in preference toward electric vehicles for higher fuel efficiency and cleaner running, fuel/electric hybrids, and plug-in electric vehicles. Also, the surge in need for higher data transfer speeds is coupled with an increase in storage capacity.

Technological advancements in spintronics technology, especially in magnetic sensors, such as high resolution, high sensitivity, compact size, and low power consumption, significantly contribute to the growth of the global spintronic logic devices market. However, the high installation cost of spintronics logic devices is a key restraining factor of the market. On the contrary, an increase in government support and funding toward electric vehicles & electronics is anticipated to offer lucrative opportunities for market expansion during the forecast period.

Segmentation Overview:

The spintronic logic devices market is segmented based on type, application, and region. Based on type, the market is bifurcated into metal-based devices and semiconductor-based devices. The metal-based devices segment dominated the spintronic logic devices market in terms of revenue in 2018, whereas the semiconductor-based devices segment is expected to grow at the highest CAGR during the forecast period.

By Type

Semiconductor Based Devices segment is projected to be the most lucrative segment

The metal-based devices segment is further classified into giant magneto resistance-based devices, tunnel magneto resistance-based devices, spin-transfer torque devices, and spin-wave logic devices. Semiconductor-based devices are sub-segmented into spin diode, spin filter, and spin field effect transistor.

By Application

Data Storage segment would exhibit the highest CAGR of 39.7% during 2019 - 2026

Applications covered in the study include electric vehicles, industrial motors, semiconductor lasers, magnetic tunnel transistors, data storage, and others (magnetic sensing and magnetic random-access memory). Region-wise, the spintronic logic devices market analysis is done across North America, Europe, Asia-Pacific, and LAMEA.

By Region

Asia-Pacific holds a dominant position in 2018 and would maintain the lead over the forecast period

Top Impacting Factors

The notable factors impacting the spintronic logic devices market include a rise in demand for spintronics in electronic devices, increasing penetration of electric vehicles, and a surge in the need for higher data transfer speed and increased storage capacity.

However, high installation cost hampers the spintronics logic devices market growth. This factor is expected to slow down the market growth. Moreover, an increase in government support & funding offers huge spintronic logic devices market opportunities in the next six years.

Competitive Analysis

The report provides a comprehensive analysis of major market players such as Advanced Microsensors, Applied Spintronic Technology, Inc., Crocus Technology, Everspin Technologies Inc., Futek Advanced Sensor Technology Inc., HBM, Kistler Group, PCB Piezotronics, Infineon Technologies, and Sensor Technology.

Furthermore, the prominent players have adopted several strategies such as product launch, acquisition, and others to enhance their business capabilities and increase their spintronic logic devices market share. For instance, PCB Piezotronics executed an agreement with Meggitt PLC to purchase the assets of their Endevco sensor business. This acquisition significantly expands PCB our product portfolio, especially in the automotive and aerospace & defense markets.

Key Benefits for Stakeholders:

- This study includes the analytical depiction of the global spintronic logic devices market growth along with the current trends and future estimations to determine the imminent investment pockets.

- The market size is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact on the spintronic logic devices market.

- The current spintronic logic devices market forecast is quantitatively analyzed from 2018 to 2026 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the spintronic logic devices industry.

- The report includes the spintronic logic devices market trends and market share of key vendors.

Spintronic Logic Devices Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Infineon Technologies, Everspin Technologies Inc., PCB Piezotronics, Kistler Group, Futek Advanced sensor Technology Inc., HBM, Sensor Technology, Advanced Microsensors., Applied Spintronic Technology, Inc. |

Analyst Review

Spintronics is a Nano technology which deals with spin dependent properties like mechanical, rotational of an electron instead of charge dependent properties. In conventional electronics, electrons are used for manipulation, storage and transfer of information but, spintronics uses electron spin in place of electron charge.

The demand for spintronic logic devices in the commercial sector is expected to increase rapidly during the forecast period, owing to various factors such as rise in demand for spintronics in electronic devices, increasing penetration of electric vehicles and surge in need for higher data transfer speed and increased storage capacity. However, high installation cost, thus hampering the market growth globally. The market for spintronic logic devices in commercial sector is analyzed and estimated in accordance with the impacts of the drivers, restraints, and opportunities.

In the report, the global spintronic logic devices market is segmented based on type, application, and geography. Based on type, the market is bifurcated into metal-based devices and semiconductor-based devices. On the basis of application, it is classified into electric vehicles, industrial motors, semiconductor lasers, magnetic tunnel transistors, data storage and others. Based on geography, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The scope of the report discusses the potential opportunities for the market players to enter the global spintronic logic devices market. This report also provides in-depth analysis of the market, outlining current trends, key driving factors, and key area of investment. The report includes Porter’s five forces analysis to understand the competitive scenario of the industry and role of each stakeholder in the value chain. The report features the strategies adopted by key market players to maintain their foothold in the market.

The key players profiled in the report include Advanced Microsensors, Applied Spintronic Technology, Inc., Crocus Technology, Everspin Technologies Inc., Futek Advanced Sensor Technology Inc, HBM, Kistler Group, PCB Piezotronics, Infineon Technologies, and Sensor Technology.

The Global Spintronic Logic Devices Market is expected to grow at a CAGR of 34.7% from 2019 to 2026.

The Global Spintronic Logic Devices Market is projected to reach $21.89 billion by 2026.

To get the latest version of sample report

Rise in demand for spintronics in electronic devices, increasing penetration of electric vehicles and surge in need for higher data transfer speed and increased storage capacity drives the growth of Spintronic Logic Devices Market.

The key players profiled in the report include Advanced Microsensors, Applied Spintronic Technology, Inc., Crocus Technology, Everspin Technologies Inc., Futek Advanced Sensor Technology Inc., HBM, Kistler Group, PCB Piezotronics, Infineon Technologies, and Sensor Technology.

On the basis of top growing big corporations, we select top 10 players.

The Spintronic Logic Devices Market is segmented on the basis of type, application, and region.

The key growth strategies of Spintronic Logic Devices market players include product portfolio expansion, mergers and acquisitions, agreements, geographical expansion, and collaborations.

Data Storage segment is expected to exhibit the highest CAGR of 39.7% during 2019 - 2026.

Asia-Pacific region holds a dominant position in 2018 and would maintain the lead over the forecast period.

Loading Table Of Content...