Sports Gun Market Research, 2033

Market Introduction and Definition

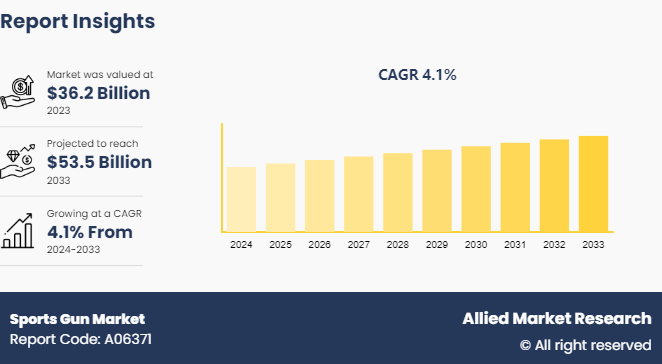

The global sports gun market size was valued at $36.2 billion in 2023, and is projected to reach $53.5 billion by 2033, growing at a CAGR of 4.1% from 2024 to 2033. Sports gun is also known as a competition or target gun, is designed for precision shooting in various sports disciplines. These firearms are built to enhance accuracy and performance in events such as target shooting, skeet shooting, and competitive shooting. Common types include air rifles, which use compressed air to fire pellets and are popular in Olympic shooting; .22 caliber rifles, favored for precision target shooting due to their accuracy; and shotguns, used in disciplines like trap and skeet shooting where multiple pellets are fired to hit moving targets. Each type is specialized for different shooting sports, featuring design elements that optimize performance for specific competitive requirements.

Key Takeaways

- The sports gun market share study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected period 2023-2034.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major energy storage system industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key market dynamics

Increased participation in shooting sports significantly drives the sports gun market demand by expanding the customer base and fueling interest in various shooting disciplines. As more individuals engage in recreational and competitive shooting, there is a growing need for specialized firearms designed to meet the demands of different sports. This surge in participants spans a wide demographic, from casual enthusiasts to professional athletes, creating a robust market for various types of sports guns, including air rifles, .22 caliber rifles, and shotguns. The increased demand encourages manufacturers to innovate and offer a diverse range of products, catering to both entry-level shooters and experienced competitors.

Moreover, the rise in participation has led to a proliferation of shooting events and competitions, further driving sports gun market growth. As these events become more accessible and popular, there is a corresponding increase in the demand for high-quality, performance-oriented sports guns. The emphasis on skill development and competitive success motivates participants to invest in advanced firearms that enhance accuracy and overall shooting experience.

Regulatory restrictions significantly impact the sports gun industry by limiting the accessibility and ownership of firearms. Stricter laws and regulations governing the sale, purchase, and use of sports guns can create barriers for potential buyers. These restrictions often include mandatory background checks, licensing requirements, and limitations on the types of firearms allowed, which can complicate the acquisition process and deter individuals from participating in shooting sports. Additionally, regulations may vary widely by region, creating inconsistent market conditions and restricting the availability of sports guns in certain areas.

Furthermore, regulatory restrictions can influence market dynamics by imposing higher costs on manufacturers and distributors. Compliance with stringent regulations often requires investments in additional safety measures, certifications, and legal consultations, which can increase the overall cost of production and reduce profit margins. These added costs are often passed on to consumers, making sports guns more expensive and less accessible. As a result, the market may experience slower growth and reduced demand due to the combined effects of regulatory barriers and higher prices, negatively impact the overall development of the sports gun industry.

Technological innovations create significant opportunities in the sports gun market by enhancing the performance, accuracy, and user experience of firearms. Advances in technology, such as improved materials, precision engineering, and smart features, allow for the development of high-performance sports guns that meet the evolving needs of enthusiasts and competitors. Innovations like electronic sights, adjustable triggers, and recoil management systems enhance shooting accuracy and comfort, attracting both new and experienced shooters. These technological advancements differentiate products in a competitive market and cater to a growing demand for cutting-edge equipment in shooting sports.

In addition, technology enables the integration of digital tools and smart features, further expanding market opportunities. For example, smart guns with biometric safety systems or digital interfaces offer enhanced security and user customization. The rise of data analytics and connected devices in sports training also creates new avenues for growth, as shooters seek technology-driven solutions to improve their skills. Manufacturers who embrace these technological trends tap into emerging market segments and establish themselves as leaders in the industry, capitalizing on the growing interest in high-tech sports firearms and related accessories.

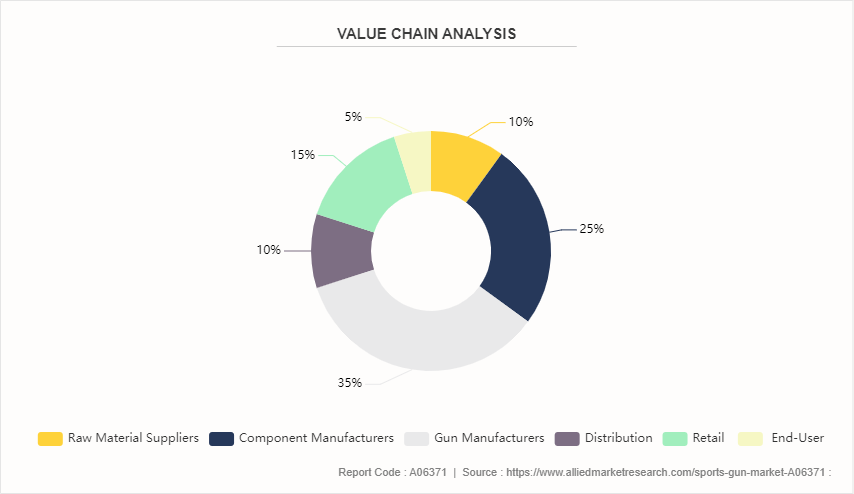

Value Chain of Sports Gun Market

The value chain of the Sports Gun Market encompasses several interconnected stages from production to end-user consumption. It begins with raw material sourcing, where manufacturers procure materials such as metals, polymers, and other components necessary for gun production. These materials are sourced from various suppliers, including metal foundries, chemical companies, and specialized parts manufacturers.

Next, gun manufacturers design and produce sports guns, incorporating various technologies and adhering to strict quality control and safety standards. This stage involves precision engineering, assembly, and testing to ensure the firearms meet performance and safety requirements. Some manufacturers may outsource certain components or processes to specialized suppliers.

the guns enter the distribution phase. This typically involves a network of wholesalers and distributors who supply the products to various retail channels. These channels include specialty gun stores, sporting goods retailers, and increasingly, online marketplaces. In many regions, this stage is heavily regulated, with strict licensing and background check requirements.

Retailers then sell the sports guns to end-users, which include recreational shooters, competitive athletes, and hunting enthusiasts. Many retailers also offer additional services such as customization, maintenance, and repair, adding value to the product offering.

Supporting the entire value chain are various service providers. These include companies offering training and certification courses, maintenance and repair services, and manufacturers of accessories and ammunition. Additionally, shooting ranges and sports clubs play a crucial role in providing facilities for users to practice and compete. The value chain of the Sports Gun Market encompasses several interconnected stages from production to end-user consumption. It begins with raw material sourcing, where manufacturers procure materials such as metals, polymers, and other components necessary for gun production. These materials are sourced from various suppliers, including metal foundries, chemical companies, and specialized parts manufacturers.

Next, gun manufacturers design and produce sports guns, incorporating various technologies and adhering to strict quality control and safety standards. This stage involves precision engineering, assembly, and testing to ensure the firearms meet performance and safety requirements. Some manufacturers may outsource certain components or processes to specialized suppliers.

Once produced, the guns enter the distribution phase. This typically involves a network of wholesalers and distributors who supply the products to various retail channels. These channels include specialty gun stores, sporting goods retailers, and increasingly, online marketplaces. In many regions, this stage is heavily regulated, with strict licensing and background check requirements. Retailers then sell the sports guns to end-users, which include recreational shooters, competitive athletes, and hunting enthusiasts. Many retailers also offer additional services such as customization, maintenance, and repair, adding value to the product offering.

Supporting the entire value chain are various service providers. These include companies offering training and certification courses, maintenance and repair services, and manufacturers of accessories and ammunition. Additionally, shooting ranges and sports clubs play a crucial role in providing facilities for users to practice and compete.

The regulatory environment significantly impacts every stage of this value chain, with government agencies overseeing manufacturing standards, distribution practices, and end-user qualifications. Industry associations also play a role in setting standards and promoting responsible use. Finally, the value chain extends to post-consumer activities, including second-hand sales markets and proper disposal or recycling of firearms at the end of their lifecycle.

Market Segmentation

The sports gun market is segmented into type, application, end user and region. On the basis of type, the market is divided into rifles, shotguns, handguns and air rifles. As per application, the market is segregated competitive shooting, recreational shooting, hunting and sports training. On the basis of end user, the market is bifurcated into recreational shooters, professional shooters, hunting enthusiasts and sports organizations. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America and Middle East and Africa.

Regional/ Country Market Outlook

North America is the most dominant region in the sports gun market due to a combination of cultural, economic, and regulatory factors that drive high demand for sports firearms. The region, particularly the United States, has a long-standing tradition of shooting sports, with a deep-rooted culture that embraces hunting, target shooting, and competitive shooting. This cultural significance fuels consistent consumer interest and a large market base. Additionally, North America's well-established infrastructure for manufacturing, distribution, and retail of sports guns supports robust market activity and innovation.

Economic factors also play a crucial role, as high disposable incomes and strong purchasing power enable enthusiasts to invest in premium and advanced sports guns. The region's extensive network of shooting ranges, clubs, and competitive events further stimulates demand and engagement in sports shooting. Moreover, favorable regulations in many parts of North America, compared to other regions, facilitate easier access to firearms and shooting activities, contributing to market dominance. The combination of a supportive cultural environment, economic strength, and favorable regulatory conditions positions North America as a leading player in the global sports gun market.

Industry Trends:

- The increasing participation in shooting sports, such as target shooting, is known to build and enhance physical discipline among athletes. The benefits of shooting sports guns, such as enhancing the ability to focus, and sharpening eyesight and concentration levels, augment the demand for sporting guns worldwide.

Competitive Landscape

The major players operating in the sports gun market forecast include Remington Arms, Beretta, Ruger, Browning, Sig Sauer, Benelli, Smith & Wesson, Heckler & Koch, CZ, and Steyr Mannlicher.

Recent Key Strategies and Developments

- In January 2022, Beretta, an Italian firearms manufacturer, announced the launch of its latest sport shooting rifle, the Beretta 694. The new model features advanced recoil reduction technology and an improved balance system, designed to enhance accuracy and comfort for competitive shooters. The rifle has been well-received in the shooting sports community, praised for its precision and innovative design.

- In March 2023, Sig Sauer unveiled its new P320 XFive Legion at the 2022 SHOT Show. The firearm integrates cutting-edge technology with a customizable modular design, allowing shooters to tailor the gun to their preferences. The P320 XFive Legion includes enhanced optics and a new trigger system aimed at improving performance in competitive shooting events.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the sports gun market analysis from 2024 to 2033 to identify the prevailing sports gun market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the sports gun market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global sports gun market trends, key players, market segments, application areas, and market growth strategies.

Sports Gun Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 53.5 Billion |

| Growth Rate | CAGR of 4.1% |

| Forecast period | 2024 - 2033 |

| Report Pages | 250 |

| By Type |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | SIG Sauer, Inc., Remington Arms Company, Steyr Mannlicher, Browning, CZ, Smith & Wesson, Beretta, Benelli, Heckler & Koch, Ruger |

The global sports gun market trends include growing demand for customized firearms, advancements in materials and manufacturing technology, increased participation in shooting sports, and stricter regulatory scrutiny.

The leading application of the sports gun market is in competitive shooting sports, including target shooting and clay pigeon shooting, where precision and performance are critical for participants.

North America is the largest regional market for sports guns, driven by a strong culture of shooting sports, recreational activities, and well-established legal frameworks supporting gun ownership.

The global sports gun market was valued at $36.2 billion in 2023, and is projected to reach $53.5 billion by 2033, growing at a CAGR of 4.1% from 2024 to 2033.

The major players operating in the sports gun market include Remington Arms, Beretta, Ruger, Browning, Sig Sauer, Benelli, Smith & Wesson, Heckler & Koch, CZ and Steyr Mannlicher.

Loading Table Of Content...